The GYFG household has been in a fortunate situation in that we have been able to live the DINK (dual income no kids) lifestyle. This has had a huge impact on our ability to generate a high income, leading to a high savings rate, and thus a larger net worth faster than we otherwise would have. Seriously, it’s a huge advantage to have a two income household.

However, we find ourselves planning the next chapter of our lives, starting a family. In recent discussions, we have been exploring what it would mean to our finances if my wife were to leave her job to be a full-time mom. This would probably only be for a few years and there is a high probability that Mrs. GYFG would find something that she could do part-time on a flexible schedule and potentially from home (she has thought about teaching Yoga). We don’t really know the details, but let’s just assume that she quits and doesn’t earn any income.

In this post, I want to explore what this change would do to our take home income. Of course, we will lose an income stream, but we will also lower our marginal tax rate, at least in the short-term.

Where Are We Today?

The GYFG Household is currently on track to generate $368,888 in gross income in 2017, broken down from the following sources:

- Mr. GYFG Day Job $234,000

- Mrs. GYFG Day Job $107,888 (includes side hustle income, related to day job)

- Rental Income $17,000

- Blog & Other Income $10,000

We currently make the $23,850 in pre-tax contributions:

- Mr. GYFG 401K $18,000

- HSA $5,850 (my employer contributes the rest to get us to max of $6,750)

And lastly, we have itemized deductions of approximately $65,800 that cover things like:

- Depreciation on rental real estate

- Interest Paid on mortgages

- Property taxes

- Business expenses that get written off against our side-hustles

- Benefits paid pre-tax (i.e health insurance premiums)

So, with that being said, let’s use the income tax calculator from SmartAsset to see what our current tax obligation is estimated to be for 2018.

Estimated Adjusted Gross Income = $279,288

Holy moly!!! $107,106 in total income taxes (29.03% effective tax rate & 45.65% marginal tax rate), that is a lot of dough. This leaves us with an after tax income of $261,782.

Impact of Losing Mrs. GYFG Income

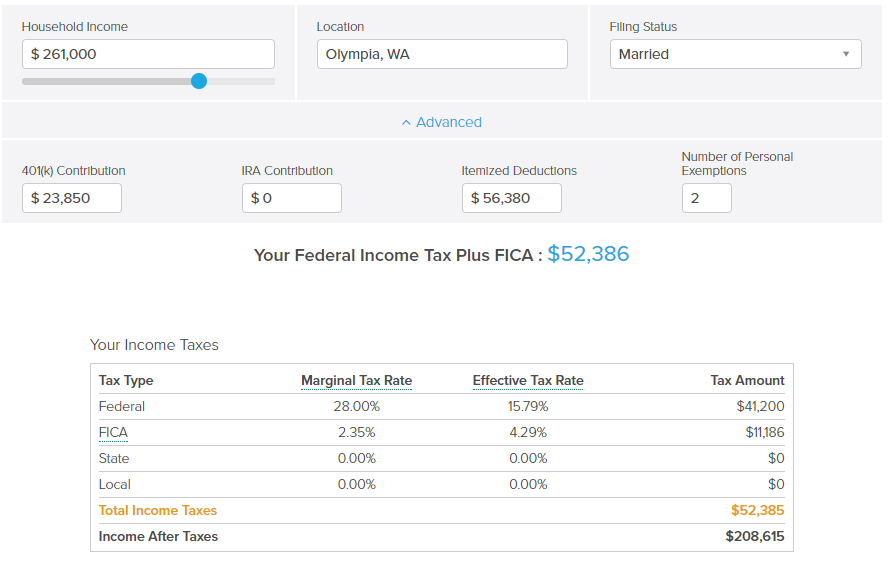

Now let’s take a look at what this looks like by subtracting out the income for Mrs. GYFG. In dropping her income from the equation, we will also lose about $9,420 in deductions against her side income (for business expenses).

Our total tax liability drops by $44,509 or 41.6% and our after tax income drops by $63,379 or 24%. Although this still amounts to $5,281/month, it’s not nearly as bad as I thought it would be.

Note: our effective tax rate drops to 23.98% and our marginal tax rate drops to 39.65%.

In fact, after running the above scenario, I realized that our AGI would fall below the $186,000 IRA contribution income phase out, which would allow us to potentially stash away another $5,500/year into an IRA for Mrs. GYFG, but that would be dependent on the growth of my income (which means this would likely only last 1 year at the most).

I am not going to count on it but I will be opportunistic if the opportunity does arrive to stash some more cash into a pre-tax account.

The X-Factor – Relocating To a State With No Income Tax

This brings us to something I have been contemplating for a couple years now, especially as I have seen our income rise exponentially, so have our state income taxes here in California. There are six states that I know of that do not have state income taxes: Alaska, Nevada, Washington, Wyoming, Texas, South Dakota, and Florida.

The two states we are considering are Texas and Washington. Based on this our income and tax situation would look like the following:

We would obviously need to consider places that have a cost of living similar or lower to what we have now. You can see that by moving out of state, this brings our tax bill down by another $10,212 and our after tax income increases by the same amount (resulting in a 20% decrease in after-tax income vs. 24% in the example above).

Note: our effective tax rate in this scenario drops to 20.08% and our marginal tax rate decreases to 30.35%.

It is also my understanding that although these states don’t have income taxes, some of the savings will be offset by an increase in property taxes.

Concluding Thoughts

First, this is not a decision that we plan to make tomorrow, but it’s nice to know ahead of time what the ramifications would be. Although a big hit to our take home income, it is far less than I thought it would be.

After writing this out, I admit that the probability of us moving out of state is very low, especially in light of the fact that all of our friends and family live in California. But it was fun to at least run the additional scenario.

It will likely be another year before we actually face making this decision, but being the planners that we are, we like to know the facts far ahead of ever making big decisions like this. In the meantime, I will be working furiously to increase my income to minimize the hit to our current standard of living, savings, and investing.

Below you will find a copy of the Smart Asset income tax calculator to play with yourself:

[sa_captivate type=”incometaxcalculator”]

– Gen Y Finance Guy

14 Responses

Wow. I wouldn’t have guessed the tax impact, and hence total impact on take-home pay. That’s very interesting and an analysis that more people should probably do when considering a decision like this. Good stuff for sure – thanks for sharing.

Hey Brad – I was pleasantly surprised by the results. I intuitively knew that our taxes would go down by reducing our income, but I wasn’t sure what total impact would be based on reducing our marginal tax rate and thus our effective tax rate.

Oh hey there from sunny Texas! I do have to say that not having a state income tax is pretty freakin’ nice. Of course, the state makes its money in other ways, too. I do have to say that the cost of living here is great compared to most areas of the country. The downside is that it’s hotter than hell in the Texas summer (but our winters rarely get down to 20 degrees–ever).

Mrs. Picky Pincher – I don’t think we will be neighbors anytime soon, but I appreciate the color on Texas.

Cheers

Dom, some thoughts…

* New Hampshire and Tennessee (kind of) also have no state income tax. Hmmm, never mind.;-)

* If a kid(s) enter the picture, personal exemptions will increase from 2.

* Replacing your income in a no-income-tax state may be problematic. Mrs. Ceezy and I explored this option, and found that salaries were approximately 75% of what they are in Cali, largely due to the ‘right-to-work’ laws removing union costs (and also lowering the basis for all compensation). And of course you are right about considering the increase in Property Tax and Sales Tax rates for potential destination states.

We decided not to move, and it came down to a simple question. For you, it would be “would you move for $10,000/year?” For us, the answer was ‘no’ but everybody is different.

While Mrs. GYFG is working, every single after-tax dollar she earns goes into your savings/NW. The economy (and your personal situation) is great now; if/when that changes, the opportunity to save and work may not always be available. Just one or two more years now could make a huge difference 20 years from now. And as we’ve discussed, the real boost to NW is savings.

Lastly, you and I sometimes talk about how everything in PF is basically a risk-management decision. If you go to one income, the GYFG gameplan is now based that. If you’ve ever been trapped in an awful work situation, lack of options make it exponentially worse.

Whatever you decide will be the correct decision!

Hey JayCeezy –

I always look forward to your replies.

If we did move, I would still work for the same company, just remotely. I already have the green light for that, our CEO has run the company remotely from the house since 2006, so it’s not that hard to get him on board. Therefore, replacing my income wouldn’t be a concern….unless I lost my job.

But as you said, the savings is only $10K/year, and given that our friends and family are all in SoCal where we live, we would not move for the $10K in savings. We would lose access to free baby sitters with my wife’s parents who only live about 20 minutes down the road. Then there would be the extra travel expenses coming back and forth to California for family events, and to visit friends. I think we would actually add more than $10K in expenses, and the trade-off would not be worth it. Plus we love Sunny SoCal.

I agree, this is just another risk-management situation, where we are trying to figure out all the consequences…both intended and unintended.

Appreciate your thoughts!

I also enjoyed your updated interview over on ESI 🙂

Dom

Great analysis, and kudos on thinking about the tax aspects. But then after reading your blog for a while, I shouldn’t be surprised…

Thanks!

Love your logo.

I’m curious, why doesn’t mrs gyfg open up a solo 401k account? I assume she’s a 1099 independent contractor. You guys would be able to put an extra 25-30 k a year in tax advantaged space.

Hi Winkle – Mrs. GYFG is actually a W-2 employee so she can’t open a solo 401K 🙁

Late comment, but this is great! I know this is beyond the scope of this post, but you could realize other types of savings if your wife stayed home as well. Like child care, eating at home more often, commuting costs, work wardrobe costs, etc. I made more money than my husband did before we had kids but still decided to stay home. We don’t regret it financially at all!

Thanks, Billie Jean – those would all be possible areas of savings when/if this change happens. It is just hard to quantify until it happens 🙂

Welcome to the $100,000 in annual taxes club! We’re so excited to have you as a member.

Such a bummer that your wife doesn’t have access to retirement account at work. Has she ever considered asking if they will hire her as an independent contractor? Could make a world of difference for you guys. The general rule is that if you’re not covered by a retirement plan at work, you can at least deduct contributions to a traditional IRA no matter your income, but unfortunately I don’t think that applies since you’re covered by a plan.

Have you opened a solo 401(k) to shelter $2000-ish of blog income?

And where are those Roth IRAs?! I’m gonna hassle you forever until you open them!

Thanks, Josh…I think???

Yes, Mrs. GYFG and I have floated the idea of being set up as an independent contractor, but that doesn’t work for their business, based on regulations. We do have a traditional IRA set up for her, but once our income grew to a certain level, and because I am covered, the deductibility of contributions was phased out for us.

No on the solo 401K to shelter blog income. And to that end, the blog has only made about $2,000 so far this year, which after expenses doesn’t leave much to contribute…so I haven’t bothered. It would have to make a lot more money for me to set one up.

We haven’t opened up Roth IRA’s because again from an income standpoint, we don’t qualify. The only thing we could do is the back door contribution, but to be honest I really don’t feel like increasing my tax liability. As you pointed out, $100K+ is more than enough for me to pay in taxes.

Cheers,

Dom