A lot of debate takes place amongst personal finance enthusiasts about which is more important: savings or compounding? The easiest answer is that they are both critical to building wealth. I have already discussed how important your savings rate is if rapid wealth building is your goal – rapid as in financial independence in 10-20 years. I even went as far as to call it the most important variable to wealth building.

Compounding is an amazing and magical force. However, compounding zero for three decades won’t get you far in achieving your dream of financial freedom. Zero compounded at 8% – or even at 20% – or 100% – for 30 years is still zero!

Compounding without savings is like driving a car without fuel: pretty worthless to transport you where you want to go. So savings is more important, right? However, this is a trick question, and the answer is multi-part: they are both “more” important, depending on where you are in your financial journey. The earlier you are in your journey the more important your savings (contributions) is. The longer you’ve been on the wealth-building path the more important compounding becomes.

But where is the inflection point?

That’s a funny question because I have been wondering the same exact thing. Humor me while I scratch my own itch.

The Assumptions For Our Example

Annual Savings = $100,000

Annual Return = 8%

I’m using $100,000 as that is the minimum amount I personally try to save and invest every year. The conclusions throughout this post will still hold whether you’re saving $10,000 per year or $100,000 per year (don’t get caught up on the absolute number).

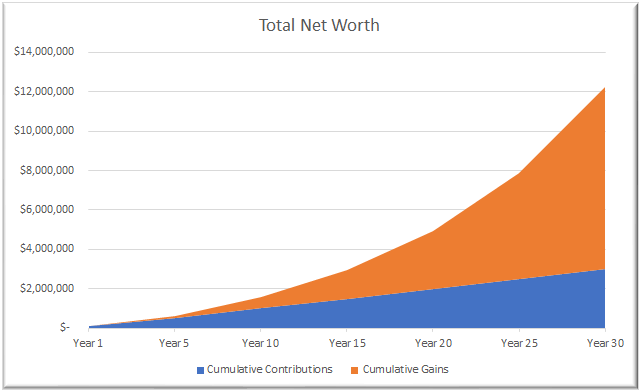

The first visual I want to share with you is what your ending net worth would be in this example (assuming you start from zero). If you invest $100,000 per year (assumes investment is made at the start of the year) and compound it at 8% per year you will end up with $12,234,587 after three decades of contributions and compounding.

Exhibit #1 – The End Result

Let’s start with a picture of the end result and then we will backtrack to the beginning.

See how after enough time, the value added from compounding makes up the majority of your net worth? By year 30, 75% of your $12,234,587 net worth has been a result of compounding. Think about that for a minute. You will have contributed $3,000,000 from your savings, which will ultimately generate an additional $9,234,587 – more than 3X your contributions. I told you compounding is a magical and amazing force!

So are you now saying that you think compounding is the more important wealth-building variable? Whoa there. I still believe that your savings rate (and amount) matter much more than compounding in the first ten years of your financial freedom journey, and I will show you why in the chart below (actually the lower the compound annual rate, the longer that first chunk of years needs to be, but I’m getting ahead of myself).

Let’s look at the pro-rata share of annual contributions vs. annual gains. We want to identify the inflection point of when annual gains from compounding outpace the annual gains from new contributions.

Exhibit #2: The Inflection Point Before THE Inflection Point

As you would expect, Year 1 ends with the majority of net worth comprised of the $100,000 contributed at the beginning of the year. Added to the 8% earned, total net worth value ends at $108,000. The arithmetic is easy: 93% came from contributions, and the remaining 7% is the result of compounding. Fast forward to Year 5, and it’s easily seen that contributions still make up the majority of the total annual increase (68%) of the total net worth increase.

(In the interest of conserving screen real estate and not wanting to make the chart too busy, Year 9 has been left out where the split becomes 50/50. It’s also important to note that your return will likely be a lot lumpier than the smooth 8% that I’m using in this example.)

All the way up until Year 10, savings is more important than compounding with respect to annual increases to net worth.

Side Bar: If your compound return is, say, 5% and not 8%, the inflection point gets pushed out to Year 15. Meaning that with a lower return, your net worth gains from compounding won’t be larger than your gains from contributions until 15 years into your journey to financial freedom.

Exhibit #3: The Mother of All Inflection Points – Financial Escape Velocity

There is one other inflection point that is important for us to identify. That is the point at which cumulative gains from compounding surpass cumulative gains from contributions. That is THE inflection point. Personally, I think this is the most important inflection point to understand, especially for those looking to retire early. Once cumulative gains exceed cumulative contributions, you have reached Financial Escape Velocity (I thought I coined this term, but after a quick Google search I realized someone beat me to the punch back in 2011).

Financial Escape Velocity is the point at which earnings and total capital grow faster than spending. Let’s move to our final chart to visualize when this happens with an 8% compound return and $100,000 annual contributions.

In the chart above, I have again only shown the data in five-year increments, in order to not make it too busy. However, you can see you are close to FEV by Year 15. You actually hit FEV by Year 16. Let’s take a closer look at some stats. By Year 16:

Annual Contribution = $100,000

Annual Gain from Compounding = $242,594 (2.4X contribution amount and 71% of the total annual increase to net worth)

Total Net Worth = $3,275,023 ($1,600,000 from cumulative contributions ad $1,675,023 from cumulative gains from compounding)

Final Thoughts

From a FIRE (financial independence retire early) perspective this is your end goal. It also aligns very well to the fifth milestone in the Five Major Milestones of Financial Independence that I published earlier this year. At this point, you’re done. Well, at least most people are done. The only reason you might keep going is if you desire to reach Financial Freedom, which I distinguish as a level above financial independence. It is true financial nirvana.

FI and FF are mostly used interchangeably across other blogs in the personal finance blogosphere, but here on GYFG they are not the same. Don’t get me wrong – reaching FI will provide you with a nice life, one of your own design, but it’s a life that you are now locked into for the rest of your days. Are you sure you will have the same wants and needs 10-30 years from now? I don’t know about you but my wants and needs have changed a lot over the last three decades and I’m willing to bet they will drastically change again over the next three.

To steal a quote from Physician on FIRE, financial freedom allows you to be self-insured against the cost of unexpected expenses and lifestyle upgrades.

Reaching Financial Freedom provides a margin of safety. I would argue that FF also makes you that much more insulated from market crashes, like the Great Financial Crisis of 2008/2009, when many asset classes sank 50% or more.

Some of us may have a Big Hairy Audacious Goal, like reaching $10,000,000 in net worth – oh yeah, that’s my goal. I chose this number because I want to leave a legacy for my family. I want my family to continue to be able to live well and give well into perpetuity. I want to make my world so big that anyone in it can have anything they desire. Most of all I aim for FF and my $10M goal is where I reach my point where money is no object.

I want the FREEDOM to decide to live a bigger life.

This analysis makes me feel pretty good about my $10M net worth goal by the time I’m 48 (originally a 20-year goal for context). Based on this example I will hit $10M by year 28, but that assumes I only contribute $100,000 per year – which happens to be my minimum goal. In 2018, we contributed (saved) $196,404 and should be in a good position to continue increasing this over the next five to ten years.

Onward & Upward!

– Gen Y Finance Guy

P.S. I’m not the only one pondering this question. Check out the tweet storm from Nick Maggiulli on this topic.

7 Responses

My kids are all accomplished adults and I don’t worry about the impact of the eventual seven figure inheritances on them. I inherited a similar amount from my parents, all of which we invested, and it had no negative impacts. Do you worry at all about handing down millions to your future heirs? That is not always the blessing it is hoped to be.

Stevark,

I haven’t really given it much thought. We want to raise our son to be a successful and independent adult. I’m inclined to have milestones that need to be reached in order to unlock tranches of inheritance.

I also like the idea of setting up a family bank that provides cheap access to capital but that needs to be paid back.

How do you plan to approach this with your kids?

Dom

GYFG, I’m still reading and loving your content! We’ve discussed the savings/investing issue, and the ‘critical mass’ required to reach ‘escape velocity’. No doubt, you will do it!

One thought for your consideration…you are now accumulating enough data to assemble your actual savings amounts each year, and compare it to your baseline(s). It is an interesting exercise, and may prove enlightening; the example above is theoretical and that 8% figure is something else. One piece of data I encountered recently is that Goldman Sachs has determined that the U.S. stock market proxy is at parity with the U.S. 10 year T-bond, from 1999 through 2018. Yes. There are a lot of calculators online to see yourself, and the S&P500 for that period is about 2.9% (4.6% if dividends are re-invested).

Am loving all the things you accomplished in 2018 for yourself and your family. Am looking forward to any news you care to share with us readers in 2019! Be well!

JayCeezy,

I’m still reading and loving your comments.

Now that I have collected four years worth of actual data, I plan to write a post vs. my original assumptions.

I do know that my original plan required 8% to achieve $10M but four years later it’s only 6% (keeping 48 years old as the target). It just means a larger portion is being made up from contributions.

My goal is to get to an amount quick enough that would allow 3% annual returns to get us there. All the better if they end up being higher than that.

I think you will enjoy this post, which should be out in the next couple months. Baby GYFG has altered my ability of being super productive, so content is taking me a bit longer to produce these days (a lot more time near the shart zone than near the computer – LOL).

Dom

Hi Dom,

Great post!! It’s amazing when compounding hits that critical mass and starts really accelerating growth. It’s a double whammy when you get quarterly dividends larger than your contribution amounts. You get the cash-flow along with the capital gains.

My wife and I don’t have kids so we plan on spending everything (for the most part) LOL.

Great goal!! I also like your concept about financial freedom. Most people are looking to cover just the basic needs… life is much more than that!

Ernest