Here we are again! Although February was a short month, the GYFG household still managed to get a lot done.

From a health perspective, I was able to drop 10 lbs and get into a daily rhythm of meditation. I’m still dealing with two bulging discs, but I was finally able to start an eight-week program that uses a machine that is supposed to help re-align the disk (they call it the DRX 9000). The short of it is that this machine does Decompression Reduction Extraction (also known as nonsurgical spinal decompression) and the goal of each DRX session is to remove the bulging disc pressure from the nerve root.

From what I’ve read, the studies show an 80% to 90% success rate, but only when the strict protocol is followed. It’s taken me a few months to finally find the time I need to fit this into my schedule. It is not cheap ($3,500 for the eight-week program) and most of it will be out of pocket, but if it works it will be well worth it. I just want to be functioning normally again. I don’t mean to bog you down with my medical updates, but they are an important area of focus for me in 2018.

Don’t worry, the rest of this report will be all about the Benjamins!

If you’re not intentional with your time, this year will be over before you know it, so I hope you’re taking advantage of every month to make forward progress on your goals (financial or otherwise). If you need some inspiration on the financial side of the ledger, I have outlined 12 steps to improve your financial future (it’s a good place to start).

If you’re a regular reader and only want to read the new content then feel free to just skip the intro below (no harm, no foul). If you are new or haven’t read many of these reports, I encourage you to take two minutes to read the intro below, which will change periodically.

Intro

Mission Statement: To Humanize Finance, Build Wealth, and Reach Financial Freedom.

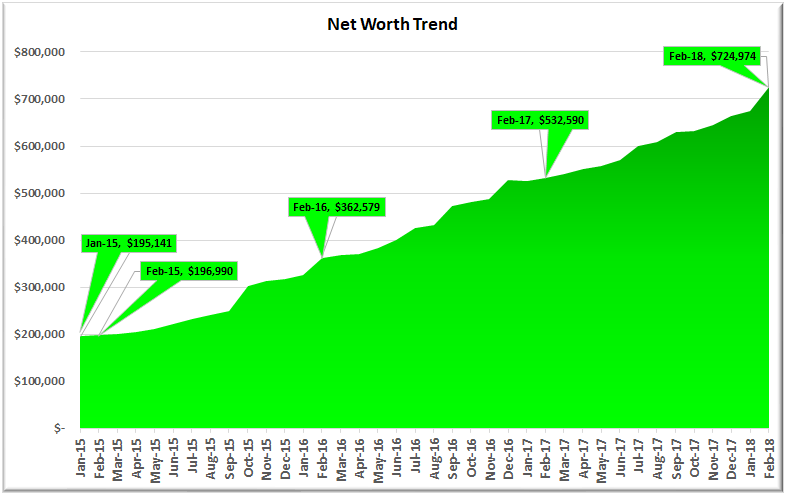

For those of you new around this corner of the internet, these monthly reports are about full transparency. They are just as much for me as they are for you. It was a hard decision to make all of my financial details public, but it has proved to be a very motivating one. The process I go through every month to produce these reports has been enlightening and life-changing. I published my first “income and net worth report” for January of 2015 when our net worth was only $195,141, and our gross income was on pace to hit $178,000 that year.

Fast forward three years: our net worth finished 2017 at $664,391 with a gross income of $372,477 (and as you will see below it is still growing exponentially).

- That’s a 3.4X increase in net worth due to a compound annual growth rate of 50% for the past three years.

- At the same time, income has increased 2.1X, which translates to a compound annual growth rate of 28%.

I honestly don’t think the GYFG household would have experienced these kinds of results without the existence of this blog and the accountability it brings. Knowing that I will need to share our results with my readers every month keeps me very focused and intentional with all things related to our financial well being. For that, I THANK YOU for taking the time to read and interact with me on this blog.

Above and beyond this benefit to my own household, my sincere hope is that my policy of full transparency will inspire you to take the helm of your own financial ship and be intentional with its direction. I truly believe that anyone can reach financial freedom if he or she is willing to do things differently than the pack. If you’re after average results, then you’ve landed on the wrong site. There’s nothing wrong with average, but the kind of results I preach are EXTRAORDINARY. Sure, the “get rich slow” method is proven, but there is an alternative, which is to “Get Rich Fast.” Look, I have no interest in living like a starving college student until I am old and brittle to only then have the means to check off bucket-list items when my body might no longer be physically capable of doing them. And I don’t want that for you either!

Here at GYFG, we approach the pursuit of FINANCIAL FREEDOM with an abundance mindset, so you won’t hear me telling you to cut out those $5 lattes. I spend a lot, but I also strategically earn a lot, save a lot and invest a lot.

I hope these reports inspire and move you to action. Don’t take a passive role in your finances and hope for the best. There is a famous Jim Rohn quote that I think everyone should keep in mind:

“If you don’t plan your future, somebody else will. And you know what they have planned for you? NOT MUCH!”

You have to be intentional with your finances if you ever want a fighting chance to make it to financial freedom. Nor does it have to take 40-50 years of slaving away for The Man before you have the option to retire. I think that 10-20 years is all you need, with the most aggressive folks probably able to reach financial freedom in 10 years or less. A high income paired with a high savings rate are two vital components of a good recipe for the 10 year track.

I know I don’t have to publish my juicy details every month, but it’s important to me that you know that I put my money where my mouth is (not that many people giving financial advice actually do this). I publish all of my financial details not to brag, but instead to show you what is working as well as what’s not working. Sometimes finance can get pretty dense, but I think real life examples and numbers can help slice through the complexities (and BS). Personally, I have always enjoyed the financial reports put out by other bloggers around the blogosphere.

As always, you can find all my previous reports on the Financial Stats page.

Net Worth

Our net worth was up $50,638 in February vs. January. The fantastic growth in February was primarily driven by my year-end bonus that got paid out along with my new compensation kicking in. This is the second largest increase we have experienced in a single month. What caught my eye was zooming out and looking at the YoY increases:

– Feb-2018 vs. Feb-2017 = YoY increase of $192,384 (or 36%)

– Feb-2017 vs. Feb-2016 = YoY increase of $170,011 (or 47%)

– Feb-2016 vs. Feb-2015 = YoY increase of $165,589 (or 84%)

Although growth in percentage terms is slowing – as one might expect as the numbers get larger – the absolute dollar increases are still expanding (yay!).

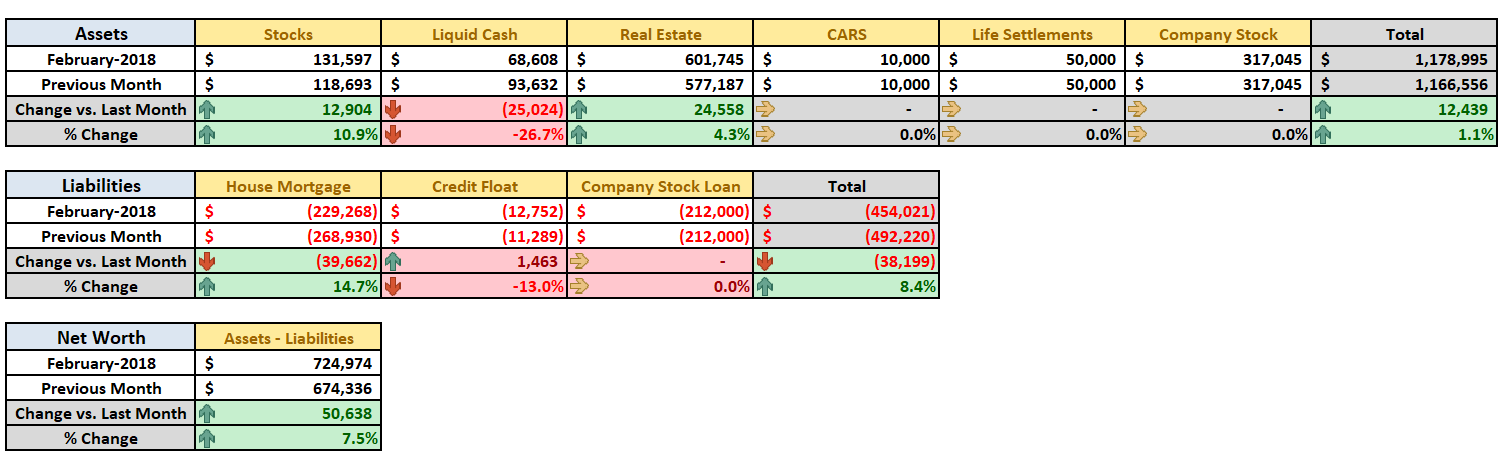

February Net Worth $724,974 (up +9.1% for 2018)

- Previous month: $674,336

- Difference: +$50,638

A few highlights include:

(1) The Real Estate bucket increased $24,558 or 4.3%. Besides some interest and dividend payments that hit, most of the increase was a result of increasing our investment by $24,000 in the Rich Uncles Commercial REIT (bringing our investment to just over $50,000).

(2) We paid down our mortgage by an additional $39,000. We had originally planned to wait until the end of the year, but later in this post I will get into why we decided to pull the trigger sooner.

(3) We increased our investments in stocks by $12,904 or 10.9%. This is a direct result of the decision to front-load my 401K contributions. I also have good news, which is that after several years of trying, my wife is finally going to have a 401K to contribute to starting in March. We have set her contributions to max out the full annual $18,500 and she will also get a 4% match on top of this (her income will reduce by the amount of the match, so it doesn’t actually cost the family business any money, while we get to shelter an extra ~$4,400, so win-win there).

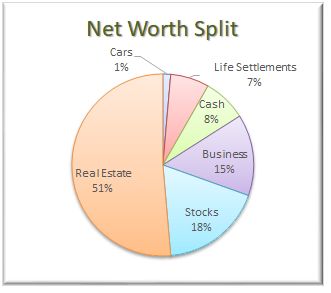

Net Worth Break Down:

– Due to #1 and #2 above, the Real Estate category increased from 46% to 51%. Keep in mind that this category includes the equity in our primary residence ($220,732), our investment in the Rich Uncles commercial REIT ($50,140), and our hard money loans through the PeerStreet ($101,685) platform.

– Due to #1 and #2 above, the Real Estate category increased from 46% to 51%. Keep in mind that this category includes the equity in our primary residence ($220,732), our investment in the Rich Uncles commercial REIT ($50,140), and our hard money loans through the PeerStreet ($101,685) platform.

– Cash decreased from 12% to 8% due to deployments to Rich Uncles and the extra principal payment we made. We are currently holding $68,608 in cold hard cash (what I like to call dry powder).

– As a clarification for newer readers, the Business category represents the ownership I have in the private company that I work for.

– In November I added a new slice to represent our newest investment in Life Settlements. We currently have investments in five policies at $10,000 each. I would like to build this up to $100,000 before 2018 is up.

– The Stocks category represents the cumulative value of our brokerage accounts (retirement accounts and after-tax account) that are invested in stocks. However, it is not all of our retirement money as the majority of our PeerStreet investments are made through a self-directed IRA (worth about $73,000 and counted in the Real Estate category of the pie chart).

– That leaves the Cars category. I include our cars because the goal is to keep the value of our cars as a percentage of the overall net worth pie as small as possible. By including them, it keeps me conscious of the opportunity cost of sinking too much capital into the machines that are only meant to get us from point A to point B. The combined value for our cars is currently being held at $10,000 based on current Kelly Blue Book. However, now that our cars make up a minuscule portion of our net worth, I am seriously considering removing it from net worth altogether. If I do follow through with this, it will likely happen in Q1 of 2018 (still one month to decide on this).

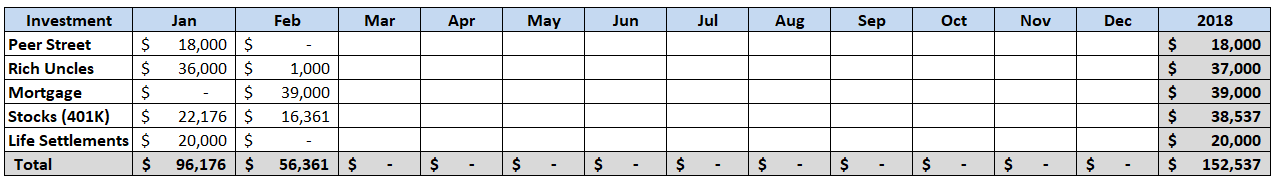

Total Capital Deployed in 2018 (YTD):

I am actually borrowing this idea from Sam over at Financial Samurai, who starting sharing his own capital deployments in a similar form last year. One item not captured in the table below is the capital deployed due to automatic reinvestment of dividends and interest, but I do plan to include that total at the end of the year. I estimate that we will deploy somewhere between $250,000 to $300,000 for the year. This will make for a very easy way to see where and when it was deployed.

About $80,000 of the 2018 total anticipated deployments is from idle cash that was sitting in my 401K (for way too long).

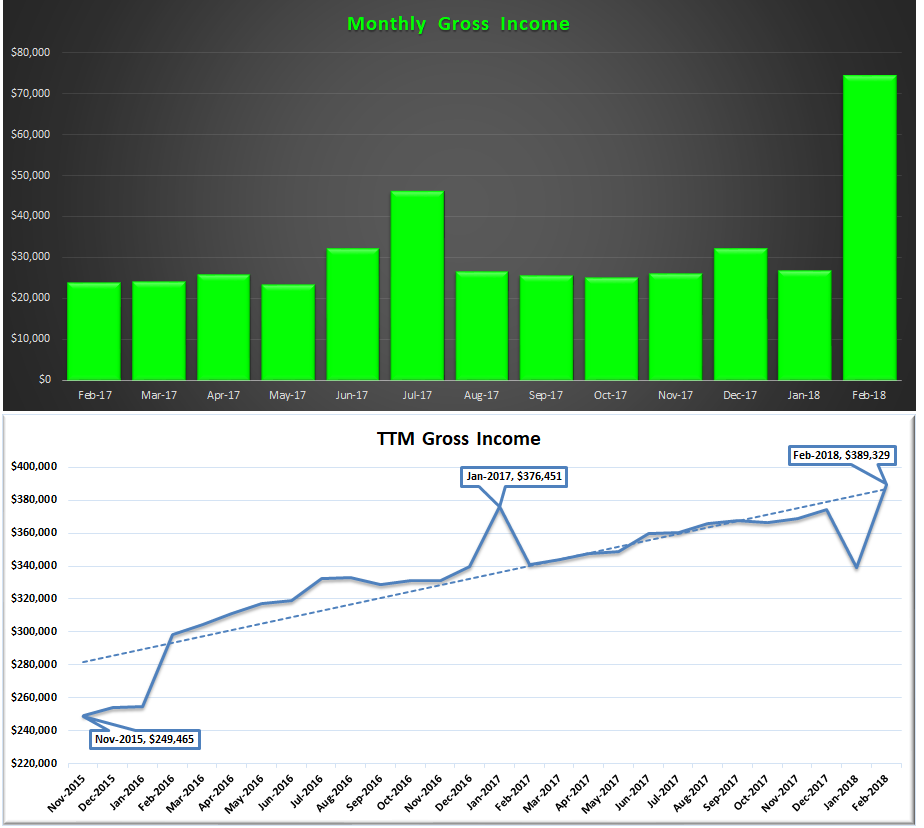

Gross Income

As anticipated, February was a record-setting month, clocking in at $74,190 of gross income for the month. In the first chart below, you can see how February dwarfs income received in any of the last 13 months. This beats our previous record of $61,972 set in January of 2017.

In the second chart above, I also track our income on a trailing twelve months, and we have finally surpassed the record set in January of 2017 as well.

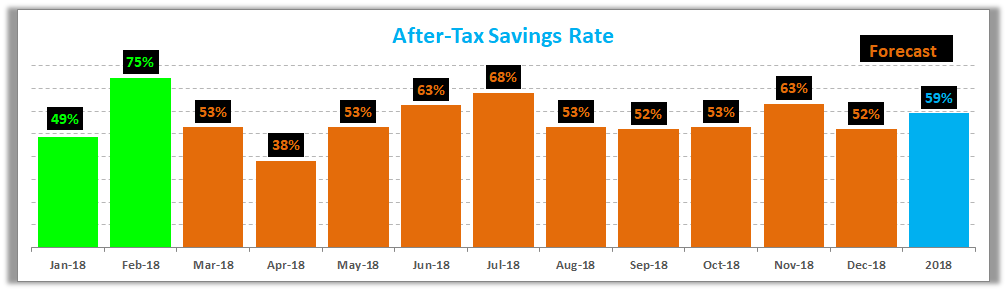

Savings Rate

Below is how we actually did vs. our goal of saving 50% of our after-tax income.

We managed to save 75% in February! This was likely the highest savings rate we will realize all year. Unlike last year, it feels like the wind is yet again at our backs.

Speaking of savings rate, have you checked out my post where I mathematically prove the importance of your savings rate as a higher priority in achieving financial independence than your compound return? If you’re trying to build wealth quickly, then you have to read this post.

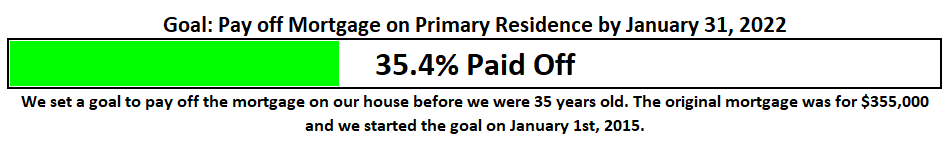

Mortgage Early Payoff Goal

You can read about our strategy to pay off our mortgage in seven years (and three months). After several refinances we currently have a 3/1 ARM at 2.25% and we currently owe $268,930.

Our primary residence is currently sitting at 30.4% of our net worth. Over the past several months (maybe all of 2017), I have been stating how we would like to see this closer to 20% in the short term and far less in the long term (like less than 10% over the next ten years). The reasons are as follows:

(1) Concentration Risk – Although I am confident we will accomplish this goal on time, you never know what may happen unexpectedly. What if we both lost our jobs and couldn’t make our mortgage payment? The bank is going to foreclose on a house with 50% equity a lot faster than one with 5% equity. Until we have the house completely paid off, this will always be a concern and risk to manage.

(2) Diversification – We don’t want our entire net worth tied up in our house. That would be poor risk management.

However, in February we decided to make a pivot. I have to admit that the two items outlined above are my concerns and not necessarily concerns that Mrs. GYFG shares. She was a bit more excited than I was to make an additional payment early, but she felt very strongly about doing so. Although we run the GYFG household together, I can’t be the one who has all the fun of making final financial decisions, so this time we decided on a compromise. We would make an additional payment of $39,000 in February and then turn around and set up a HELOC as risk mitigant to my concerns above (we are currently in the middle of this process as I type). Our credit union is going to cover all the fees associated with setting up a $100,000 HELOC.

The original philosophy of this plan to pay off the mortgage was to accomplish this goal while avoiding any austerity to our lifestyle. I coined it the “pay more tomorrow” plan. I decided that we could easily increase our income (after tax) by at least $9,600/year and dedicate that additional income to fund the goal effortlessly. It has played out as planned, and we have used the cumulative increases in income thus far to execute this goal flawlessly. Since setting this goal in January of 2015, we have paid down an additional $96,600 (Year 1: $9,600, Year 2: $19,200, Year 3: $28,800, Year 4: $39,000).

This allowed us to move the needle on this goal from 24.2% to 35.4% complete! This also accomplishes another goal of mine, which is to leverage the locked up capital in our home for other potential opportunities down the line, particularly when we are ready to get back into the physical real estate game. With $100,000 available in the HELOC, this will give us the ability to quickly make all-cash offers on out-of-state investment properties. It will be a short-term tool to get better deals, get a tenant in the property, and then get financing from a bank (with which to then pay back the HELOC). To be honest, we won’t likely be executing on any properties in 2018, but it will be nice to have the ammunition should the opportunity come.

RELATED: Our Mortgage Will Be Gone In Four More Years

Closing Thoughts

I really feel like 2018 is off to the races. Everything seems to be seamlessly moving in the right direction. I’m making incredible progress on my goals for 2018, while at the same time regaining some balance.

I finished the book I mentioned in last month’s report and I really am committed to mastering the art of having it all, across body, being, balance, and business. Is it going to be a perfect path? No, it never is! The only thing I know is that it will be an incredible journey. It’s never really about the achievement of accomplishing your goals but instead, the true magic is who you become in the process. I believe we were all put on this earth to fulfill a lifetime of never-ending expansion.

There is always an opportunity to level up. How about you: will you accept that challenge each and every day?

I look forward to chatting with you all in the comments below. How was your month? Also, if you have a blog, I encourage you to write a monthly financial report and come back here and share the link. I would love to be part of your support and accountability.

Cheers!

– Gen Y Finance Guy

p.s. I recently had the opportunity to be interviewed by Erik from The Mastermind Within. The conversation we had was fun, informative, and filled with some great nuggets of wisdom. It was deeply gratifying that Erik reached out to have me on the podcast, as the greatest compliment I could ever receive is knowing that I’ve had a positive impact on someone else. Plus, revisiting The Slight Edge is always great – it’s the book that’s had the most impact on my life!

14 Responses

” I also have good news, which is that after several years of trying, my wife… “………. You had me going for a moment there!

Jason,

I guess 401k’s aren’t the same as announcing babies 🙂

Dom

Hey Dom, that’s a crazy income for Feb. I like the idea of the HELOC and using it to buy property. Do you have a city in mind?

Millionaire Doc – I pinch myself every once in a while to make sure I’m not dreaming. If only I can find a way to realize that kind of income every month…

On the HELOC, we don’t have a particular city in mind yet, but do you have suggestions?

Dom

Wow absolutely huge month! We are right around 805k. I had a nice surprise in that I got about 20k in RSUs that I was not expecting. This is the first year that my company gave RSUs to HCE since 2008. I like that you are dabbling in so many different investment arenas and hope you will keep us updated on all fronts! I continue to be stubborn and have 100% of our wealth, outside of our condo, in the market.

All best,

Sean

Sean – Congrats on the RSU’s. What does “HCE” stand for?

I just can’t seem to catch up to you on the net worth front. Every time I think I’m closing in you make a big jump. I’m coming for you!!!

The race to $1M continues…

Dom

HCE means highly compensated employees. For most companies the threshold is $150k. Basically anyone at my company that made over $150k got the RSUs. And yes it certainly does! We will be slowing down a bit from here on out I think. Steady grind for that last 200k

Sean – I think I asked you that same question about HCE last year. Thanks for the reminder.

Keep grinding!!!

Dom

I lost quite a bit of money in February. My portfolio was up 60% from September to January. Down 12% in February, but doing a lot better now.

Troy – It’s only a loss if you sell! Volatility is probably here for a while.

Dom

Congratulations Dom! Nice bonus bump. I caught your interview with Erik a couple of weeks ago and it was fantastic. It’s very uplifting.

I just finished the Slight Edge and i’m working on my plan for the rest of the year. Feb and Mar have been tough in the stock market but real estate keeps humming along.

All the best,

Hey Carlos – Glad you enjoyed the interview. What did you think of The Slight Edge?

Cheers,

Dom

I’m putting it to work already. It’s truly common sense however sometimes we need to be reminded to get back to basics, and the rest will take care of itself.

I read another book along the same lines, called the Compound Effect by Darren Hardy.

Carlos – is another great book.

is another great book.

The Compound Effect

Onward & Upward!