GYFG here checking in for the July monthly financial report. For those of you that are new around this corner of the internet, I wanted to fill you in as to what these reports are all about. These monthly reports are about full transparency. They are just as much for me as they are for you. It’s a hard decision to make all of your financial details public, but it’s also a very motivating one. It’s not just the post, but the process of putting this post together that really benefits me.

My sincere hope is that my transparency will inspire you to take the helm of your own financial ship and be intentional with its direction. I truly believe that anyone can reach financial freedom, if they are willing to do things differently. If you earn an average salary and have an average savings rate, then you can expect an average result! That means you will likely have to work at a job you may or may not enjoy until you’re 65 and then maybe you can retire IF you’re lucky.

Hey, there is nothing wrong with average. If you’re happy with average, then by all means keep doing what everyone else is doing. Not sure how you feel about that, but I have no interest in living an average life. I want EXTRAORDINARY.

Most people don’t want to live below their means in order to reach FINANCIAL FREEDOM, because that’s painful. They think it involves cutting out all the joy in life. You know what I’m talking about, those financial gurus that tell you that in order to get rich you need to cut out the $5 lattes and stop going out to eat. Then after 40 years of diligent and above average savings and super low spending, you will be a millionaire. Basically, you have to live like a college student and suppress all the things you want to do in life and then when you’re old you will be rich.

Okay, that doesn’t sound like the plan for me either.

The good news is there is another way. This site and these reports are here to show you the OTHER path to financial freedom. There is a way where you can have your cake and eat it too. I believe and hope that over time I will be able to convince you of the following:

In order to reach financial freedom you can choose to live below your means by cutting expenses to the bone and living in a state of scarcity or you can expand your means and live in a state of abundance by increasing your income and enjoying the $5 latte or other indulgence of your choice.

Not only that, but if you’re diligent you can reach financial freedom a lot sooner than anyone has ever led you to believe.

Our Mission Statement:

To Humanize Finance, Build Wealth, and Reach Financial Freedom.

I know I don’t have to publish my juicy details every month, but it’s important to me that you know that I put my money where my mouth is (because not that many finance blogs or people giving financial advice do this). I publish all of my financial details not to brag, but instead to show you what is working as well as what’s not working. Sometimes finance can get pretty dense, but I think real life examples and numbers can help slice through the complexities (and BS). Personally, I have always enjoyed the financial reports put out by other bloggers around the blogosphere.

As always, you can find all my previous reports on the Financial Stats page (as well as annual trends and a few other financial metrics not found on this report). In these monthly reports the plan is to give you a month over month update on Gross Income, Assets, Liabilities, Net Worth, Expenses, Contributions, and progress on the mortgage pay down goal.

Shall we begin?

Summary of July 2015

I have so much to update everyone on this month. First let’s take a look from a high level to see what happened this month and then we will get more granular with it. You will also want to take note that I have added some new graphics to the report as well. It was time to change things up a bit.

What went down in July

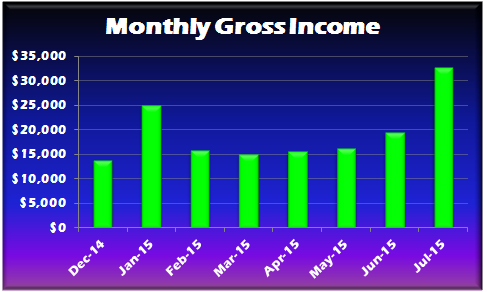

During the month of July gross income was up 68.1%. With such a big increase I am going to call out the big items this month:

- Mrs. GYFG continues to kill it [+$1,400]. She earned a nice $6,100 bonus in July. In total she brought in an additional $1,400 vs. last month. She earned a $3,000 bonus the previous month (June), but this was partially offset from lower income from here side business and no reimbursement (she got an extra $600 towards her coaching program). At the end of the day she is absolutely crushing it and it is awesome to watch here grow her business.

- We received a windfall [+$5,000]. This was related to an inheritance distribution. I will talk about how we plan to use this money later in the report.

- Mr. GYFG mid-year bonus [+$3,000]. Until my recent promotion to director my bonus was only $10,000 a year. My company pays out 30% in July and the remaining amount in January. Starting in August my bonus potential jumps to $40,000 a year, so January should turn out to be pretty nice. But this year it will likely be prorated with a max bonus potential of $25,000 for 2015. Be sure to check out the email I sent that got me a $60,000/year bump in compensation.

- Mr. GYFG additional pay cycle + All other puts/takes [+$3,828].

This was by far our best income month this year and actually ever.

As I write this my wife is 5 months into the coaching program and has increased her monthly gross income by $2,376/month on average since March. This equates to an additional $11,880 over the past five months against an original investment of $5,000. That is already a 138% return on investment.

The best investment you can ever make is in yourself. The dividends will compound for the rest of your life.

Mini Blog Income Update

Since monetizing in March, the blog has produced $517.64 in revenue. But don’t worry, I will be detailing all that and more in a separate blog update where transparency will still be the name of the game (this will probably start once we hit the 1-year mark in September). I am sure you guys have seen a lot changing and I want to share the results with you all – especially those that are currently blogging or those that are thinking about blogging. You can learn from my successes and my failures. Sorry for the delay on this, I just haven’t had the bandwidth to get this started yet.

Let me be your blogging and financial guinea pig!

The Juicy Details

- Previous Month: $19,423

- Difference: +$13,228

We will definitely see a drop in income next month. Here are a few things that we won’t expect in August:

- The $5,000 windfall. It was an unexpected one-time thing.

- My mid-year bonus and additional pay cycle. But this will be partially offset as my new compensation kicks in. My base salary is going up by $30K/year. The rest of the compensation increase will be in the form of bonus and not paid out until January.

- Not sure what my wife’s bonus might be in August (if any). It all depends on how her business unit does.

- We are also losing our roommate of 10 months as he moves his family out from the East Coast and gets a house of his own.

With that said, I would expect income to fall back down to around $16,000 in August. This will likely be the new set point.

Can I ask you for one small favor before you continue reading? Could you use one of the icons to the right of this post to share it on your favorite social media channel to help spread the word?

Thank you, thank you, thank you soooooo much!!!!

Now where did all that money go?

I have come to the realization that there are always going to be unplanned expenses. Especially since we strive to save 50% of our income and live off and enjoy the difference guilt free. With that type of rule governing our financial life, it is a free pass to inflate our lifestyle, but only proportional to our income. In the last few months I have included the following sentence “I THINK I can finally say that our “one-time expenses” are behind us,” but this will be the last time you see that showing up here. You can see prior financial reports here: January, February, March, April, May, and June.

Home Mortgage & HOA $3,233 The NEW normal payment is $2,349/month for the mortgage and $84 for the HOA (after property taxes went up). However, as a part of our 7-year mortgage pay off plan, we started adding an extra $800/month towards principle.

- Previous Month: $3,233

- Difference: $0

Condo Mortgage & HOA $1,138 This is the payment on our rental condo and includes the mortgage of $888 and HOA of $250. We currently rent this place out for $1,350/month, as seen in the summary table above. We just got notice in the mail that our interest rate is going up slightly from 2.875% to 3%. Starting in October this will be increasing by $10/month (no biggie).

- Previous Month: $1,138

- Difference: $0

Timeshare $189 My grandparents left me their timeshare before they passed away. Last month I paid the $37 listing fee in order to place it with the management company for rent. We decided to use a few days for the 4th of July weekend in Vegas. I put the remaining days with the management company to rent out in order to cover the annual fees.

- Previous Month: $37

- Difference: –$152

Home Improvement $6,761 Just when I thought we were not going to do any more big projects around the house, we get a windfall of $5,000, experience our best income month ever, and I get a huge raise. With that we decided to spend the windfall and a small portion of the extra income this month to put in the hot tub we were planning for next year. It cost about $1,000 to get the paver pad installed (what the hot tub will sit on top of) and the hot tub itself costs $5,724 (out the door). That is after I negotiated the sticker price down from $6,999 + tax. I saved myself about $2,000 by doing my research and sticking to my philosophy of “the price you see is never the price you pay.”

- Previous Month: $967

- Difference: -$5,794

Food & Dining $2,408 This amount includes money we spend at the grocery store, dining out, drinking out, and dog food/treats ($149 this month). In the month of July we spent $957 on groceries and $1,302 on eating out at restaurants. We totally went off the deep end this month. We had a trip in Vegas for 4 days that racked up $700 eating out. I also attended a bachelor party for a friend that is getting married in August. We also had a trip out to the Lake and that is why the grocery bill is inflated by about $550 from that.

This is an expense that tends to get a little out of control for us. Last year we spent $14,000 on eating out or almost $1,200/month on average. The goal for 2015 is to keep this combined expense at or below $1,200/month; $500 for eating out and $700 for groceries. During the summer we expect this number to stay elevated, but we are still doing much better than we did in 2014. I would expect this to be around $1,600 in August due to a 10 day road trip we have at the end of the month.

- Previous month: $1,582

- Difference: -$826

Shopping & Entertainment $1,925 This category will cover any discretionary shopping and entertainment expenses. This expense like most this month is also elevated. I won’t call out all the expenses here, but I will call out the bigger ones: Suit for Wedding I am in ($250), William Sonoma ($130), Costco ($352, we only went for Steaks…LOL), Cash Withdrawl ($120), Gift to my brother ($100), Spa Day for the Wife with her girlfriends ($174), Wife’s Hair Cut ($125), Dry Cleaners ($80), and Other ($714). I expect this expense to drop substantially next month.

- Previous month: $803

- Difference: -$1,122

Travel & Hotel $385 We went to Vegas and while we were there we did get a Cabana and spent a day at the spa. This also includes $100 in cash that I took out for spending money for cabs and tips. Everything else was just food that was covered above. We will definitely have some charges here in August related to our 10 day road trip.

- Previous month: $61

- Difference: -$324

Auto and Transport $771 This includes fuel, car insurance on two cars, and toll roads. It’s still high with the trips to Vegas and the Lake. Will likely stay elevated with our road trip this month. But it should come back down to around $500/month in September.

- Previous month: $1,087

- Difference: +$316

Personal Development $0 We do buy books on a regular basis but that would fall in the shopping category below. This is just for some of the larger investments we make in ourselves.

- Previous month: $0

- Difference: +$0

Bills & Utilities $526 This includes our monthly utilities like gas, electric, water, internet, and cell phones. The summer heat has really kicked in and we have had to crank up the air conditioning. We have also seen an increase in water due to the drought here in California and the fact that we had a faucet bust on the side of the house that was gushing water for about 20 minutes.

- Previous month: $541

- Difference: +$15

Health & Fitness $254 This includes a monthly massage subscription, monthly dues to remain an active member of Team Beachbody to ensure my discounts on supplements like Shakeology and Results and Recovery Formula. And a new order of Bulletproof Coffee (This deserves a post all in itself).

- Previous month: $229

- Difference: -$25

Business Services $179 I spent about $34 in Facebook advertising for the book giveaway (actually more but that is all I have been charged for so far). This also covers hosting with WP Engine for $24/month and parking for an event I attended. This also covers my wife’s new business cards as well.

- Previous month: $151

- Difference: -$28

Total Expenses $17,769

- Previous month: $9,829

- Difference: -$7,940

Expenses were up 81% this month, with a large part of that increase coming from the purchase of the hot tub. But also related to an increase is many expense categories.

CALL OUT: It is crazy how slippery money can be. Because of this I totally recommend you automate as much of your finances as possible, especially the saving and investing piece. We set our financial goals at the beginning of the year and then automate the process of reaching them.

Examples:

- Our mortgage payment is automatically set up to pay $800 in additional principal.

- My 401K contribution is automatically deducted at a rate that will ensure I max out by year end ($18,000)

- We have an auto investment of $500/month into my wife’s IRA to make sure we max it out by year end ($5,500)

- At the beginning of the month I have been sending $1,000/month to a REIT investment.

All of these things take priority over any spending that we do in a given month. We monitor expenses but don’t really manage them. Instead we manage savings and investments and let the expenses work themselves out.

What were Investments and Contributions?

I currently work for an employer that offers a 401K with matching. For years now, I have taken advantage of maxing out my 410K for both the tax benefit and company match. This works out to be about 16% of my income off the top before I ever even see my paycheck.

My wife happens to work in a family business and unfortunately they are not able to offer a retirement plan, let alone matching. So starting in 2014 we opened up an IRA for her that we plan to max out with $5,500 every year. Starting with February of 2015, we have set up an automatic contribution of $500/month.

I also have an IRA due to a 401K rollover from a previous employer. I personally wish I could have all my retirement money in my TD Ameritrade IRA account because of the unlimited investment choices and the ability to invest in many different asset classes, including options.

Now let’s take a look at what activity went down this month:

- Contributed $500 to the wife’s IRA for the 2015 tax year.

- Previous month: $500

- Difference: $0

- Contributed $1,649 Into my 401K. The normal contribution will average 16% for the year, but I do play around with the percentage occasionally.

- Previous month: $1,169

- Difference: +$480

- Prosper Lending $0 We have deposited $1,000 so far this year.

- Previous month: $500

- Difference: -$500

- Rich Uncles REIT $2,500 We now have $5,074 (includes partial dividend and 5 bonus shares)

- Previous month: $1,000

- Difference: +$1,500

- Increase in Savings $5,516 This includes checking, savings, and CD’s. This is $500 less than the increase shows above (in “liquid cash” section) because I am currently holding Prosper in my cash section and I did not want to double count it. Eventually I will break this out on the table once it gets to be larger in value.

- Previous month: $4,354

- Difference: +1,162

- HSA Contribution $500 I have set up a contribution of $500 per pay check to be deducted from my check between now and the end of the year. This will allow us to max out for the full tax benefit of $6,650 per family (we also get a generous contribution from my employer).

- Previous month: $0

- Difference: +$500

Total Investments & Contributions $10,665

- Previous month: $7,523

- Difference: +$3,142

Summing it all up against the Gross Income

Benjamin Franklin famously said, “that everything has a place and that everything should be put in its place.” With that, let’s summarize where the total gross income for the month of July went.

Gross Income $32,651

(Less) Expenses* $17,769

(Less) Investments & Contributions $10,665

Sub-Total $4,217

(less) Taxes & Benefits $4,217

Total = ZERO

Everything is accounted for (phew!).

Net Worth and Mortgage Pay Down Update

My ultimate goal is to build up a Net Worth of $10M returning 6% a year or $50,000/month in gross income. Don’t freak out, this is only about $5.5M in today’s dollars when you take into account a 3% inflation rate.

I am not anywhere close to a 7-figure net worth yet (or what some refer to as the double comma club). However, it is growing at a very respectable rate. If you want to see how I plan to get there you can read all about it here.

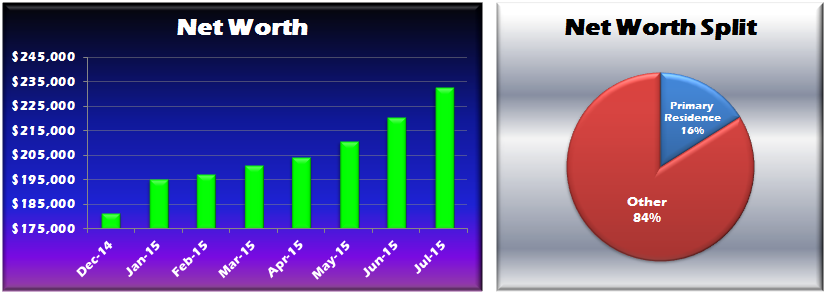

July Net Worth $232,728 (with seven months down in 2015, this puts us up $51,364 or 28.3% vs. 2014 so far and we still have 5 months to go)

- Previous month: $220,313

- Difference: +$12,415

With a year to date net worth gain of $51,364, that puts us slightly ahead of target. Recently I published a post where I outlined our goal to increase our net worth by $69,000 in 2015 (through contributions alone). We are officially 58% through the year and have reached 74% of our goal.

The stretch goal that I didn’t really put in writing anywhere was to achieve a $100,000 increase in Net Worth. We have 5 months to go and I think we can average about $8,000/month between now and the end of the year, which would put us up another $40,000 or $91,364 for the year. So we will be close, will have to see what I can do to find a few more sources of income to fill the gap. Of course there is always market appreciation, but it would take a pretty large move to get us all the way there. If anything I think the stock market will be pretty flat by the end of the year (I even bet there wasn’t much upside).

You will notice that in the second chart above that I have broken out the piece of our net worth that is based on the equity in our house. I have done this because it is something I want to watch, because I don’t want this to exceed 25%. And it is good to know the split.

Note: I think people tend to glaze over the fact that the savings rate plays a much bigger role in increasing your net worth than the rate of return on your investments. In the short term savings rate has a bigger impact on net worth. The goal is to eventually build a big enough asset base that the gains from compounding will eventually outpace the gains from savings.

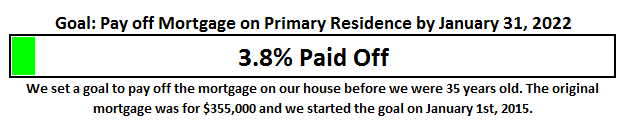

One of the other huge goals that I announced on the blog was the strategy to pay off our mortgage in 7 years. When you break it down and follow the 3 simple rules, it’s not as hard as it sounds. We bought our house in February of 2014 and then refinanced it into a 5/5 ARM in September of 2014 to remove PMI and free up cash-flow to put towards the principal and keep us on track to pay the mortgage off at an accelerated pace.

The progress chart above shows how much of our goal we have completed. Last month we were at 3.4%, which means we picked up another 40 basis points in July. At this rate we will be about 6% complete with this goal at the end of 2015 (assuming no extra lump sum payments).

Update to Mortgage Payoff

This year was the start of our 7 year plan to murder the mortgage on our primary residence. And this is still the goal, but as I have been playing around with the execution of the plan. This year we are paying an additional $800/month in principal and starting January of 2016 that is supposed to increase to $1,600 (and then an additional $800/month until year 7). There are two risks I want to manage with this plan:

- Cash Trap – What I mean by this is that I don’t want the cash to be trapped in the house if something were to happen to either my wife or myself before we finished paying the mortgage in full. It would suck to have all this money tied up in the house and then one of us lose our jobs (or both) and then not have access to the money in a time of need. The worst case scenario would be that things got so bad that we lost the house and all the money we poured into it. I don’t think this is likely, but I would rather not see it happen.

- Too large a % of Net Worth – I realize that for most Americans, the majority of their net worth is their house. I want to manage this at 25% or less, thus the new chart I added to the section above.

With that, we are making a slight pivot in the execution of this goal. We will continue to make the additional $800/month in principal through the end of the year and actually for the next 7 years of the plan. However, we are going to place the increases called for by the plan in a separate account for now. That means we will continue to pay an additional $9,600/year in principal, which ensures that if/when our rate goes up our mortgage payment will actually never increase. I did the math and in 2019, when our rate has the first opportunity to adjust up a max of 2%, as long as we have paid an additional $50,000 in principal our payment will stay the same when they reset the amortization schedule for the remaining 25 years of the mortgage.

But then we will have additional money with an intended purpose of paying down the mortgage to deal with in a separate account. It increments by $9,600 a year. By March of 2022 when we project to pay off the house (7 years 3 months), we would have about $220,000 that we could then use in a lump sum to pay the mortgage off.

The next question I have to tackle is what to do with the cash as it piles up. I still have another 5 months before I need to cross that bridge, but I am open to suggestions.

The End

July will likely be the peak of our income this year and a new high will probably not be seen until January of 2016. At the end of the day net worth is the ONE METRIC THAT MATTERS, and we had an increase of $12K in July. July was better than June, but not as good as it could have been (hello Jacuzzi). However, I am very happy with the results and the progress we have made towards our financial goals so far this year.

I hope these reports inspire and move you to action. Don’t take a passive role in your finances and hope for the best. There is a famous Jim Rohn quote that I think everyone should keep in mind:

If you don’t plan your future, somebody else will. And you know what they have planned for you? NOT MUCH!

You have to be intentional with your finances if you ever want a fighting chance to make it to financial freedom. It doesn’t have to take 40-50 years of slaving away for the man before you have the option to retire. I personally think that 20-25 years is really all you need, and for the folks that are more aggressive (i.e. extremely frugal, not us) or very high earners you can probably reach financial independence in 10 years or less (maybe us, it’s yet to be seen but income is our focus vs. expenses).

I am looking forward to chatting with you all in the comments below. How was your month? Also, if you have a blog, I encourage you to write a monthly financial report and come back here and share the link. I would love to be part of your support and accountability.

Cheers!

– Gen Y Finance Guy

PS: Here are my favorite ways to track this stuff:

- The “Financial Stats” spreadsheet – a simple Excel template I created to provide the tables and charts you see in this post as well as on the Financial Stats Page. If you would like a copy of this spreadsheet, sign up for my email list at the top of the page and I will send you a copy.

- Mint.com (free) – Mint is great for setting up budgets and automating the tracking of your actual spending habits vs. the budgets you set.

- PersonalCapital.com (free) – This is like Mint, but is geared towards investments and net worth tracking.

37 Responses

Looking forward to seeing how you progress over time. We have always been good at maxing our 401K but not good savers, living paycheck to paycheck. You (and a few other blogs) have me motivated to change that. Thanks

ps. Nice graphic of you in the hot tub. You need to give yourself some arms to go with that chest. 🙂

Hey Matt – Glad to be a source of motivation. Besides the personal accountability that this blog brings me, a major goal is to inspire and motivate others to take charge of their own financial life and prosper.

Will work on getting some arms on my Avatar that are proportional to the barrel chest 🙂

“Sun’s out…Guns out!!”

My thought is to make your avatar a moving .gif, that flexes. Time for the “Gun Show”….pow! pow!:-)

Way to go to Mr. and Mrs. GYFG, one month at a time, one dollar at a time. Very impressive!

Thanks JayCeezy!

Did you get the tickets?

What tickets?

TO THE GUN SHOW!

Wow GYFG, that is a really great month. Congrats on the promotion! You are on your way to financial success.

I really like your strategy for your house. You don’t want more than 25% of your net worth in your house which makes sense for the reasons detailed above. I think that this is smarter than just paying down the debt because it is debt.

Great job and hope this year continues to be great!

Erik

Thanks Erik!

Our finances continue to be evolving and dynamic. The change in execution of the mortgage payoff is really sitting well with me.

Appreciate the comment!

Some would do the math on what the hot tub purchase would be worth if invested for 10 years, I say enjoy the spoils of your already high savings rate once in a while! Congrats on the stellar increase and good luck on reaching hte $100k for 2015.

Hey Vawt – If we did the math on every purchase and rationalized it against the potential worth 10 years from now, we would put off a lot of expenses. Sometimes you have to enjoy some of your money in the present, because there is not guarantee of a tomorrow for any of us.

Like you said, we have a high savings rate and as long as we hit our goals, that is all that matters. It is easy to get caught up in the “what if” game.

You got me motivated to hit the $100K increase in Net Worth. If we don’t hit it, we should come pretty close. We will surely beat our goal to increase our net worth by $69K this year.

Cheers!

Dom, those pics you create are hilarious. How do you create them? With what software?

Glad to see the income kicking in. I enjoy myself a good hot tub as well. Got a 10-jetter in my bathroom expansion.

Do you think you’ll be able to reign in spending as your income goes? The correlation seems kinda 1:!

S

Hey Sam – the application I used to create the cartoons is Bitstrips on iPhone.

That 10-jetter sounds awesome. I have really missed a hot tub since buying the house 18 months ago. We really were not planning to get one until next year, but then we got the extra cash and we tend to use windfalls to pay for fun stuff (as long as we are hitting our financial goals).

I definitely think we are going to be able to reign in spending as income grows. This month was an extremely high spending month due to the hot tub purchase. Our goal is to save 50% of our gross income, which through July we are running at 37%, so slightly behind goal at the moment. But we should catch up by the end of the year.

At some point as our income continues to grow we may re-visit the gross savings rate goal of 50% and increase it to minimize the allowable lifestyle inflation. But we are not there yet.

You got any tips or advice?

Cheers!

Great post as always. Probably my favorite of the month.

I have contemplated replicating a similar breakdown for myself, but with no real estate holdings and a good deal tied to the markets, I just don’t find it as accurate and reflective for me. Even remaining disciplined, I can go down week to week etc. Do love how linear yours seems on a month over month basis.

As for the extra cash, if your horizon is truly 7 years, P2P or betterment would seem to be good havens to allow them some growth.

Godspeed.

Hey FS – Glad you like these reports. These are probably my favorite ones to write every month.

Why do you think that doing the same thing would not be accurate and reflective for you? I personally think anything less than monthly will probably to often to get an accurate picture. But for most people monthly ore quarterly should represent a pretty good picture.

I think the biggest contributors to the linear nature of my reports are as follows:

1 – I am sitting in about 50% or more cash (so not a lot of movement there)

2 – I hold the value of our home and rental condo constant and only update it once a year (not liquid enough to update monthly like stocks)

3 – I am in the beginning journey of wealth accumulation where a high savings rate has a much larger impact on net worth than market fluctuations.

4 – Of the money I have invested in the financial markets, the markets have really relatively flat vs. where we started the year, not bringing much volatility into the portfolio.

I don’t anticipate these reports to always be as linear. At some point market fluctuations will have a much larger impact on the month to month net worth numbers.

Cheers!

Makes sense. Market fluctuations of even 1% can often negate or even outpace my incremental investments for a month. I just try to remind myself of that I am picking up pieces of businesses every month and focus less on the net worth number.

Thanks again for sharing.

I second Betterment. I am deeply impressed with them as an investment location (They have about 20% of my taxable investments). Nice low fees and I like the fact that the TLH even for us lowly investors who have less than 50k with them (that used to be their thresh hold in the past to execute TLH). Very much fire and forget investing (the best type).

I don’t know why but for some reason I thought you lived in NYC. In any case, congrats on the promotion and the awesome income in July.

Hey Taylor Lee – Thanks for the comment. I am actually in Southern California.

Are you in NYC?

Great month Dom! Have to love those months where income outpaces the average. I should be having one soon, and can’t wait to put the money to work.

Great FF! Got to get that money working on the next $100K immediately if not sooner 🙂

What do you have coming up that will be bringing in the extra income? Will it be a one off or continuing?

Cheers!

Raise and bonus season 🙂

Wow congrats on the huge increase in monthly income. Your wife is crushing it. Tell her I said congrats too!! Im really interested in hearing how that timeshare pans out for you. Very interesting!

Dude! Hot tubs are awesome! I say that was a good move. You will enjoy that thing to the end of days!

Hey Alexander – Thanks for the kind words. I will make sure I pass on the kind words to my wife.

The timeshare was a gift from my grandparents. And when we don’t use it it pays for itself. I am really just holding out for one of the bigger casinos on either side to make an offer to buy out all the owners and tear it down.

We are really enjoying the hot tub.

Cheers!

Hey GYFG,

Sounds like you’re doing great! I’m not sure net worth is the only metric that matters, but it is definitely important. We could all use to be more intentional with our finances.

Best of luck in your journey!

Laura Beth

Thanks Laura Beth.

Your right, Net Worth is not the only metric that matters. But it is the most important one to me at this stage in my journey. Of course I look at many other metrics, but this one tells me if I am moving towards or away from my longer term financial goals.

I am curious what metric you would choose as the “One Metric That Matters” the most to you?

Cheers!

Wow, fantastic income report format – you’re super thorough. That must have taken a long time to put together!

Congrats on a fabulous income month! And that’s cool you guys got a hot tub. 🙂 It’s nice to celebrate wins

Thank you Sydney. The report format itself did take a while for me to come up with and has kind of been an evolution. I like where it has landed.

It probably takes me about 4 hours to put together every month.

We are really enjoying the hot tub.

Man I just love your energy GYFG, almost as much as your creative pics and your big financial numbers!

You’ve got some serious momentum going, both on the finances and on the blogging, and I really hope you keep it up and reap all the rewards you so thoroughly deserve.

I love the mortgage payoff goal too, although I conveniently try to ignore my gigantic mortgage and focus on building up investments instead – I wish it was a $355k mortgage to pay off… although in reality I wouldn’t change what we have, it’s very much worth it!

Cheers,

Jason

Jason – Thank you very much for the kind words.

The goal is to keep the momentum going for as long as possible. It’s always easier to KEEP it going then GETTING it going.

Cheers!

Well done GYFG! Love how well you’re doing on the income side of the equation. A hot tub can be a lot of fun, although I think in SoCal, I probably would have gone for a pool instead. If we ever head back to the frozen tundra, I think a hot tub or a Sauna would be on our list of purchases to consider.

Thanks Hannah!Our income has certainly been something that has been working, but it has definitely been a team effort. There have also been some unplanned additions that are always nice as well. As I noted in the post though, we will see a pretty heavy fall off in August with respect to income, but at a new set point of around $16K/month.

A pool is really nice for about 3-4 months out of the year hear in SoCal, but I honestly love hot tubs year round. Definitely not going into during the heat of the day in summer. But it is still very nice in the evenings in summer time.

My favorite time to hot tub is fall and winter when the mornings can be in the 40’s to 50’s.

Plus, we have friends and family with pools, so no need to take on that expense. We have found that most the people we know that have pools never use them (or at the very least hardly use them). We were only okay with buying a hot tub because before we bought the house we lived in a community with a hot tub that we used almost daily. We only used the pool once in 13 months.

Cheers!

IT looks like you guys are really killin it on the income side. THe higher the income the easier it is to reach FI. Good luck GenY

Thanks Rich Uncle EL!

Sorry for back tracking here but I just found your site. Curious how you have over 32k in income but pay less then 5k in taxes, especially here in California. Me and my fiance make about 20k a month in income but pay about 8k in taxes..any help how you keep it so low would be much appreciated!!

Hey Sean – That is a fantastic question, and one I am very surprised most have not asked yet. I have been waiting for it all year.

There are a lot of things going on here (some things specific to the month):

1 – In July we did receive a gift of $5,000 (non taxable)

2 – The $2,000 in rental income we receive does not have any taxes being taken out (at least until we file)

3 – We contributed $2,200 to tax deferred retirement accounts.

4 – We contributed $500 to and HSA which is exempt of federal, state, and FICA taxes (bonus of 7.1% savings)

5 – My wife and I had a combined $3,000 in 1099 income (again it won’t be taxed until we file, we will probably have to look into doing quarterly estimates)

6 – Some of the money that my wife “earns” is actually a reimbursement of business expenses (this month that didn’t happen).

7 – I have also not factored in credit card float that has an effect on cash flow, which also distorts the picture. I called this out in the September report, and will fix it going forward in October.

8 – The last piece is that we adjust our withholding on our W-4 based on what we estimate our tax bill to be based on our deductions (mortgage interest, depreciation on rental, carry forward market losses, property taxes, Business expenses, etc.). Based on this planning I have my deductions set to 10 with my wife at 1.

So if you make those adjustments to come up with taxable income you are looking at $19K of taxable income (vs. $32K reported gross income). This gives us an effective tax rate of 26% for the month.

I should also point out that we are also planning for a tax credit for installing solar this year. A post is in the Que to be published sometime in the next couple of weeks.

I will also point out that our income has increased substantially this year and I expect I will have to cut a check to the IRS again. There is even a chance that we will be hit with a penalty. We never get money back from the IRS.

Taxes can become a pretty complicated thing to share with everyone. You will notice that I actually have gotten rid of the section on taxes going forward because of this. I don’t want to be in the business of giving tax advice.

Thanks for the question and for keeping me honest. I am working through a way to provide even more transparency around this as we head into 2016.

Cheers!

Man this question sent me down the rabbit whole. I just updated my tax sheet and realized that I am going to come about $12,000 short of my total tax liability for 2015, even after the tax credit.