GYFG here checking in for the September monthly financial report. If you have been reading these reports for a while you will notice that I introduce each month with the same intro month after month. I do this for two reasons, a) for the newbies to the site (which make up about 50% of the sites traffic) and b) to remind everyone what these reports are all about. By all means if you have read the intro at least once, then please feel free to skip down to the “Summary of September 2015” section where the new content begins (click the orange link to be taken there automatically).

For those of you that are new around this corner of the internet, I wanted to fill you in as to what these reports are all about. These monthly reports are about full transparency. They are just as much for me as they are for you. It’s a hard decision to make all of your financial details public, but it’s also a very motivating one. It’s not just the post, but the process of putting this post together that really benefits me.

My sincere hope is that my transparency will inspire you to take the helm of your own financial ship and be intentional with its direction. I truly believe that anyone can reach financial freedom, if they are willing to do things differently. If you earn an average salary and have an average savings rate, then you can expect an average result! That means you will likely have to work at a job you may or may not enjoy until you’re 65 and then maybe you can retire IF you’re lucky.

Hey, there is nothing wrong with average. If you’re happy with average, then by all means keep doing what everyone else is doing. Not sure how you feel about that, but I have no interest in living an average life. I want EXTRAORDINARY.

Most people don’t want to live below their means in order to reach FINANCIAL FREEDOM, because that’s painful. They think it involves cutting out all the joy in life. You know what I’m talking about, those financial gurus that tell you that in order to get rich you need to cut out the $5 lattes and stop going out to eat. Then after 40 years of diligent and above average savings and super low spending, you will be a millionaire. Basically, you have to live like a college student and suppress all the things you want to do in life and then when you’re old you will be rich.

Okay, that doesn’t sound like the plan for me either.

The good news is there is another way. This site and these reports are here to show you the OTHER path to financial freedom. There is a way where you can have your cake and eat it too. I believe and hope that over time I will be able to convince you of the following:

In order to reach financial freedom you can choose to live below your means by cutting expenses to the bone and living in a state of scarcity or you can expand your means and live in a state of abundance by increasing your income and enjoying the $5 latte or other indulgence of your choice.

Not only that, but if you’re diligent you can reach financial freedom a lot sooner than anyone has ever led you to believe.

Our Mission Statement:

To Humanize Finance, Build Wealth, and Reach Financial Freedom.

I know I don’t have to publish my juicy details every month, but it’s important to me that you know that I put my money where my mouth is (because not that many finance blogs or people giving financial advice do this). I publish all of my financial details not to brag, but instead to show you what is working as well as what’s not working. Sometimes finance can get pretty dense, but I think real life examples and numbers can help slice through the complexities (and BS). Personally, I have always enjoyed the financial reports put out by other bloggers around the blogosphere.

As always, you can find all my previous reports on the Financial Stats page (as well as annual trends and a few other financial metrics not found on this report). In these monthly reports the plan is to give you a month over month update on Gross Income, Assets, Liabilities, Net Worth, Expenses, Contributions, Savings Rate (NEW), and progress on the mortgage pay down goal.

Summary of September 2015

Did September just disappear? It seems like just yesterday we were talking about the end of summer, we had just gotten back from our 10-day road trip, then I blinked and it’s October as I type this post.

The year is now 75% complete, where are you in reaching your goals? Whether you are ahead of behind, you have 25% of the year left to hustle and finish strong. You know the saying “it’s not how you start, but how you finish.”

Let’s finish this year strong together.

We use Personal Capital To Track Everything

I use Personal Capital to aggregate and consolidate our transactions from across all of our financial accounts (checking, savings, retirement, credit cards, mortgages, HSA, and other investment accounts). At the end of the month I then drop that information into my financial stats spreadsheet for this monthly report.

Tracking your finances is, in my opinion, the best way to stay on top of your finances. You can’t optimize what you don’t measure. You can’t make informed decisions if you don’t know what you having coming in vs. going out. Without a holistic view of how much you spend every month, there’s no way to set savings, debt repayment, or investment goals. It’s a financial freedom must, folks.

Personal Capital (which is free to use) is a great way for us to systematize our financial overviews since it links all of our accounts together and provides a comprehensive picture of our net worth. If you’re not tracking your expenses in an organized fashion, give Personal Capital a try.

What went down in September

During the month of September gross income was up 37.8%. You may recall a hint from last month about an extra $10,000 that was possibly headed my way this year, well, it came in September. This was a one-time performance bonus for 2014 that came as a result of my recent promotion. The short story is I received $1,000 shy of my bonus potential last year, but way over performed, so this was the CEO’s way of saying thank you for all the hard work.

Gross income will be somewhere in the $15,000 to $17,000 range for the rest of 2015 (the only upside I am aware of would be any additional bonuses my wife earns or additional freelance work I take on). I do have $1,000 coming my way in October for a gig I took to build out a custom financial model.

Here is a look at the trend for the last 10 months:

Mini Blog Income Update

GYFG officially turned 1 year old in September. Big thank you goes to all the readers and fellow bloggers that have helped make this first year fun and very successful. Can’t wait to see what we can accomplish together over the next 12 months.

Over the course of the last year the blog has received 81,834 page views and the blog has produced $807.22 in revenue. One of the metrics tracked in the online space is RPM, which represents the revenue you have received per 1,000 page views. GYFG produced a very healthy $9.86 for every 1,000 page views. Over the course of the last year I have invested about 15 hours a week for a total of 720 hours…that gives me a robust hourly rate of $1.12/hour. Luckily I don’t depend on income from blogging to pay the bills.

Actually, I even reinvested $633.08 of that back into the blog to cover things like hosting, email, a book giveaway, and some Facebook ads. On a net basis, I was left with $173.94. At the end of the day I had a lot of fun writing and interacting with all of you, and that is what made this past year worth it. There are also some indirect benefits that have resulted from this blog as well, that are hard to quantify monetarily.

Update: I have a blog post scheduled for publication on 10/12/15 that will cover my 1st year of blogging. In that post I go into detail about monetization and what’s working for this blog and how it’s trending. It also covers traffic and other related metrics.

Let me be your blogging and financial guinea pig!

The Juicy Details

- Previous Month: $20,370

- Difference: +$7,699

Now where did all that money go?

I have come to the realization that there are always going to be unplanned expenses. Our goal is to save 50% of our income and live off and enjoy the difference guilt free. With that type of rule governing our financial life, it is a free pass to inflate our lifestyle, but only proportional to our income. You can see prior financial reports here: January, February, March, April, May, June, July, and August.

Home Mortgage & HOA $3,233 The NEW normal payment is $2,349/month for the mortgage and $84 for the HOA (after property taxes went up). However, as a part of our 7-year mortgage pay off plan, we started adding an extra $800/month towards principle in January of 2015.

- Previous Month: $3,233

- Difference: $0

Condo Mortgage & HOA $1,150 This is the payment on our rental condo and includes the mortgage of $888 and HOA of $250. We currently rent this place out for $1,350/month, as seen in the summary table above. Our interest rate adjusted up from 2.875% to 3%.

- Previous Month: $1,138

- Difference: –$12

Timeshare $0

- Previous Month: $0

- Difference: +$0

Home Improvement $170 This should be around $200/month through the end of the year.

- Previous Month: $2,374

- Difference: +2,204

Food & Dining $1,570 A significant reduction from last month. As I have mentioned, our long term target is $1,200/month.

- Previous month: $2,446

- Difference: +$876

Shopping & Entertainment $1,041 This category covers any discretionary shopping and entertainment expenses.

- Previous month: $963

- Difference: -$78

Travel & Hotel $248 This was mostly related to our trip out to my in-laws houseboat at Lakemead for Labor day weekend.

- Previous month: $1,635

- Difference: +$1,387

Auto and Transport $972 This includes fuel, car insurance on two cars, and toll roads. It was my wife’s car this month that need all kinds of preventative maintenance. The only thing we have left is her breaks, which will likely happen in January.

- Previous month: $901

- Difference: -$71

Personal Development $0 We do buy books on a regular basis but that would fall in the shopping category above. This is just for some of the larger investments we make in ourselves.

- Previous month: $0

- Difference: +$0

Bills & Utilities $505 This includes our monthly utilities like gas, electric, water, internet, and cell phones. Sometimes this also includes a cleaning lady and our monthly lawn service. I also bought my wife the new iPhone 6.

- Previous month: $406

- Difference: -$99

Health & Fitness $31 This includes a monthly massage subscription (on pause, while I change locations), monthly dues to remain an active member of Team Beachbody to ensure my discounts on supplements like Shakeology and Results and Recovery Formula.

- Previous month: $97

- Difference: +$66

Business Services $59 This covers hosting with WP Engine for $49/month and MailChimp email service $10/month (for those emails I have been sending everyone on my list).

- Previous month: $68

- Difference: +$9

Total Expenses $8,978

- Previous month: $13,261

- Difference: +$4,283

Expenses were down -32.3% this month vs. last month, and was our lowest expense month this year.

Here is the trend so far this year:

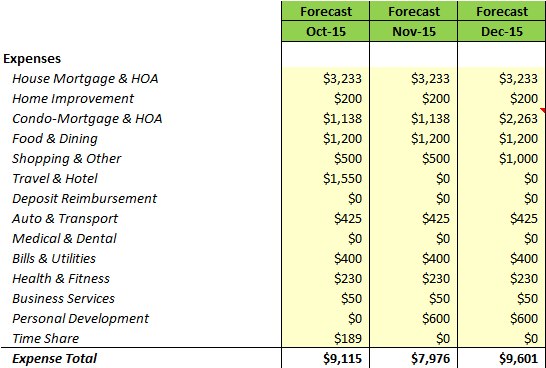

In addition to the trend above, I have gone through an exercise to forecast our expenses by month for the remainder of the year. Based on what I have put together I have us forecasted to have some of our lowest expense months at around $7,860/month through the end of the year.

Last month was the first month that I started to forecast our expenses. I have always tracked our expenses, but never really tried to forecast them. After reviewing these with my wife, I realized I had left out property taxes on our condo. We also added in $600/month for my wife to continue her business coaching starting in November. And lastly, we bought our tickets for our trip to Kansas City for Thanksgiving. This was originally forecast in November for $1,000, but ended up coming in at $1,550.

What is great, is at the end of the year, I will have a full P&L for 2015 to use as the base for 2016 planning.

CALL OUT: It is crazy how slippery money can be. Because of this I totally recommend you automate as much of your finances as possible, especially the saving and investing piece. We set our financial goals at the beginning of the year and then automate the process of reaching them.

Examples:

- Our mortgage payment is automatically set up to pay $800 in additional principal.

- My 401K contribution is automatically deducted at a rate that will ensure I max out by year end ($18,000)

- We have an auto investment of $500/month into my wife’s IRA to make sure we max it out by year end ($5,500)

- At the beginning of the month I have been sending $1,000/month to a REIT investment or to Prosper.

All of these things take priority over any spending that we do in a given month. We monitor expenses but don’t really manage them. Instead we manage savings and investments and let the expenses work themselves out.

What were Investments and Contributions?

I currently work for an employer that offers a 401K with matching. For years now, I have taken advantage of maxing out my 410K for both the tax benefit and company match. This works out to be about 11% to 14% of my income (depending on bonuses) off the top before I ever even see my paycheck.

My wife happens to work in a family business and unfortunately they are not able to offer a retirement plan, let alone matching. So starting in 2014 we opened up an IRA for her that we plan to max out with $5,500 every year. Starting with February of 2015, we have set up an automatic contribution of $500/month.

UPDATE: Starting in January of 2016, my wife will be setup with a 401K at work. We will stop contributing to the IRA and immediately start contributing to max out a 401K for her. I was able to get her mom’s business set up with a really low cost 401K plan through their payroll processor, ADP, for $150/month. There will not be any matching to start, but at least we can shelter some more money from taxes.

I also have an IRA due to a 401K rollover from a previous employer. I personally wish I could have all my retirement money in my TD Ameritrade IRA account because of the unlimited investment choices and the ability to invest in many different asset classes, including options.

Now let’s take a look at what activity went down this month:

- Contributed $500 to the wife’s IRA for the 2015 tax year.

- Previous month: $500

- Difference: $0

- Contributed $3,138 Into my 401K.

- Previous month: $1,446

- Difference: +$1,692

- Prosper Lending $1,000 We have deposited $2,000 so far this year.

- Previous month: $0

- Difference: +$1,000

- Rich Uncles REIT $0 We currently have $5,074 (includes partial dividend and 5 bonus shares)

- Previous month: $0

- Difference: $0

- Increase in Savings $1,056 This includes checking, savings, and CD’s. This is $1,000 less than the summary above because it includes prosper, and this does not (see #3 above).

- Previous month: $3,863

- Difference: -$2,807

- HSA Contribution $1,000 This is set up to max out by the end of the year. We currently have $3,110 here.

- Previous month: $1,000

- Difference: $0

Total Investments & Contributions $6,694

- Previous month: $6,809

- Difference: -$115

Note: With income up as high as it was and expenses as low as they were, you would expect to see an increase in contributions. However, there are two things that sucked up the additional income; 1) Increased Tax Payments & 2) Credit Card Float Catching up. Although we pay off our credit cards every month, I always take advantage of the FREE float, and on a normal basis we have anywhere from $3,000 to $5,000 in float. If you recall, we recently purchased a hot tub that we put on the credit card to get the points (in August), this finally caught up to cash in September when the bill was due.

Ideally, I should be including the float as a liability in our net worth calculation, but have not done so yet. This is something I will likely change in 2016.

Savings Rate

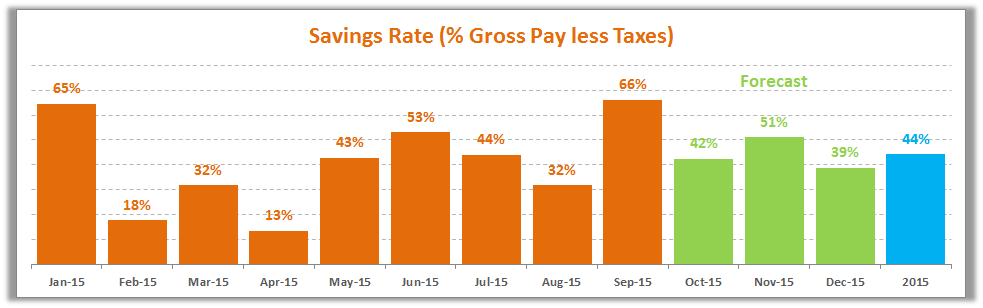

Last month we added a new section to track our monthly savings rate. Since publishing our goal of saving 50% of our after tax income, I thought it would be a good idea to keep track of it in these reports going forward.

In the above chart you will see the trend of our savings rate by month. You can see that although our goal for the year is 50%, we bounce all over the place on a monthly basis. I recently put a forecast together for the remainder of the year and realized that we are likely going to miss our goal slightly. But hitting 44% is still awesome, especially when you consider we didn’t formalize this goal until sometime in the 2nd quarter of 2015.

This year has largely been a foundational year, where I finally formalize the financial philosophies that drive our finances. It will be very interesting to see what we can do in 2016, going in with such a solid foundation.

Net Worth and Mortgage Pay Down Update

My ultimate goal is to build up a Net Worth of $10M returning 6% a year or $50,000/month in gross income. Don’t freak out, this is only about $5.5M in today’s dollars when you take into account a 3% inflation rate.

I am not anywhere close to a 7-figure net worth yet (or what some refer to as the double comma club). However, it is growing at a very respectable rate (just take a look in the side bar for growth at a glance). If you want to see how I plan to get there you can read all about it here (soon to be reviewed and updated in 2016).

September Net Worth $248,578 (with nine months down in 2015, this puts us up $67,214 or 37.1% vs. 2014 so far and we still have 3 months to go)

- Previous month: $241,085

- Difference: +$7,493

With a year to date net worth gain of $67,214, that puts us way ahead of target. Recently I published a post where I outlined our goal to increase our net worth by $69,000 in 2015 (through contributions alone). We are officially 75% through the year and have reached 97% of our goal.

The market has gotten pretty volatile as of late, but our net worth has been pretty insulated to date, mostly because we were holding on to so much cash (and I have been aggressively selling calls against any long positions we hold). In the recent move lower, we did put some of that capital to work according to our plan. So, a further down move (below the August lows) will have more impact on our Net Worth than the latest move did.

You will notice that in the second chart above that I have broken out the piece of our net worth that is based on the equity in our house. I have done this because it is something I want to watch, because I don’t want this to exceed 25%. And it is good to know the split.

Note: I think people tend to glaze over the fact that the savings rate plays a much bigger role in increasing your net worth than the rate of return on your investments (in the early days of your journey). In the short term, savings rate has a bigger impact on net worth. The goal is to eventually build a big enough asset base that the gains from compounding will eventually outpace the gains from savings.

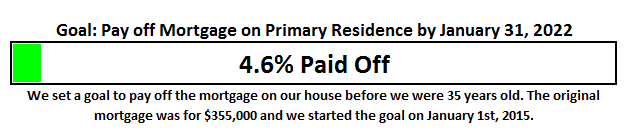

One of the other huge goals that I announced on the blog was the strategy to pay off our mortgage in 7 years. When you break it down and follow the 3 simple rules, it’s not as hard as it sounds. We bought our house in February of 2014 and then refinanced it into a 5/5 ARM in September of 2014 to remove PMI and free up cash-flow to put towards the principal and keep us on track to pay the mortgage off at an accelerated pace.

The progress chart above shows how much of our goal we have completed. Last month we were at 4.2%, which means we picked up another 40 basis points in September. At this rate we will be 5.8% complete with this goal at the end of 2015. Those monthly 40 basis point improvements have really started to add up.

I am still working out our plan for the slight change in the execution of the mortgage payoff goal. If you don’t know what I am talking about, you can go to last month’s report to read about my concerns around tying up to much capital in the property before it’s paid off and it becoming too large a percent of our net worth here (You will find it in the same section).

The next question I have to tackle is what to do with the cash as it piles up. I still have another 3 months before I need to cross that bridge, but I am reviewing a few different options (not ready to share them just yet, but they will make for some interesting and controversial posts).

The End

I hope these reports inspire and move you to action. Don’t take a passive role in your finances and hope for the best. There is a famous Jim Rohn quote that I think everyone should keep in mind:

If you don’t plan your future, somebody else will. And you know what they have planned for you? NOT MUCH!

You have to be intentional with your finances if you ever want a fighting chance to make it to financial freedom. It doesn’t have to take 40-50 years of slaving away for the man before you have the option to retire. I personally think that 20-25 years is really all you need, and for the folks that are more aggressive (i.e. extremely frugal, not us) or very high earners you can probably reach financial independence in 10 years or less (maybe us, it’s yet to be seen but income is our focus vs. expenses).

I am looking forward to chatting with you all in the comments below. How was your month? Also, if you have a blog, I encourage you to write a monthly financial report and come back here and share the link. I would love to be part of your support and accountability.

Cheers!

– Gen Y Finance Guy

PS: Here are my favorite ways to track this stuff:

- The “Financial Stats” spreadsheet – a simple Excel template I created to provide the tables and charts you see in this post as well as on the Financial Stats Page. If you would like a copy of this spreadsheet, sign up for my email list (sign up form in the right side bar) and I will send you a copy.

- PersonalCapital.com (free) – I track everything in Personal Capital and then enter into my custom Excel template. Check out my Personal Capital Review to see if its right for you.

17 Responses

Congratulations on your fantastic growth! Your numbers are evidence of your dedication and persistence.

One number surprises me though. I know I put I much more than 15 hours a week into my blog.

All the best,

Laura Beth

Hi Laura Beth,

There were certainly times during the first 6-months where I was putting in more than 15 hours a week. I honestly wish I had more than 15 hours a week to put in, but it would be at the expense of other things I hold important. There are so many things I still want to do for the blog.

What kind of time do you put in every week?

Cheers!

Great job, you are certainly kicking ass this year! I do enjoy these, and they motivate me to keep a closer tally of my personal progress. I have not kept the data you have. I do use mint and personal capital as my main tools. At this point I really do not have goals, I am feel like am on auto-pilot in life. I work hard, save money, invest money, I save over 70% plus of my income! My net worth is over 500k, mostly all in index funds, bonds, cash, P2P lending and few other investments. I am 31 years old and not married… I have thought about starting my own blog or online business, but I do not have a clue were to start. I have read so much, so my thoughts are all so scattered. My goal ultimately is to get away from the day job and do my own thing. Work used to motivate me, but lets just say that same level of motivation is not there. Sure its nice making a 100k + income a year, but it gets old (1stworldproblems).

Thanks Ap999!

It sounds like you are doing great on the income/saving/investing side of things. If you ever do decide to pull the trigger, there is a link in my menu bar to the left that has step by step directions on how to start a blog 🙂

Let me know if there is anything I can do to help.

Cheers!

Nice work! Looks like you’ve built out some great detailed statements and forecasts to help keep you on track. Look forward to seeing your growth over the next year!

Thanks lifetimeandmoney!

Let’s crush this next year together 🙂

Congrats on setting up a 401k for your wife! We don’t have the luxury of having one for me, but I only work part time anyway. I love your emphasis on how savings rate makes a bigger impact than investment returns in the beginning. That’s where we’re at. I’m finding that it’s a process. We’re working toward increasing our savings rate a little bit at a time and hope to get the momentum behind us to increase our savings rate drastically. I like tracking that with a chart. It’s a good addition! Well done this month!

Hey Maggie – The 401K for Mrs. GYFG was a big win and just in time. We were going to lose the tax benefit for the IRA we were contributing too because of the way the tax code is written. But all is good now 🙂

I actually have a post that really goes deep to show the math behind the savings rate vs. investment returns. But I don’t have it on the calendar to be published until 11/26/15. Stay tuned!

That’s great that your working at slowly increasing your savings rate. It didn’t happen for us from day 1, but the sooner you start working towards it, the sooner you will hit your target savings rate.

Cheers!

Wow congrats on that promotion and bonus! It always feel great to get a big chunk of cash at once. The best bonus I got was in 2007 and then I didn’t get anything for a couple years and practically peanuts after taxes until I left the firm.

That’s great you made it past your 1st year blogversary too – that’s a great accomplishment! Congrats!

Thanks Sydney!

Following other bloggers like you and Sam have definitely been big motivators for me to stay in the game. Looking back, I think the first 6-months were the hardest. Now I am in a really good rhythm.

Keep up all the great work you do over at Untemplater 🙂

Awesome job getting your wife’s company set-up with a 401k! Nothing gets me more excited than deferring more taxes 🙂

FF – It is definitely exciting to know that we will be able to shelter an additional $11,500 in 2016.

Cheers!

As a first time visitor to your site, thank you for the explanation plus the detailed monthly breakdown & transparency. It’s more than just reading a textbook on how to be financially savvy!

My pleasure Josh! Glad it isn’t as dry as a text book.

Cheers!