HAPPY BIRTHDAY, GYFG! The blog officially turned five years old last month. It doesn’t seem possible but it happened. This blog has been a critical ingredient to my success over the last five years in several key ways: It’s held me accountable to my goals. It’s allowed me to solidify my philosophies. It’s allowed me to document my journey. It’s allowed me to connect with AMAZING people.

My original goal was to stick it out for three years…but here we are those three plus two more! Blogging has become a part of my identity.

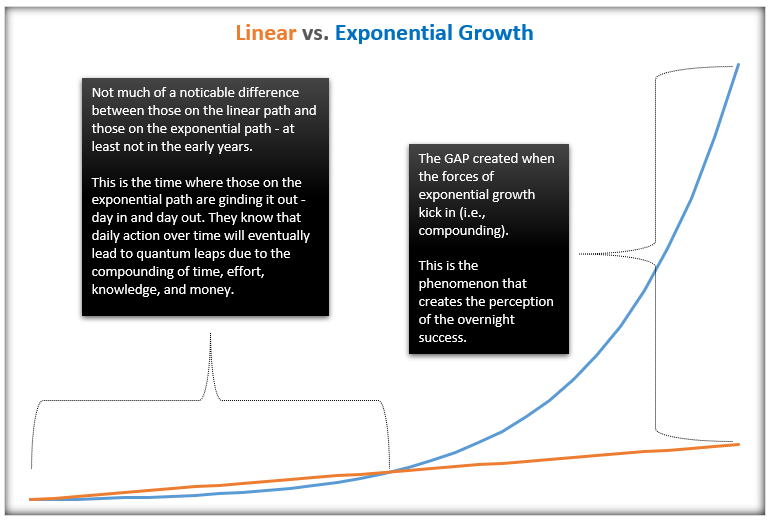

I don’t see myself stopping anytime soon. My new goal is to make it to the ten-year milestone. I figure I’ve made it five years, why not try for another five? There are not many things I can say I’ve done for a decade or longer. Imagine what can be accomplished over the next five years if I – and you – allow for uninterrupted compounding in all aspects of our lives. The chart below is a visualization of what happens.

If you’re a regular reader and only want to read the new content, feel free to just skip the intro below, and head to Net Worth. If you are new or haven’t read many of these reports, I encourage you to take two minutes to read the intro below, which does change periodically.

Why I Share These Monthly Reports

Mission Statement: To Humanize Finance, Build Wealth, and Reach Financial Freedom.

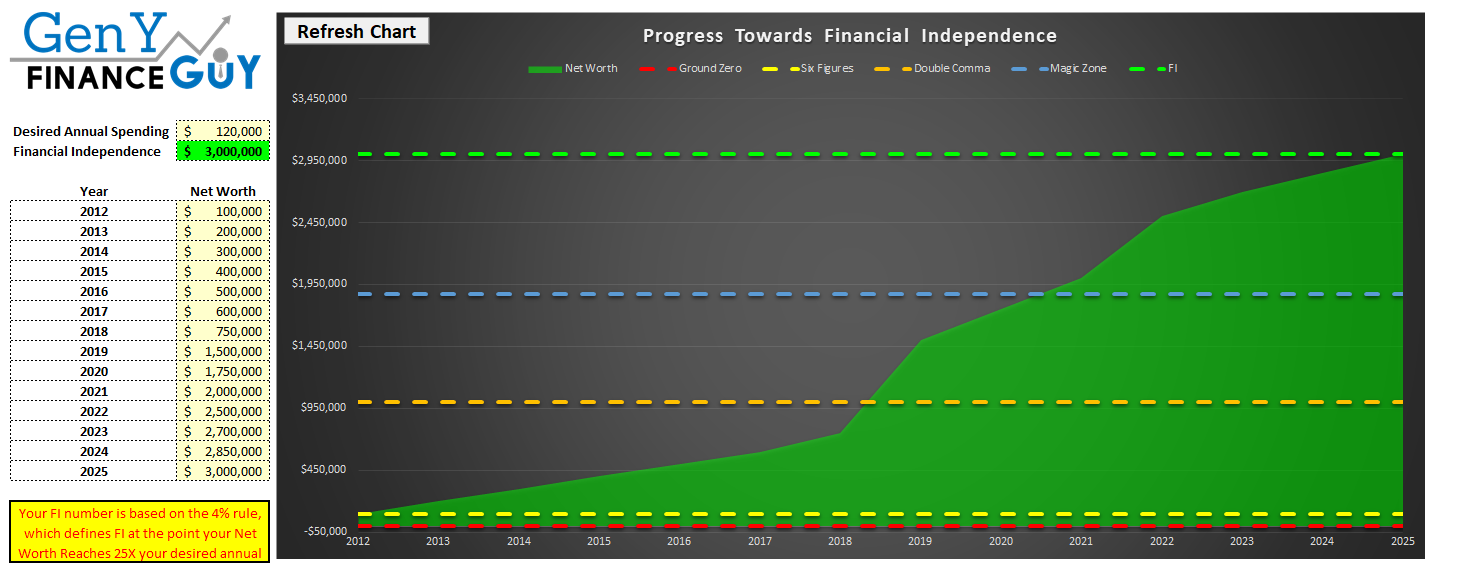

For those of you new around this corner of the internet, these monthly reports are about full transparency. And, they are just as much for me as they are for you. It was a hard decision to make all of my financial details public, but it has proved to be a very motivating one. The process I go through every month to produce these reports has been enlightening and life-changing. I published my first “income and net worth report” for January of 2015 when our net worth was only $195,141 and our gross income was on pace to hit $178,000 that year.

Four years and eight months later, our net worth currently clocks in at $1,360,555 with a gross income over the trailing twelve months of $558,738.

- That’s a 7.0X increase in net worth due to a compound annual growth rate of roughly 50% for the past four years.

- At the same time, income has increased 3.1X, which translates to a compound annual growth rate of roughly 27%.

Honestly, I don’t think the GYFG household would have experienced these kinds of results without the existence of this blog and the accountability it brings. Knowing that I will share our results with you readers every month keeps me very focused and intentional with all things related to our financial well being. For that, I THANK YOU for taking the time to read and interact with me on this blog.

Above and beyond this benefit to my own household, my sincere hope is that my policy of full transparency will inspire you to take the helm of your own financial ship and be intentional with its direction. I truly believe that anyone can reach financial freedom if he or she is willing to do things differently than the pack does. If you’re after average results, then you’ve landed on the wrong site. There’s nothing wrong with average, but the kind of results I preach are EXTRAORDINARY. Sure, the “get rich slow” method is proven, but there is an alternative, which is to “get rich fast.” Look, I have no interest in living like a starving college student until I am old and brittle to only then have the means to check off bucket-list items when my body might no longer be physically capable of doing them. And I don’t want that for you either!

Here at GYFG, we approach the pursuit of FINANCIAL FREEDOM with an abundance mindset, so you won’t hear me telling you to cut out those $5 lattes. Choose to spend on what is meaningful to you. I spend a lot, but I also strategically earn a lot, save a lot and invest a lot.

I hope these reports inspire and move you to action. Don’t take a passive role in your finances and hope for the best. Keep this famous Jim Rohn quote in mind:

“If you don’t plan your future, somebody else will. And you know what they have planned for you? NOT MUCH!”

You must be intentional with your finances if you ever want a fighting chance to make it to financial freedom. But it does not have to take 40-50 years of slaving away for “The Man” before you have the option to retire. I think 10-20 years is all you need, with the most aggressive folks probably able to reach financial freedom in 10 years or less. A high income paired with a high savings rate are two of the vital components of a good recipe for the 10-year track.

I know I don’t have to publish my juicy details every month, but it’s important to me that you know that I put my money where my mouth is (not so many people giving financial advice actually do this). I publish all of my financial details not to brag, but instead to show you what is working as well as what’s not working. Sometimes finance can get pretty dense, and I think real life examples and numbers can help slice through the complexities (and the BS). Personally, I have always enjoyed the financial reports put out by other bloggers around the blogosphere, so I always intended to share my own.

You can find all my previous reports on the Financial Stats page.

Financial Stats Dashboard

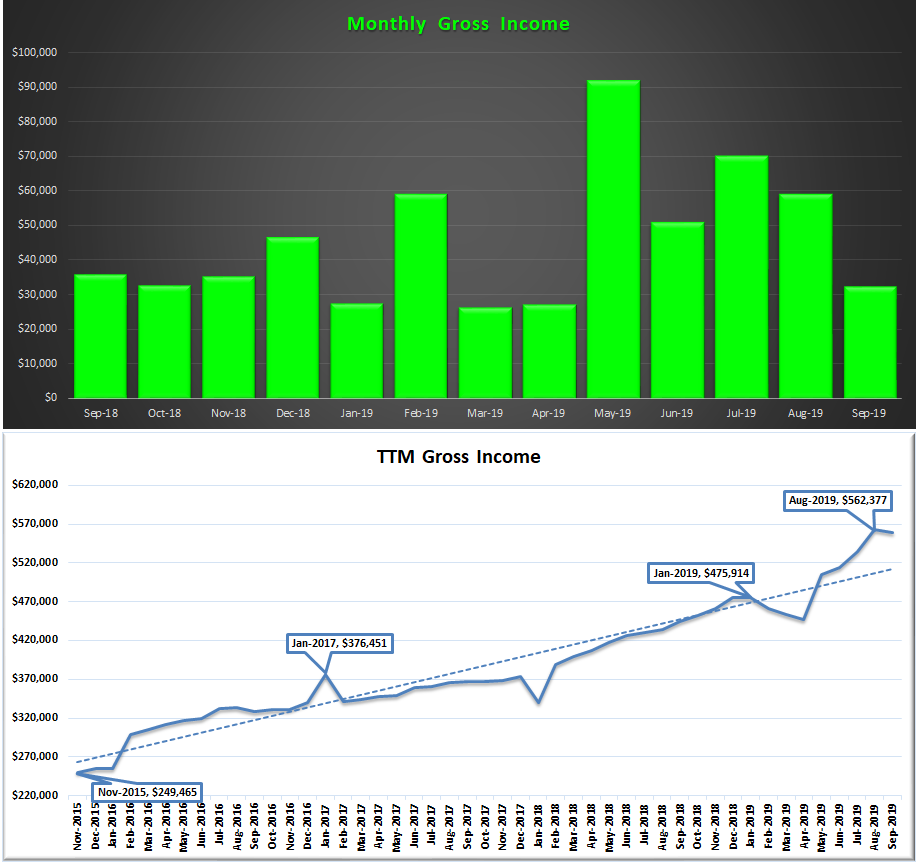

At the end of every month, I download a .csv file from my Personal Capital account and drop it into my custom built excel workbook in order to update the dashboard you see below. I’m blown away every month by the progress we have made in a relatively short period of time.The only number below that is not an actual number and instead is a forecast is the current year projected income of $536,176 in the gross income chart below.

Now that we have seen the overall, let’s take a closer look at a few of the items below.

Net Worth

The trajectory of our net worth doesn’t seem real. We are nine months through 2019 and our net worth has already increased by roughly $350,000…in less than one year. I was watching a documentary last night and heard the following quote: “Going from $100 to $110 is work but going from $100,000,000 to $110,000,000 is inevitable.” The way I translate that quote is that when you only have $100, it’s hard to grow it because you likely need to spend it to live, but when you have $100,000,000 the cost of your needs are a rounding error and so the majority of your worth can remain invested to compound FOREVER!!!

This is the first year I think that the increase in our net worth could be on par with our actual income for the year. That would be a huge inflection point!

September Net Worth $1,360,455 (up $347,590 or +34.3% for 2019)

- Previous month: $1,312,526

- Difference: +$47,929

Net Worth Break Down (MoM):

The Real Estate ($642,660) category decreased from 49% to 47%. This category includes the equity in our primary residence ($463,896), our investment in the Rich Uncles commercial REIT ($76,672), and our hard money loans through the PeerStreet ($102,091) platform. I have been taking capital as it’s freed up from our after-tax PeerStreet account and using it to fund Rich Uncles as we work the RU account value up to $100,000 (which is why the PeerStreet value hasn’t been changing much MoM).

The Real Estate ($642,660) category decreased from 49% to 47%. This category includes the equity in our primary residence ($463,896), our investment in the Rich Uncles commercial REIT ($76,672), and our hard money loans through the PeerStreet ($102,091) platform. I have been taking capital as it’s freed up from our after-tax PeerStreet account and using it to fund Rich Uncles as we work the RU account value up to $100,000 (which is why the PeerStreet value hasn’t been changing much MoM).

Net Cash ($217,614) increased from 14% to 16%. We actually have $226,257 in cash but net cash is only $217,614 after you adjust for our current credit card balance of $8,643, which we pay in full every month based on the statement due date. Keep in mind that of that $217,614 a portion (~$118K) is related to what my business owes me (a combination of my direct billable work and the profits of the business). I’ll discuss why this has grown so large and will continue to accumulate in the income section below (Spoiler: it’s due to taxes).

The Business ($234,962) category decreased from 18% to 17%. This represents the ownership I have in the private company that I work for. This is an illiquid investment that only gets an update to its value one time per year. I net the company stock asset value of $446,962 against the company stock loan of -$212,000 to arrive at the $234,962.

Life Settlements ($93,076) remained flat at 7%. We currently have investments in seven policies at $10,000 each. They are accreting in value by about $1,000 per month. For anyone familiar with options, I liken the fixed return of life settlements to the theta of a short option. In this case, the accreted value is like the theta decay of an option you’ve sold. In more simple terms, with this fixed return you are amortizing (realizing) that value with the passing of time.

The Stocks ($172,143) category decreased remained flat at 13% and represents the cumulative value of our brokerage accounts (retirement accounts) that are invested in stocks. However, this is not all of our retirement money, as the majority of our PeerStreet investments are made through a self-directed IRA (worth about $82,000 and counted in the Real Estate category of the pie chart).

Total Capital Deployed in 2019:

Now that both of our 401Ks are maxed out, the only consistent monthly deployment we are making is the $1,000/month to Rich Uncles. We are currently just letting cash build up. I am paying back the 401K loan at about $450 per month but it’s not reflected in the above table as I plan to just update it at the end of the year (I currently owe $46,034 of the original $50,000 loan). We have plenty of cash sitting around to put the loan to bed at any time, but I’m not interested in doing so at all-time-highs in the market. We also have automatic reinvestment turned on with most of our accounts so I will add those amounts in the last update of the year under the dividends/interest column (and 401K match column).

Gross Income

Income for the month of September was $32,342 vs. $59,115 in August. On a cumulative basis, we have earned $444,137 through September of 2019. I don’t think I have ever explicitly stated this but in case it isn’t obvious, I operate our personal financials on a cash-basis accounting. I call this out because our income is starting to – and will continue to be – significantly understated due to what is due from my business in the form of both compensations for my own personal billable work and the distribution of profits. I’ve recently met with my CPA for a tax planning session and we have agreed on several strategies that will substantially lower my taxes for 2019.

An S-Corp has many options available that enable you to reduce your taxable income (a topic I hope to dive into more in future posts). In addition to converting my business from a sole proprietorship to an S-Corp, we’ve also decided that we will operate on an accrual basis of accounting vs. cash basis. Doing this is allowing me to accrue the compensation related to billable work the company owes me personally, but not actually make the payment until 2020. This allows me to decrease the profits of the company, while at the same time deferring the income into 2020, thus deferring taxes. I don’t need the income right now and I really don’t need a larger tax bill. In addition to this, there are a number of ways that my personal life has become significantly more tax-efficient with a lot of expenses that my business can now cover. I’ll give one example of what I mean: A team member recently started working for my new company and lived with my wife and me for the month of September so that I could train him and we could work side by side. Since I provided lodging and a training facility, I can charge my business for that.

Talking with my CPA, he said I could reasonably charge $1,000/day to the business. However, we decided we would only charge the business for the first 14 days, in order to take advantage of another IRS tax law that says you can rent out your house (or a portion of it) for up to 14 days a year tax-free. This is just one strategy that will allow me to extract $14,000 in profits from the company tax-free.

I don’t plan to pay myself anything for the remainder of the year. Instead, I will accrue the expenses, and defer all the income into 2020. I can take the $14,000 I mentioned above out any time without creating a taxable event (I just have to book it and document it correctly). But I’m leaning towards deferring that and other reimbursements that we’ve identified until next year as well. This means there will potentially be $200,000 in income that I’m pushing into Q1 of 2020 – that will be a big quarter!

In the second chart above, I also track our income on a trailing twelve months. It failed to make a new all-time high in September. Due to the changes/strategies discussed above, I now don’t expect to hit another new all-time high until some time in Q1 of 2020 (I anticipate a TTM of $600K or more).

Savings Rate

Below is how we actually did towards our goal of saving 50% of our after-tax income. In the chart below, the green bars represent our actual savings rate for the month, the orange bars are what we anticipate based on our 2019 budget, and the blue bar is the projected savings rate for all of 2019.

We had a nice rebound in our savings rate to 40% for the month of September. You can see that our projected 2019 savings rate is currently under our 50% target. The driver here is the decision to defer income into 2020. But…I still have a few tricks up my sleeve and think we can still get to 50% by the end of the year.

Do you want to calculate your own savings rate? I’ve made it super easy for you with the savings rate calculator included in the free GYFG FI Toolkit that you can download instantly by clicking the link below. Here’s a peek. Did I mention it’s free? You have nothing to lose and everything to gain, Freedom Fighter! Remember, what gets measured gets managed.

Speaking of savings rate, go check out my post where I mathematically prove the importance of your savings rate as a higher priority in achieving financial independence than your compound return. If you’re trying to build wealth quickly, then you have to read this post.

Closing Thoughts

Is it bad to admit that I can’t wait for vacation? I’m overdue. The GYFG household is overdue. We have been grinding hard all year and now it’s time to enjoy the fruits of our labor. As I type this we are six days from our departure to Maui. While there, I plan to completely disconnect. This will allow for two things: (1) provide some much-needed R&R and (2) test the business to see if it can continue to operate and earn money while I’m absent from the helm.

That’s all for now. I’ll see you all on the other side of the vacation. Aloha!

– Gen Y Finance Guy

p.s. Personal Capital now offers a 1.8% high yield savings account that is FDIC insured.

6 Responses

Hi GYFG!

Thank you for sharing your financial advice and stories. I wanted to start investing in REITs for passive income as I save for FIRE, so I followed the Rich Uncles link in this post. I signed up for an account and the “Select an Investment” screen shows “Shares of NNN REIT are temporarily unavailable.” Do you ever run into this problem with Rich Uncles during your investing?

Hi Kristina – it’s because they are in the middle of an acquisition of another REIT. This is the first time this has happened since I started investing with them in 2015.

Dom

Awesome job! I continue to be amazed at what you’re able to pull off and I love reading your posts.

On another note, when you are running your company full time, take a look at http://www.guideline.com for your business 401k. The prices are dirt cheap, they have all Vanguard Admiral Share and DFA funds on the list (https://www.guideline.com/funds), and the reviews have been exceptional.

Thanks, Kevin!

Hey Kevin,

I just wanted to circle back and say thank you for the recommendation for Guideline. I’m in the process of setting up employee health benefits and a 401k and this was on my list to be sure to say thanks. I have a demo call set up with them this next week. So easy! And it integrates with Quickbooks, which is what I use to run the back office of my business.

Happy New Year!

Dom

Hey Dom,

That’s great to hear. You’re giving your employees (and yourself) one of the best 401k options available right now. I’m not sure who you’re using for payroll and health benefits, but one of the best in the industry, especially for smaller companies, is https://gusto.com/. They also partner and integrate with Guideline seamlessly. Just something else to keep in mind. I can’t wait to see what you accomplish in 2020.

Happy New Year!

Kevin