GYFG here checking in for the August monthly financial report. If you have been reading these reports for a while you will notice that I introduce each month with the same intro month after month. I do this for two reasons, a) for the newbies to the site (which make up about 50% of the sites traffic) and b) to remind everyone what these reports are all about. By all means if you have read the intro at least once, then please feel free to skip down to the “Summary of August 2015” section where the new content begins (click the orange link to be taken there automatically).

For those of you that are new around this corner of the internet, I wanted to fill you in as to what these reports are all about. These monthly reports are about full transparency. They are just as much for me as they are for you. It’s a hard decision to make all of your financial details public, but it’s also a very motivating one. It’s not just the post, but the process of putting this post together that really benefits me.

My sincere hope is that my transparency will inspire you to take the helm of your own financial ship and be intentional with its direction. I truly believe that anyone can reach financial freedom, if they are willing to do things differently. If you earn an average salary and have an average savings rate, then you can expect an average result! That means you will likely have to work at a job you may or may not enjoy until you’re 65 and then maybe you can retire IF you’re lucky.

Hey, there is nothing wrong with average. If you’re happy with average, then by all means keep doing what everyone else is doing. Not sure how you feel about that, but I have no interest in living an average life. I want EXTRAORDINARY.

Most people don’t want to live below their means in order to reach FINANCIAL FREEDOM, because that’s painful. They think it involves cutting out all the joy in life. You know what I’m talking about, those financial gurus that tell you that in order to get rich you need to cut out the $5 lattes and stop going out to eat. Then after 40 years of diligent and above average savings and super low spending, you will be a millionaire. Basically, you have to live like a college student and suppress all the things you want to do in life and then when you’re old you will be rich.

Okay, that doesn’t sound like the plan for me either.

The good news is there is another way. This site and these reports are here to show you the OTHER path to financial freedom. There is a way where you can have your cake and eat it too. I believe and hope that over time I will be able to convince you of the following:

In order to reach financial freedom you can choose to live below your means by cutting expenses to the bone and living in a state of scarcity or you can expand your means and live in a state of abundance by increasing your income and enjoying the $5 latte or other indulgence of your choice.

Not only that, but if you’re diligent you can reach financial freedom a lot sooner than anyone has ever led you to believe.

Our Mission Statement:

To Humanize Finance, Build Wealth, and Reach Financial Freedom.

I know I don’t have to publish my juicy details every month, but it’s important to me that you know that I put my money where my mouth is (because not that many finance blogs or people giving financial advice do this). I publish all of my financial details not to brag, but instead to show you what is working as well as what’s not working. Sometimes finance can get pretty dense, but I think real life examples and numbers can help slice through the complexities (and BS). Personally, I have always enjoyed the financial reports put out by other bloggers around the blogosphere.

As always, you can find all my previous reports on the Financial Stats page (as well as annual trends and a few other financial metrics not found on this report). In these monthly reports the plan is to give you a month over month update on Gross Income, Assets, Liabilities, Net Worth, Expenses, Contributions, Savings Rate (NEW), and progress on the mortgage pay down goal.

Summary of August 2015

The end of August typically marks the end of summer for us, even though the official end is not until September 23rd this year. Not that we have any, but kids are back to school, and my work schedule in particular usually picks up through the end of the year. The last four months of the year is typically a good time for us to bunker down and increase our savings since both my wife and I are typically pretty busy this time of year.

It actually comes at a great time as we get back from our 10-day road trip and look to revise our savings goal higher for the year. Previously we were shooting to increase our net worth by $69,000 through pure savings alone this year (as of August we have saved $59,721, more details below). We are now shooting for around $85,000.

What went down in August

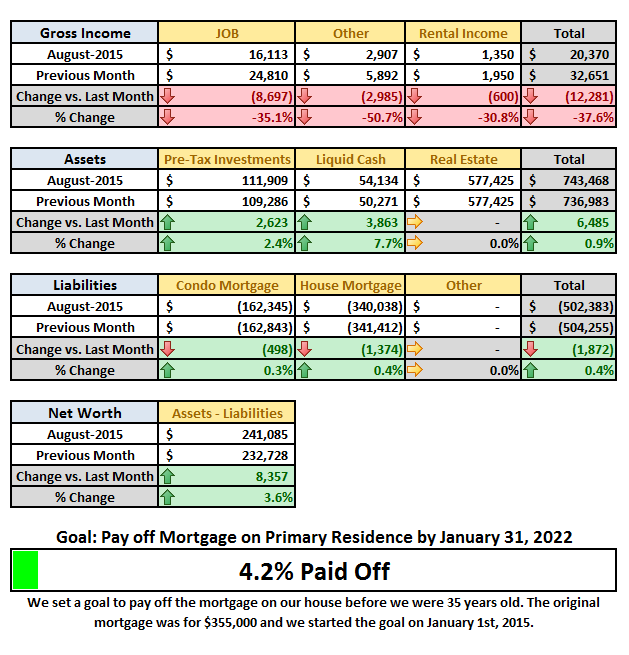

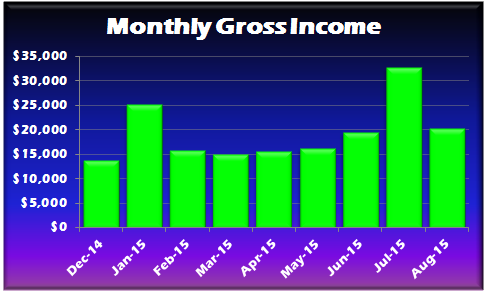

During the month of August gross income was down 37.6%. The decrease was expected as July included a windfall of $5,000 and other things like bonuses and a 3rd pay cycle that can’t be counted on every month. However, we expected income to fall closer to $16,000 in August and were pleasantly surprised when we tallied it up at closer to $20,000 for the month. Again, the expectation is that we will be somewhere in the $15,000 to $17,000 range for the rest of 2015 (although there may be an extra $10,000 in on of the remaining 4 months of the year, but its not a sure thing yet).

Here is a look at the trend for the last 9 months:

As I write this my wife has completed her 6 month coaching program and has increased her monthly gross income by $2,304/month on average since March. This equates to an additional $13,824 over the past six months against an original investment of $5,000. That is already a 176% return on investment. This will be the last month that I will break this out separately. The purpose was to show you what an investment in yourself can do. Try getting those kinds of returns in the market!

The best investment you can ever make is in yourself. The dividends will compound for the rest of your life.

Mini Blog Income Update

Since monetizing in March, the blog has produced $775.07 in revenue. August brought in a record $257 in revenue. But don’t worry, I will be detailing all that and more in a separate blog update where transparency will still be the name of the game (this will probably start once we hit the 1-year mark in September). I am sure you guys have seen a lot changing and I want to share the results with you all – especially those that are currently blogging or those that are thinking about blogging. You can learn from my successes and my failures.

Update: I have a blog post scheduled for publication on 10/12/15 that will cover my 1st year of blogging. In that post I will go into detail about monetization and what’s working for this blog and how it is trending. It will cover traffic and other related metrics. It will also cover what I am doing with email as well. I wanted to solidify a date for those of you that have been waiting for this.

Let me be your blogging and financial guinea pig!

The Juicy Details

- Previous Month: $32,651

- Difference: -$12,281

Now where did all that money go?

I have come to the realization that there are always going to be unplanned expenses. Our goal is to save 50% of our income and live off and enjoy the difference guilt free. With that type of rule governing our financial life, it is a free pass to inflate our lifestyle, but only proportional to our income. You can see prior financial reports here: January, February, March, April, May, June, and July.

Home Mortgage & HOA $3,233 The NEW normal payment is $2,349/month for the mortgage and $84 for the HOA (after property taxes went up). However, as a part of our 7-year mortgage pay off plan, we started adding an extra $800/month towards principle in January of 2015.

- Previous Month: $3,233

- Difference: $0

Condo Mortgage & HOA $1,138 This is the payment on our rental condo and includes the mortgage of $888 and HOA of $250. We currently rent this place out for $1,350/month, as seen in the summary table above. We just got notice in the mail that our interest rate is going up slightly from 2.875% to 3%. Starting in October this will be increasing by $10/month (no biggie).

- Previous Month: $1,138

- Difference: $0

Timeshare $0 My grandparents left me their timeshare before they passed away. We actually received $650 in rental income from the timeshare this month, which is included in our “other income.”

- Previous Month: $189

- Difference: +$189

Home Improvement $2,374 Last month we got the hot tub, but we still needed to get electricity hooked up ($1,850) and a path that you could walk on to get to the hot tub without walking in the dirt. We had a cobble stone path installed ($524).

- Previous Month: $6,761

- Difference: +4,387

Food & Dining $2,446 This amount includes money we spend at the grocery store, dining out, drinking out, and dog food/treats ($70 this month). In the month of August we spent $530 on groceries and $1,846 on eating out at restaurants. This expense is not up much vs. last month, but is still double our target of $1,200/month. This is largely due to the 10-day road trip we just got back from. We ate out every meal and some of those meals came with a hefty price tag. For example, we went to Maestros Steak House for dinner in Beverly hills to start our trip off, and that put us back about $240 (It was a great meal though, with great friends).

We should see this at least $1,000 less in September. As I have mentioned, our long term target is $1,200/month. After putting together a recent forecast (shared below), I am projecting that we will actually average something closer to $1,400/month, which is still a great improvement from the $1,700/month we were spending in 2014.

- Previous month: $2,408

- Difference: -$38

Shopping & Entertainment $963 This category will cover any discretionary shopping and entertainment expenses.

- Previous month: $1,925

- Difference: +$962

Travel & Hotel $1,635 We stayed in hotels on our 10 day trip up the coast of California. Well, actually they were motels and we tried to get good deals using the “Hotels Tonight” App. We saved something like 40-50% off regular rates, but as you can see they were not that cheap. The hotel portion of this expense was about $1,000, so we averaged about $100/night, but we also stayed 3 nights with friends and camped one night (that helped bring the average down). While on our trip we got a couples massage, went to the aquarium, toured Hearst Castle, and took out money for other excursions and what not.

- Previous month: $385

- Difference: -$1,250

Auto and Transport $901 This includes fuel, car insurance on two cars, and toll roads. This is up vs. last month due to our 10 day road trip up the coast of California.

- Previous month: $771

- Difference: -$130

Personal Development $0 We do buy books on a regular basis but that would fall in the shopping category below. This is just for some of the larger investments we make in ourselves.

- Previous month: $0

- Difference: +$0

Bills & Utilities $406 This includes our monthly utilities like gas, electric, water, internet, and cell phones. Sometimes this also includes a cleaning lady and our monthly lawn service.

- Previous month: $526

- Difference: +$120

Health & Fitness $97 This includes a monthly massage subscription, monthly dues to remain an active member of Team Beachbody to ensure my discounts on supplements like Shakeology and Results and Recovery Formula.

- Previous month: $254

- Difference: +$157

Business Services $68 There was another $19 that was charged for the Facebook advertising I ran for the book giveaway on the blog. This also covers hosting with WP Engine for $49/month and parking for an event I attended (my promotional rate is done so this is the new hosting rate).

- Previous month: $179

- Difference: +$111

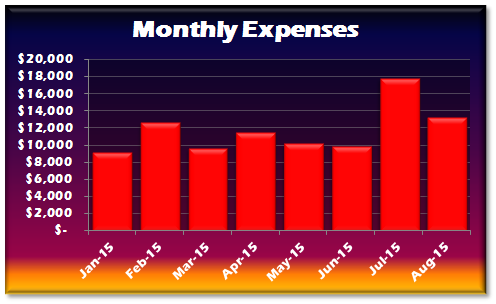

Total Expenses $13,261

- Previous month: $17,769

- Difference: +$4,508

Expenses were down 25% this month vs. last month, with an expectation to continue to decrease through the end of the year. July will surely be the highest month of expenses. As you may recall, we bought the hot tub last month. This month we still had some related expenses for that purchase along with a vacation that we will not have in the next few months. Here is the trend so far this year.

In addition to the trend above, I have gone through an exercise to forecast our expenses by month for the remainder of the year. Based on what I have put together I have us forecasted to have some of our lowest expense months at around $7,860/month through the end of the year.

From January through August we have average around $11,700/month, with a low of $9,180, and a high of $17,769. You are probably wondering how we can get down to $7,860/month. A significant portion of the savings is going to come from the home improvement category, where we have spent $16,190 through August (or about $2,000/month), we only have $200/month budgeted for the remainder of the year. The other big chunk is going to come from the Food and Dining category where we have averaged $1,600/month through August and have planned $1,200/month through the end of the year.

Here is the full breakdown:

Average through August = $11,700

Less Home Improvement = $1,800 (this is based on our average monthly spend of $2,000 for the year less the $200 we have budgeted)

Less Food & Dining = $200 (This is based on our average monthly spend of $1,600 for the year less the $1,200 we have budgeted)

Less Shopping & Other = $550 (This is based on our average monthly spend of $1,050 for the year less the $500 we have budgeted)

Less Personal Development = $575 (This was an expense inflating the average for my wife’s coaching. It is non-recurring)

Less Travel & Hotel = $163 (This is based on our average monthly spend of $413 for the year less the $250 we have budgeted)

Less Auto & Transport = $259 (This is based on our average monthly spend of $759 for the year less the $500 we have budgeted)

Less Other = $293 (This is just all other misc. spending).

Total = $7,860

CALL OUT: It is crazy how slippery money can be. Because of this I totally recommend you automate as much of your finances as possible, especially the saving and investing piece. We set our financial goals at the beginning of the year and then automate the process of reaching them.

Examples:

- Our mortgage payment is automatically set up to pay $800 in additional principal.

- My 401K contribution is automatically deducted at a rate that will ensure I max out by year end ($18,000)

- We have an auto investment of $500/month into my wife’s IRA to make sure we max it out by year end ($5,500)

- At the beginning of the month I have been sending $1,000/month to a REIT investment.

All of these things take priority over any spending that we do in a given month. We monitor expenses but don’t really manage them. Instead we manage savings and investments and let the expenses work themselves out.

What were Investments and Contributions?

I currently work for an employer that offers a 401K with matching. For years now, I have taken advantage of maxing out my 410K for both the tax benefit and company match. This works out to be about 11% to 14% of my income (depending on bonuses) off the top before I ever even see my paycheck.

My wife happens to work in a family business and unfortunately they are not able to offer a retirement plan, let alone matching. So starting in 2014 we opened up an IRA for her that we plan to max out with $5,500 every year. Starting with February of 2015, we have set up an automatic contribution of $500/month.

I also have an IRA due to a 401K rollover from a previous employer. I personally wish I could have all my retirement money in my TD Ameritrade IRA account because of the unlimited investment choices and the ability to invest in many different asset classes, including options.

Now let’s take a look at what activity went down this month:

- Contributed $500 to the wife’s IRA for the 2015 tax year.

- Previous month: $500

- Difference: $0

- Contributed $1,446 Into my 401K.

- Previous month: $1,649

- Difference: -$202

- Prosper Lending $0 We have deposited $1,000 so far this year.

- Previous month: $0

- Difference: $0

- Rich Uncles REIT $0 We now have $5,074 (includes partial dividend and 5 bonus shares)

- Previous month: $2,500

- Difference: -$2,500

- Increase in Savings $3,863 This includes checking, savings, and CD’s.

- Previous month: $5,516

- Difference: -$1,653

- HSA Contribution $1000 I have set up a contribution of $500 per pay check to be deducted from my check between now and the end of the year. This will allow us to max out for the full tax benefit of $6,650 per family (we also get a generous contribution from my employer). We now have about $2,100 in this account.

- Previous month: $500

- Difference: +$500

Total Investments & Contributions $6,809

- Previous month: $10,665

- Difference: -$3,856

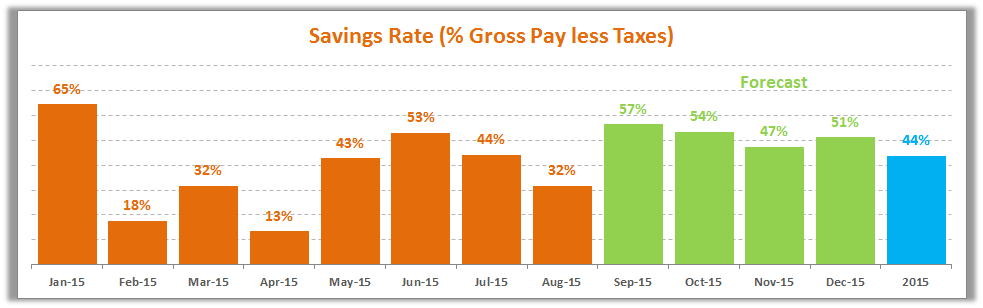

Savings Rate

This month we are adding a new section to the report in order to track our monthly savings rate. Since publishing our goal of saving 50% of our after tax income, I thought it would be a good idea to keep track of it in these reports going forward.

In the above chart you will see the trend of our savings rate by month. You can see that although our goal for the year is 50%, we bounce all over the place on a monthly basis. I recently put a forecast together for the remainder of the year and realized that we are likely going to miss our goal slightly. But hitting 44% is still awesome, especially when you consider we didn’t formalize this goal until sometime in the 2nd quarter of 2015.

Net Worth and Mortgage Pay Down Update

My ultimate goal is to build up a Net Worth of $10M returning 6% a year or $50,000/month in gross income. Don’t freak out, this is only about $5.5M in today’s dollars when you take into account a 3% inflation rate.

I am not anywhere close to a 7-figure net worth yet (or what some refer to as the double comma club). However, it is growing at a very respectable rate (just take a look in the side bar for growth at a glance). If you want to see how I plan to get there you can read all about it here.

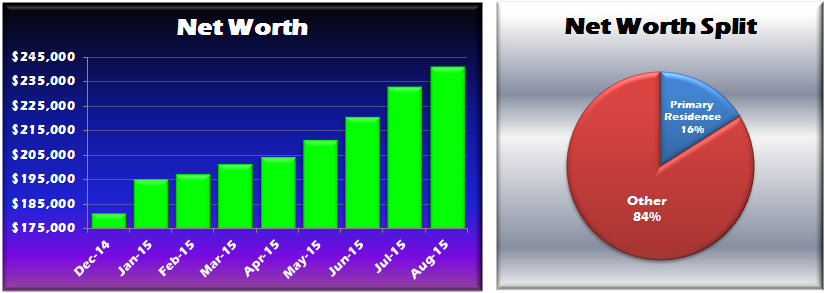

August Net Worth $241,085 (with eight months down in 2015, this puts us up $59,721 or 32.9% vs. 2014 so far and we still have 4 months to go)

- Previous month: $232,728

- Difference: +$8,357

With a year to date net worth gain of $59,721, that puts us slightly ahead of target. Recently I published a post where I outlined our goal to increase our net worth by $69,000 in 2015 (through contributions alone). We are officially 67% through the year and have reached 87% of our goal.

The market has gotten pretty volatile as of late, but our net worth has been pretty insulated to date, mostly because we were holding on to so much cash (and I have been aggressively selling calls against any long positions we hold). In the recent move lower, we did put some of that capital to work according to our plan. So a further down move will have more impact on our Net Worth than the latest move did.

You will notice that in the second chart above that I have broken out the piece of our net worth that is based on the equity in our house. I have done this because it is something I want to watch, because I don’t want this to exceed 25%. And it is good to know the split.

Note: I think people tend to glaze over the fact that the savings rate plays a much bigger role in increasing your net worth than the rate of return on your investments (in the early days of your journey). In the short term savings rate has a bigger impact on net worth. The goal is to eventually build a big enough asset base that the gains from compounding will eventually outpace the gains from savings.

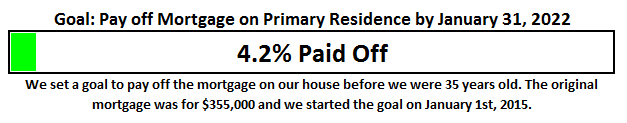

One of the other huge goals that I announced on the blog was the strategy to pay off our mortgage in 7 years. When you break it down and follow the 3 simple rules, it’s not as hard as it sounds. We bought our house in February of 2014 and then refinanced it into a 5/5 ARM in September of 2014 to remove PMI and free up cash-flow to put towards the principal and keep us on track to pay the mortgage off at an accelerated pace.

The progress chart above shows how much of our goal we have completed. Last month we were at 3.8%, which means we picked up another 40 basis points in August. At this rate we will be about 6% complete with this goal at the end of 2015. Those monthly 40 basis point improvements have really started to add up.

Update to Mortgage Payoff

This year was the start of our 7 year plan to murder the mortgage on our primary residence. And this is still the goal, but as I have been playing around with the execution of the plan. This year we are paying an additional $800/month in principal and starting January of 2016 that is supposed to increase to $1,600 (and then an additional $800/month until year 7). There are two risks I want to manage with this plan:

- Cash Trap – What I mean by this is that I don’t want the cash to be trapped in the house if something were to happen to either my wife or myself before we finished paying the mortgage in full. It would suck to have all this money tied up in the house and then one of us lose our jobs (or both) and then not have access to the money in a time of need. The worst case scenario would be that things got so bad that we lost the house and all the money we poured into it. I don’t think this is likely, but I would rather not see it happen.

- Too large a % of Net Worth – I realize that for most Americans, the majority of their net worth is their house. I want to manage this at 25% or less, thus the new chart I added to the section above.

With that, we are making a slight pivot in the execution of this goal. We will continue to make the additional $800/month in principal through the end of the year and actually for the next 7 years of the plan. However, we are going to place the increases called for by the plan in a separate account for now. That means we will continue to pay an additional $9,600/year in principal, which ensures that if/when our rate goes up our mortgage payment will actually never increase. I did the math and in 2019, when our rate has the first opportunity to adjust up a max of 2%, as long as we have paid an additional $50,000 in principal our payment will stay the same when they reset the amortization schedule for the remaining 25 years of the mortgage.

But then we will have additional money with an intended purpose of paying down the mortgage to deal with in a separate account. It increments by $9,600 a year. By March of 2022 when we projected to pay off the house (7 years 3 months), we would have about $220,000 that we could then use in a lump sum to pay the mortgage off.

The next question I have to tackle is what to do with the cash as it piles up. I still have another 4 months before I need to cross that bridge, but I am reviewing a few different options (not ready to share them just yet).

The End

I hope these reports inspire and move you to action. Don’t take a passive role in your finances and hope for the best. There is a famous Jim Rohn quote that I think everyone should keep in mind:

If you don’t plan your future, somebody else will. And you know what they have planned for you? NOT MUCH!

You have to be intentional with your finances if you ever want a fighting chance to make it to financial freedom. It doesn’t have to take 40-50 years of slaving away for the man before you have the option to retire. I personally think that 20-25 years is really all you need, and for the folks that are more aggressive (i.e. extremely frugal, not us) or very high earners you can probably reach financial independence in 10 years or less (maybe us, it’s yet to be seen but income is our focus vs. expenses).

I am looking forward to chatting with you all in the comments below. How was your month? Also, if you have a blog, I encourage you to write a monthly financial report and come back here and share the link. I would love to be part of your support and accountability.

Cheers!

– Gen Y Finance Guy

PS: Here are my favorite ways to track this stuff:

- The “Financial Stats” spreadsheet – a simple Excel template I created to provide the tables and charts you see in this post as well as on the Financial Stats Page. If you would like a copy of this spreadsheet, sign up for my email list (sign up form in the right side bar) and I will send you a copy.

- Mint.com (free) – Mint is great for setting up budgets and automating the tracking of your actual spending habits vs. the budgets you set.

- PersonalCapital.com (free) – This is like Mint, but is geared towards investments and net worth tracking.

23 Responses

That was, as always, very detailed financial update. Thanks so much for sharing. I can see that your net worth is going higher and higher. You should be able to reach $1M within 4-5 years under this speed. Keep up the great work!

Cheers,

BSR

Thanks BSR!

Based on my road map to $10M, it has us hitting the $1M mark by the time we are 33 (in a little over 5 years).

Thanks for reading.

Cheers

You and your wife are killing it, congrats! One question regarding your mortgage payoff plan, if you are putting the additional money into an account (vs. paying it to your principal as you go) wouldn’t you end up paying more in interest over the course of the loan? Or would that be offset because you would keep it in some kind of investment account that makes more than your mortgage interest rate. I just wondering because I’m currently paying extra toward my principal each month and I think your idea to put it in a separate account sounds like a good one, I just wasn’t sure what the benefit was for that vs. putting it immediately toward the principal. Thanks!

Hey Kirsten – I just fished your comment out of Spam, sometimes real comments get tagged as spam the first time you post. Anyways, sorry for the delay in response.

Thanks for the thoughtful comment.

You are exactly right, that by putting the extra money in a side account instead of against the mortgage you would incur additional interest expense. So in order to offset that additional interest account you would want to try and get about 70% of your mortgage interest rate (assuming a 30% tax bracket). So for us we need to earn a 2.57% rate of return to essentially “break even.”

Hey GYFG, strong effort and strong results! On the side-account substituted for principal paydown, not understanding the “70%” if you pay taxes on the 2.57%. Is your ARM rate 3.67% (2.57% / .7)? My arbitrage break-even has always been the mortgage amount APR, and I’ve never experienced an interest rate environment where my risk-free return on a side-account investment equaled the risk-free return on prepayment. Keeping good thoughts as your weight your options and risk. Continued success!

Hey JayCeezy – Yes, you backed into our rate correctly on our ARM. It is 3.675%. But you bring up a very good point about how to go about earning a risk free rate of 2.57%. We bank with Navy Federal Credit Union and they offer 3% CD’s currently, but we are maxed out at $6K for the special rate. I am evaluating a few different ideas that would likely mean I have to either make a choice to take on additional risk or be okay with the added interest costs for holding onto the money until we have enough to pay one lump sum.

Everything in life comes with trade-offs right?

I am open to ideas if you have any 🙂

Cheers!

GYFG, you are doing just fine and making good decisions. Only wanted to make sure you will shoot for a 3.675% break-even , because you will be paying taxes on your CD interest. You and Mrs. GYFG have a nice balance of present/future outlook, and whatever you decide will be correct.

makes sense, thanks! 🙂

You’re well on your way mate. Absolutely flying. Look forward to the blog update.

MrZ

Thanks Mr. Z!

Great month! Not many people can say their net worth went up in August… Keep it up!

Thanks man! The net worth increase was really largely a result of holding so much cash and not being fully invested in the market like most. Obviously the downside of that is earlier in the year when the market was up, I did not see much benefit.

Cheers!

Wow, excellent report, GYFG… so much detail! It’s great to see you’ve automated your extra mortgage payment. Looking forward to the mini blog income update in Oct. Keep up the great momentum!

Thanks Michael! Automation is really the only sure fire way to make things happen. I am looking forward to putting together the blog update as well.

Way to be one of the few with a positive result this past month. I had my first negative posting and it hurt! It hurt real bad! haha!

Wow that must have been a really good steak! $240 is no joke. I took my GF to sushi for her Bday a few months ago and our bill was $310. So I got you beat there. 😉 I told her we are not going to be doing that again!

By the way your hot tub is baller!

Hey Alexander – Like I mentioned in the post the positive net worth is really a function of a really high savings rate and a really high percentage of my investable assets sitting in cash.

I think I will be able to produce positive results through out the rest of the year, regardless of what the market does.

However, I did put some new capital to work near the bottom of this last move, so a further decline will hurt me more than this last decline did.

The Steak was freakin amazing. My wife and I shared a ridiculous 33oz Rib Eye, had Lobster mashed potatoes, brussels sprouts, crab for an appetizer, butter cake for dessert, and wine to wash it all down.

We figured we had enough food to feed four. So next time we go back, we fully intend to order the same thing with four people.

The hot tub has been really nice. Especially since I started up a fresh round of P90X.

Cheers!

Nice detail! Congrats on your success this far. The gross income stats are super impressive. Looking forward to your blog update post. As a relatively new blogger I always did those super interesting.

Hey Thomas – Thanks for the kind words.

We have been pretty focused on the income side of the equation. Actually if you have been following the financial reports since the beginning, you will notice that this is really the first time we are making an active effort on the expense side, but mostly just to try to hit our stretch goal for savings.

I am looking forward to writing that post, which I plan to start this weekend 🙂

Cheers!