We have officially closed out 9 months of the year, thus the need for another peek into the equity portfolio. As many of you know that have been reading for any length of time, every month I put together a very detailed financial report that details out gross income, expenses, net worth, savings rate, and progress on the 7 year 3 month mortgage pay off goal. Since the report already pushes 3,000 – 4,000 words a month, I thought it would be more appropriate to provide details of the equity portfolio in an entirely separate post.

Also, I don’t really see the benefit of updating this on a monthly basis, quarterly should be just fine.

One of the guiding tenets of this blog is that of FULL TRANSPARENCY. This is another step in living up to the high standards we set here at GYFG.

This will serve several purposes:

- It will force me to analyze the performance of my portfolio.

- It gives you a better view of what is under the hood.

- It will also provide some visibility around where the increases come from. Too many people overestimate their returns and forget about new money contributions, company matches, dividends, etc.

Breakdown of Portfolio Performance [9/30/16 vs. 12/31/15]

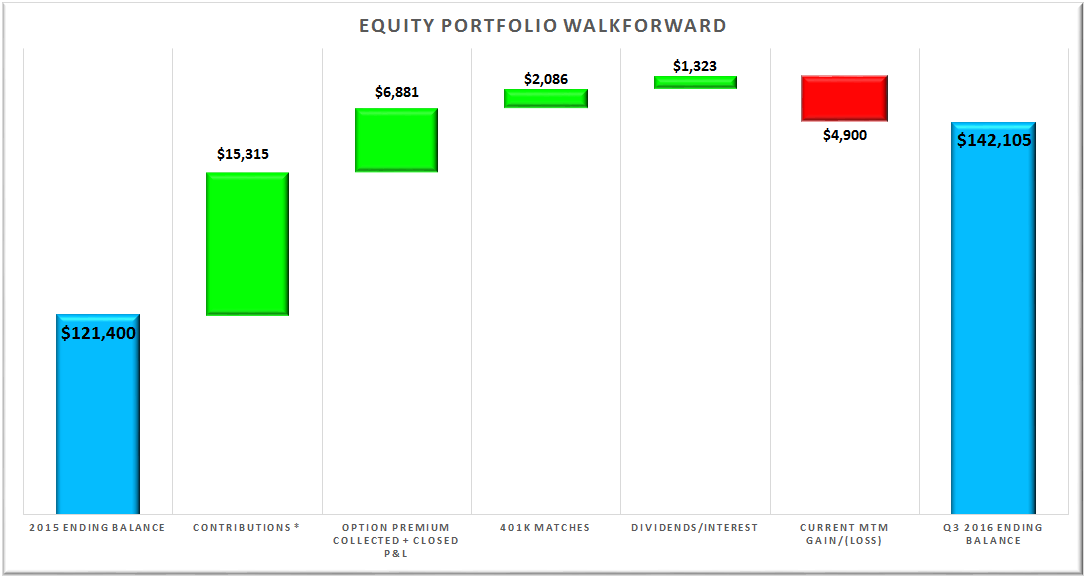

You may have noticed in the title of this post that the portfolio is up 17.1% so far in 2016, and I will be the first to admit that this is a bit misleading at first glance. But never fear, I will be breaking down the components of where the gains came from and will also be comparing the performance to the S&P 500 as my benchmark.

For many of you this will be your first time seeing a waterfall chart. If this is your first time I hope you like the visual of how the portfolio grew and what made up the gains.

Now let’s breakdown the buckets…

2015 Ending Balance = $121,400

[+ $15,315] Contributions – 2016 Contributions to Mr. GYFG 401K. We lost the tax advantage this year for Mrs. GYFG and stopped contributing to her IRA. We may need to reconsider this once I can do some more research on the backdoor Roth IRA.

[+ $6,881] Option Premium Collected + Closed P&L – This is representative of the option premium I’ve collected for selling cash secured puts, covered calls, other option selling strategies, and any other realized gains from closing stock positions (I have been called on a few of my covered call positions).

[+ $2,086] 401K Matches – At this time I am the only one in the GYFG household that has a qualified retirement plan through work that offers contribution matches. Last year the company I work for offered 25% on up to 6% of your income. This year it has increased to a 50% match, but it will only be on up to 4%. The next match should take place in October (they happen quarterly).

[+ $1,323] Dividends/Interest – One of the rules I use when selling covered calls or puts is to only do this on stable companies with a long history of paying dividends, and a dividend rate of 3% or greater. It is just another way I look to increase my margin of safety in the event that I am exercised and forced to take a stock position from short puts. It also helps to reduce cost basis on long covered call positions, until the stock is eventually called away. The interest is very minimal and comes from interest on cash sitting in my brokerage accounts. On track for about $2,000 in dividends in 2016.

[- $4,900] Current MTM Gain/(Loss) – This has grown slightly from the end of year MTM loss of $4,500 in 2015. I will detail them later in the post. This is a little misleading by itself, because the premium from the $6,881 above offsets these open MTM losses.

2016 Q3 Ending Balance = $142,105 [+ $20,705 or + 17.1%]

Now that you can see the detailed breakdown you realize that a large part of the portfolio increases came from new contributions (again). When you back out the contributions you are left with the investment gains.

Note: I include the 401K match as an investment gain. It is not money I contributed and I don’t distinguish it from market gains.

This leaves a gain of $5,390 or 3.9% (this is up slightly from Q2’s reading of 3.3%).

A reader asked me (via email) shortly after publishing my last quarterly update what my return was without the 401K matches, so JayCeezy if you are reading this, this if for you. The gain excluding 401k matches was 2.4% (or ~$3,300). But I will also point out that I don’t take into acount the timing of adding new money to the portfolio, so the return is not time weighted, and is thus understated. But I would rather keep this simple. It’s really just not that important to me right now.

This compares to the return of the SPY (ETF representing the S&P 500) of 6.1% before dividends or 7.74% with dividends. The good news is that I have a positive return and the 3.9% has been earned, even with 50% of my portfolio sitting in cash waiting to seize lower pricesm (someday they will com). Volatility seems to be poking its head a bit, but still nothing irresistible. With current prices, I would rather continue outperforming the market and continue building up the war chest.

Note: the SPY gain was calculated taking the September 2016 closing price of $209.92 and total return here.

What is the Current Make-up of the Portfolio?

First and foremost I should remind you that of the $142,715, only about $70,000 is actually invested. The rest is sitting in CASH. This leaves me sitting with 51% of my investable assets, across my brokerage accounts, in CASH.

I have changed my tune a bit on strictly following the 4 tier system to deploy cash. I have decided that it makes sense to compliment this 4 tier system with monthly dollar cost averaging, so I have set all future contributions to the 401K to invest in the SPY index fund that is available. In addition to that we continue building up our cash stash in our savings account which is currently at over $100K. This will be a growing problem over the next 4 months, I am projecting it to be around $165K by end of January 2017 (a good problem to have I suppose).

Current Open Positions

- CAT – Covered Call

- OIH – Covered Call

- PG – Covered Call

- WMT – Covered Call

- SPY – Big Fat Jade Lizard

- XLE – Covered Call, Short Callspread

- KO – Covered Call

Well there you have the Q3 portfolio update (you can see the last update here). One day I will also include performance of my P2P investments, REIT’s, and Rental Real Estate. I may even create a separate post series. I have not decided yet…if you have an opinion, please let me know.

How did your portfolio do in Q3 of 2016? What is your plan for the rest of 2016?

– Gen Y Finance Guy

4 Responses

Great update. When you are called on one of your covered calls, do you buy back the stock immediately?

With a cash secured put, I’m curious how you calculate the return. Is that portion of money that is in your portfolio in cash counted as a 0% return (whatever the interest is)? I have people ask me this about my reserves for my real estate. For simplicity I don’t include it in my calculations.

Brian – No, usually after I am called the price has move well past the area that made it interesting in the first place. I look for several key criteria to be met:

1 – Is in the lower 50% of its trading range over the last 12 months

2 – Has implied volatility of 50% or greater

3 – Has a dividend that around 3% (not a hard an fast rule, but more a preference)

Re: return on cash secured put

I wrote up a lengthy post on covered calls and short puts for Sam at Financial Samurai here: http://www.financialsamurai.com/investing-in-options-hedge-against-risk-make-profit/

But in short I take the premium collected divided by the capital at risk. For example, if I sell a $50 strike call for $5, then the capital required (for a cash secured put) would be $4,500 and the premium collected would be $500 ($5 x 100 shares). Therefore the return (assuming full reward) would be 11.1% (500 / 4,500).

That said, there is a lot of my portfolio sitting in cash that is essentially get a 0% return. The return I am sharing is blended with that accounted for. And it also doesn’t take time into account for new deposits, so is understated, but I want to keep it simple.

Cheers,

Dom

LMFAO! Awesome title. Always read and enjoy your stuff GYFG, you and Mrs. GYFG are killing it, and having a great time while you do it.

The reason for my initial question was to present to possibility that a basic index fund might be a better vehicle for return-plus-dividend, especially when risk-adjusted and put/call returns are annualized. When placing a value on one’s time, there is an even greater difference. Anyway, your are stacking the bricks of your NW, and I am glad you can break out the real investment return so you can compare it to a general benchmark.

You are doing great, so this isn’t advice; just information to keep in your hip pocket. But wanted to mention that the concept of Covered Calls was a big deal in the early ’90s, and a series of books, infomercials, tapes and seminars was a big pop-finance phenomenon back then. “Wall Street Money Machine” was a NYT bestseller for a long time, by former taxi-driver Wade Cook. Long story short, Cook promised people could double their money twice each year. He went bankrupt, and he and his wife went to prison.

Lastly, your post title reminded me of a great joke: “Everything is so politically correct these days. You can’t use the “C” word, can’t use the “N” word, can’t use the “F” word. How are people supposed to know when I’m talking to them?” – Jim Norton

Good to hear from you JayCeezy. I am lucky to have readers like you to challenge my thinking, it makes the blog fun and interactive.

“Double their money twice each year” – That is a pretty big statement. If I could double my money twice each year I would no longer be working 🙂

If it sounds to good to be true it probably is.