One of my hobbies is to find new revenue streams that take minimal effort (and minimal time). In late 2017, The Wealthy Accountant (TWA) published a post on how he was earning $1,000/hour selling tradelines – that piqued my interest. I had no idea what a tradeline was before reading that article. But I quickly learned that a tradeline was just a fancy word for a line of credit. Lines of credit comes in all sorts of shapes and sizes but TWA was writing about one type in particular: credit cards.

It sounded too easy. Too good to be true. I was skeptical but kept an open mind. After all, this was coming from TWA, who is worth $12M+ (according to Rock Star Finance). I continued to do my own research and found that this was in fact a legit opportunity. But before I jumped in and started doing this myself I needed to understand how it worked and what the risks were.

The Mechanics of Selling Tradelines

First, let’s cover what it actually means to sell a tradeline. Who would want to buy a tradeline? And why – what’s in it for them?

Like I mentioned above, a tradeline is what a bank calls a line of credit. Every one of your credit cards is a tradeline: the bank extends you credit every month, and you pay them back after you use that credit. You have the ability to add an authorized user (AU) to each of your cards, which extends certain benefits to the person you add. Although added as users, these people never actually get to use your card. They cannot rack up a bunch of debt in your name. But these people aren’t buying an authorized user spot on your credit card in order to spend your money; they have poor credit and want to draft off your good credit in order to improve their own score.

Let me explain.

As the primary cardholder, any time you add an AU the physical card is sent to your address and you remain in control of it at all times. The person buying an AU spot on your card gets the benefit of your good credit history for that particular card, for as long as they stay on your card. This is because many of the credit cards companies report the credit history to the various reporting agencies for both the primary cardholder and any AU’s. The AU doesn’t get to use your card, but in a sense, they get to use your good credit. A potential AU customer may be looking to improve their credit score in order to get a better rate to refinance debt, or for a car or home loan.

When you sell an AU spot on your card, the broker you use provides you all of that person’s personal details after doing a full background check (to prevent fraud). Although you get all of the AU’s personal information, they get none of yours, so they have no idea who you are. Once you add the AU to your credit card they stay on for two full reporting cycles and then you remove them and collect a commission from the broker that supplied the AU to you. The broker does all the marketing and vetting, while you spend a few minutes adding and removing AU’s. Then you collect a check every two months (my commissions are actually direct deposited into my bank account).

What’s in It for Me?

Money, money, money!!!

I use a company that does all the marketing and vetting and sends me AU’s. The price they charge for an AU varies due to the following two variables:

(1) The credit limit of the card.

(2) The age of the card (how long it’s been open).

The higher the credit limit and the longer the card has been open the higher the price they can charge the customer. The higher the price they can charge the customer, the higher your commission is. Here is the latest commission schedule from the company I work with:

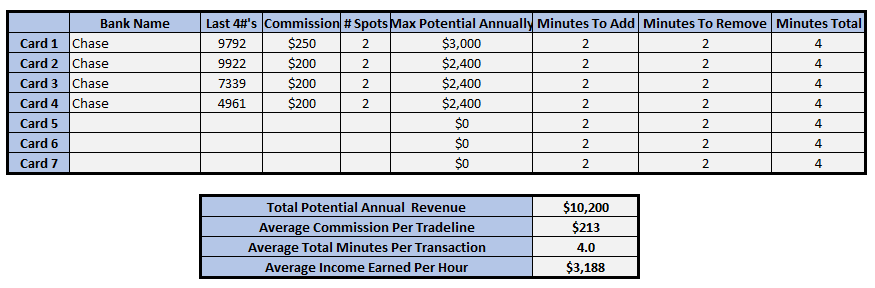

I currently have four cards listed with the company I work with and each card has two AU spots available for sale. Depending on the card issuer (Chase, BoA, Capital One, etc.) there is a recommended maximum number of AU’s to keep the account from getting closed. Yes, the risk you take by participating in this side hustle is that your account could be closed. That’s why I only do this with credit cards I have churned, on which I don’t mind this risk. That said, I still follow the recommendations to reduce the chances of account closure. I want to maximize this income stream.

I have four cards listed and each AU spot is worth $200 to $250 in commission to me. This means the eight spots have a maximum earning potential of $10,200 cumulatively per year. This equates to about $850 per month. When you consider the fact that the time required to add and remove AU’s is only a couple of minutes, my effective hourly rate for this “side hustle” is $3,188 per hour.

What Are the Risks?

Everything I have read and reviewed states that this is a legal activity. However, as I mentioned above there is a risk of getting your account closed down by the issuing credit card company. If you read your terms and conditions it does say you are allowed to add authorized users but you agree that you know and have a relationship with any AU that you add (like friends or family members). The agreement between you and the credit card company states that if they find out or suspect you have added an AU that you do not know, they reserve the right to close your account (and potentially all accounts with them if you have more than one credit card with them).

The Wealthy Accountant had a nice summary of his findings:

“Is this legal? Another question people have is the legality of doing this. My research indicates it is legal, including remarks from a spokesman from the FTC. The illegal issues lay with tradeline companies not doing adequate background checks. This is why it is important to vet any tradeline company before signing up with them. My understanding is this cannot be listed as credit repair and money can’t be collected up front from the client. You get paid after the fact so reading FTC reports indicate there are no legal issues with selling tradelines. If you vet a tradeline company and later the company takes a shortcut there is liability risk to the tradeline company. Having your due diligence in order protects you.”

Risking having my account shut down is worth it to me. But it’s also why I suggest you only enroll cards that you don’t mind getting shut down. Personally, I only enroll cards that I have churned and no longer actively use. If the said card has an annual fee tied to it, I call the credit card company and ask to have it downgraded to a different card with no annual fee. This allows you to maintain the credit history of the card while minimizing its cost.

Concluding Thoughts

This is a great way to double dip on your credit card churning activities. For example, in 2017 I shared how I had churned the Chase Reserve credit card in both my name and my wife’s name. We ended up earning about $6,000 in cash back from those two cards between the juicy signup bonus, travel credits, and 3X points on dining and travel (2X points on everything else). These two cards have since been downgraded and enrolled to sell two AU spots each (four total) earning the GYFG household $450/month on average.

Every card I churn now represents two new revenue streams, one from the rewards and points redeemed for their cash value, and the other from selling AU spots once we have earned our rewards. You should know that a potential tradelines card needs to be “seasoned” for at least a year, meaning it needs to be open for at least that long before you can sell any AU spots on it. You also should know that not all credit card companies report credit history for listed AU’s so those cards won’t qualify for enrollment. The major card issuers that do report credit history for AU’s are Chase, Capital One, Barclays, and Bank of America.

The GYFG household actually has two Barclays cards that are in incubation waiting to be enrolled (another potential $450/month once they are seasoned). I think that the extra $10K we’re currently earning is well worth the three hours it takes to earn that money. I don’t know of many opportunities where you can earn $3,188 per hour for your time.

Thoughts? Have you ever heard of anyone doing this? Do you do this? What other ways are you creating revenue streams with insane effective hourly rates?

– Gen Y Finance Guy

p.s. I have received comments and emails asking which company I use. I personally only use one company that I believe to be the most trusted and legit in the business. The volume they do is incredible. I was just speaking to David, one of the founders, and he shared that sales of tradelines have doubled since January. The company I personally use in this incredibly lucrative and easy side hustle is Tradeline Supply. If you decide this is a good fit for you, be sure to tell them Dom and Gen Y Finance Guy sent you.

15 Responses

Hi Dom,

I’m wondering what company you’re using? I had never heard of this until reading you this morning and would like to get involved! I’ve been reading up for three hours now but can’t find a trusted blogger I follow that mentions a company.

Are you willing to share that info?

Wow I is there a way I can ask a relatively detailed question going deeper into this subject possibly reach out via email? Similar to TWA there is a lot of truth to the post and would love to get an insight. Understanding how the credit game works is powerful!

Rafael – sure, send me an email at dominic@genyfinanceguy.com

Hi Barbara – I’m using Tradeline Supply. It is the best company I could find in this space and they also do an incredible amount of volume.

Thanks, Dom! I appreciate the info…and the great content you’re putting out. Have a wonderful day!

~Barbara

Great article. I have been thinking about doing this for a while and have looked at a few companies. What is your opinion on Tradeline supply.com as a provider? Would be good to find out who you are using. Also do you need to keep the credit card utilization down to 10% or 30%. Thanks

KT – Tradeline Supply is the company I use exclusively. You need to keep card utilization below 10%.

Dom,

This is an interesting article. I came across this idea about a year ago on the Mr. Money Mustache forums and it’s been on the back of my mind as something I want to try, but I haven’t done it yet. It’s great to see that it has worked so well for you.

It’s the easiest money I have ever made.

Been doing this for the last year and have cross shopped many companies.

Some things I have found:

Many don’t have the volume of customers to sufficiently fill up tradeline spots right away.

Some companies don’t pay you until after 2 months and the line has posted on the customers account.

Compensation varies a LOT. The companies that pay more dont always have enough volume to even find you an AU, others with a lot of volume pay you less.

At the time of this writing Chase cards are flagged and you may add but when you begin to remove AU they start to ask for documentation like customer drivers license and other personal documents creating a hassle.

Hey Jason – Thanks for sharing your experience. Do you mind sharing what companies you are using or have decided not to use? I have several Chase cards that I sell AU’s on and have yet to have any issues over the past 18 months. I will admit that I did have a couple of accounts that got shut down by Chase because I did more than the recommended two AU’s (on a couple of my wife’s cards).

You give readers a lot to think about and I appreciate that kind of writing.

Great blog, I love how it’s full of useful information. I look forward to reading more. In case you don’t know, IZM has a great program for selling tradelines as well. They also pay the more than other companies I’ve spoken to.