We bought our house almost four years ago and we acquired it for ~50% less than the bank said we could afford to borrow. The bank approved us for a $750,000 loan but we ultimately borrowed $355,000 on a total purchase of $376,000 (47% of what we were approved to borrow). Anyone that has read my ten guidelines to rapid wealth building knows that as a rule of thumb, I recommend buying a house for 50% (or less) of what you are approved to borrow. In doing so, you set yourself up to be mortgage-free in five to seven years if you follow my mortgage snowball strategy.

The GYFG household has just completed year three of our seven-year goal to be mortgage free. When I devised this plan three years ago, there were three fundamentals I laid out:

(1) Buy a house that is less than you can afford, preferably 50% or less of what the bank says you can borrow.

(2) Increase your income every year. This will be what funds the pay-off strategy. The amount will be different depending on the size of your mortgage and how fast you want to pay it off. When we decided on seven years, we worked backwards and calculated that we would need to increase our after-tax income by $9,600/year.

(3) Practice the “pay more tomorrow” strategy. You only pay additional principal payments when you receive a raise. Each time you get a raise, divide that after-tax amount by 12 and pay down your mortgage principal by that extra monthly amount. Alternatively, you can make one lump-sum payment at the end of each calendar year, which is what we started doing in 2017. Remember that every year is cumulative. So, in our example we pay down $9,600 in additional principal in year one, then $19,200 in year two, $28,800 in year three, and so on.

Note: These guidelines have been slightly revised since publishing this strategy back in 2015. The refinements are minor but necessary to capture elements I had not considered when I originally crafted the plan.

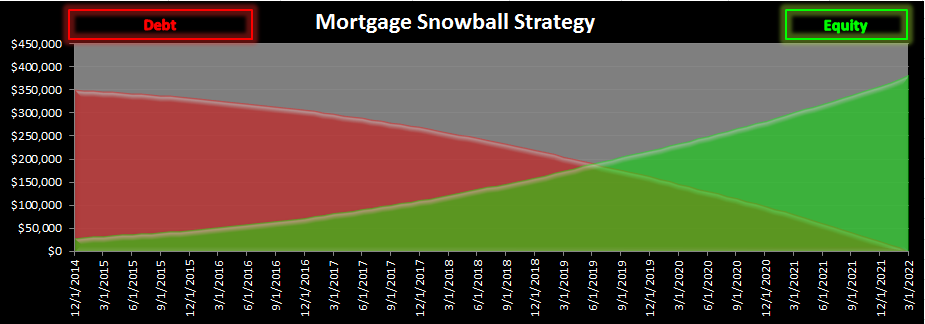

Below you will find a chart that visually shows the progress we have made through 2017 as well as what the remaining four years look like. Keep in mind that the red bars, which represent the principal reduction, include both regular amortization from our normal monthly payment and the reductions due to additional principal payments. For example, when you see that in 2018 we are scheduled to pay down $46,812 in principal, $8,012 is due to normal monthly amortizations, and $38,800 is the additional amount we are paying down the mortgage.

You will notice that based on what I shared in item number three above, that we have not followed the plan exactly as it was laid out, but we have still managed to stay on track. Remember that a battle plan never survives the first day of battle.

Here is the original chart I created to visualize this strategy from start to finish:

Note that the starting debt position (in red) corresponds to the first green outlined bar in the first chart above, which represents the official start to our seven-year goal to be mortgage free.

Yes, I love chart porn!!! (more to come below)

The last piece of consideration in testing for the feasibility in achieving this goal is to compare the initial mortgage amount ($350,913 in our case, which was a result of a refinance before starting down this path) to the amount of income you expect to earn over the same time period of the goal (seven years in our case).

Three years ago, when I first forecast our income over the next seven years (2015-2021), I estimated that we would earn about $1,575,000. This means that the $350,913 would represent 22.3% of our gross income over that seven-year period. In light of the fact that banks will typically loan up to a 43% ratio of monthly loan to monthly gross income, paying this off seemed more than reasonable (and even conservative). I actually started to feel that it would be irresponsible not to pay the mortgage off in seven years based on this amount of income.

Even though it is considered normal and acceptable to carry a mortgage for the full 30 years of its term, I feel differently. I know far too many people who find themselves 20 years into their mortgage with the same if not more money owed than when they originally bought or built their home (obviously not the same exact mortgage). This was all made possible during the refinance craze that took place in the decade leading up to the Great Financial Crisis of 2008/2009, when people took out way more mortgage than they could realistically afford (counting on ever-increasing home values), many times at ridiculously aggressive terms that only benefited the mortgage holders. But this even continues today with people taking out equity from their homes, increasing their mortgages to do so, for purchases such as home improvement, cars, kids’ college tuitions, etc. Increasing debt is never a good idea!

Needless to say, our income has exceeded my initial projections, and some may accuse me of sandbagging. I now estimate our income over the same time period at $2,559,173 (see chart below).

The $350,913 starting debt position now represents 13.7% of the income we anticipate earning between 2015 and 2021.

It is exciting to know that we only have four years before we are officially mortgage free. At 35 years old we will be mortgage free when many of our peers will be buying their first house. In the short-term, we may have missed out on some market gains (due to paying down the mortgage early instead of investing those extra payments), but in the long run, our financial foundation will be stronger than most. Imagine the freedom gained without a mortgage payment to consider.

“You’ll learn, as you get older, that rules are made to be broken. Be bold enough to live life on your terms, and never, ever apologize for it. Go against the grain, refuse to conform, take the road less traveled instead of the well-beaten path. Laugh in the face of adversity, and leap before you look. Dance as though EVERYBODY is watching. March to the beat of your own drummer. And stubbornly refuse to fit in.”

― Mandy Hale

We have chosen to take the road less traveled and our results have been extraordinary. We refused to handle our mortgage according to the conventional wisdom of the day so our results have not been conventional…and that’s a very good thing.

The reason I share so much of my personal details with YOU is that I’m inviting you to join me on this contrarian path. I want YOU to experience EXTRAORDINARY!

Will you join me?

– Gen Y Finance Guy

29 Responses

Great job guys on reducing your mortgage. You only have 4 years left, you can do it.

We are almost in the same position as you guys, we have 3 years left, we hope to pay off ours in 2020. We started with a $550K mortgage and we are now at $220K. In march, when we hit $199K, we will need to go out for a celebration 🙂

99to1percent recently posted…How we plan to pay off our $500K+ mortgage in 5 years

https://99to1percent.com/pay-off-mortgage-5-years/

Nice job right back at you! Our stretch goal is 5 years as well, but it all depends on a lot of variables. Our income has significantly surpassed our projections, but in addition to paying the mortgage off early I am trying to manage a few other things:

(1) The concentration of our net worth that is “trapped” in our home equity. It is currently at about 25%, which is as high as we are comfortable with, at least until we have enough funds to pay the entire thing off.

(2) Keeping enough capital free to continue making other investments

(3) Keeping 6-12 months of living expenses liquid.

That said, in 2018 we are going to look into adding a HELOC onto the house…just in case.

Cheers,

Dom

You have so much of confidence and pride.!!

One doesn’t know whether one would see tomorrow or the day after.

The Lord willing you will see you closing out your mortgage in 4 years

MJC – You’re right, no one knows if they will live to see tomorrow. That said, it’s a win/win as far as I see it. If I live and we reach the goal I will be happy. If I don’t make it, then at least my family will be in a better financial situation.

I guess the alternative would be to live like there was no tomorrow and just blow all our money 😉

Fantastic. Many reasons this will work out great for the GYFGs. With the new Tax Reform Standard Deduction limits, the advantages of a mortgage-deduction itemization disappear. This will be about the time you might be considering growing the GYFG family-unit. Reduced risk, reduced cash flow requirement, and your stock options will be maturing.

P.S. – love the chart pr0n!:-)

JayCeezy – I agree on all points. With any luck, 2018 will be the year we announce news that we will be adding a new member to the GYFG family.

With the tax reform, the sale of our condo, and the elimination of the personal exemption, we will likely be taking the standard deduction vs. itemizing our taxes (it will be close).The good news is that with the lower tax brackets and the new $75K increase that I just got approved our effective tax rate will remain about the same in 2018, but of course our tax bill will go up in absolute dollars.

It’s nice to see our marginal tax rate go down a good amount.

Happy New Year!!!

Holy sh*t!

That is incredible news, GYFG, thank you for sharing this!

Also, congrats on the baby-thing, too.

Thanks, JayCeezy!

We aren’t pregnant yet, but we are trying as of October, the fun part that doesn’t involve sleep deprivation 🙂

Whoa, I was just about to queue up a big CONGRATS! But, guess I’ll use that to celebrate your future mortgage free self in the near future… for now. 😉

Happy New Year, Dom! Wishing you a stellar 2018.

Thanks, Michael!

Let’s make 2018 EPIC together!!!

Congrats on reducing your mortgage. 4 years will go by in a blink, and then your mortgage is gone!

Happy New Years

Troy

Thanks, Troy! I wish you a prosperous and fulfilling 2018.

Nice work, Dom! I’ve been a big proponent of paying off mortgages early, too, despite a lot of naysayers telling me to let inflation take care of a lot of that interest over time. I’m currently on track to have my house paid off in about 5.5 years, although that plan may change a bit depending on how things shake out with interest rates (my rental property is an ARM) and the tax changes affecting the deductibility of interest. Either way, the thing I dig about paying mortgages down as quickly as possible is that it gives you more flexibility later on, if you need to refi and move things around. Yeah, you lock up some equity, but if you have a crappy year and get stuck in a need-to-refi situation, it’s easier to refi a lower principal balance.

Yetisaurus – 5.5 Years is awesome! The flexibility is of no mortgage is priceless.

Nice work Dom. I was wondering though, about a slightly different way to think about the mortgage debt. What if, instead of paying down the mortgage, you purchased series-I bonds or put an equivalent sum in a savings account. I completely agree that on a risk adjusted basis it may be more prudent to pay off your debt than to seek out yield in other non-risk free investments. However, cash has optionality value and at a low mortgage rate the tax adjusted delta between the return on a high yield savings account (1.0%) or a series I bond (2.7%) and could be anywhere from slightly negative ( 3.6%(1-t of 40%)) -2.7% (tax deferred) to minimal (3.%*(1-t of 40%)) – 1.0(1-t of 40%). So lets say instead of $300 thousand in home equity you have $300 thousand in cash that has been earmarked to secure the mortgage. In that scenario, particularly if you elected to save using series I bonds ( you could get around 10 thousand max contribution by purchasing for yourself, your wife, your partnership etc.), you stand to gain from rising interest rates (particularly in series I -bonds), you have the option to prepay the mortgage whenever you might wish to, you have the option to invest in a once in a lifetime opportunity should it arise without having to pay costs of HELOC, and you are no less secure in your ownership of your home. The primary drawback I can see is the behavioral economics standpoint that perhaps you succumb to the temptation to spend cash but this has to be weighed against some fairly compelling upside. What do you think?

Hey Robert – I have thought of many different alternatives, but in the end knowing my mortgage is paid off will free me to take a lot more risk in other areas. But I think your thought process is solid.

I am also not very bullish on interest rates over the long-term. I tend to believe that we are going to be stuck in a low-rate environment for a decade or more (just my own hypothesis).

An article like this is what everyone needs in this stressful lifestyle. The suggested points simply take the person beyond financial growth. Superb research and very well written article. I am sure it will help people especially millennials to plan their new year and have a debt-free year.

Keep up the awesome work!

Four years will fly by and it will be an awesome feeling knowing you’re mortgage free at 40 or less! And it’s so refreshing to know that you borrowed LESS than what the bank said you could afford. So many people borrow more and then realize that was a mistake.

I agree, four years will pass by so quickly.