Last week I was reading a post by fellow a blogger and unfortunately did not bookmark the post. And to make matters worse, I don’t remember which blog it was (first thank you to the blogger for the inspiration for this post, secondly this post is going live a few months since reading that post). However, the post was talking about how even people who work in Finance don’t make the best decisions when it comes to their finances. It reminded me of a story that I would like to share with you all here.

Back Story

I used to work for a public company a little over a year ago that offered an “employee stock purchase program” or ESPP for short. The program allowed all employees who opted to participate to buy company stock at a discounted price. Here are the particulars on how it worked:

- Employees could allocate up to a max of 15% of their income, but there was a cap at 4,000 shares per purchase window.

- The shares were distributed every 6-months.

- The price was discounted by 15%. But the kicker was that the priced used for calculation was the lower of the closing price on the 1st or last day of the 6-month trading window. So if the stock closed day 1 at $10 and then on the last day before distribution at $15, then the starting price before the discount would be $10. The cost to employees was then discounted by 15%, which in this example would have resulted in a share price of $8.50/share (for a gain of $6.5/share or 76.5%).

- Shares were allocated out in July and January. After every distribution you had about 2 weeks to sell your shares before the blackout period. You didn’t have to sell, but because we were a public company we had certain windows to sell. I always sold my shares immediately after distribution.

This was a sweet deal that I really miss. You don’t get too many opportunities for a guaranteed return like this. Well, it was almost guaranteed.

My Analysis before participation

At first the program sounded a little too good to be true. When I was first informed of the program, the worst case scenario I came up with was that the stock finished on its lows and you only got a 15% return instead of something greater. So if you reverse my example from above, let’s say the stock started at $15 and then closed on the last day at $10. Your cost per share would still be $8.50, but the return now is only 15% ($1.50/share).

Again I thought to myself “that is a sweet deal, but there has to be a catch…”

What if the stock tanked pre-market on the day of distribution? The stock would have to decline by more than 15% before you lost any money. But it could happen. Obviously in my first example you had a lot more cushion. So I decided to do one final piece of analysis before I signed up for the program. Don’t get me wrong, I had always intended to sign up for the program, I just wanted to know exactly what I was signing up for (you should always do your homework).

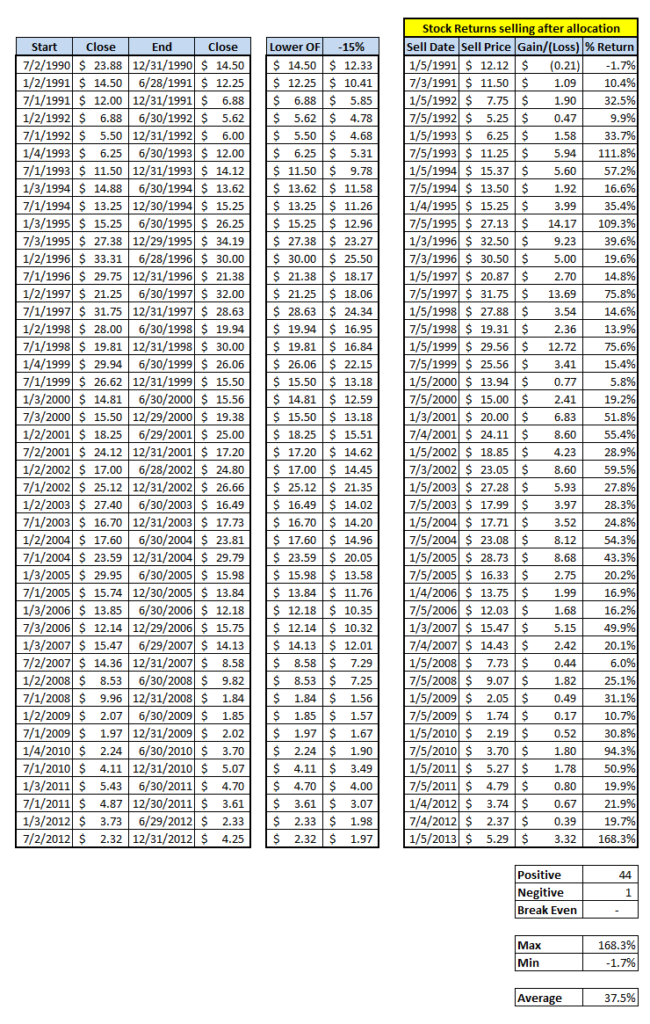

The next thing I did was download the historical closing prices for the past 23 years. First I filtered the data to isolate January, June, July, and December closing dates as these would be the start and end months of each of the two 6-month windows needed for analysis.

I was now armed with the data set that I needed to complete my analysis. Of course I did this in Excel (such a handy tool).

[share title=”Digging the blog? If so, can you please share this post on your favorite social media channel?” facebook=”true” twitter=”true” google_plus=”true” linkedin=”true” reddit=”true” email=”true”]

The Analysis:

As you can see from the above table, my data set included 45 6-month investment periods. The average return over the entire data set was 37.5%. And there was only 1 instance where you lost any money as long as you sold your shares immediately after distribution.

The 1 loss was minimal at -1.7%.

This meant that this program was profitable 98% of the time with a very low risk of losing money.

How my distributions worked out

My first distribution I sold returned almost 180% on my money.

My second distribution made produced a return of 120%.

And my last distribution before leaving the company returned 70%.

Note: I always maxed out my contribution to 15% of my salary.

Yes, I had to deal with short-term capital gains. I would argue that sometimes tax deferral is not always the best option. And taxes can be a good problem to have. At the end of the day it means you made money. I sold my shares immediately after distribution for the following reasons:

- This company was responsible for my salary, and I didn’t want to have all my eggs in one basket.

- Nobody ever went poor taking a profit. You don’t look a gift horse in the mouth.

- Although this employee benefit was very lucrative to its employees, the company was and continues to be in a poor financial position. For example, I made my last stock sale at a price of $8.54/share before I left the company…Today the stock is trading at less than $2/share.

Conclusion

If your company offers a similar benefit, I highly recommend you take advantage of it. I would even go as far to say that this should be put at a higher priority than maxing out your 401K. There were a few employees that I worked with that were apprehensive to max this out because of cash flow issues. So I had them lower their 401K contributions for the first 6-months of the year, and divert those funds to the ESPP program. Then after the first distribution in July they could sell their distribution and use that money as a pad in their bank account so that during the 2nd half of the year they could catch up on the 401K contributions and also continue participating in the ESPP.

I do miss my employee stock purchase program. The company I currently work for is private and has no such program.

Does your company offer an employee stock purchase program? Do you participate? How does the one your company offers work?

– Gen Y Finance Guy

29 Responses

Yep, I have and have had similar ESPP plans. I have used this mightily over the years – and my annualized return from this event came out to 20%/year – guaranteed. I say guaranteed, because I knew when the shares were to be bought and received , so I hedged it by making a short sale that same day. When shares were delivered, I sold them and covered the short sale in the other account.

That is definitely a good way to lock in your gains and make it guaranteed. Nice work!

I have never had an ESPP at work, but would have loved to have access to one. I have had excellent 401k matches or high pension contributions, even a generous HSA contributions, but never an ESPP!

Now that I think about it, I did have a couple of one off opportunities to purchase company stock a few years ago, but it was not a regular program. We got 3 shares for every 1 we purchased the first time and the second time was some number of free shares and more if you bought some. That stock has tanked, but since I got so many free shares it is pretty much worth what I put into it. I still have it for some reason.

I need to get me some pension contributions 🙂

Sounds like you have done pretty well even if you haven’t had access to an ESPP.

Is the stock you bought with the company you are currently with or from a previous employer?

Great story! Im glad you took advantage of that opportunity. Im sure there were plenty of people who did nothing about it. Kuddos to that!

For my day job, im already maxed out on my stock options but I have no intentions of selling because I know where the company is headed. And that is just up and up. Its amazing how much my company stock has grown. I would be a fool to sell it. So my plan is to just watch it grow and when I feel that company is done growing, maybe then ill cash out and buy more rental properties.

Most people did not take advantage of the stock purchase program. And others took lot’s of convincing. I don’t get it…I make you an offer…If you give me $100 now, in 6 months I will give you $115 or more, oh and on average I have typically given back $136 for every $100. And there has only been one time in the last 23 years that I gave you less than your $100 (-1.7% less to be exact).

It’s a no brainier to me. I would had done 50% of my income if I could. Shoot if they didn’t have a limit, I would find a way to do 100% of my income.

Sounds like you have a pretty sweet deal.

You work in Tech?

Cheers!

Yep I work in tech. Software.

My company also offers a ESPP that is capped at $8k. It’s similar to your previous employer except the purchase is only done once a year. The stock price had been stagnant for the past decade so held on for the dividends. Luckily I sold most of my stock last year before the the price dropped $10 to the new steady price.

Hey Jeff – You know what they say “sometimes it’s better to be lucky that smart”.

How is the pricing done for your ESPP? Do they offer a discount?

Cheers!

Had this ESPP at an employer ( a boring old-economy construction company that actually delivered work and made a profit, that was acquired, and then that one was acquired) some years back. It was actually a 15% discount, meaning $85 today would be vested as $100 in six months. Discussing this with co-workers who imagined themselves to be PF whizkids (this was around the tech bubble when 5 yrs of 20%+ returns and Enron, WebVan, and Ryan Jacobs were all killing it) were turning this down. “I can do better!” was one guy’s reply, which will forever ring in my ears as an example of “arrogant ignorance.” (©Rob Riggle) What was worse, was trying to explain the return was actually 17.65% ($100/$85, less 1), and with a 3% dividend over 20% annualized. “No, it’s 15%!” Needless to say, sometimes it is better to save one’s breath!

Sometimes ego gets the best of people and they forget they are comparing apples to oranges.

Love how they couldn’t see how a 15% discount actually equated to a 17.65% return before the dividend. I will admit that I had not done the math to realize that I was actually getting a 17.65% return with a 15% discount. But rest assured I would not have been one of those finance guys arguing it was on 15%. I would just quickly do the math and realize it myself. You can’t argue with the math.

Thanks for sharing my friend!

Great advice. I’ve never worked for a public company, so I’ve never had the opportunity to get an offer like that. At least I did get 4% company matching on my 401k, so I started maxing that out as soon as I could afford it. I do miss having a company match 401k now that I’m on my own, but I love my freedom way more. 🙂

Yeah, I am sure that freedom is well worth sacrificing the 401K match.

I work for the Government so there is no employee stock purchase program. However, if my next job (who ever/ when ever that is) offered it, I would definitely participate in it if it was worth it. The down side is I am not savvy when it comes to investing, so I wouldn’t know a great investment opportunity if I saw one. 🙁

But you do get a pension don’t you?

Yes they deduct 8% and match it. The vesting period is 8 years so I probably won’t be getting their contribution. I want to start investing that way if I do leave before the vesting period I have a good bit of money. I have only been there for 6 months and 8 years is a long time, so I just want to cover my bases.

Good call!

Yup, ESPP’s are pretty sweet deals and I believe the 15% discount to the lower of the starting/ending date is a standard offering. HNZ had one for years prior to the Buffet/3G debacle. I know a lot of guys that have a much richer retirement because they always participated and just let the shares sit and compound further with DRIP. Then the buyout happened at a large premium and Yahtzee! On top of that, HNZ at one time, also simultaneously had a pension with % contributions based on your age on top of a 401k match plus an ESPP! This wasn’t that long ago, but now, retaining top talent is the last thing on their mind. Different owners…different values.

I believe in the notion of employee stock ownership no matter what form it comes in: ESPP, options, grants, etc. Employees with “skin in the game” care a lot more and are more motivated to see the company do well. I agree that the decision to hold or flip is a personal one and is highly dependent on the stability of the company and the industry. Working in consumer products, it’s a lot safer to be on the hold side than if you’re in tech or another higher beta field. Share the wealth…such a simple concept.

Wow! That HNZ compensation plan and perks sounds amazing.

I totally agree with you that giving employees a stake in the company is one of the best things a company can do. If it were not for the harsh financial hardships the company I was working for at the time, I probably would had considered holding onto the stock. But things were not and continue to not look very promising. I hope they pull though, but it may take more runway then they have.

“Share the wealth” I like that!!!

PS – I love the content on your blog, but honestly, I think my favorite part is your introductory cartoon accompanying each article. Questions – do you create those yourself? If so, How’d you pick up that skill? And lastly, does the cartoon guy actually resemble you? LOL

Glad you enjoy the content and the cartoons. The cartoons really add a unique character to the blog and helps to differentiate among the plethora of PF blogs out there.

I use a free app called bitstrips. Within the app you get to customize your own avatar that you can then place in hundreds or maybe eve thousands of scenes. I did spend a bit of time getting my cartoon to resemble me as best I could 🙂

One of these days I will have to put a real picture up, but for now I need to maintain anonymity as to not complicate my life.

Cheers!

I work for a megacorp and also have the ESPP option, but we’ve never taken advantage of it. In general, we don’t like things that are so restrictive (the idea of having to hold the stock for however long, and having to buy through automatic payroll deduction, which makes it hard/impossible to cancel if we change our minds). But you’re making me rethink…

Hey Our Next Life,

In this instance the pro’s probably outweigh the cons. Think of it like CD on steroids. How does the ESPP work at your company? Is it similar to the one I described?

Would hate for you to be leaving really good money on the table.

Cheers!

Right there with you on this one. My company allows us to purchase up to $25,000 annually which I have taken advantage of the last two years and am doing the same this year. Plan on doing the same for as long as I can. Only concern now is when to start exiting so as not to get overweighted. Guess I have to keep striving to build the portfolio elsewhere so it can’t overweigh.

A colleague and I couldn’t understand our coworkers who didn’t take advantage of the 17%+ return and tried to come up with a business plan to help others within the firm observe theirs in a mutually beneficial arrangement. Never wrapped our minds around the intricacies of pulling it off unfortunately.

Cheers.

It is so puzzling to me that people could turn down such a lucrative offering.

The logistics would probably be pretty tough, and companies probably wouldn’t be to keen on it if you were profiting from another employees ESPP benefit.

Sounds like you have a plan.

Cheers

This is the first year my company is offering an ESPP and I’ve been maxing out (15k/year, 15% discount). I’m still trying to decide if I want to hold for LTCG. I normally wouldn’t stock pick but the company seems to be doing well enough and growing fast. Inertia or assiduous rebalancing, decisions decisions.

That’s awesome! Maybe you can split the decision, sell half during each open window, and hold the other half for the long term?

Well I just got killed on my company’s ESPP. On the purchase date, it was a 30% profit from the offering price. But, we had a month long blackout period. Earnings missed and the street punished the stock -28% before blackout period ended. Okay, no big deal, still made a little profit, right? Nope! I have to pay ordinary income taxes on the initial 30% gain (the gain on the purchase date) and take a capital gain loss on the price decline. The problem is I’m already maxed on my capital gain loss carryover, and even if I wasn’t, the ordinary income tax is higher than cap gains tax, so it’s a loss either way.