Celebrate! Celebrate! We are officially members of the double comma club! That was one hell of a marathon and it is SWEET to finally cross the finish line. But our race isn’t over yet. This is one of those multi-legged races and we have only completed milestone three out of five on our race to Financial Independence. Then, after that milestone, we’re reaching for the bonus challenge of leveling up from Financial Independence to Financial Freedom, which for us is achieving a net worth of $10,000,000 (GYFG household FI = $3,000,000; FF = $10,000,000).

Keep in mind that it’s the 30th of December as I write this. If there is a significant decline in stocks on the last trading day of the month, this report will not reflect that. The portion of our net worth made up of stocks has definitely taken a beating with the recent decline into Bear Market territory. As I shared last month, November saw a recovery of most of the losses from the October correction. However, volatility came back with a vengeance and we saw the major indices take out the October lows, making new lows with the S&P 500 down 20% from its September all-time high.

Overall, our stocks portfolio (all in pre-tax accounts) took one on the chin with a decline of -8.2% MoM. Although this hurt, stocks only make up 15% of our portfolio, so a 10% move in either direction can only move our net worth by +/- 1.5%. In a normal month, this would have been enough to cause our net worth to decline. But our saving grace was the increase in value due to updating the valuation of a private investment (the one I hold in the company I work for). I will share more details on this below.

This marks the 47th month of net worth growth out of the 48 months I have been publishing them. In these four years of reports, our net worth has grown more than $800,000.

The ongoing volatility in the market has led to a lot of nervous chatter on the internet about fears of a recession on the horizon. Unfortunately, my crystal ball isn’t working at the moment and I can neither confirm nor deny if a recession has started or will start soon. I can, however, say with confidence that we are eventually due for a recession. The GYFG financial foundation is therefore purposefully strong and ready for whatever lies ahead. As many have continued leveraging up, we have been taking the opposite approach, and deleveraging the longer this bull market runs. I personally hope that the recent decline to lower prices holds, at least for a while. That way I get to take advantage of lower prices come January with my preemptively-set front-loaded contributions to my 401K, which I have set to max out within the first six weeks of the year.

It’s always easier said than done to invest when the market is declining. Emotions get involved, media chatter revs up, and it seems counter-intuitive to do what feels like “shoveling dollars into an incinerator.” But in order to get the full benefit of “dollar cost averaging” you have to keep the investments flowing in all market conditions. If the market continues to fall and I start second guessing whether I should continue to invest, I will just refer back to my post outlining the wisdom from the Oracle of Omaha himself and remind myself that it’s not a very good idea to bet against America.

If you’re a regular reader and only want to read the new content, feel free to just skip the intro below, and head to Net Worth. If you are new or haven’t read many of these reports, I encourage you to take two minutes to read the intro below, which does change periodically.

Intro

Mission Statement: To Humanize Finance, Build Wealth, and Reach Financial Freedom.

For those of you new around this corner of the internet, these monthly reports are about full transparency. And, they are just as much for me as they are for you. It was a hard decision to make all of my financial details public, but it has proved to be a very motivating one. The process I go through every month to produce these reports has been enlightening and life-changing. I published my first “income and net worth report” for January of 2015 when our net worth was only $195,141, and our gross income was on pace to hit $178,000 that year.

Four years later, our net worth currently clocks in at $1,012,865 with a gross income over the trailing twelve months of $475,745.

- That’s a 5.2X increase in net worth due to a compound annual growth rate of nearly 51% for the past four years.

- At the same time, income has increased 2.7X, which translates to a compound annual growth rate of roughly 28%.

Honestly, I don’t think the GYFG household would have experienced these kinds of results without the existence of this blog and the accountability it brings. Knowing that I will share our results with my readers every month keeps me very focused and intentional with all things related to our financial well being. For that, I THANK YOU for taking the time to read and interact with me on this blog.

Above and beyond this benefit to my own household, my sincere hope is that my policy of full transparency will inspire you to take the helm of your own financial ship and be intentional with its direction. I truly believe that anyone can reach financial freedom if he or she is willing to do things differently than the pack. If you’re after average results, then you’ve landed on the wrong site. There’s nothing wrong with average, but the kind of results I preach are EXTRAORDINARY. Sure, the “get rich slow” method is proven, but there is an alternative, which is to “get rich fast.” Look, I have no interest in living like a starving college student until I am old and brittle to only then have the means to check off bucket-list items when my body might no longer be physically capable of doing them. And I don’t want that for you either!

Here at GYFG, we approach the pursuit of FINANCIAL FREEDOM with an abundance mindset, so you won’t hear me telling you to cut out those $5 lattes. Choose to spend on what is meaningful to you. I spend a lot, but I also strategically earn a lot, save a lot and invest a lot.

I hope these reports inspire and move you to action. Don’t take a passive role in your finances and hope for the best. Keep this famous Jim Rohn quote in mind:

“If you don’t plan your future, somebody else will. And you know what they have planned for you? NOT MUCH!”

You must be intentional with your finances if you ever want a fighting chance to make it to financial freedom. But it does not have to take 40-50 years of slaving away for The Man before you have the option to retire. I think 10-20 years is all you need, with the most aggressive folks probably able to reach financial freedom in 10 years or less. A high income paired with a high savings rate are two of the vital components of a good recipe for the 10-year track.

I know I don’t have to publish my juicy details every month, but it’s important to me that you know that I put my money where my mouth is (not so many people giving financial advice actually do this). I publish all of my financial details not to brag, but instead to show you what is working as well as what’s not working. Sometimes finance can get pretty dense, and I think real life examples and numbers can help slice through the complexities (and BS). Personally, I have always enjoyed the financial reports put out by other bloggers around the blogosphere, so I have always intended to share my own.

You can find all my previous reports on the Financial Stats page.

Net Worth

Our net worth was up $117,864 in December vs November. Compared to last December, our net worth is up $348,474 year-over-year (+52.5%). We finally got our application to the Double Comma club accepted. Mrs. GYFG and I celebrated the milestone for less than a minute and then moved on to planning 2019. The seven-figure milestone is but a stop on a much longer journey. The first $1M took us ten years out of college to achieve. From our current vantage point, the next million looks like it will come much faster. If I had to guess I would say the next million will only take three years or less, with each million dollar increment taking less time than the last.

December Net Worth $1,012,865 (up $348,474 or +52.5% for 2018)

- Previous month: $895,001

- Difference: +$117,864

Net Worth Break Down:

Below is a more granular look at the nuts and bolts of our net worth – a peek inside the sausage factory!

The majority of the gain in net worth this month was driven by the increase in value to the equity I hold in the company I work for.

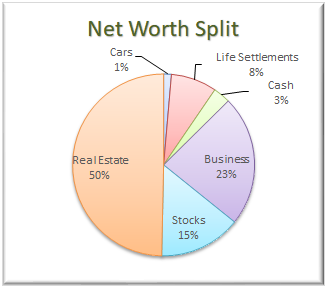

The Real Estate category decreased to 50% from 54%. This category includes the equity in our primary residence ($333,957), our investment in the Rich Uncles commercial REIT ($63,408), and our hard money loans through the PeerStreet ($105,581) platform. I have been taking capital as it’s freed up from our after-tax PeerStreet account and using it to fund Rich Uncles as we work the RU account value up to $100,000 (which is why PeerStreet value hasn’t been changing much MoM).

The Real Estate category decreased to 50% from 54%. This category includes the equity in our primary residence ($333,957), our investment in the Rich Uncles commercial REIT ($63,408), and our hard money loans through the PeerStreet ($105,581) platform. I have been taking capital as it’s freed up from our after-tax PeerStreet account and using it to fund Rich Uncles as we work the RU account value up to $100,000 (which is why PeerStreet value hasn’t been changing much MoM).

Cash decreased to 3% from 5%. We are currently holding $31,066 in cash. This is net of our credit card balances of $6,116, which we pay in full every month based on the statement due date.

The Business category increased to 23% from 12%. This represents the ownership I have in the private company that I work for. This is an illiquid investment that only gets an update to its value one time per year. Last year it was flat year-over-year but this year it’s up $123,918 (+38.4%). The increase in value is actually greater than this, but I only took 70% of the increase in order to account for taxes on an eventual liquidity event (I will be taxed at long-term capital gains on most of this but there is a small portion related to options that will be taxed at ordinary income rates). This is also a position that I have leveraged (in that the company loaned me ~65% of the value of my original investment + I have options) and therefore the $123,918 gain on my investment is actually an increase of ~118%.

Life Settlements decreased to 8% from 9%. We currently have investments in seven policies at $10,000 each. They are accreting in value by about $1,000 per month. For anyone that is familiar with options, I liken the fixed return of life settlements to the theta of a short option. In this case, the accreted value is like the theta decay of an option you’ve sold. In more simple terms, with this fixed return you are amortizing (realizing) that value with the passing of time.

The Stocks category decreased to 15% from 18% and represents the cumulative value of our brokerage accounts (retirement accounts and after-tax account) that are invested in stocks. However, this is not all of our retirement money, as the majority of our PeerStreet investments are made through a self-directed IRA (worth about $78,000 and are counted in the Real Estate category of the pie chart).

The Cars category decreased to 1% from 2% as anticipated.

Note: I include our cars because the goal is to keep the value of our cars as a percentage of the overall net worth pie as small as possible. By including them, it keeps me conscious of the opportunity cost of sinking too much capital into the machines that are only meant to get us from point A to point B.

Total Capital Deployed in 2018:

We deployed an additional $20,908 in the month of December, bringing the total for 2018 to $413,920. Please note the addition of two new columns to the table above: Dividends/Interest and 401K Matches. I will only update these two columns once per year as it’s too much of a hassle to update every month. I didn’t think we would break through $400,000 for the year but was pleasantly proved wrong.

I want to reiterate the point I made last month, that this is an unusually high amount of money for the GYFG household to deploy. It was possible only due to the following sources:

(1) We came into the year with about $81,000 in idle cash sitting in my 401K.

(2) In October of 2017, we sold our rental condo and ended up with about $93,000 in cash from that transaction and a significant chunk of that got carried into 2018 (in addition to existing savings).

(3) The rest has come from cash flow from the income we earn from our respective employers.

I don’t anticipate being able to put anything close to this amount to work in 2018. In fact, my 2019 forecast has only $182,583 available for deployment. With dividends, interest, and 401K matches earned this will likely increase to around $200,000 – less than half of what we will have deployed in 2018.

Gross Income

December income was up 31.5% at $46,533 vs. November of $35,396. However, this is misleading because I have realized all of our dividends, interest, and 401K matches in December as one lump sum ($21,517). Going forward, this is an anomaly that will happen every December. In years past, I never took the time to include these figures in our income, because it is a tedious exercise to do on a monthly basis and the numbers were very small. I now feel like the numbers are significant enough to include at the end of each year.

In the second chart above, I also track our income on a trailing twelve months, and we set another record in December at $475,745 (that’s eleven consecutive months of record highs). I had expected a dip this month but because of the lump sum mentioned above, it didn’t happen.

Savings Rate

Below is how we actually did vs. our goal of saving 50% of our after-tax income.

We finished the year with a 59% savings rate!

Speaking of savings rate, go check out my post where I mathematically prove the importance of your savings rate as a higher priority in achieving financial independence than your compound return! If you’re trying to build wealth quickly, then you have to read this post.

Mortgage Early Payoff Goal

After several refinances, our mortgage is a 3/1 ARM at 2.25% and we currently owe $116,043. We had originally set a goal to pay it off in seven years and three months but recently accelerated that timeline by a few years. In the progress bar below you will notice that we were originally working towards a goal completion date of 1/31/2022, but are now aiming to have this goal completed by 7/31/19.

For the past few years, I have been writing about the desire to avoid concentration risk and ensure diversification, and therefore not rush to pay off our mortgage. But in June 2018 we decided to go after this goal hard and fast. Why the change of heart? The first major driver is the fact that our income has grown far faster than we had ever imagined in our wildest dreams. Based on the 20-year plan I shared on the blog back in 2015, our income wasn’t projected to hit current levels until 2030 – that puts us 11 years ahead of schedule.

Prior to the 2018 tax reform, the tax benefit we received from being able to deduct the interest and property taxes was already minimal. And now, under the new reform, there is zero tax benefit (due to SALT limit and the increased standard deduction to $24,000 for a married couple which is greater than our itemized deductions). I still don’t understand why anyone could be dogmatic about keeping a mortgage for the tax deduction, which is worthless under the new tax reform for most households across the USA.

Moreover, why would you spend a dollar on interest to get thirty cents back? Why not pay zero interest and keep 70 cents out of each dollar that you don’t have to pay towards interest? Our lightbulb moment came when we realized that we could get this pay-off accomplished in about a year, which became very motivating when baby GYFG arrived. We feel this gives us a very strong financial foundation from which to spring into our next phase of life, and wealth-building.

This acceleration means that the equity value in our home will be growing rapidly over the next seven months, as will the percentage of our net worth concentration tied up in this asset. It currently makes up 33% of our net worth (down from 35.7% last month), and I anticipate it will make up as much as 40-50% of our net worth between now and July of 2019.

LESS THAN SEVEN MONTHS TO GO!!!

The original philosophy of this plan to pay off the mortgage was to accomplish this goal while avoiding any austerity to our lifestyle. I coined it the “pay more tomorrow” plan. In keeping with the GYFG emphasis on the income side of our financial equation, I decided that we could easily increase our income (after tax) by at least $9,600/year and dedicate that additional income to fund the goal effortlessly. This has proved to be not only true but also very conservative. To date, we have paid down the mortgage by $238,947 in four years.

This goal is now 67.3% complete (vs. 63.1% in November)!

Closing Thoughts

What an incredible year it has been. Life continues to exceed our wildest expectations. Every time we think it can’t get much better than this, it does, and we are both humbled and happily surprised. Our life feels surreal at times, especially for a boy from the “wrong side of the tracks.” We are grateful to be in the position we are today and don’t take it for granted. As we head into the new year we are gearing up for what we expect to be another EPIC year. Based on how the markets have been performing as of late it may not be a banner financial year but our focus in 2019 is around family, fitness, and fun. The financial arm has been programmed and will be on auto-pilot most of the year, freeing us to spend our time and mental bandwidth elsewhere.

I sincerely hope that you, too, had an amazing year in 2018. I would love to share in your success by hearing your highlights reel in the comments below.

Lastly, I will be coming at you soon with a post in the next few weeks outlining 19 steps for leveling up in 2019 – so stay tuned!

Happy New Year!

Gen Y Finance Guy

17 Responses

Hey Dom, Congrats on hitting the double comma club! Your families net worth growth over the years is nothing short of amazing. Are you guys done with pursuing rental properties in lieu of your private stock investment in the company?

Hey Aaron,

We are still interested in rental real estate but we want to have our house paid off and don’t currently want to leverage up.

We are also battling with whether we want to get in to the physical game or just invest through crowdfunding platforms.

It will be late 2019 or Early 2020 before we pull the trigger on any properties if we do at all.

Dom

Errmmm I see two commas in that net worth…congratulations!

The fact that you are enjoying life, growing your earnings, investing and casting-off the shackles of your mortgage (all whilst you have an almost 60% savings rate) is ace.

Talk about blowing the barn doors off. I think this update proves how critical it is to increase one’s income in order to build wealth.

There IS no limit to what can be earned but expenses can only be cut so far. Your numbers are a great demonstration that being intentional with your life, your career and your spending can yield phenominal results.

HH

Hey HH,

Yes, we did indeed make our debut into the double comma club.

I agree, we have all the variables working in our favor at the moment. I still wonder if this can last forever or if there is a major shoe to drop right around the corner. Either way, we are prepared for whatever life throws our way.

Earnings have played a much larger role in getting us to this milestone. Well, that, paired with a high savings rate. I have a great analysis that I think you might enjoy coming out in the next couple of months. It takes a look at how we have done against the original $10M blueprint and where the gains have come from – stay tuned.

I’m a big believer that the sky is the limit when it comes to the earning side of the coin. I think that growing your income is the only way to have your cake and eat it too. And as you said, there is a natural floor in how low you can cut your expenses.

Onward & Upward!

Dom

Congratulations Dom on joining the double comma club !

Looks like the GYFG household is firing on all 8 cylinders … I have been following you for about a year, and I told you this much in a different comment, that you would cross this milestone this year (2018).

Very well done, congratulations again, and godspeed ahead.

Carlos

Thanks, Carlos!

Awesome work – you must be ecstatic to have hit the double comma club by the end of 2018.

Yes, it was a great feeling to reach our stretch goal for the year.

We celebrated briefly and got back to work on the next million. We still have so much ground to cover in order to catch up to you 🙂

Wow congrats for reaching that important milestone. This is an amazing journey and your are a model of patience and dedication.

Keep on the good work !

Congratulations, buddy! I’ve been waiting to see this post for a while now.

You continue to crush it and are an inspiration to many (including me).

I’m gonna have to turn on the after burners if I’m gonna have any chance of beating you to $10M.

Happy New Year to you and your family.

Thanks, Michael!

I’m not slowing down because I still have so much ground to gain in order to catch you.

Happy New Year!

Dom

How did I miss this! Congrats, bro!

I told you that you were going to rocket past me.

Keep it moving. Next up, $5MM!

Church,

You were busy working two very demanding jobs so you could get your own six-figure increase to net worth.

I like the idea of skipping directly to $5M!

Dom