Every couple of years I like to go back and revisit some posts that reflected a point in time to see how far things have come. I wrote the below guest post as a part of the Millionaire Interview series for the ESI blog. It’s only been three years but boy…how so much has changed. I will be adding annotations with comments from the present day. BTW, I’m always blown away by what can happen over just a couple of years with intentional effort and decision-making. One final not is that the updates below were as of March 2023 and I will have a complete three year update being published in the ESI blog in the near future with a more detailed update.

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

My wife and I are both 33 years old and have been married for eight years and some change (together for almost 15 years, which doesn’t seem possible).

[GYFG Present Day: my wife and I are going to turn 37 later this year and yet we still feel much younger, which is a good thing. The scary part of that is that we recently realized that 50 is only 13 years away…that doesn’t even seem possible. It still feels like it is so far away but when you put it in the context of years it feels far too close for comfort.]

Do you have kids/family (if so, how old are they)?

Yes, we have a 19-month-old human child, an Australian Shepherd Husky Mix, and a Black Lab Shepherd Mix – we do consider our dogs part of the family.

[GYFG Present Day: Our son is going to be five this year and apparently we didn’t get the memo about social distancing during the pandemic because we ended up welcoming our daughter to the world in August of 2021. She turned two this year.]

What area of the country do you live in (and urban or rural)?

We live in Suburban Southern California. Even though the state income taxes are high, it’s hard to imagine us living anywhere else (although I have done the analysis from a pure economic standpoint and we could save a boatload of cash if we moved to a state with no income tax). I see us happily paying the “sun tax” for the indefinite future.

[GYFG Present Day: We still live in sunny SoCal but have since migrated to wine country as we settle into our dream house. We actually put down the initial 25% down payment in March of 2020, right before the pandemic lockdowns began. This was accidental opportunistic timing as we locked in a price that proceeded to double only a year later. We didn’t officially move in until late December of 2021. We are now on 5 acres and in the process of transforming our property into a resort that we never have to check out of.]

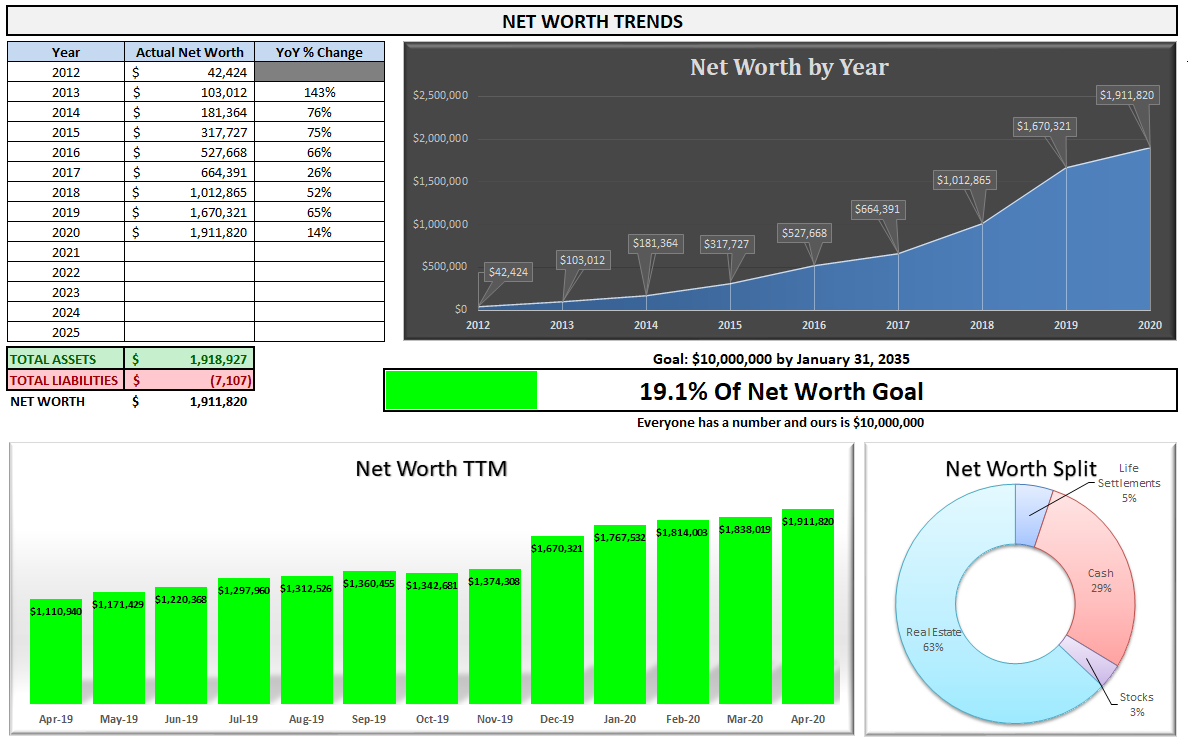

What is your current net worth?

As I type this (May 18th, 2020), our net worth currently clocks in at $1,911,820. The oil tycoon J. Paul Getty once said: “If you can actually count your money, then you’re not a rich man.” We certainly don’t feel rich. I think a big part of that is that our “number” is about 5X our current net worth ($10M) and we also live a much smaller lifestyle than our income can support. We may not feel rich but we certainly don’t feel vulnerable and are definitively in a position of strength – as I will get into below.

[GYFG Present Day: reflecting back on this snapshot makes me realize that our net worth was likely underreported because we hadn’t been holding any value for the business that I had started 17 months earlier. I have since sold 100% of that business and our net worth has ballooned to over $10M – exceeding our goal in seven years vs the twenty years allotted. WE STILL DON’T FEEL RICH!]

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

Business – $0 (0%)

Stocks – $64,543 (3%)

Life Settlements – $98,329 (4%)

Cash – $545,515 (29%)

– CD’s $6,000

– Brokerage Accounts $227,515

– High Yield Savings $200,154

– Checking $111,846

Real Estate – $1,203,431 (63%)

– Commercial Real Estate REIT $100,497

– Hard Money Lending $252,754

– Primary Residence $463,896

– Mortgage Note $386,283

We have almost zero liabilities as we prioritize freedom from the shackles of debt – the only debt we do have is our monthly credit card balance, which is paid in full every month. I know that some might say that ours is not the most financially optimized position, but I optimize for peace of mind rather than the highest possible rate of return. I like to sleep soundly at night and if that means my returns aren’t going to get juiced a few hundred basis points, then so be it; I’ll make it up on the income side of the equation. We paid our mortgage off in May 2019 at the age of 32 and I can tell you it felt good making that last payment! It’s a lot easier to live life on your own terms when you don’t have debt obligations to service.

As you analyze the above asset allocation, you’re probably thinking this is one risk-averse dude. And I’ll be the first to admit that I don’t like losing money. But I also tend to build up large piles of cash before making large deployments. A month ago, our cash position was even higher due to a liquidity event I experienced upon exiting an investment in my private employer, which was private equity-backed. I was actually leveraged 3:1 on that position and it paid off very well. I ended up turning $105,000 into $537,000 in just over three years.

Does it seem odd that I listed Business as a category but it’s empty??? Well, that is because I started a business last year, and have not yet included anything in my net worth for its value. Initially, this was because the business was so new. Although the business has now been generating revenue and profit for a little over a year, I’ve still remained conservative on not holding a value for it. I do have a goal of eventually selling the business. Based on my experience in the M&A activity I’ve been involved with, I would estimate its value by taking 1-5X TTM profits. As of April 30, 2020, the TTM profit was $349,868, indicating a value range of $349,868 to $1,749,340. The business value is currently compounding at a very rapid rate. We expect growth of 300% in 2020 vs. 2019. So, our net worth could be almost double what I’m reporting, but until I’ve sold I continue to remain conservative.

[GYFG Present Day: You can review the last financial update I published to see where we stand vs. what was previously shared here.]

Over the years I’ve developed a philosophy of viewing investments with a risk-mitigation lens first. When evaluating investments I’m much more concerned with the return of capital rather than return on capital. I like a healthy margin of safety when entering investments. Our stock allocation is much lower than I imagine it will be over time but that’s because the market just doesn’t make sense to us right now, in light of the pandemic damage to the economy already occurred, and still anticipated. We believe there are going to be “once in a lifetime” opportunities in the months ahead as we start processing the real damage of COVID-19. In the meantime, we sit on our hands and continue stuffing the war chest with cash!

We will continue to focus our attention on the income side of the equation, which has been the real engine in the growth of our net worth. I first started publicly tracking our net worth in 2015, where we started with a net worth of $181,364. In the last five years, we have increased our net worth by $1,730,456, which represents a compound annual growth rate of 55.5%. Just a few years ago I participated in the ESI scale interview when my net worth was $806,918 (I was ESI Scale Interview #33).

EARN

What is your job? (type of work and level)

I’m the CEO of my own company. This is a fairly new role for me. Previously I occupied a C-Suite role prior to going off on my own. My company is a software implementation and management consultancy. We implement specialty finance and accounting software. My background is in Finance but I’m a bit more technically savvy than the average finance person.

[GYFG Present Day: Since selling my business, I’m now a partner in the firm that bought my company.]

What is your annual income?

This is a hard question to answer because my income has been growing so fast over the last five years. Last year as a household we grossed $750,000 and this year we expect to gross about $1,000,000. Below is a chart that I update as a part of my monthly financial review process and it represents our trailing twelve month (TTM) income. Based on our projections for the 2020 calendar year, you will notice that we are anticipating a decline in TTM income in the short term. I should also point out that a major driver of the spike this year was due to cashing out of that private equity investment where the gains became income.

[GYFG Present Day: Below is an updated chart that shows the parabolic path our income took due to the business.]

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

I like to believe I’m a rags to riches story in the making. I was born into poverty but luckily still in the United States of America – arguably one of the greatest countries in the world, in my opinion. I believe it doesn’t matter where you start in life. What matters is how you play the hand you were dealt.

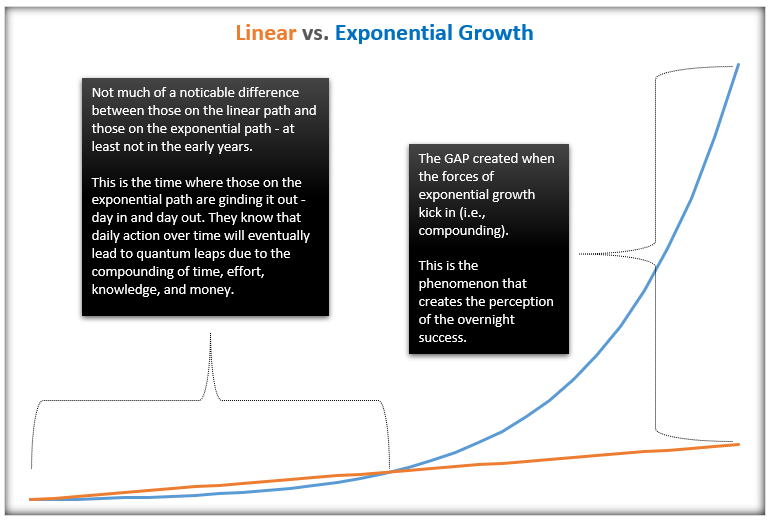

I’ve never been the most talented or most intelligent person – I’m no Elon Musk – but I’ve always been able to out-hustle anyone. I realized early on that most people are lazy and that I could design the life I desired through pure AMBITION if necessary. I would overcome my lack of innate talent by outworking and outlearning those more naturally gifted than me. I intuitively knew that compound effort is just as powerful as compound interest.

Like compound interest, compound effort has the ability to return exponential results over time. Most people can comprehend the idea of compound interest, but they miss the idea of compound effort. With consistency and sustained effort, the results become exponential. It is harder than it sounds because the exponential results don’t really start showing up for years.

In the beginning, there is often very little noticeable difference between the truly ambitious and the average. This causes motivation and excitement to fizzle, and many that start off strong get discouraged and let their foot off the gas peddle. They give up in the middle of the dip, right before the magic of compound effort is about to become visible.

Have you ever heard of the Latin phrase “Fortitudine Vincimus?”

It translates to “by endurance we conquer.” It’s a motto I’ve internalized while building my own career and wealth. It’s a motto I encourage everyone to adopt if they truly want to experience the magic of exponential results. It is endurance (i.e., time) that makes the power of compounding so magical!

You don’t have to be the smartest or most innately gifted to succeed. I have found that any normal person can gain an edge by outworking and outlearning the innately gifted. To me, there is no such thing as competition. Most people are pretty lazy, which means the top is never crowded.

That said, I would be lying if I didn’t acknowledge that luck always plays a role in success. I’m not talking about the kind of luck people count on when throwing away money on the lotto. I’m talking about the kind of luck you create by being prepared when an opportunity comes knocking.

With a lot of hard work (working 70-90 hours a week for the better part of a decade) and a little luck, I was able to accelerate both my career and the income that came with it.

I know that was a big divergence from the stated question, but I thought it a necessary preamble to a walk through my professional career.

Since the question specifically asks what the starting salary of my first job was, I’m going to skip everything prior to graduating college, although the numbers will be included in the table below.

[May 2008 – August 2008] I initially turned down the offer from the company where I had interned for almost two years. I actually took less money, in order to be near a girl…who eventually became my wife. I got my start in corporate finance making $52,000 per year out of college at a biopharma company. It was in my home town and that is where my future wife was going to be. But it wasn’t a good fit after all (the job, not the girlfriend!), so after four months I reached out to my old internship boss and asked if the offer was still on the table, and returned there.

Titles: Financial Analyst (2008)

Starting Comp: $52,000

[September 2008 – May 2012] Back at the company where I interned during college (a third-generation family-owned oil company), I initially wore the traditional FP&A hat (financial planning and analysis), but I was fortunate to participate in some mergers and acquisitions. After a few years, I transitioned into the trading group, where I helped run all the hedging activities related to the inventory we held, and traded West Coast products (gasoline and diesel fuel) and options (on the NYMEX) for profit. I learned a lot but made a lot less than I thought I would have in the trading group.

Titles: Financial Analyst (2008-2010), Supply Analyst and West Coast Products Trader (2010-2012)

Starting Comp: $58,500 + $5,000 bonus

Ending Comp: $77,000 + $10,000 bonus

[May 2012 – March 2014] Next, I left the oil industry and joined a public $2B company in action sports. After doing a small stint in FP&A again, I weaseled my way onto the eCommerce team, where I helped launch a global analytics team to support the fast-growing $100M online business. I was then and am still fascinated with the online world because of how measurable everything is. It looks like I took a pay cut, but since I never got the opportunity to earn the $10,000 bonus from the prior job and the most I had made was $80,000, this was a lateral move. I only stayed with this company for about 18 months before realizing they were about to experience a ton of financial pain. In the 18 months that I had been there, they had already had six major layoffs, and I could see the writing on the wall. This was not going to be the place my career would flourish. They eventually filed for Chapter 11 bankruptcy.

Titles: Senior Financial Analyst (2012-2013), Senior Data Analyst (2013-2014)

Starting Comp: $80,000

Ending Comp: $88,000

Note: I did make about $27,000 participating in the employee stock purchase program. We were allowed to allocate up to 15% of our income every six months and we would get the lower of the price on the first or last day of the six-month time frame plus a 15% discount. I studied the 44 six-month periods of performance of this program and found that the average return was 37.5% and that there had only been one time you would have lost money – a minor 1.7% loss (all assumed that you sold every six months during the trading window). I tried very hard to convince finance and accounting folks to take advantage of this, but they didn’t most of the time. At the very least you were almost guaranteed a 15% or higher return.

[2014 – 2020] Next would be my last stint in Corporate America. I joined a consulting firm in the construction management space. I was once again back in FP&A earning $98,000 per year. I had finally landed at the right company for me. It was entrepreneurial. It was growing. It had leadership that valued grey matter over grey hair. It was the closest thing to a meritocracy I’d ever experienced. This company was a game-changer for me.

Titles: Senior Financial Analyst (2014-2015), Director (2015-2016), Chief Business Intelligence Officer (2017-2020)

Starting Comp: $90,000 + $8,000 bonus

Ending Comp: $275,000 + $75,000 bonus

Note: I also was able to purchase equity in the company. The $105,000 I invested was cashed out for $537,000 as I mentioned above.

[2019 – Present] I could have continued to do very well financially and professionally had I decided to stay with my previous employer. I had actually accepted the COO role in February of 2019 that I was to transition into by June of 2020, and it came with substantial upside in compensation and additional stock. However, my true calling has always been to start a company of my own (links to my first annual letter to shareholders). What you don’t see in my career and salary history that I’ve shared so far is all of the side businesses and ventures I’ve had, each with varying degrees of success. You will notice a large overlap in when I started my company and when I left my previous employer. I started my company in February 2019, gave notice in June of 2019, but didn’t officially leave my previous employer until February 2020.

As a “side hustle” my new business earned me $235,671 through wages and profit distributions in 2019. I expect to earn about $500,000 in 2020 and much more as the business continues to grow. That about does it for me.

[GYFG Present Day: Not only did this turn into my main hustle, but it was also an insane wealth accelerator for the GYFG family.]

This next part for my wife will be a bit shorter but I want to also touch on her career and compensation progression. Out of college, she started out working for a firm that specialized in reducing property taxes for large real estate holders. She started in 2008 at $35,000 per year and by the time she left five years later to work for the family business, she was earning about $75,000.

When she went to go work for the family business she strategically took a pay cut to $48,000 per year but added monthly bonus potential (with no cap). She is was being groomed to take over a family business (in real estate), and she will would have represented the third generation to run it. However, after seven years in the business, she isn’t so sure that is what she wants to do.

[GYFG Present Day: Sometimes in life, you get to choose and other times the universe chooses for you. My wife had every intention to walk away from the family business…until her mom was diagnosed with cancer and found out it was terminal. My wife stepped up to take over the business and we eventually bought it from her parents in order to take care of her dad. It has now been two years and my wife finally got to a position to sell and exit the business. Although it took longer than expected, I’m so proud of her stepping in to take care of the family.]

Today, she is earning a base salary of $72,000 and has earned on average about $121,000 per year for the last five years with commissions.

[GYFG Present Day: The above table has now grown to over $10M when you true up 2020 for our actual income of ~$1.3M and add in 2021 and 2022, which includes the cash received from two separate liquidity events related to selling my business.]

The above table isn’t a perfect history as I didn’t actually start tracking our income in detail until 2015. However, I was able to go to the Social Security website to capture all of our income subject to social security taxes. Unfortunately, it misses anything else that wasn’t subject to those taxes. Also, note that I have included a line for 2020 that shows the forecast I have for all of 2020, 70% of which we have already realized through April 2020.

My first “official” job was as a junior in high school where I worked for a medical device manufacturer assembling speech aid devices for those that had a laryngectomy. I worked plenty before this but it was always cash-paying side jobs (e.g., mowing lawns, painting houses, shampooing carpets, etc.). In high school, I also sold candy out of a shoebox earning about $60-$80 per day and that doesn’t show up in the above table. If I didn’t have documentation of the income I didn’t include it.

What tips do you have for others who want to grow their career-related income?

(1) Never stop learning and investing in yourself.

(2) Do whatever it takes to obtain a rare and valuable skill set.

(3) Use that skillset to build career capital.

(4) Deliver so much value that the universe can’t ignore you.

(5) Play a long game.

(6) Continually reinvent yourself to remain relevant with the times.

(7) Strategically cash in career capital by asking for what you have earned.

Also, remember that you can only connect the dots looking backwards.

What’s your work-life balance look like?

This has gotten better with time. I strategically hustled my way to accelerated financial and professional success. Until we had our son in late 2018 and the ten years prior, I regularly worked 70-90 hours per week. I consciously decided to live my life like most wouldn’t for a better part of a decade in order to live the rest of my life like most never will. Today, my workweek averages about 50 hours a week.

[GYFG Present Day: Always a work in progress. My wife has officially gone down to two days a week as she transitions out of the business she sold and I have gone down to four days a week and working about 32 hours a week. I’m trying to find the right balance, which right now is finding a way to split work time and free time based on the same law of 50/50 that we came up for our savings rate.]

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

We do have some other sources of income that stem from investments and side hustles (in the “Other” column of the income table I shared above):

- $23,000/month in profit distributions from my business – this is on top of the W-2 income I earn from the business (this represents the average for Jan-Apr of 2020, but it is lumpy).

- $1,285/month from $385,000 interest-only note at 4% (although it’s currently more phantom income as it is just accruing to the back end of the loan)

- $1,250/month from a $150,000 note at 10%

- $1,000/month from notary services (my wife’s side hustle)

- $586/month from a Commercial REIT that pays a 7% dividend (although I was just notified that due to COVID-19 this has been cut to 5% and I’m taking a 30% haircut on valuation)

- $600/month from hard money lending (through PeerStreet in a self-directed IRA)

- $300/month from selling tradelines

- $200/month from my blog

- $150/month from CDs and High Yield Savings Accounts

- $100/month from dividends (in a 401K account)

Total = $28,471/month or $341,652 annually

I didn’t include income from selling investments as that is not recurring and happens opportunistically. The real game-changer is the profit distributions that are coming from the business I started only 15 months ago. I have always had some sort of side business and the majority of them have produced income but this was the first one that turned into a real gusher. I think everyone should have a side hustle – or many – until you find one that has the potential to turn into your main hustle. I learned a lot of skills through my various side hustles that may not have directly earned much money but paid huge dividends in my professional career in Corporate America and that eventually led to my entry into full-time entrepreneurship.

The other streams are mostly from putting money to work or other side hustles that take minimal time. I’ve become much more guarded with my time and will continue that trend over the coming years, so most income streams that get added from here on out will be as passive as possible. The plan was always to use a strong financial position to buy back more and more time to spend with my family and other activities as I choose.

SAVE

What is your annual spending?

As you will see in the below table, we are not part of the extreme frugality club. Instead, we practice relative frugality, so our spending is very low relative to our income. You can see that lifestyle inflation has been a regular participant in our annual spending.

Our spending for 2020 is forecast to be down significantly; mostly due to COVID-19, we are just spending a lot less money.

What are the main categories (expenses) this spending breaks into?

In the table below, note the adjustment to spending for amortization. I mentioned above that we paid our mortgage off early and since the extra principal payments were merely a balance sheet transfer, I deduct them from the total expenses to get our true spending.

I’ve seen previous interviewees include taxes as an expense. Taxes are certainly the largest expense we have, but I don’t include them in the table above. As an example, we ended up paying well over $200,000 in taxes in 2019…definitely our largest expense.

[GYFG Present Day: After tightening down the hatches at the start of the Pandemic in 2020, we started to loosen the purse strings as we got better visibility and regained confidence that our businesses were still growing and income was still flowing. It was very uncertain for about two months. We ended up blowing past the $120,833 forecast we pulled together and spent $258,476. $115,000 of that was for home improvements we made after putting down 25% to buy our dream house in March of 2020 but didn’t actually move into until December of 2021. We have continued to increase our spending with 2022 at $467,000 and 2023 projected at $571,000 as we work to complete the remaining home improvement projects. If you back out the one-time home improvement expenses from the 2023 projection then our spending is projected to be ~$225,000.]

Do you have a budget? If so, how do you implement it? (who creates it, who monitors it, how do you work together on it (if married), etc.)

Yes, we have a budget, but we don’t use it to control our expenses. We use a budget to get an idea of how much income we will produce and where we are likely to be spending our money over the next year. There is control-based budgeting and then there is allocation-based budgeting. We follow the latter.

[GYFG Present Day: After a hiatus from any sort of budget the last couple of years, we decided to put one together for 2023 to understand what our spending was going to look like, with an effort to ensure we were not spending money without intention.]

What percentage of your gross income do you save and how has that changed over time?

We have averaged a 37% gross savings rate over the past five years. Historically, the majority of our income has been earned (taxable) income, so it’s difficult to do much better than this. I do have a long term goal to move this closer to 50% by growing more tax-efficient income streams. That said, we focus more on our after-tax savings rate, and our goal since 2015 has been to save 50% of our after-tax income. We don’t always hit the goal in every year, but when you average the years we are just over 50%.

We follow what I’ve dubbed the “Law of 50/50,” whereby we save 50% and spend the remaining 50% guilt-free. It’s a free pass to indulge in lifestyle inflation.

[GYFG Present Day: We stopped tracking our savings rate but only because our income grew to such a ridiculous number that our savings rate is in far excess of our 50% target. As long as our income remains high – north of seven figures – and our net worth is stable-to-growing we won’t be tracking our savings rate. But should those conditions change significantly, it will be something we track again.]

What is your favorite thing to spend money on/your secret splurge?

I wouldn’t call it a secret but I love spending money on really good food with really good friends. Prior to COVID-19 a large percentage of our spending was in the “Food & Dining” category, which you can see in the table I shared above. Travel is another area where we really enjoy spending money. It’s hard to tell in the chart above, but that is because I’ve had a habit of credit card churning which has offset our actual travel costs by $5,000 to $10,000 per year.

INVEST

What is your investment philosophy/plan?

Invest with a risk mitigation lens first. I’m constantly looking for investments that have a huge margin of safety in terms of downside protection before our money is at risk of loss. Another way to put it is that I focus more on the return of capital over the return on capital. I tend to hold way more cash than most but then deploy large chunks when I find something I really like. I’m not really too concerned with inflation eating away at the value of dollars sitting in the bank because we’re talking about months to maybe a year of building up cash before deploying it.

I only need to earn 5-6% on my money in order to reach my “number,” which I’ll dive into below. This assumes that I can keep the income machine in full production mode.

[GYFG Present Day: Inflation has ticked up significantly since writing. Higher inflation is one of the unintended consequences of the massive amounts of liquidity dumped on the world economy from central banks and governments around the world during the lockdowns that essentially shut economies down. The GYFG household has also significantly increased its available cash due to liquidity events. We still sit on a large amount of liquidity but instead of keeping it with the bank we cut out the middle man and keep it parked in US treasuries that are currently yielding ~5% as I type.]

What has been your best investment?

The $267.42 I invested to start my business. The business has been self-funded since then and has become a cash cow. To date, it has earned me $387,119 ($206,000 of which has been distributions) – that’s a 1,447X return! The business has only been around for approximately 15 months, so this is going to get even better with time and continued growth. In its first 15 months, it has produced $832,605 in revenue. We are currently on pace to grow 300% in 2020 vs. 2019. I’m currently projecting about $300,000 in profit distributions and $210,000 in wages from the business in 2020.

[GYFG Present Day: This has not only remained the best investment of all time, but as of my last liquidity event put the total return at 8,647,201%. Read how I did it.]

What has been your worst investment?

When I was still in college I got into investing in the stock market during a time (2007ish) when all you had to do was buy and prices magically increased – I naively thought it was that easy. I also soon discovered “margin” and quickly realized that I could turn my then $8,000 of seed capital into $16,000 with borrowed money on margin. I somehow managed to grow my equity from $8,000 to $20,000 with no skill or talent for investing at all. AND…I now had buying power of $40,000 – what could go wrong? I don’t remember the ticker but I remember I was using a trading platform called Zecco and it was a low-cost brokerage with no bells or whistles. I was convinced that I had found the holy grail of stocks. It was a pharma company that had been developing a cancer drug that was close to being tested for statistical significance in its ability to fight cancer. I was sure it was going to the moon.

Needless to say, this one-trick pony failed to show the statistical significance and the company failed…as in it went to zero. I ended up losing all my gains and half my seed capital with a total loss of $14,000. Oh, and I almost forgot, I also bought a house with someone my brother introduced me to as his “money partner” at around the same time. It was 100% financed with a “stated income” loan. I won’t get into the details, but it turns out the guy I partnered with was a crook and so was his mortgage broker. All said I lost about $14,000 on the stock loss and another $35,000 (over a few years before letting the property go to foreclosure) on the real estate.

With the benefit of hindsight and an additional 13 years of maturity, experience and wisdom, I now see how young and dumb I was. That said, these costly lessons led me down a path that eventually built a very solid financial foundation. I’m happy that it happened when I really didn’t have much to lose.

What’s been your overall return? (rough estimate is fine)

I have absolutely no clue what my overall return on my investments have been. I’m more concerned with the compounding rate of our net worth. From January of 2015 to April of 2020, our net worth has compounded by 55.5% per year ($181,364 to $1,911,819). My guess is that at least 50% of that growth has been fueled by our ability to continue increasing our income substantially (through pure savings and paying off debt like our mortgage). Over the same time period our income has compounded at 48.6% per year ($178,000 to $1,288,551).

The compounding rates are a little higher than this if I go back further in time (our careers started in 2008 when we graduated college), but 2015 is a line in the sand when we really started to focus on building our wealth.

[GYFG Present Day: Our net worth has compounded at 73% for the decade between 2012 and 2022….and the crazy thing about compounding is that 90% of our wealth came in the last three years!]

How often do you monitor/review your portfolio?

I review our entire financial position once a month when I write a detailed financial report on my blog.

NET WORTH

How did you accumulate your net worth? (Did you make a lot of money, invest well, inherit it, or what? Please provide specifics and details so readers can know exactly what you did and be able to apply the same principles themselves).

I think by now I’ve made it pretty obvious that the majority of our net worth has been achieved through our ability to earn a high and increasing income. (If you read my origin story, you’ll see how far I was from inheriting my “fortune!”) I’ve always had a preference to focus on maximizing income rather than investment returns because I’m of the opinion that you have more control on what you can earn and little control over the rate of return on your investments. I also really like the income-focused approach early on in one’s financial journey because it takes a good decade before you really start seeing the power of compounding get to work – when small numbers start turning into very large numbers.

It wasn’t a high income by itself that got us to where we are. It was a high income paired with a high savings rate. It’s a very simple path to wealth: spend less than you earn and invest the difference wisely.

[GYFG Present Day: Today I would say that we accumulated our net worth through a high income paired with a high savings rate and owning equity in our own businesses as well as others.]

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

In order of strength I would say Earn, Save, and then Invest.

Earning money has always been easy and natural for me. So, over time I’ve doubled, tripled, and quadrupled down on that strength. I also believe that we live in the best time in history in terms of low barriers to high earnings.

What are you currently doing to maintain/grow your net worth?

I’m super focused on growing my business, as I think it will add millions to my family’s net worth. I continue to be hyper-focused on income growth (both passive and active income). My goal has always been to get richer every year regardless of the performance of my investments.

[GYFG Present Day: as expected, the business did indeed add millions to my family’s net worth. It was through both the direct earnings from wages and profit distributions as well as several liquidity events that we’ve realized over the last three years. You can read all about how I turned the original investment of $267.42 into $20,500,000 in less than four years here. I didn’t capture all of it because I paid my people well and gave away 40% of the equity in order to accelerate the growth and eventual exit but it did add about $9M to our net worth.]

Do you have a target net worth you are trying to attain?

Yes, my target net worth is $10,000,000. That’s what I term “Financial Freedom.” A lot of people use financial independence and financial freedom synonymously, but I differentiate between the two. Our “Financial Independence” number is around $3,000,000.

How old were you when you made your first million and have you had any significant behavior shifts since then?

I was 32. My wife and I started our “adult” lives in 2008 when we graduated college and from that point it took 10 years to accumulate our first $1,000,000 in net worth. What’s crazy is that we are on track to accumulate our second $1,000,000 in under two years from the first! I suspect that each incremental million will be attained in increasingly less time.

Our mindset started to shift about six months after hitting our first million mark, which coincided with us paying off our mortgage. We actually started to feel well-off. As we approach $2,000,000 in net worth and with the success of the business we are starting to begin feeling wealthy.

[GYFG Present Day: It took 10 years to reach the first $1M, 19 additional months to hit $2M, 13 additional months to hit $3M, 1 additional month to hit $6M, 4 additional months to hit $7M, 6 additional months to hit $8M, and 9 additional months to hit $10M+. It was a lumpy ride and the first $1M felt like it took forever and growing from $1M to $10M+ happened in what felt like a blink of an eye.]

What money mistakes have you made along the way that others can learn from? (or something you’d do differently)

My early mistakes were due to trying to chase the easy money. Do your due diligence. If something sounds too good to be true, run in the other direction – I’ve learned there is no such thing as easy money, and that “too good to be true” actually is! Also, figure out what your risk tolerance is and commit to a financial plan that works best for you and your goals. There is no one size fits all strategy. There are, however, underlying fundamentals that are universal.

What advice do you have for ESI Money readers on how to become wealthy?

I said it earlier and I will say it again the golden rule to building wealth is to spend less than you earn and to invest the difference wisely. The bigger the “gap” between earning and spending, the more powerful the invest component becomes.

You get to choose how you operate in that framework. Personal finance is like an “all you can eat” buffet where you can pick and choose what to put on your (financial) plate. I truly believe – which explains where I have focused my efforts – that a high income paired with a high savings rate is the fastest path to financial freedom. I chose this path due to my preference for relative frugality over extreme frugality.

It’s not rocket science!

FUTURE

What are your plans for the future regarding lifestyle? (for instance, will your net worth allow you to retire early, downsize jobs, etc.)

Wealth building for me and my family is all about optionality. We are working towards our $10,000,000 net worth goal because that is the number where money is no object (<-linked to part one and you can find part two here) and we are confident we can both live well and give well. We have been using our growing wealth as leverage to continue designing our desired lifestyle. We are working towards what I’ve dubbed the 3-6-3 lifestyle, where we spend three months at the beach, six months at our home base, and three months in a foreign country.

[GYFG Present Day: The 3-6-3 lifestyle seems a bit less appealing to us these days now that we have kids and are in the process of turning our house and property into a resort we never want to check out of. That said, we still have a deep desire to travel and explore the world with our family. It may just be the season of life we are in right now, only time will tell.]

What are your retirement plans? (both financially as well as activities in retirement)

I don’t ever plan to fully retire. Early retirement is also of no interest to me. I like working and being productive and I’m not ashamed to admit that I LOVE making money – it’s a game to me.

So my definition of FIRE is Financial Independence Recreational Employment.

[GYFG Present Day: I still have no interest in retirement. That said, I also have graduated past my willingness to work long hours. I believe the perfect amount of productive time for me is around 30-35 hours a week. However, there is still work that I don’t like doing that I push myself to delegate to others. My ideal work week is one that isn’t spent with others controlling my calendar, but rather with lots of white space to write, read, invest, and make plans with people I want to talk to and meet up with.]

MISCELLANEOUS

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

The book that I have recommended and gifted the most is The Slight Edge by Jeff Olson. I have the following graphic from the book blown up and hanging on the wall right above my computer monitor as a daily reminder to embrace the path of the 5%.

This book has had such an influence in my life and is the only book I’ve read more than once (seven times + three times via audio). I love it because it takes the concept of compounding and shows you how this magical force can work in all aspects of life, not just your finances. As humans it is very hard for us to think in exponential terms because we are innately wired to think in linear terms. This ends up holding people back from realizing their full potential as they adopt self-limiting beliefs. If you adopt The Slight Edge philosophy I promise you that your life will be better than even your wildest dreams. You will not only accomplish but crush your goals.

The last chart I want to share with you before I sign off is the best graphic I could come up with to share with those I mentor on what living The Slight Edge philosophy really looks like.

I hope you have found this interview entertaining at the least and I thank our amazing host for this series and allowing me to make my contribution to it.

Onward & Upward!

– Dom @ Gen Y Finance Guy

2 Responses

Hi Dominic,

I’ve been following you for years now and your journey has been inspiring to watch from a distance. This blog with the updates is my favorite with so much valuable information for those who want to see it. Fortitudine Vincimus.

Wishing you and your family continued success.

RPS

Thanks, Rory.

Your comment made my day. I’m so happy you’ve found value in reading along.

I wish you a happy new year and a healthy & fulfilling year ahead.

Dom