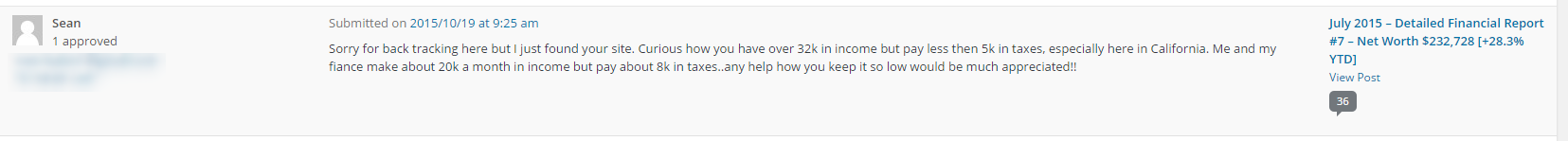

The GYFG blog recently picked up a new reader (Sean), who finally asked the question I have been waiting for all summer. It was around how my taxes were so low on such a high income. It’s a good thing we have smart readers that ask good questions (someone has to keep me honest). It makes for nice opportunities to continue to provide full transparency. On other blogs I see many commentators get ignored when a question like this is asked.

Not here!!! Not us!!!

See his original comment below:

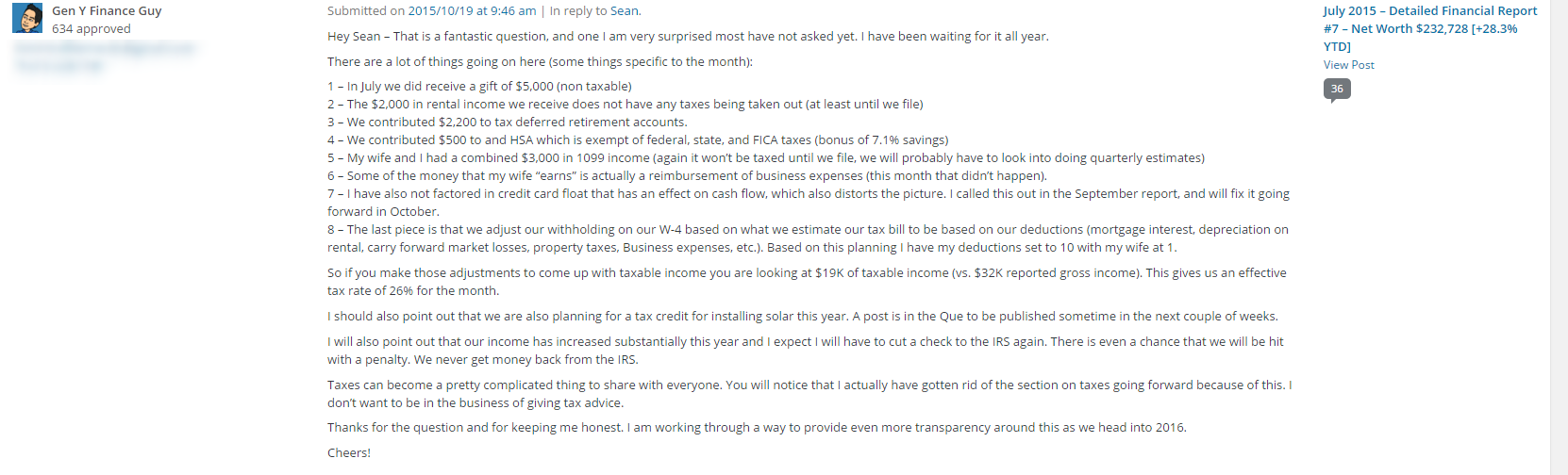

Although I was prepared to answer this question as taxes have been on my mind a lot lately, but I kept putting off finally building accurate tax calculations into my spreadsheet. I had been using the back of the napkin rate I calculated at the beginning of the year when I thought our income was going to drop in 2015 to about $180K (vs. $214K in 2014). So, without thinking anything of it I replied the following:

All of these points were valid and in alignment with my policy of full transparency. But then my alarm bells started going off when I was getting close to finishing my comment.

Notice the sentence about 2/3’s down the comment above where I say “I will also point out that our income has increased substantially this year and I expect I will have to cut a check to the IRS again. There is even a chance that we will be hit with a penalty. We never get money back from the IRS.” The good news is that we will not be hit with a penalty after all (but more on that below).

It was that particular reply that forced me to realize that I had not re-calculated my new tax liability for 2015 based on the extra income from my promotion and the additional income that my wife had been earning as she has been growing her business (and she has been killing it). Typically, the way I like to pay taxes in the current year is to pay as little as possible, and then back load the end of the year, that way we get to hold onto the money as long as possible.

If you read my September financial report (in the contributions section) you will note that I did call out the fact that taxes did go up as I reduced my withholding’s from 10 down to 2. But again this was based on the old plan (definitely a blonde moment and huge oversight on my part). Oh, and by the way I have black hair, so figure that one out 🙂

New Tax Calculations Indicate a $13,000 Gap

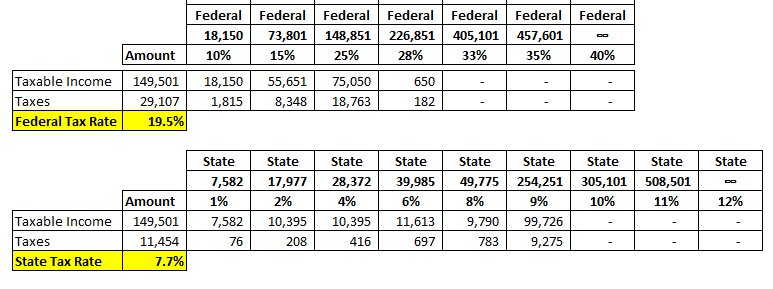

I immediately went to work finally building out a tax module in my spreadsheet to be able to calculate the following taxes:

- Federal Income Tax (Tiered tax bracket, see below)

- State Income Tax (Tiered tax bracket, see below)

- Medicare (1.45% on all income and increase by 0.9% for high earners, see Vawt’s link in comment below)

- Social Security (6.2% on income up to $118,000 per tax payer)

- CA SUI/SDI (0.9% up to a max of $7,000 per tax payer)

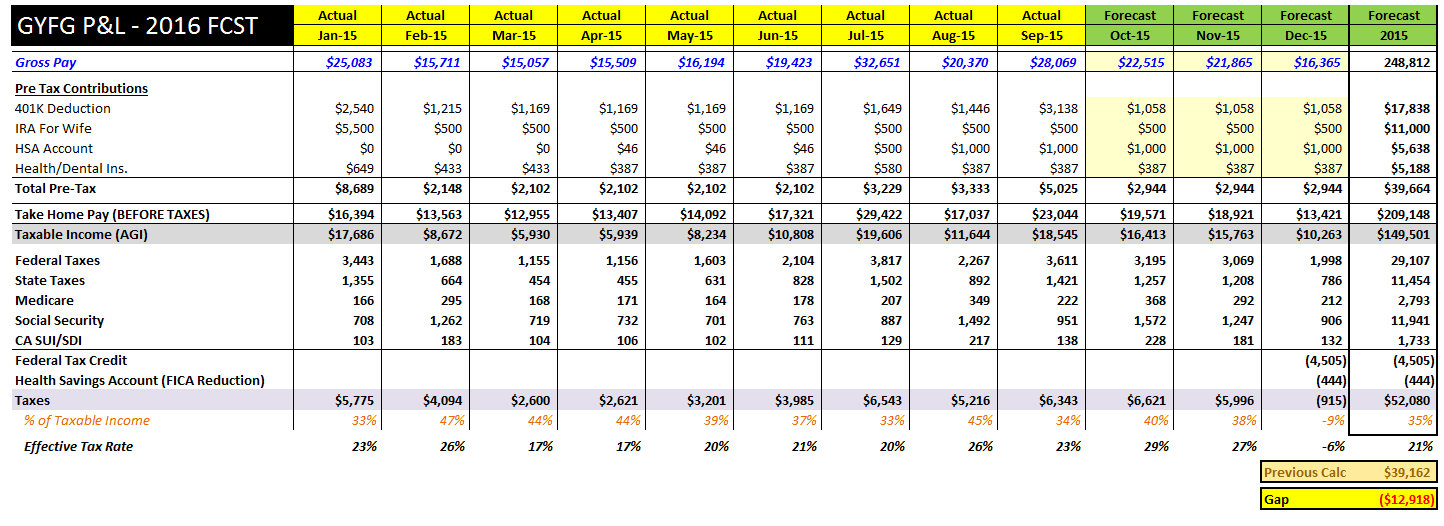

Although our total projected income for 2015 is $248K, our taxable income is around $150K after all tax deferred contributions and our estimated deductions. After building in detailed tax calculations into my spreadsheet, here is what I came up with:

You will notice that I have layered in a tax credit of $4,505 that we will be realizing in the 2015 tax year for going Solar (there is a post coming on this soon). I also layered in the FICA (Medicare and Social Security) savings for contributions made to our HSA.

WE HAVE A $13,000 TAX GAP!!!

Side Note: I had to take a few tums to relieve the heart burn after realizing we will our tax liability for 2015 was $52,080 (that’s how much I made during my first year out of college). Imagine what you could do with an extra $52,080…even worse, imagine how the government is going to waste that money. But such is life and it’s the PRICE WE PAY to live in this AWESOME USA.

Since making these calculations I went into our ADP portal and changed my personal deductions to ZERO and told ADP to add an additional $1,000 per pay period in additional tax payments. This should close the gap by $5,000 (give or take), but still leaves us with an $8,000 check to write to Uncle Sam come APRIL 15TH OF 2016.

As much as I hate writing a check to Uncle Sam, I like holding onto my money as long as possible. This move will ensure we don’t get hit with any penalties for underpayment.

Generally, most taxpayers will avoid this penalty if they either owe less than $1,000 in tax after subtracting their withholding and estimated tax payments, or if they paid at least 90% of the tax for the current year or 100% of the tax shown on the return for the prior year, whichever is smaller. – IRS website

Summary

The good news is that I won’t be caught off guard on this again next year. My master spreadsheet now has the tax model built into it, to allow me to keep close tabs on what our tax liability is going to be. The timing was good, because I had just started to take a first past at forecasting 2016, so that we could start setting our goals.

Taxes are never fun, but I always remind people that taxes are a good problem to have. It means you are making money.

Learn from my blonde moment and make sure you stay on top of your taxes, especially when you start making huge financial strides in your income.

-Gen Y Finance Guy

35 Responses

Just a quick note- the 1.45% medicare tax does not stop at $118k (taxed on all earnings I think). In fact, it keeps going and then adds another .9% at the $200k income level for singles and $250k level for married filing jointly! It looks like your spreadsheet has it too low to me, but I didn’t spend a lot of time calculating it, just wanted to mention that it looks like you imply that it stops.

Tax planning is a big deal that people are afraid of for some reason. Usually it is to get a big refund. I don’t mind getting a refund, but don’t want to loan the government too much money for a whole year. When people use it as a savings account and then blow the giant refund it just seems irresponsible to me!

Here is a link to the IRS site (wanted to make sure I was using the right numbers):

https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Questions-and-Answers-for-the-Additional-Medicare-Tax

Hey Vawt,

Your totally right, I misread that…the income limit is only on the social security taxes. Thanks for the link.

I will need to fix my spreadsheet to account for this change. And I just realized that the limit for SS is actually $118,500.

It always confuses me when people tell me that they would rather knowingly overpay and get a refund that to at the very least optimize their tax withholding to no owe anything. Like you I don’t want to let the government borrow my money either at 0%. But I also don’t want to pay any unnecessary penalties for underpayment.

This has been an interesting year with lots of first for us.

Thanks for being a second set of eyes.

Cheers!

My taxes are pretty simple since I have basically only a W2, interest, some dividends, and capital gains/losses (trying to divest my individual holdings when it makes good tax sense so I can move to index funds). I set my federal allowances to 2 and it usually yields me a small refund (less than $500) which I’m okay with. Getting it closer to zero (or have me cut a check) really isn’t worth it to me personally right now. But yikes – I would have shit a brick if I saw I was going to end up $13k in the red! Luckily your new reader caught it!

Yes, my initial reaction was not fun.

I don’t mind cutting a check to the IRS, just want to make sure I don’t have to pay any penalties (I should be good there). Also would like to keep the liability below $10K. Right now with the changes I made to my extra withholdings I will still have to cut a check for $8,000 worst case. I still have some more number crunching to do on that end and may end up increasing my withholdings again in December (not sure yet).

Going to try and be a bit more strategic with taxes next year.

I am in the middle of planning for 2016 and our tax liability looks like its going to increase from $52K this year to $65K next year. This is mostly a direct result of of the mid-year promotion, and it will be the first time we realize the increase in my bonus in conjunction with the promotion.

Luckily I was able to get a 401K set up and be in effect in 2016 for my wife’s office. That will help a little. But the reality is that I am going to pay a lot more taxes again next year.

Cheers!

Okay I lied – You convinced me to go calc it. And I’m right where I through I was going to be $450 refund. Maybe I’ll change my allowances for the remainder of the year from 2 to 3 so that gets closer to zero.

Nice FF. You have your taxes pretty dialed in!!!

Nice post, Gen Y. We have a total household income very similar to yours, and the key is to reduce your “taxable income” as much as humanly possible, which will become even more important as my wife and I move into retirement and start wading through the complexities of our healthcare options in respect to our income and overall wealth.

High income + low taxes = happy future early retirees!

Could not agree with your more Steve. We did everything we could to reduce our taxable income from $249K down to $150K.

Have you been following Jeremy over at Go Curry Cracker? Sounds like they are already doing what you will need to be doing soon 🙂

Yup, we’re keeping close tabs at what he’s been able to figure out over there at GCC. Some of it hurts my head. 🙂

Yeah, his last one was a bit confusing to me >> http://www.gocurrycracker.com/obamacare-optimization-vs-tax-minimization/

Concerned that we might have a tax gap again this year, we looked at this very issue two days ago, particularly because income from side hustling took off like a rocket (to the IRS). Fortunately, we’ll end up even at the end of the year due to the additional paycheck deductions we started the year with. In 2014, we didn’t look at our tax liability and ended up owing about $5k, so I feel your pain.

Hey Claudia – Congrats on the side hustle income taking off. That is never something to complain about.

I guess I look at it as pay it now or pay it later. Anything $10K or under and without penalty is within my comfort zone. My wife on the other hand does not like when we have to write a check to the IRS. She has a hard time realizing that our take home was higher during the year and that this was owed regardless. She has just been conditioned by the masses to be in refund mode.

Glad you guys will end up even though 🙂

Thanks for the analysis. I dislike paying taxes too. Unfortunately, I’ve taken a ton of capital gains in Apple this past year and owe nearly $5500 in capital gains taxes from it. In order to offset some of that I’ve been selling off a few stocks and LEAP options that have large losses to try and offset some of that.

I’ve so far sold most of BBL, IBM, and CAT to try and lock in some of those losses. I’ll be buying them back after the wash sale rule expires at hopefully similar prices. Great job on reducing your taxable income!

Only good thing about taxes is that you only pay them when making money!

Scott

Scott – at least the capital gains are at more favorable rates. How much of the gain will you be able to offset by realizing losses in the positions you listed?

I agree, that taxes are a good problem to have, because you only pay when you earn.

Cheers!

Oh man. My self employment is always killer on the taxes! Thanks for the inspiration to build a new spreadsheet and start calculating!

My pleasure Maggie. Always love giving other people homework 🙂

Hey look I made it into the post! Not sure if that’s a good or bad thing, though.. 🙂

Thanks for this very detailed analysis. We just recently purchased our condo in July so I am unsure how that will help our tax situation, if at all. I know you own 2 properties but in your table above I don’t see any deductions from either, is this because the standard deductions are more beneficial for you? I am trying to see how my condo purchase will potentially help my tax situation. It may be time for me to engage a CPA, as taxes are definitely my weakest point!!

Hey Sean – It’s a good thing that you made it into the post. You brought things font and center that I needed to address and think about. It also acts as the impetus for others to jump into action themselves.

The bonus is that it makes for easy content creation. When you write about real life it’s really not that hard.

Regarding deductions:

You are right, we do own two properties (our house and the rental condo). In the screenshot of the image I shared I hid rows with all my deductions.

Notice how our gross income is $248,812. From there I deduct all of our pre-tax deductions in the amount of $39,664, which gives us a take home pay before taxes of $209,148.

Then you will notice that our “Taxable Income (AGI)” drops to $149,501. The difference is equal to our other deductions in the amount of $59,47, which is much larger than the standard deduction (which is $6,300 for singles and $12,600 if married filing jointly). So, as long as your interest + property taxes is higher than the standard deduction you will get a net benefit from buying the condo.

Cheers!

Great post GYFG!

Tax planning is something I have not done in the past due to not owning a home and our household income not being high enough to really have to worry too much about it. The good news is we now have the assets and income that this needs to be an area of focus for us. This past year was the first that we have owed my money and my wife was steadfast that “I don’t care, we are not giving anymore money to the government.” Luckily, I was able to convince her to not become a felon and we begrudgingly made the payment. Could you by chance share the template of the spreadsheet that you have built to estimate your taxes?

Thanks and keep up the great posts!

Hey Adam – Glad you like the post.

I am happy to share the template, let me make a few tweaks so it will be set up for mass use and then I will add a link to this post and let you know via the comments that you can download it.

Cheers!

GYFG, my thought is you will pay a lot less than that on the income you show in the spreadsheet. Remove $20,600 from your AGI. (Standard Deduction for 2015 is $12,600 for a married couple. Personal exemptions for two is $8,000.) I feel like a nag, but it is for your own good…read “The Tax Racket” by Martin Gross. If your itemized deductions are greater than $12,600 (and I imagine they are with your Property Tax, Auto tax, Mortgage Interest, Charitable deductions, etc.) use last year’s number instead. If your wheeling-and-dealing with covered calls, short-term capital gains, dividends, etc. are significant, you might want to plug in a number for that as well.

Can I guess? Thanks, I will! I think you will recalc, find your withholding decision was too aggressive, and return to your original plan. Let me know! I love this stuff, and it is worthwhile to do ‘what-ifs’. In example, four years ago we paid a combined Fed & State tax of $80K, and for 2015 we estimated combined of $4K. You can use their rules to help yourself.

Don’t know if you do your own taxes (and I’m not asking, that is your own business), but if you do, you can boilerplate the 2014 returns (add an ‘x’ or ‘2015’ to the suffix). Plug in your new numbers for income, and adjust accordingly. If it turns out you still will have a big gap, one solution is to print out the IRS 1040 Estimated Tax quarterly payment form here https://www.irs.gov/pub/irs-pdf/f1040es.pdf and when you get close to year-end you will have a pretty good idea about your final income and tax liability. You can mail in Payment Voucher 4 with a check for 80% of your liability gap (ensuring you don’t overpay) and get the rest in with your return by April 15, 2016. You are killing it, and I hope you don’t let up! Continued success to you!

Hey JayCeezy –

Our itemized deductions are much larger than the standard deduction and I do take them into account (but it is easy to miss on the spreadsheet, because I hid that section before adding the screenshot).

If you look at the spreadsheet carefully you will see the following steps to get to “Taxable Income” (AGI):

Start – $248,812

Less – $39,664 (401k, IRA, HSA, and benefits that all come out before taxes)…well except FICA (HSA is the only one that has not FICA tax associated with it)

Sub Total #1 – $209,148 (what I am calling pre-tax income)

The next step is not as clear in the spreadsheet as it could be. But you will notice a another jump lower to taxable AGI.

Less Itemized deductions – $59,647 (interest, property taxes, gift monies, donations, business expenses, depreciation on rental, etc.)

AGI = $149,501

The other thing that probably isn’t as clear as it could be is the tax % calculation. The 35% you see is as a percent of my AGI, but if you take the total tax liability due of $52,080 divided by total income of $248,812, then my effective tax rate is ~21%.

What am I missing?

Do you think I can reduce this below 21%? I was thinking 21% was pretty good, since a majority of our income is earned income.

I do happen to do my own taxes and always have.

Please share your secrets.

I had to edit my comment, because I realized in my haste that I made a mistake and used the wrong numbers to calculate my effective tax rate (which should be 21% and not 25%). This is really for those that are signed up for the email notifications of new comments.

Sorry about that.

GYFG, my thought is that 21% is still too high. Thanks for pointing out your modification to published spreadsheet, I found that Excel never got it done for anything other than a top level tax rate for Fed and State. Two quick things you might plug in: 1) $4,000 personal exemptions, so $8,000 total reduced from AGI; 2) no Fed taxes paid on State taxes ($11K, which also looks high).

This is just my ‘blink’ on your taxes from top-down. One fast sanity check is take 2014 return and plug in real numbers at the top level. A second way is to take your 2014 return on software (i.e. H&R Block), copy the 2014 final in a new version, and plug in these estimated numbers at the top level. It is possible you may also be hit with AMT, but it will be very close if at all. My thought is your cume will be closer to 19%, but what do I know.

Just my two cents, this exercise is very forward thinking.

“…plug in real 2014 FINAL TAX RETURN numbers INTO THE SPREADSHEET…” (added to clarify that sentence)

Appreciate the input JayCeezy.

You definitely have me in thinking mode. Your comments are always so valuable and thought provoking. Keep them coming!

I will definitely be looking at this closely. Will have to try plugging these into my tax software as you suggest (I use Tax Slayer).

BTW, I just went and placed my order on Amazon for “The Tax Racket .” I had added it to my wishlist the first time you recommended it…but should have it before the end of the month.

.” I had added it to my wishlist the first time you recommended it…but should have it before the end of the month.

Cheers!

JayCeezy,

Thanks again for being a second set of eyes. I have adjusted my spreadsheet to tax into account the fact that state taxes are deductible from the federal calculation. This brought the calculated “tax gap” down from $13K to about $9K.

And, you are right, after this re-calc I logged back into ADP and removed the additional $1K per pay check in additional withholding. Will continue to evaluate each month, and will likely run the numbers through my tax software as you suggested before then.

Cheers!

JayCeezy,

So, I just finished my first pass at taxes (still waiting on a few official documents, but used estimates). And at the end of it we actually only owe approximately $2,600. I was shocked.

My latest spreadsheet had the calculation at $8,124.

I know I missed the $4,000/person personal exemptions that you mentioned above. And obviously there are a ton of other things that I will not catch in my spreadsheet.

In all honesty I like the fact that my spreadsheet is conservative. I think I will use it going forward knowing it is fat.

Cheers!

Thanks for the reminder to calculate my tax gap! The numbers say I’ll need to write a small check, but I’m okay with that.

Side note: For my first few years of filing taxes, I was a 1099 contractor and always had to pay in a big chunk of my (little) income. I never understood how so many people could complain about tax time when they were getting big checks back!

Hey GYFG,

Thanks for another great post. I’ve been using TurboTax pretty much forever to do my taxes, which has worked just fine so far. In your opinion, what’s the best way to ensure that I am actually minimizing my taxes to the fullest extent? Do you use TurboTax, and have you found it to be adequate?

The BEST way? Is probably to hire a really good CPA.

I personally use Tax Slayer and have since 2005. It’s completely online.

Obviously, you can minimize taxes by maxing out all tax-favored accounts (401ks, IRA’s, HSA’s). Having a business is helpful because of the expenses that qualify as business expenses that you can run through it. Depreciation from real estate is always good. At the very least your depreciation could offset any positive cash flow on the property. Depending on your AGI you could pass through up to $25,000 in losses to your personal income return as a passive investor. But that get’s phased out between $100K and $150K. If you qualify as a real estate professional then there are no limits.

Check out this link: http://www.markredfield.com/taxbyte17.shtml

Also a good book for you to check out is Lower Your Taxes – Big Time .

.

I am certainly not a tax professional, I just try to do the best I can with the information I can find online.

But I have already promised myself once I hit the $300K/year income mark (combined for my wife and I), I will bite the bullet and get a tax guy. I will probably do a shadow tax return to compare what he does for me and what I could do on my own to see if it is worth it or not. I really only want to pay someone if they can save me more than if I did it on my own (net of their fees of course).

Hope that helps.

Love the transparency man! Great question from the commentator as well, not sure if you’ve done a post on this & it may be a tad random although I’d love to see a post about how to ask great questions as I imagine you’d be great at them 🙂

Cheers & all the best with the IRS 😉