GYFG here checking in for the June monthly financial report. For those of you that are new around this corner of the internet, I wanted to fill you in as to what these reports are all about. These monthly reports are about full transparency. They are just as much for me as they are for you. It’s a hard decision to make all of your financial details public, but it’s also a very motivating one. It’s not just the post, but the process of putting this post together that really benefits me.

My sincere hope is that my transparency will inspire you to take the helm of your own financial ship and be intentional with its direction. I truly believe that anyone can reach financial freedom, if they are willing to do things differently. If you earn an average salary and have an average savings rate, then you can expect an average result! That means you will likely have to work at a job you may or may not enjoy until you’re 65 and then maybe you can retire IF you’re lucky.

Hey, there is nothing wrong with average. If you’re happy with average, then by all means keep doing what everyone else is doing. Not sure how you feel about that, but I have no interest in living an average life. I want EXTRAORDINARY.

Most people don’t want to live below their means in order to reach FINANCIAL FREEDOM, because that’s painful. They think it involves cutting out all the joy in life. You know what I’m talking about, those financial gurus that tell you that in order to get rich you need to cut out the $5 lattes and stop going out to eat. Then after 40 years of diligent and above average savings and super low spending, you will be a millionaire. Basically, you have to live like a college student and suppress all the things you want to do in life and then when you’re old you will be rich.

Okay, that doesn’t sound like the plan for me either.

The good news is there is another way. This site and these reports are here to show you the OTHER path to financial freedom. There is a way where you can have your cake and eat it too. I believe and hope that over time I will be able to convince you of the following:

In order to reach financial freedom you can choose to live below your means by cutting expenses to the bone and living in a state of scarcity or you can expand your means and live in a state of abundance by increasing your income and enjoying the $5 latte or other indulgence of your choice.

Not only that, but if you’re diligent you can reach financial freedom a lot sooner than anyone has ever led you to believe.

Our Mission Statement:

To Humanize Finance, Build Wealth, and Reach Financial Freedom.

I know I don’t have to publish my juicy details every month, but it’s important to me that you know that I put my money where my mouth is (because not that many finance blogs or people giving financial advice do this). I publish all of my financial details not to brag, but instead to show you what is working as well as what’s not working. Sometimes finance can get pretty dense, but I think real life examples and numbers can help slice through the complexities (and BS). Personally, I have always enjoyed the financial reports put out by other bloggers around the blogosphere.

As always, you can find all my previous reports on the Financial Stats page (as well as annual trends and a few other financial metrics not found on this report). In these monthly reports the plan is to give you a month over month update on Gross Income, Assets, Liabilities, Net Worth, Expenses, Contributions, and progress on the mortgage pay down goal.

Can I ask you for one small favor before you continue reading? Could you use one of the icons to the right of this post to share it on your favorite social media channel to help spread the word?

Thank you, thank you, thank you soooooo much!!!!

Shall we begin?

Summary of June 2015

What went down in June

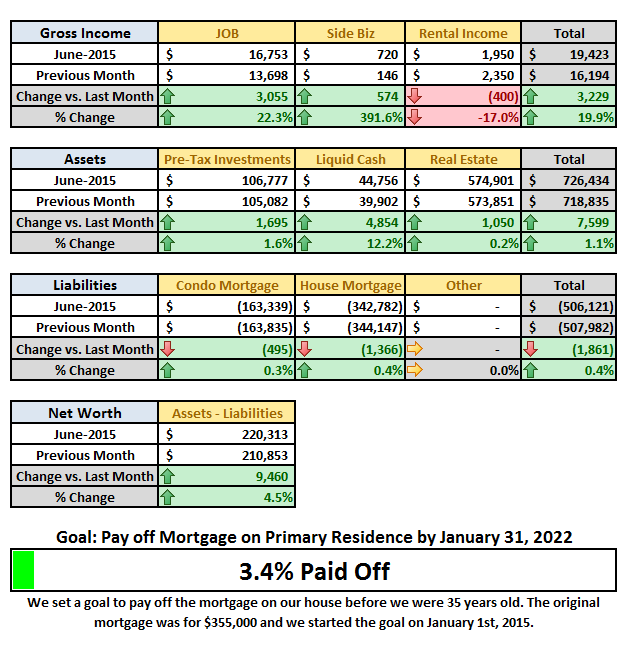

During the month of June gross income was up 19.9%. If you have been following for any length of time you may remember in March when we made the decision to invest in business coaching for my wife. After much thoughtful deliberation we decided that it was just the thing my wife needed to “level up” in her business. Adam Chudy of AdamChudy.com wanted us to share whether we thought it was worth it:

We never had a doubt that making an investment like this would pay off. We can emphatically say that it was/is worth it. As I write this my wife is 4 months into the coaching program and has increased her monthly gross income by $1,700/month on average since March. This equates to an additional $6,800 over the past four months against an original investment of $5,000. That is already a 36% return on investment.

The best investment you can ever make is in yourself.

This past month my wife continued kicking ass and taking names. She earned an extra $3,000 as she continues to grow her book of business. The hard work and business coaching has already more than paid for itself. We did see a drop in rental income of $400 due to a roommate that moved out (but she will be back in September). This was partially offset by an increase in side biz income of $574.

June’s income does include $100 of blog affiliate income that was paid in June. Since monetizing in March, the blog has produced $464.18 in revenue. But don’t worry, I will be detailing all that and more in a separate blog update where transparency will still be the name of the game (this will probably start once we hit the 1-year mark in September). I am sure you guys have seen a lot changing and I want to share the results with you all – especially those that are currently blogging or those that are thinking about blogging. You can learn from my successes and my failures.

Let me be your blogging and financial guinea pig!

- Previous Month: $16,194

- Difference: +$3,229

In July I anticipate a nice spike in income due to semi-annual bonus payments and a 3-period pay cycle (I get paid on a bi-weekly schedule). We also have a windfall of $5,000 coming our way this month as part of an inheritance distribution. We could see income jump to as high as $25,000+ in July.

Now where did all that money go?

The last four months have been very high with regard to expenses due to some planned and some unplanned expenses. I THINK I can finally say that our “one-time expenses” are behind us. If you want to see what I mean you can go look at the prior four reports here: January, February, March, April, and May.

Home Mortgage & HOA $3,233 The NEW normal payment is $2,349/month for the mortgage and $84 for the HOA (after property taxes went up). However, as a part of our 7-year mortgage pay off plan, we started adding an extra $800/month towards principle.

- Previous Month: $3,233

- Difference: $0

Condo Mortgage & HOA $1,138 This is the payment on our rental condo and includes the mortgage of $888 and HOA of $250. We currently rent this place out for $1,350/month, as seen in the summary table above.

- Previous Month: $1,138

- Difference: $0

Timeshare $37 My grandparents left me their timeshare before they passed away. This month I paid the $37 listing fee in order to place it with the management company for rent. We decided to use a few days for the 4th of July weekend in Vegas. I put the remaining days with the management company to rent out in order to cover the annual fees.

- Previous Month: $0

- Difference: –$37

Home Improvement $967 There always seems to be some sort of project that we are working on around the house. This month the big expense was adding a rod iron gate to create a dog run on our side yard. The gate was necessary because one of our two dogs (Daisy the Destroyer) likes to dig up all of our plants. It was getting pretty expensive to constantly be replacing the plants. So we had a custom 6ft fence made that put us back $650 after I negotiated from $800 and offered to pay cash. The remaining expense was used to buy rock for our back planters ($150), pay a Home Depot credit card bill ($128), and a Lowe’s bill ($39).

- Previous Month: $785

- Difference: -$182

Food & Dining $1,582 This amount includes money we spend at the grocery store, dining out, drinking out, and dog food/treats (our two dogs eat well). In the month of June we spent $491 on groceries, $112 on dog food, $100 for our quarterly wine club, and $879 on eating out at restaurants. This is an expense that tends to get a little out of control for us. Last year we spent $14,000 on eating out or almost $1,200/month on average. The goal for 2015 is to keep this combined expense at or below $1,200/month; $500 for eating out and $700 for groceries. During the summer we expect this number to stay elevated, but we are still doing much better than we did in 2014.

- Previous month: $1,651

- Difference: +$69

Shopping & Entertainment $803 This month I have renamed this category to cover any discretionary shopping and entertainment expenses. I am feeling a bit lazy and will not be breaking these expenses out this month.

- Previous month: $1,537

- Difference: -$734

Travel & Hotel $61 We are going to Vegas for the extended 4th of July weekend and booked a cheap room at the Hard Rock for the first night. The other two nights we will be staying at our timeshare that is already paid for.

- Previous month: $500

- Difference: +$439

Auto and Transport $1,087 This includes fuel, car insurance on two cars, and toll roads. This month I had a few more services that I needed to get done on my car to keep up with the recommend maintenance, but you need to keep up with the routine maintenance so you don’t end up spending more than you need to by letting things break. I had the transmission serviced, the front breaks replaced, and a few other services. My wife’s car will be coming up in the next month or so as well (it is what it is).

- Previous month: $636

- Difference: +$451

Personal Development $0 We do buy books on a regular basis but that would fall in the shopping category below. This is just for some of the larger investments we make in ourselves.

- Previous month: $0

- Difference: +$0

Bills & Utilities $541 This includes our monthly utilities like gas, electric, water, internet, and cell phones. Our internet did increase by $20/month since we are out of the promotional period. I may try and call to see if they will lower it if I threaten to switch providers. We also paid $120 for a cleaning service that we bring in every few months to do deep cleaning around the house.

- Previous month: $468

- Difference: -$73

Health & Fitness $229 This includes a monthly massage subscription, monthly dues to remain an active member of Team Beachbody to ensure my discounts on supplements like Shakeology and Results and Recovery Formula. And a new order of Bulletproof Coffee (This deserves a post all in itself).

- Previous month: $223

- Difference: -$6

Business Services $151 I purchased a premium plugin this month for $99 in order to run the book giveaway. This also covers hosting with WP Engine for $24/month and parking for an event I attended.

- Previous month: -$43

- Difference: -$194

Total Expenses $9,829

- Previous month: $10,128

- Difference: +$299

Expenses did inch lower. As many of you know, our goal is to be mortgage free before we are 35. So this month I wanted to take a look at what expenses are less any mortgage payments (but leaving in property taxes and HOA, since those won’t go away).

Total Expenses (less mortgages) $6,535

- Previous month: $6,837

- Difference: +$302

CALL OUT: It is crazy how slippery money can be. Because of this I totally recommend you automate as much of your finances as possible, especially the saving and investing piece. We set our financial goals at the beginning of the year and then automate the process of reaching them.

Examples:

- Our mortgage payment is automatically set up to pay $800 in additional principal.

- My 401K contribution is automatically deducted at a rate that will ensure I max out by year end ($18,000)

- We have an auto investment of $500/month into my wife’s IRA to make sure we max it out by year end ($5,500)

- At the beginning of the month I have been sending $1,000/month to a REIT investment.

All of these things take priority over any spending that we do in a given month. We monitor expenses but don’t really manage them. Instead we manage savings and investments and let the expenses work themselves out.

What were Investments and Contributions?

I currently work for an employer that offers a 401K with matching. For years now, I have taken advantage of maxing out my 410K for both the tax benefit and company match. This works out to be about 16% of my income off the top before I ever even see my paycheck.

My wife happens to work in a family business and unfortunately they are not able to offer a retirement plan, let alone matching. So starting in 2014 we opened up an IRA for her that we plan to max out with $5,500 every year. Starting with February of 2015, we have set up an automatic contribution of $500/month.

I also have an IRA due to a 401K rollover from a previous employer. I personally wish I could have all my retirement money in my TD Ameritrade IRA account because of the unlimited investment choices and the ability to invest in many different asset classes, including options.

Now lets take a look at what activity went down this month:

- Contributed $500 to the wife’s IRA for the 2015 tax year.

- Previous month: $500

- Difference: $0

- Contributed $1,169 Into my 401K. The normal contribution will average 16% for the year, but I do play around with the percentage occasionally.

- Previous month: $1,169

- Difference: $0

- Prosper Lending $500 We have deposited $1,000 so far this year.

- Previous month: $0

- Difference: +$500

- Rich Uncles REIT $1,000 We also got 5 free shares for leaving a review ($50 value). We are have $2,550 invested here.

- Previous month: $1,000

- Difference: +$0

- Increase in Savings $4,354 This includes checking, savings, and CD’s. This is $500 less than the increase shows above (in “liquid cash” section) because I am currently holding Prosper in my cash section and I did not want to double count it. Eventually I will break this out on the table once it gets to be larger in value.

- Previous month: $1,904

- Difference: +$2,450

Total Investments & Contributions $7,523

- Previous month: $4,573

- Difference: +$2,950

Summing it all up against the Gross Income

Benjamin Franklin famously said, “that everything has a place and that everything should be put in its place.” With that, let’s summarize where the total gross income for the month of June went.

Gross Income $19,423

(Less) Expenses* $9,829

(Less) Investments & Contributions $7,523

Sub-Total $2,071

(less) Taxes & Benefits $2,071

Total = ZERO

Everything is accounted for (phew!).

Net Worth and Mortgage Pay Down Update

My ultimate goal is to build up a Net Worth of $10M returning 6% a year or $50,000/month in gross income. Don’t freak out, this is only about $5.5M in today’s dollars when you take into account a 3% inflation rate.

I am not anywhere close to a 7-figure net worth yet (or what some refer to as the double comma club). However, it is growing at a very respectable rate. If you want to see how I plan to get there you can read all about it here.

June Net Worth $220,313 (with six months down in 2015, this puts us up $38,949 or 21.5% vs. 2014 so far and we still have 6 months to go)

- Previous month: $210,853

- Difference: +$9,460

With a year to date net worth gain of $38,949, that puts us slightly ahead of target. Recently I published a post where I outlined our goal to increase our net worth by $69,000 in 2015 (through contributions alone). We are officially 50% through the year and have reached 56% of our goal.

Note: I think people tend to glaze over the fact that the savings rate plays a much bigger role in increasing your net worth than the rate of return on your investments. In the short term savings rate has a bigger impact on net worth. The goal is to eventually build a big enough asset base that the gains from compounding will eventually outpace the gains from savings.

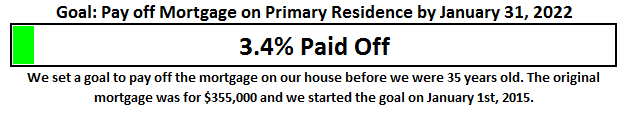

One of the other huge goals that I announced on the blog was the strategy to pay off our mortgage in 7 years. When you break it down and follow the 3 simple rules, it’s not as hard as it sounds. We bought our house in February of 2014 and then refinanced it into a 5/5 ARM in September of 2014 to remove PMI and free up cash-flow to put towards the principal and keep us on track to pay the mortgage off at an accelerated pace.

The progress chart above shows how much of our goal we have completed. Last month we were at 3.1%, which means we picked up another 30 basis points in June. At this rate we will be about 6% complete with this goal at the end of 2015 (assuming no extra lump sum payments).

The End

We had both edges of the sword working for us this month with expenses falling slightly and income increasing dramatically. That is always a fantastic combination. At the end of the day net worth is the ONE METRIC THAT MATTERS, and we had an increase of almost $10K in June. I am stoked with the results in June. The good news is that July should be even better 🙂

I hope these reports inspire and move you to action. Don’t take a passive role in your finances and hope for the best. There is a famous Jim Rohn quote that I think everyone should keep in mind:

If you don’t plan your future, somebody else will. And you know what they have planned for you? NOT MUCH!

You have to be intentional with your finances if you ever want a fighting chance to make it to financial freedom. It doesn’t have to take 40-50 years of slaving away for the man before you have the option to retire. I personally think that 20-25 years is really all you need, and for the folks that are more aggressive (i.e. extremely frugal, not us) or very high earners you can probably reach financial independence in 10 years or less (maybe us, it’s yet to be seen but income is our focus vs. expenses).

I am looking forward to chatting with you all in the comments below. How was your month? Also, if you have a blog, I encourage you to write a monthly financial report and come back here and share the link. I would love to be part of your support and accountability.

Cheers!

– Gen Y Finance Guy

Don’t Miss Your Chance To Win

[x_callout type=”center” title=”Summer Book Giveaway” message=”Don’t forget to check out the summer giveaway we’re running. Enter the contest for YOUR chance to win the 11 books that will change YOUR money mindset and make you rich!” button_text=”Enter Now!” button_icon=”adjust” circle=”true” href=”https://genyfinanceguy.com/giveaways/win-10-books-will-change-mindset-make-rich/” target=”blank”]

PS: Here are my favorite ways to track this stuff:

- The “Financial Stats” spreadsheet – a simple Excel template I created to provide the tables and charts you see in this post as well as on the Financial Stats Page. If you would like a copy of this spreadsheet, sign up for my email list below or at the top of the page and I will send you a copy.

- Mint.com (free) – Mint is great for setting up budgets and automating the tracking of your actual spending habits vs. the budgets you set.

- PersonalCapital.com (free) – This is like Mint, but is geared towards investments and net worth tracking.

19 Responses

Again, some very solid numbers.

Kudos to your wife for making the investment worth the effort. This looks very promising for both of you.

Thanks AmberTree!

It is great have such a solid partner in this how Financial Freedom fight. I also specifically don’t break out our individual numbers, because at the end of the day it is a team effort and it doesn’t matter how we reach our goals, as long as we reach them. I call out my wife in the report because I want people to realize that I am not alone in this race and she deserves credit.

Hope you had a great month as well.

How is the option trading coming?

Cheers!

GYFG- once again proving that earning income is the true secret to net worth growth (well that and not spending it all).

Well done good sir! We lost money this month.

You know they say the secret to wealth building is simple:

Spend less than you make and invest the difference. Done.

GYFG,

Fantastic month! You have a lot of moving parts within your budget. Eating out is my Achilles heel and I don’t see things changing much in the future. I am pretty frugal, but I love eating good food. I love Saltgrass and Benihana and we eat at these types of restaurants a couple of times a week.

As far as the home improvement projects. They never seem to stop. I once heard that you can typically expect to spend 5% of your home’s value each year on maintenance and updates. That sounds about right to me. Some years much more. My wife has recently been hinting around at installing a pool. Ouch! Hopefully she gets over that idea. 🙂

Anyway, keep up the great work over here!

MDP

Thanks MDP! Looks like we both had good months in June. January of this year was our best month ever, but July might actually top that, which would be awesome. Should also put some jet fuel on the income side of the equation as I recently negotiated a $60K increase in compensation that should take effect sometime in the next couple of weeks. And the wife is on fire with building her business, so the trend looks good. It’s funny, because 6 months ago I thought we were going to take a sizable hit to income this year, due to a one-off windfall and the closing of my side consulting business.

But now it looks like we will exceed our income from 2014.

We definitely have a lot of moving parts in the budget, but the only thing we really try to manage is saving 50% of our gross income on an annual basis. We know that January and July will always be the biggest months in our plan. So July should put us ahead of schedule with having saved more than 50% of our gross.

If I had it my way we really would not do much around the house for home improvement projects, but my wife really enjoys that, so we find middle ground and have a budget of up to $10,000 a year, but it is contingent on making sure we stay on track to pay the house off early on our 7 year time frame. So trade-offs have to be made elsewhere. Actually we ended up re-allocating $5,000 of the budget to my wife’s coaching (which was/is a fantastic move).

Food and Dining out can get a bit excessive for us, but it is down substantially from 2014. In 2014 alone we were spending $1,200/month on dining out and another $600/month on groceries. So we have probably saved about $3,000 vs. last year through June. That is mostly because we moved from the OC where there were so many new places to try constantly.

A pool does make me cringe a bit as well. We are actually planning to get a hot top sometime between now and the end of summer.

Cheers!

GYFG,

Love what you and your wife are building there together. 4.5% monthly growth is a number I would be very happy with — for the quarter ha! These monthly posts of your financial details have me rethinking my quarterly NW calculations. I’m thinking of switching to monthly, especially given the fact that I love doing these calculations!

Keep up the fantastic work.

Thanks Buddy!

I look forward to putting this report together all month. It is definitely a team effort.

Quarterly is better than nothing. But I like to keep a more frequent pulse, and monthly is about as granular as I can get to capture a good snapshot. It gives you 12 instead of 4 opportunities to optimize.

Cheers!

Wow! You and your wife are crushing it! That is awesome, im happy to hear that. Cant wait to hear more about your blog earnings too. As you know, I just created my blog and last month was the first full month. I had no intentions on making money from it but I actually made $20. Ha, not much but I think its super cool that any income can be made at all from doing a blog. In the short time i have been blogging, ive grown to really love it. Its great!

Thanks Alexander. It has certainly been a fund adventure.

Congrats on making your first $20 online. It’s a great feeling isn’t it?

Cheers!

Wow, congrats to you and to your wife! I really adore your wife, she rocks!

Kate – She does rock!!!

Excellent month for you! Keep it up.

Have you done any net worth projections? I recently built an Excel model that roughly estimates your net worth given certain assumptions.

http://www.amoresuccessfulyou.com/self-improvement/net-worth-calculator/

As I have stated, it is a rough estimate of where you will be, but it is very interesting to see what different assumptions will give you (investing 1000 a month vs 500 a month for example)

Hope July goes well and have a great day!

Erik

Thanks Eric! I have projections built out based on my plan to accumulate a $10M net worth.

Great to see you’re still exploring Prosper. Looking forward to reading more about that in the coming year.

Good to hear from you Simon. I am building up that account slowly but surely. Once the REIT I am investing in closes I will likely direct more funds to Prosper.

Man sounds like your wife wasn’t the only one kicking ass & taking names 😉 back then..

Good effort here, must admit my big focus right now (in June 2016 rather than June 2015) is to look at creating income streams :).. It’s ticking along nicely..

I’d love to chat to you about how you’ve put your site together as well, I’ve not mentioned this before although it looks great..

I know this may be mentioned in future posts, so maybe I should be patient haha 🙂

Hey Jef – It’s crazy as I read your comment I am just now putting together my June-2016 financial report and I am amazed at what we have been able to do in 1 years time. Net Worth came in at $383,167, which is up from June-2015 by 73%.

Re: chatting about website and income streams, shoot me an email at mrgenyfinanceguy@gmail.com and we can set up a skype call.

Cheers,

Dom