Bam!

That is the best word I can use to describe January. It started with a Boom! had a few a Bangs! and ended with a Bam!

What does that even mean? It means there were a lot of good things that happened while under incredible overwhelm during certain points in the month. Many of you know that I took a nice long break in November, but what many of you don’t know is the grueling schedule I started on December 1st and maintained for about eight weeks. I went from enjoying the beach and working only a few hours a day in November to working like a full-blown maniac. I was waking up between 3 am and 4 am seven days a week working around the clock (putting in as much as 16 hours a day). Some of this was because of the limited schedule I worked in November and most of it was me pretending to be Atlas and taking on the weight of the world as my business continued its high growth trajectory. That can be crushing when you try to take it on solo.

The good news is that I was not only able to make it through a very demanding time, but I had enough self-awareness to realize that it was time to start shedding responsibilities. My company had hit an important inflection point where I had to decide to either be the bottleneck to its evolution (and likely a miserable founder due to crazy long hours resulting from trying to be Superman), or the conduit to leveling up. I chose the latter and in the fog of chaos put a plan in place to delegate at least 80 hours a month to my very capable team (I’ll shed more light on this in the Business Spotlight section below).

To say the least, it was an incredible month of growth! Financially. Professionally. Personally – speaking of growth, I found out we are expecting GYFG Baby #2 (Bam!).

Let’s dive into the details of this month’s update!

Financial Dashboard

I remember when I first created this financial dashboard back in 2015 and how that first update I shared had us at less than 2% of the way to our $10M goal. Here we are, six years later, at 26.1% of the way there. The most astonishing thing to me is the compound annual growth rate (CAGR) we have been able to maintain since 2012. Our income has grown at a robust 30.5% CAGR. Even more mind-blowing is that our net worth has been compounding at a 66.5% CAGR during that same time period.

Note: My current projection for GYFG household income in 2021 is less than 2020, but it has come up from last month’s projection of $1,062,000 (currently projected at $1,175,441). My goal is to surpass our 2020 income and personally, I have set a goal to earn seven figures from my business through my W-2 earnings and profit distributions. When I reach this goal I will reward myself with the funds for an electric car – maybe a Tesla or maybe the new GM electric Hummer.

TTM Gross Income

The income figure I like to track most is our Trailing Twelve Month (TTM) gross income. We have had a very good run since 2015 but recently hit a peak in September 2020 that I thought would be challenging to exceed in the short term. We have a pretty large cliff coming up in February, which will be the last month that the $415,000 gain I realized from selling the shares I owned in my previous employer will remain in the TTM range. Our income was strong in January – so strong that it pushed us to a new all-time high of $1,456,178 (Bam!).

Net Worth

Current Net Worth: $2,614,367 (up $234,926 or +9.9% for 2021)

Previous month: $2,379,441

Difference: +$234,926 (Bam!)

As we work our way through the Five Major Milestones of Financial Independence, we have our sights set on reaching level five. Although $10M is THE number the GYFG is working towards, that is our Financial Freedom number, which is the bonus sixth step in the Five Major Milestones I laid out in 2018. Our financial independence number is $3,000,000 paired with annual spending of $120,000 per year. Although I backed into the $3M number via the 4% rule by multiplying our desired annual spending by 25, there are a few additional clarifications needed that I failed to include in the original post:

(1) Our goal is for the $120,000 per year to be generated from our net worth without ever needing to spend any of the $3M. So, this is not the traditional 4% rule, but just used to get a target number.

(2) You have to use common sense on whether the $3M includes the value of your primary residence or not. We (the GYFG household) believe that we can obtain both a $3M net worth including our primary residence and generate $120,000 per year in passive income all in the same bucket. We only need to earn 6% on $2M, leaving $1M to be tied up in our primary residence (example to illustrate why). Actually, based on this metric, we have already surpassed this figure! (See passive income section below.)

In the below chart you will see that we ended 2020 at the orange chart label and that our goal is to finish 2021 at or above the black chart label.

Note: I’m still not holding a value for my business in my net worth. Depending on the multiple you use, the value of my business is somewhere in the range of $700,000 (1X) to $3,500,000 (5X). I’m hesitant to hold a value in my net worth for this until we achieve a liquidity event.

Net Worth Break Down:

Real Estate (55%) – This category no longer includes the equity in our primary residence. This is a mixture of private placement deals, equity, debt, and crowdfunding.

Primary Residence (12%) – I decided to split this out on its own because it is something I do want to manage separately from our overall holdings in Real Estate. Our primary residence currently makes up 12% of our total net worth (down from 23% in September 2020) due to a cash-out refinance (locking in 2.8675% for 30 years) that put a mortgage back on the property. I expect the concentration to continue its downward trend until we move into our new house in October of 2021.

Net Cash (22%) – We currently have $571,000 in cash vs. $408,000 last month.

Alternatives (6%) – This is a catch-all category that captures our investments in the following: life settlements, a special purpose acquisition company (SPAC), and a private investment in the Robinhood trading platform.

Stocks (5%) – We have $1,000 that is being invested weekly with Betterment and with the new year we are also able to contribute to our 401k accounts again.

Total Capital Deployed in 2020:

I had said last month that I was going to take a break from deploying capital until April of this year and I tried really hard but then a real estate deal in the hospitality space (of all spaces) came across my desk and I couldn’t help myself. I know you’re probably thinking I’m crazy for getting into the hospitality space and six months ago I would have agreed with you but people will eventually start traveling again and until then there will be some distressed opportunities to take advantage of. This particular hotel was originally marketed in 2019 for $205M and the sponsor had already negotiated a nice discount prior to the original expected close in March 2020…and then the pandemic hit. The sponsor is now acquiring the hotel for $157M and has since secured much better financing rates on the debt side of this transaction.

We will continue contributing $4,000 to $5,000 per month into our Betterment account via weekly investment. We will also be maxing out our 401k accounts within the first six months of the year. I will continue to focus on getting through tax season and building up our cash balance, but I have already expressed interest in participating in another real estate transaction as well as a deal in the consumer goods space (more to come if I do participate). I need to balance the uses of our cash for three main areas:

(1) Our Emergency Fund, which I like to have 1-2 years’ worth of living expenses.

(2) Our Remodel Fund, which we are paying for out of pocket and expect to spend $100,000 to $200,000 on this year.

(3) Our Investment Fund, to make sure we continue to deploy capital to work hard for us.

Business Spotlight – What Got You Here Won’t Get You There!

I’ve laid the groundwork for something pretty incredible when it relates to the business I’m building. However, we have hit an inflection point that I’ve been preparing for that will require a very different approach if we are to keep growing and eventually hit my very lofty ambitions for this company. If there is one thing I’ve learned over the years, it’s that “what got you here won’t get you there.” I once heard this from the president of my former employer’s company and it has always stayed with me. I’ve witnessed this countless times in my own personal and professional life. It’s difficult to continue growing if you’re not continuously learning and evolving. This is as true for a company as it is for an individual.

I have been very intentional from day one to build a business and not just a higher paying job. There are a lot of entrepreneurs out there that fall into this trap. They think they own a business but then realize that they actually just own a job (I once heard someone say on a podcast that “entrepreneurship is the only time someone willingly gives up a 40-hour workweek for an 80-hour workweek and many times for less pay to start”). I’m not passing judgment because I still have not yet been able to fully transition from working in my business to working on my business (read the E-Myth by Michael Gerber for further context). It’s not a business until you can step away for a month or several months and find that when you come back everything is the same if not better than when you left it. This transition requires systems, procedures, and talented people employed by the business.

This early realization is why I decided early on to carve out 40% of the equity (ownership) to bring on partners, not employees. We’ve been in business for almost two years now and in that time I have identified four partners and successfully onboarded them all as full-time employees with a stake in the outcome. I could have taken a slower route to growth and maintained more equity, but I’m not a very patient person. I was also lucky to partner with some of my smartest and most talented friends. It’s not every day you get to build a company with the same people you love spending time with. The focus over the last two years has been to build a solid consulting practice. During this time I have remained billable (120 hours per month on average for most of 2020) while also attending to all the other areas of the business: recruiting, sales, accounting, payroll, and all the other admin activities.

Right or wrong, I felt the need to shoulder the burden of everything outside of billable work, keeping it away from the partners I’ve brought on to help me build this business. Maybe I should have delegated earlier. Maybe I should have hired more help earlier. As my grandfather used to say “Shoulda, coulda, woulda…if ifs and buts were candies and nuts, we’d all have a Merry Christmas, right?” The point is that hindsight is always 20/20 and I had a vision of where I needed to get the company before recruiting help. I also wanted to ensure that my partners were able to have a controlled and manageable onboarding to help ensure the success of the consulting side of the business, which is software implementation.

I’m happy to say that I’ve officially cried for help and my partners were happy and eager to jump in. Until this month I had let my role compound for 22 months without ever offloading anything from my plate. I had luckily hit my breaking point at the same time my company hit its breakout point. I drafted a memo to my partners explaining the situation and the help I needed from them. In that memo, I also outlined all of the things I needed to offload from my plate effective immediately. At the end of the memo (sent in mid-January), I laid out an agenda for what would become the first of a monthly recurring management meeting. It was time for me to let go and trust the very talented and capable partners (and friends) that had joined me in this incredible journey.

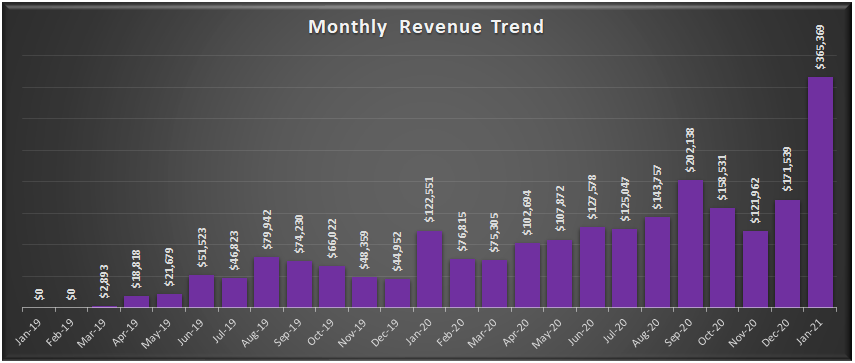

The future looks really exciting as I shift my focus to building out the sales and marketing functions of the business, which is currently the highest and best use of my time. Below is a simple column chart that shows the revenue trend since inception with me allocating just a portion of my time to sales. I’m excited to imagine what is possible with the majority of my time being allocated to sales. I won’t be doing this alone – part of the reason I hired a business coach is to help guide me in this evolution, but to also help me build the team and the system I need to eventually remove myself from the business altogether.

Bam!

Podcasts Dominating my Airwaves

I listen to podcasts every morning when I walk my dogs at 5 am. I have about 50 minutes and I try to learn and absorb as much as I can by listening to podcasts on 2X speed. Below I will list the podcast, the snippet from Apple about the podcast, and then any comments I have personally in [brackets]. This is not a comprehensive list of podcasts I listen to but is instead focused on the ones I’ve been obsessively listening to the past few months.

– The Grant Williams Podcast: Join Grant Williams and his guests for a series of random walks around the fringes of finance and gain a better understanding of how the economic sands are shifting beneath our feet. [If you want to listen to conversations that will teach you a ton about the financial markets and question what you really know or understand, this is a show for you. I don’t know that I would say it is hosted by perma-bears, but it does shed light on a lot of the risks and potential paths on the horizon.]

– Invest Like The Best: Exploring the ideas, methods, and stories of people that will help you better invest your time and money. [I’ve been listening to this podcast for years now. Patrick O’Shaughnessy is around my age but has wisdom beyond his age. He also interviews some of the most interesting investors and founds on his show.]

– Panic with Friends: On this podcast, you will hear interviews with great entrepreneurs, investors, venture capitalists, traders, and friends about their companies, their track records, and their new fave ideas and trends. This includes best ideas, worst investments, biggest failure, daily habits, and recommended reading. [I’ve been following Howard Lindzon for years now. I was first exposed to him when Stocktwits exploded as the social network for the finance world. I haven’t been active on Stocktwits for years, but I’ve always enjoyed Howard’s writing and conversations. I think he is hilarious. I actually met him a long time ago at a conference and he is a super nice guy.]

– Founder Real Talk: From GGV, this is Founder Real Talk, where we get real about the challenges that founders and startup executives face, and how they’ve grown from tough experiences. [I binged on the entire library of interviews between December and January. I love listening to these interviews and I learn so much. Being a founder myself I’m constantly trying to learn from others who have gone before me.]

Passive Income

I have been aggressively deploying capital into cash-flowing assets over the last twelve months and I’m amazed at where we are as of today in terms of the projected passive income streams we’ve generated based on the deployments listed below. Of the $1.1M, all but about $200K has been deployed in the last 12 months. A lot of this was possible due to three major buckets in 2020:

(1) Gaining liquidity from the stock I held in my previous employer ($500K).

(2) The decision to put a mortgage back on our primary residence ($300K).

(3) The massive cash being generated and distributed from my business ($600K).

The above table is only inclusive of the cash flowing assets contained in our net worth as I write this. The other $1.5M in net worth is tied up in other assets that do not currently produce a spendable cash flow. I don’t include the distributions from my business, because they are not all that passive at the moment, but they are robust and help fuel the fire with respect to our pursuit of passive income.

You’ll notice that I’ve broken the income streams into after-tax vs. pre-tax to keep tabs on what is readily available for spending now vs. in the future.

Closing Thoughts

Although January was a challenging and exhausting month, it was one that was filled with so much growth, good news, and progress. I’m looking forward to a more manageable schedule in the coming months with all the changes set in motion during January. As I free up more white space on my calendar I’ll be planning my final ascent to self-actualization as outlined in the letter I wrote to myself almost ten years ago and the vision I set for the next ten years more recently. For me, the ultimate goal has been to become a full-time investor and wealth manager of the GYFG household. The intended evolution has always been to go from employee to C-Suite executive, from C-Suite Executive to Entrepreneur, and finally from Entrepreneur to full-time investor.

Mrs. GYFG and I have willingly lived well below our means and put in the long hours to obtain a level of wealth and more importantly the optionality that comes with that wealth to live life on our terms. Make no mistake, there is always an opportunity cost to every decision we make. There were times we second-guessed our decisions. There were times we wondered if the juice would be worth the squeeze. When you are head-down grinding it out day in and day out and watching friends and colleagues having more fun, you wonder if you’ve made the right decisions. At the end of the day, we both know that the price we have paid the past decade will pay dividends so great that we will ultimately get to live the life of our dreams.

Our path is uniquely ours and represents one of an infinite number of permutations. We could have taken the slow lane but we decided the fast lane was better suited to our goals and desired lifestyle. This year truly feels like an inflection point for me and my family. We will be moving into our dream house later this year, which we expect to be the home base in which we raise our kids for the next two decades. We can’t believe that our son will be three years old as we welcome GYFG baby #2 later this year. I’m excited to see how we evolve as parents this year and in the years to come.

Mrs. GYFG and I have also realized and admitted that work will always be an important piece of our lives and we think it will be important to model our work ethic to our kids. That said, we need to find the balance between excelling in our professional lives and crushing parenthood by being a present and involved mom and dad. The most important thing you can give your kids is time and attention – that’s all they want from you!

Onward & Upward!

– Gen Y Finance Guy

15 Responses

Fantastic. Great meme, too! Recently learned some details about Emeril Lagasse’s emergence into popular culture, and “Supermensch” Shep Gordon is responsible (or the one to blame!). I’m a fan of both, if you are ever looking for a fun-and-interesting documentary about a business-mind, “Supermensch: The Legend of Shep Gordon” (85 min.) is awesome. As an example of doing business right, Gordon has managed Alice Cooper for more than 50 years on a handshake. And they live next door to each other on beachfront eight-figure homes in Hawaii. Win-win. Just like you and your partners. Loving the podcast summaries, thank you!

But back to you! So happy for the GYFG family news, will watch for updates. Have you ever heard of the Holmes and Rahe Stress Test? It measures 43 ‘life events’ with assigned values. Between your business, family, planned change of residence, and financial progress, you are racking up points. This is a great thing of course, and the test is interesting to help awareness and stress-management. Easy to find-and-take online. Appreciate your self-awareness to offload some professional duties, some high-speed entrepreneurs have a hard time letting go of control, so you have graduated past that phase. Thanks for the updates, continued success to you!

“It was my pork chop. But that’s okay, I ate his dog food.” – Bam Bam Bigelow

Hey JayCeezy,

Thanks for the recommendations, I will check out that documentary and the Rahe Stress Test.

All the best!

Dom

Outstanding. I have been following almost from the start and it is amazing what you have achieved.

Thanks, Troy!

Do you remember how you originally found my blog? Also, what keeps you coming back? (Always interested to here what brings people back)

Someone mentioned Mr Money Mustache to me and I found his blog and read all his back articles over a few days and it really clicked for me. I then searched for other bloggers and found “Budgets are Sexy” with the net worth list. When I saw your blog I was impressed by the higher financial target than most bloggers were going for and I was hooked.

All these blogs were instrumental in me FIREing about 18 months ago at 52 years old.

Congratulations!

And thank you for describing your path to GYFG.

impressive start to the new year GYFG!

What’s the Clint Mass investment and does it distribute 25% in annual cash each year or is that over the term?

Are you putting the tax-deferred investments into 401k or a different tax structure?

all the best for 2021

Thanks, Charlie.

The Clinton Mass investment is an industrial real estate deal that is supposed to pay out 25% per year. It was a fire sell from a Fortune 500 company that acquired the real estate due to an acquisition of the company that used to inhabit the property.

The tax-deferred assets are held in a self-directed IRA.

Congrats, Dom!

You’ve officially pulled away past me! But, hey, I gave away $90k last year… haha. 😉

Don’t count out the slow guy though!

Seriously though, I’m glad to see your continued success. It’s a testament to your diligent planning, action, and persistence. We’re just seeing the results of that momentum you’ve built.

Anyhow, I’ll ping you later this week. I’d love to get you back on the podcast soon now that things are slowing down a touch for ya.

Cheers!

Being up an extra $234K is something that I hope to achieve in two years yet you achieve it in a month. Very inspirational, Dom.

I can’t imagine getting to a $1.4MM TTM income. I wouldn’t really know what to do with that much money. But who knows, if I actually get to that income level, maybe I’ll figure out a way to spend more than $20,000 a year, ha.

Hey David,

It blows my mind writing about that kind of increase. Sometimes I feel like I’m sharing the story of some personal finance character I created.

Wow, are you saying you live in less than $20,000 per year? What part of the country do you live? Are you single or do you have a family?

That is harder for me to imagine than finding a way to double my current TTM income. It’s probably because my household spending is minimum $120,000 per year.

Dom

I usually lived on ~$25,000 a year but the coronavirus pandemic made it impossible for me to spend more money. Now I live on closer to $20,000 a year which I’m so tired of because I wanna go on out of town trips, eat at restaurants, and do all of the normal stuff.

I live in Texas so the cost of living is peanuts compared to living in California. When the pandemic is over, I’ll more than likely spend closer to $30,000 a year, the pent-up demand has been real.

David – I’m so curious…can you provide a breakdown of a typical year of $25,000 and what you spend on? I’m assuming your housing is paid for so that lowers your cost of living substantially. I would also assume that you drive a paid-for car.

Hmm.. is that worth a guest post to do over? 😉

In seriousness, it does include my housing but excludes cars because it’s paid off.

It goes something like: food – $200 / month

Car insurance – $60 / month

Phone bill – $40/month

Internet – $35/month

Gas for car – $20/month (maybe)? Probably closer to $10 a month

Fun – $500 / month

Rent / Utilities – $1,125 / month

Would have been my typical budget.

My fun budget probably lowered to like $100/month because of the pandemic. Friends also don’t like to go out and would rather do free stuff like go to the park, play board games, watch movies in house, etc.

Hope this helps, Dom.

Dom!

Congrats on the big money and Baby #2! You’re killing it!

I expect that you’ll fly past me in net worth before the decade is up and maybe before 2025. When you do, please wave and don’t forget about the little guys like me! I’ll be the guy in the blue Tesla!

🙂