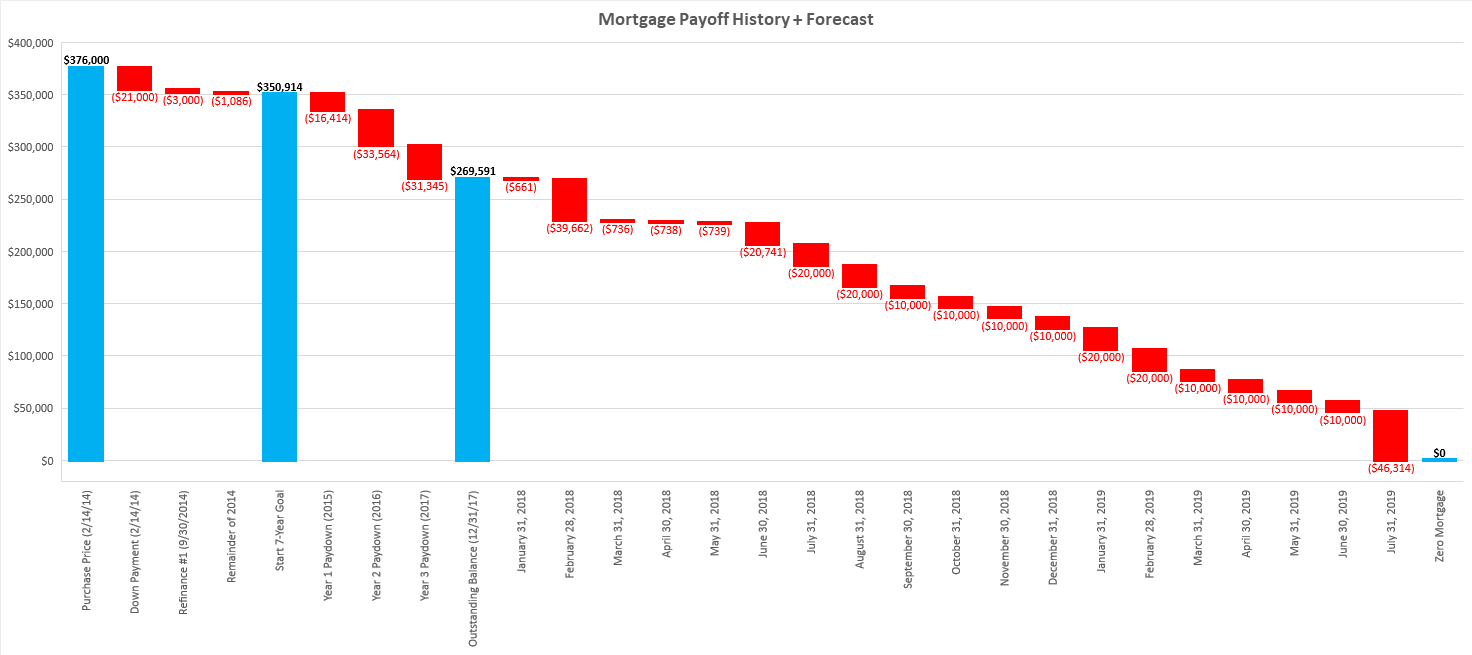

Imagine life without the shackles of debt. The GYFG household developed such a vision back in 2015 when we decided to pay off our $350,000 mortgage in seven years. We had already eliminated student loans, car loans, and were in the regular habit of paying off the credit cards every month (always have, always will). We developed what we thought was an achievable plan based on a projected income that turned out to be far less than what we have actually realized.

In December of 2017, I shared how well the GYFG mortgage snowball strategy was performing and that we would be mortgage-free in four more years, based on following that original plan. I have been very careful to balance our net worth to ensure that the equity in our home doesn’t make up too large of a percentage of the total pie. This has been for two primary reasons, stated every month in my detailed financial write-ups:

(1) Concentration Risk – Although I am confident we will accomplish this goal on time, you never know what may happen unexpectedly. What if we both lost our jobs and couldn’t make our mortgage payment? The bank is going to foreclose on a house with 50% equity a lot faster than one with 5% equity. Until we have the house completely paid off, this will always be a concern and risk to manage.

(2) Diversification – We don’t want our entire net worth tied up in our house. That would be poor risk management.

All the while, I had Mrs. GYFG constantly whispering in my ear every month, saying “Why don’t we just pay it off as quickly as we can?” I would go on my repeat reel about concentration risk and the importance of diversification. If I’m honest with myself, I have to admit that in the beginning I wasn’t even listening – really listening – to her. That’s not cool!

The good news is that Mrs. GYFG didn’t let up. She just kept planting seeds. Then in February of 2018 we found out we were expecting. This is when those seeds started to germinate and take root as a real possibility to consider. It’s now the middle of June as I’m writing this and I’m on board with expediting this goal to the finish line. As of our May 2018 financial report, we still owe $227,055 on our mortgage.

How long would it take us to pay it off if we really focused on it?

We looked at the cash we currently have in the bank and projected what we thought our income would be between now (June 2018) and the end of 2019 (December). We estimated that over the next 19 months we would generate around $600,000 in gross income and already had $70,000 in cash.

After careful consideration, we decided to reset our timeline and make a run at paying off the mortgage over the next 14 months (by July 31, 2019). This is going to require us to deploy $16,214 per month on average. That is not the exact amount we are going to throw at the mortgage every month, just the average to show you the magnitude of how much it’s going to take to get this goal done on a 14-month timeline.

In the short term, this is going to cause our net worth concentration in our house to increase to the 40-50% range. I feel less apoplectic about this now that we have the HELOC in place and a 14-month timeline to pay-off. It’s exciting to think we could be completely debt-free in 14 months.

Here is how I project this goal playing out between now and July of 2019:

I admit that this is not going to be an easy feat, but then again, nothing worthwhile is ever easy.

As I type the final words of this post we have already completed the additional principal reductions seen in the chart above through June. This may not end up being exactly how we pay off the $227,000 balance over the next 14 months but it’s how I see it from my current vantage point. This is scary and exciting at the same time. This will take most if not all of our excess savings every month to accomplish.

Your turn! Are you a fan of paying off your mortgage early? Have you been working towards paying it off early? If so, what timeline have you given yourself? Or, if you have already paid your mortgage off early, I would love to hear your story in the comments below.

Onward & Upward!

– Gen Y Finance Guy

36 Responses

Looking forward to the “Life After Debt” post and what you plan to do with ZERO housing expense.

Church – Hmmm…I like that title “Life After Debt.”

BOOM!! https://www.youtube.com/watch?v=I3Adiy8DkwA

When you make that last payment, now there is no way that you and Mrs. GYFG do not play out this 30 second scene together.

On your NW pie-chart, there is no wedge for ‘psychological freedom’, but it is very real. As you have wisely noted to us readers, ‘personal finance is all about risk-management.’ Am loving this very achievable plan, another piece in place for upcoming parenthood, and women that are ‘relentless’ are somehow just a little bit hotter, AMIRIGHT?;-) Continued success to you, Dom!

JayCeezy – that YouTube clip was on point!

Relentless women are a lot hotter!!!

Hope you and the Mrs. are enjoying summer – stay cool.

Dom

I think you missed a big advantage to this plan (maybe your wife thought of it): aggressive savings. By setting such an ambitious goal, such as saving $16,214 a month, you’ll probably save more money than if you were just trying to throw “as much as possible” in a taxable savings account. At least that’s what I found a few years ago when I decided to pay off $100,000 in student loans in one year … set the goal and watch it happen!

Very true!

Buying my first house in 2007 probably could be considered my biggest financial mistake. But despite paying nearly 40-50% more than if I would have waited just a couple years, I had the house paid off in full in about five years. It was incredibly freeing! Would I have been much better off investing in the market? Absolutely. But having the freedom of no debt helped to encourage my wife and I to downsize from the home (and rent it out), move into a condo next door to her work (and rent), using the cash flow from the house. We improved both of our commutes substantially, amp’ed our savings rate, and generally our happiness as our free time was now spent doing more of things we enjoyed instead of commuting and house chores. Long way of saying, we highly support the payoff of the house and the potential opportunities it could bring!

Jason – First, congrats on paying off the mortgage in five years. A few questions if you’re in the sharing mood:

(1) Has your home’s value recovered to its original purchase price?

(2) What percentage of your gross income did paying off the home early take up? For example, if you earned $1.5M over the five year period, and you paid off a $500,000 mortgage in that time, then it would have represented 33% of your gross income.

(3) Do you guys have plans to eventually move back into it?

Cheers,

Dom

Absolutely!

1 & 3) In 2016, just under 10 years, the home value appreciated back to the original value. It might now even be 10% above that. We had a moderate intention to move back in upon starting a family; it was a perfect 3/2/2 within a couple miles of family as well as decent school district. Following a tenant story that went from ideal to nightmare overnight (naturally on the day we were leaving for a two week vacation), and it appreciating back to its initial value, we sold in 2016, only losing out on the expensive transaction costs. We invested half of the proceeds into the market, keeping half for a future down payment on the next house when we finally determine a location we’ll be happy to settle down to.

2) Great question and I’ve never calculated it that way. According to the social security website my income increased over 50% during those five years as I purchased the home just a few months after starting my career. Looks like about 41% of gross income went to killing the mortgage (I also had a large down payment, a rare exception of graduating college with a strong cash balance).

Thanks, Jason!

Thanks for sharing the 41% of gross income data point. I was just trying to get a comparison metric that stripped away the cost of the real estate and income by looking at in on a percentage basis. For us, it is going to be about ~20%. It doesn’t feel as aggressive when you shared that you guys plowed almost double your gross income to paying off the mortgage.

Thanks again for sharing.

“Are you a fan of paying off your mortgage early?” No, because I prefer to use the leverage and try to invest in assets that generate a higher return.

“Have you been working towards paying it off early?” Not yet, I’d like to continue to put some income generating assets in place.

However, as they say personal finance is personal. I think if I were in your shoes I can see the attraction in removing the mortgage. It’s a small amount relative to the income of the GYFG household. In an apocalypse scenario (where income drops to zero) you still have your life settlement, peer street and rich uncles assets in addition to cash and the business interest (i.e. there are some assets that you could mobilise if you absolutely needed to) – and that doesn’t even take into account the HELOC. Given that no apocalypse is forecast – there’s no reason why you can’t quickly remove the mortgage, save yourself interest payments and then kick the investing into high gear using the additional cashflow that you’ll have once you no longer need to make mortgage payments.

HH

HH – what are you currently investing in that you find attractive right now?

I totally agree that they call it personal finance for a reason. What makes sense for the GYFG household probably doesn’t make sense for every household. If our income had not grown as fast as it has, we would have stuck to the original 7-year goal. That said, we also would not have embarked on this in lieu of maxing our pre-tax accounts and making other investments (which we continue to do).

I also see a scenario where we pay off the house, refinance to expand the HELOC, and then use the house as a revolving credit facility to start really building our passive income through rental real estate. This would allow us to “pay cash” for a property, secure a tenant, and then get financing to pay back the HELOC and lock in a fixed rate.

As many readers know, I tend to look at everything through a risk mitigation lens first, and knowing we still have housing in an apocalyptic scenario is very calming. Also, with tax reform, we no longer get any benefit from itemized deductions. The new standard deduction is $24,000 and the interest on our home is less than $12,000/year. Lastly, with baby GYFG on the way later this year, this gives us something to work towards, which won’t take any additional time to think about or manage.

Dom

Excellent Post! have you noticed when you have an idea or a loose goal, and all of the sudden you see it everywhere!!! ??

We’re currently paying off two rentals. 5 months to go on one, and 15 months on the other.

Congrats on such a hefty goal!

So true, Carlos! Good luck on your own goal of paying off the two rentals.

Dom

I’m glad you finally “listened” to your wife. 🙂 We paid off our mortgage in June 2016. It was very rewarding to have our house paid in full in less than 4 years. Our story isn’t too fancy. We purchased our house in a small community for $245,000. We put $95,000 down and we were living off of one income $70,000, August 2012. After I secured a full-time job February 2014, we promptly maxed out our investment savings Roth and my 401K and went to work on the mortgage (we had a 2nd child and bought a used SUV with cash during that time as well). Currently we’ve been socking most of the surplus in Index Funds. We’re looking at a couple of investment properties and hopefully “retiring” in 5-8 years. I understand your diversification mindset and really had to sell my husband on this, because when our house was paid off, we were probably at a 50/50 ratio for assets. However in the 2 years, it’s now 70% investments, 30% house and investments will continue to rise. Your income is absolutely incredible so the savings you’ll start to accrue in 15 months is mind blowing and you won’t even have to worry about diversification. Good luck and I hope you feel a sense of peace once that mortgage is gone. I know I did!

Joyful – That is fantastic, congrats! I think you’re right, diversification will come in a short amount of time based on our income and savings rate.

We are so excited to have a little mortgage burning party. I haven’t seen my wife as exciting about a financial goal as this one, so it’s fun to both be stoked!

So what was the reason that you finally converted to this viewpoint?

TheHardenedInvestor – I think it really came down to three things:

(1) We are expecting baby GYFG in November 2018.

(2) The possibility that Mrs. GYFG might not want to go back to work.

(3) The exponential growth of our income.

I’m also a lot more comfortable with the fact that we will be able to accomplish this goal in about one year. Although it’s not the highest return we could potentially earn, it is guaranteed and it won’t take much thought, especially in light of becoming parents for the first time.

As I have mentioned in a few other posts below, it is very likely that we will refinance after the mortgage is paid off to expand our current HELOC, and use it to start building our passive income through rental real estate.

Dom

Yeah kill the mortgage. It’s empowering and it keeps you secure in your home. We killed ours in three years and then were able to focus on building up investments.

Three years! That is amazing.

Dom

We’re doing both. Investing and paying off our mortgage. Slowly but surely makig progress. The slowball is rolling and the debt is shrinking. 🙂

This past April I paid off my mortgage of $267K in one swoop. I am a real estate investor and sold one of my properties that I owned free and clear for $234K. I had a decision to make – buy two smaller rentals for about $120K each which would generate about $1K each in rental income (gross) or just pay off mortgage by using the $234K from the sale and tapping into $33K of cash savings I had. Through a long winded financial analysis, it made more sense to pay off my mortgage. BOOM! It’s gone. Feels good.

That’s fantastic! What’s next?