August was another crazy month and there doesn’t seem to be a slowdown coming in September in terms of the growth in my business – with the same true for Mrs. GYFG, who is in Real Estate. It has been challenging to manage the growth while also trying to be good (present) parents but we are trying our best. The Mrs. and I have done a decent job cutting it off on the weekends to be fully present with the little man. We are both looking forward to the beach house we rented for the month of November and we both plan to be completely unplugged for at least two weeks out of that month to get a much-needed break.

The silver lining is that we are making incredible progress towards our goals in this particular season of life. As long time readers know, the majority of our financial success has been driven by our ability to earn a high income that has grown substantially every year. In fact, our income since 2012 has grown by a compound annual growth rate of 30.6% (from $168,986 in 2012 to our current TTM of $1,306,284). In that same time, our net worth has compounded at 66.6% (from $42,424 to $2,127,140 – a 4,814% increase!).

A few years ago a reader (Jay Ceezy) asked if I would eventually move these reports from a monthly cadence to a quarterly cadence once the results started slowing down when income and net worth weren’t growing as fast. I answered at the time that I did think I would eventually move these reports to a quarterly cadence but here we are with my 68th consecutive monthly report. I’m not sure what the inflection point will be to switch the cadence but I can tell you now that we are not close to that point yet, not when our income and net worth are still growing as rapidly as they have for the past decade.

To put things in perspective, we currently anticipate our income to be up 65% and our net worth to be up 40% in 2020 vs. 2019.

Let’s dive into the details!

Financial Dashboard

Note: The income figure you see in the chart above for 2020 is our current projection for the year, which is different than our TTM income figure I shared above that clocked in at just over $1.3M this month.

Net Worth:

Current Net Worth: $2,127,140 (up $456,820 or +27.3% for 2020)

Previous month: $2,071,369

Difference: +$55,771

Note: I’m still not holding a value for my business in my net worth. Depending on the multiple you use, that could add anywhere from $300,000 (1X) to $1,400,000 (5X).

Net Worth Break Down:

Real Estate (75%) – This category includes the equity in our primary residence, a hard money loan at a 10% interest rate, our investment in the Rich Uncles commercial REIT, and our hard money loans through the PeerStreet platform. This also includes a 4% PIK loan that will be converted to an equity position in 2022. In recent months I shared that we had deployed money into an industrial real estate deal and this month we made an additional $100,000 investment into a commercial real estate fund focused on the Cannabis industry. We will be reducing our concentration in the real estate category in the near future once our $300,000 cash-out refinance closes in September. In the chart below you can see that our primary residence makes up the largest chunk (at 31% of the real estate category and 23% of total net worth), but that will substantially decrease by the time I publish the September report (Real Estate will make up ~60%).

Net Cash (13%) – We plan to see an increase of $300,000 in cash in September, which will boost this to a 30% allocation of net worth. That’s because, after being mortgage-free for 17 months, we have decided to put a mortgage back on our house with a cash-out refinance. This will help us reduce our concentration in the real estate category, while also taking advantage of the lowest mortgage rates in history. We were able to lock in 2.865% for a 30-year mortgage.

Alternatives (7%) – This is a new catch-all category that captures our investments in the following: life settlements, a special purpose acquisition company (SPAC), and a private investment in the Robinhood trading platform.

Stocks (5%) – We have not been deploying new capital into stocks, but I did recently open up an account with Betterment (something I’ll talk about in a future report when I start moving money there).

Total Projected Income in 2020: We are currently on pace to earn $1,226,121. Keep in mind that ~$415,000 of that is from a realized gain from selling the stock I owned in my previous employer.

Total Capital Deployed in 2020:

Last month I said I needed a breather but then a few investment opportunities came across my desk, one of which looked really good, so we allocated $100,000 to it in August. The fund is focused on commercial real estate in the Cannabis industry and is projected to remain open for new investment until February of 2021 or until the capital is fully committed. We may invest more into this fund between now and then. I’ve been very interested in gaining exposure to this industry and I like doing indirectly through Real Estate. I really like the sponsor’s approach and strategy. The fund is not using any leverage and is targeting a 10% cash yield and 15% IRR. The fund already has three seeded assets that are cash-flowing with several disbursements already made to investors. The sponsor is backed by a larger $1B fund that currently has a $15M investment and will not own less than 20%…always a positive to see skin in the game.

I made this investment through the Crowd Street platform. This is the first platform that I’ve invested in that required more than a questionnaire to certify our status as an accredited investor. I actually had to submit tax returns from the last two years and an attorney drafted up a letter confirming we were indeed accredited investors. A few years back I hosted a guest post from the folks at Crowd Street and noted that they would eventually be a platform I would make investments through.

If you’re interested in the deal I participated in it is the “Rainbow Realty Cannabis Fund” and once you sign up for an account on the platform you can see all the details about the investment.

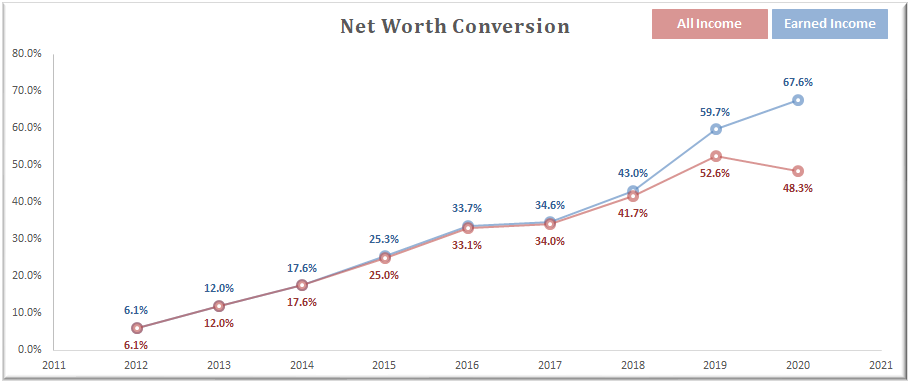

Net Worth Conversion Ratio

Definition: The Net Worth Conversion Ratio measures an earner’s ability to convert earned income into wealth (net worth). It excludes passive income since passive income is dependent on the earner’s decision of putting earned income to work or spending on consumption.

This is a new metric I will be updating and sharing monthly. Now that “the machine” is in full production, it is time to not only bring back the net worth conversion metric but to make it a star of the show. I once wrote that financial nirvana is reached once this metric exceeds 100%. When I first calculated this back in early 2016 the GYFG ratio clocked in at 25.3%. Since then we have significantly increased our savings rate and the gravitational pull of increasing both our savings rate and income helped us significantly improve the performance of this metric, which now clocks in at 67.6% (up from 65.8% last month).

You will notice that I have shared the metric based on ‘earned income’ and ‘all income’ but I’m most interested in the earned income calculation (per the definition above).

The goal the past five years since adopting this metric was to focus on increasing our earned income while simultaneously saving at least 50% of our after-tax income in order to create excess capital for investing. I should note that I’ve excluded from the earned income calculation any income that’s derived passively from investments and more recently profit distributions from my business (I do include the W-2 income I earn as an employee of the business).

The end goal is to get to a point where net worth is 100% or greater than earned income – bonus points if you can accomplish the same thing based on all income sources. I expect our net worth conversion to finish the year somewhere between 70% and 75%.

An Update on My Business

There is so much I want to share about the business but so little time in my schedule to do it right now. That said, I wanted to take a moment to at least share the performance of the business since it is such a large contributor to our net worth growth this year (and hopefully for many years to come).

It’s interesting to see the dip in October through December of last year where we intentionally took our foot off the gas pedal in order to enjoy the holidays, something I’m looking forward to doing again this year, only this time I have more resources doing the work so the drop shouldn’t be dramatic. Actually, if you look at the above I’m currently forecasting a peak in September with a slight fall off from the all-time-high I’m projecting in September.

Some Quick Details

- At the end of August, we had five full-time team members. However, I had to let one go in September as it wasn’t working out. (September 1st will go down as one of the hardest days of my life)

- We are currently on track to deliver $1,472,718 in revenue for 2020, which is ~47% ahead of the $1,000,000 target we set out to achieve this year (3.5X what we did in 2019).

- Our pipeline is worth about $2,000,000 in terms of prospects we are pursuing in various stages of the sales cycle. Probability weighted this is $827,057. If you do the math you can see that I’m using a 40% win rate, which is much lower than the 80% we have actually experienced to date. My thought process is that this is either extremely conservative or as we get bigger the probability will go down…only time will tell.

- Our contracted backlog (deals we’ve already won) is $1,618,715, which takes us through April of 2022.

- We launched a new website in early August.

- We now have three strategic partnerships with other consulting shops that do what we do, which gives us access to an additional ten flex resources.

- We are officially an international business after winning our first international deal in Singapore (we are using our partner in Ukraine to perform most of the implementation work).

- We currently have two very strategic resources in our recruiting pipeline. They would be plug-and-play resources because both have not only used the product we implement as a client but they also have depth of experience in Finance & Accounting.

- Our profitability continues to be robust at ~40% pre-tax profit margins. We are structured as an S-Corp so the taxes “pass through” to the owners’ personal returns based on their pro-rata share of the earnings.

The growth and performance of the business continues to exceed my expectations. I’m very transparent with my team and they have come to realize that I am always conservative when forecasting the future performance of the business and they appreciate that for several reasons:

(1) It’s very common in Corporate America to be stuck with unrealistic goals, which makes celebration rare. Instead, I like to set achievable goals that have room for upside. I believe this creates a culture and attitude of winning. And winning begets more winning.

(2) As we grow, everyone benefits. Some are already owners in the business and others are working towards hitting their targets to become owners in the business. This means that as the business does well, they are or will be participating in a larger and larger profit distribution pool.

(3) More celebrations! I’ve made a commitment to the team that my goal is to have 2-4 company retreats a year. We had our first ever company retreat in June of this year to celebrate our first cumulative million in revenue. We are now planning a winter retreat to celebrate our second million in revenue which will happen sometime in Q1 of 2021.

Closing Thoughts

I really wish I had more time to write but at the same time, I accept that during this season in life that other areas require more of my attention. The good news is that I’ve got a growing list of topics I want to write about when I’m able to allocate more time to writing.

I didn’t mention it anywhere above but we have already begun on some of the improvement projects for the new house we will be moving into come January 2022. I know it is 16 months away but it will be here so fast. Who knows, we may decide to occupy the property earlier. We are currently under contract to get solar installed on the new property as well as a complete replacement of the entire AC system (which is original and 30+ years old). Mrs. GYFG has also been busy gathering design ideas for the upcoming kitchen remodel, pool remodel, and outdoor kitchen we plan to build.

The only other thing taking mental bandwidth is 2020 tax planning. Now that my return for 2019 was filed back in July and we received our unexpected refund, I have now turned my attention to 2020. I’m working very closely with my CPA to ensure we do everything available to pay the legal minimum in taxes.

I hope you enjoy the last couple weeks of summer.

Onward & Upward!

– Gen Y Finance Guy

9 Responses

Wow, what an incredible journey. I hadn’t visited your site in a year or so, so it’s amazing to see the snapshot one year at a time. Keep it up!

Hey Simon – long time!

Yes, the trajectory of our financial journey continues to amaze me!

I hope you’re doing well.

How is the Peer to Peer lending space? I’ve just about pulled out all of my funds between Lending Club and Prosper as I’ve found better returns and uses of capital. Curious to get your perspective.

Dom

Hi Dom. The p2p lending space is a bit dead. The glory days of stock market like returns are probably done forever so most people have moved on. The low return period of 2016 is probably over and returns have probably settled for the foreseeable future at 6-7%. Not bad, but most people including myself just aren’t excited about it anymore (this could change though if some new form of online lending with higher rates comes out; your real estate lending looks interesting). I will be launching a Christian theology site sometime in 2021-22, so that’s where my focus is right now.

Cheers

I’m enjoying reading about all these developments in your business Dom! Congratulations! I think you’re wise to celebrate meeting goals and rewarding employees with retreats and equity. You’ll build a devoted, happy and loyal workforce. And you will all enjoy the journey together. So many people forget that last part.

Hi Heather,

Thank you so much! I’m glad you find my business updates interesting. I do think that a fair amount of my writing in the future will be about the business. I totally agree with you on using rewards like retreats and equity to build happy and loyal team members. The cherry on top for me is that I’m building a company with all my smart friends.

If you ever see me forgetting to celebrate…please call me out!!!

Dom

GYFG, you are really in the sweet-spot when the deals start coming to you! It is great to read about your success and progress and decision process. But it will also be fun to read about your opportunity to take some deep breaths and recharge, with your upcoming retreat. Speaking of which, you mentioned gifting ‘The Wealthy Gardener’ to your colleagues; maybe you will have a chance to get some of their takeaways from that book. I did get a chance to read it, along with another GYFG recommendation, “Born to Win’ by Zig and Tom Ziglar. Here are my thoughts…

The Wealthy Gardener – This is a nice combination of parable, autobiography, and life-lessons and would make an excellent stocking stuffer this Christmas.:-) My takeaway was Dead Time versus Alive Time. I recently came upon this idea by recently reading Aubrey Marcus’s ‘ ‘Own The Day’ and he credited Robert Greene (48 Laws of Power) with the concept. My biggest ‘snicker’ moment was the example of a winery as a profitable business (rather than a long-term real estate investment play). Those of you who live in wine country, just ask an owner next time you go tasting when the quarantine is over. Soforic has really taken to this new Personal Finance personality lifestyle. He does YouTube, podcasts, and has another book coming out August 2021, ‘Wealth Essentials’. My summary of this new book would be: “First, become a chiropractor in a coal-mining town, then pay off student debt, then buy real estate, then live off the $240,000 passive-income, and then side-gig as a best-selling author and speaker.” I’m probably not the right audience for this book now, but really would have been as a much younger man. I appreciate the stories of student/mentor/teacher/benefactor relationships, we all have somebodies to thank!

Born To Win – I did like this short book, and have spent time with Zig Ziglar’s books and podcasts, some years back. I am actually familiar with his son Tom, who is really the author of this book with some unfinished material for publication along with some old Zig chestnuts thrown in. If you can find it, Tom is a pretty great speaker himself, now the CEO of Ziglar. He opens his presentation to audiences who mainly knew his father but don’t know him. So he comes out in a rumpled sloppy suit and starts talking. He takes off his coat. His tie. His shirt. His pants. And underneath, he has another layer of suit-and-clothes. He takes them off piece-by-piece. And keeps going for many minutes. His point is these are his old clothes, before he lost 80 lbs. Point made! ” You gotta Be before you can Do, and you gotta Do before you can Have. The Be part starts with what you put into your mind. I also like the point doubters make, “the motivational inspiration wears off.” And the point the Ziglars make, that you shower every day and eat several times a day, too! So this book is helpful in maintaining my ‘motivational hygiene.’

Up-and-to-the-right! Thanks for the recommendations, GYFG!

Hey JayCeezy,

I’m glad you enjoyed the two book recommendations. I don’t think anyone on my team has read the book yet but I do know that several have finished reading a few other in the bunch: The Slight Edge & Tribe of Millionaires. I asked everyone to try and read them by the time we have our holiday party at the end of the year. It will be interesting to see what the feedback is.

I didn’t realize that John (The Wealthy Gardener) was working on a second book. I did recommend The Slight Edge to him and he wrote back letting me know that he loved that book and that he was going to track down John Olsson the author.

Take care!

Dom

Hi Gen Y ,

I have been a long time lurker. I love your updates and I eagerly wait for them.

Questions I have for you.

1. I wanted to invest more in real estate, What would be the one website you would blindly recommend?

2. Are you planning to retire after hitting 10 mil? If yes do you think you lifestyle will be sustainable on that?

3. Any other investment ideas that you are actively chewing?

Thanks,

Stan

Hey Stan,

Thanks for following along. When I started this blog six years ago, someone told me that even if people weren’t commenting they were reading and eventually they will fill compelled to reach out. I’m happy that day has come as I love connecting with my readers.

See my replies to your questions below:

1. I wanted to invest more in real estate, What would be the one website you would blindly recommend? Blindly? That is a tall order as every investment still requires due-dilligence and needs to fit your own investment goals and risk profile. The real estate investment site that I’m most fascinated with currently is Crowd Street (I recently invested $100,000 in the Rainbow Reality Cannabis Fund).

2. Are you planning to retire after hitting 10 mil? If yes do you think your lifestyle will be sustainable on that? I don’t currently have a goal to retire early, at least not in the traditional sense. That said, I believe I have or will have reached my peak hustling now or sometime in the next 12 months. My plan is to work less and live more…but work in some form or fashion will always be a part of my life…I need the stimulation, just not the long hours (20 hours a week would be perfect with the ability to take long stretches of time off when desired). I do think that at $10M, whether I were to retire or not, would be enough to support my families lifestyle. My goal is to produce about $500,000 to $600,000 per year in income and never touch the principal (based on our current burn rate, we should still actually be able to keep building additional wealth beyond $10M).

3. Any other investment ideas that you are actively chewing? I’m really focused on 2020 tax planning (minimization right now) and preparing for a much-needed vacation in November. Therefore, I’m not actively looking at any investments at the moment…really just trying to close up loose ends during October.

Cheers,

Dom