Here on GYFG, transparency is the name of the game. I put my money where my mouth blog is, and show you everything: both what works and what does not. Today it is time to check under the hood of my own PeerStreet experience, and let you know how it’s going. To recap, it’s been a year since I started investing in hard money loans through the PeerStreet platform. Within five months, I built up my initial $5,000 seed investment to $73,000 and in early 2018 I topped my total account value off to make an even $100,000. As I write, the current value of my total investment (across two accounts) is ~$103,000. I want to show you the actual Peer Street dashboards, so you get a feel for them, too.

PeerStreet is right on schedule as per expectation, and doing great in my portfolio. I’m very pleased. Which is to say that I’m in the boring phase of the investment, which should be the eventual goal of every investment you make, too! I’m always after a “set it and forget it mode” in my investments. After I have spent a huge amount of time vetting them, and doing my deep dive before committing even a single dollar, I then want some boredom on my part, and to step back to let time, compounding and automation do their thang. I did my work, now all my little $oldiers need to do theirs! A well-vetted investment that’s working as it should? Yes, please – that lets me get back out there to generate more capital!

So let’s check on the steak, and not the sizzle – how is this investment performing?

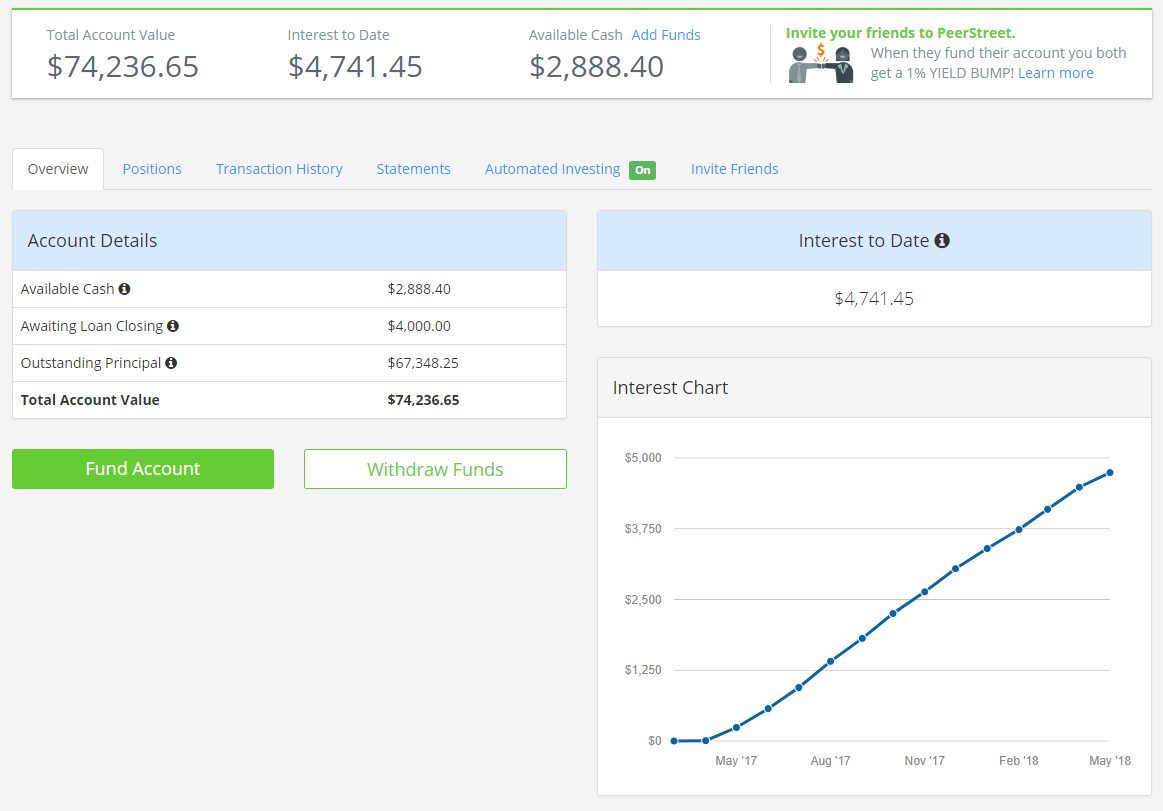

I have two separate accounts with PeerStreet: an after-tax account with about $29,000 (Account #1), and a self-directed IRA with about $74,000 (Account #2). Since 99% of my money in the self-directed IRA has been invested for about a year, that’s where I’m going to take the deepest dive today, and spend most of this post. That’s enough time to get a true read on PS overall. As with all “audits” of my investments, I’m looking at actual performance vs. expected performance. (Over five to ten years, not just this one year, I expect this asset class to deliver a pre-tax yield of 8%). But first, I will take a look at Account #1:

Account #1 (After-Tax Account)

In February 2017 I started this account with about $7,000. It wasn’t until late December 2017 that I added an additional $4,000 of investment capital. Then, in January 2018 I added another $18,000, which is why on the interest chart above you see it increased significantly. The reasoning behind keeping this particular account smaller than the pre-tax account was twofold:

(1) I was in the process of setting up a self-directed IRA (Account #2) with ~$70,000 from an old roll-over IRA, which I knew would represent the lion’s share of my PS commitment.

(2) The other consideration was the fact that any gains in the after-tax account would be taxed as ordinary income. Realizing that the GYFG household would be moving into a marginal tax rate somewhere in the neighborhood of 37%-42% based on our 2018 projected income, the after-tax returns would be between 4.5% and 5.04% – assuming an 8% yield.

The real reason I increased the investment in this account at all was simply to round off the investment to $100,000 as part of my stated goals for 2018. Additional pre-tax contributions were not an option. Since most of the capital in this account was contributed only over the last five months and because I had taken some withdrawals earlier on (I wasn’t sure if I wanted to maintain two separate accounts), it’s more complicated than Account #2, so I think it’s best to focus on the second account.

Account #2 (Pre-Tax Account)

This account funded on March 27th, 2017 with about $50,000 initially. I wasn’t sure how long it was going to take to deploy this much money because PeerStreet was still working on balancing supply and demand, which is why I waited to move the remaining $20,000 from the rollover IRA until a month later (on May 24th, 2017). It took about three weeks for the initial $50,000 to become fully invested at $2,000 per loan. The next $20,000 was fully invested within about two weeks of funding.

Now with $69,495.20 (the exact investment amount) spread across 35 loans, it was time to sit back and collect interest payments. After about one full year, as you can see from the above screenshot, this account has collected $4,741.45 in interest payments. I’m writing this on May 6th, 2018, so keep in mind that not all the money has had a full year of interest yet, while some of the money has been invested for a little over one year. So far this account has earned a yield of 6.8% to date.

I am a little disappointed that the PeerStreet platform does not calculate your time-weighted return for you. Believe it or not, I don’t feel like it’s worth the time to work through the math myself and would guess my time-weighted return is somewhere around 7%. This has fallen short of my overall 8% goal in the long-term but it has also only been one year. I believe this has happened for several reasons:

(1) There is a drag on returns caused by the amount of time it takes for available cash to be invested or reinvested. Not as big of an issue now, but in the first half of the year, supply was not as abundant as it is now. Free cash would have to sit on the sidelines – earning 0% – waiting for new investments to become available.

(2) There is a drag on returns due to the delay in the time between investment and funding the loan. It might take a couple of days between your investment and when the loan is actually funded. You don’t start accruing interest until the loan is funded.

(3) There is also drag created by the minimum investment of $1,000. You may have every intention to reinvest all of your monthly earnings but if the available cash is less than $1,000 you will have to wait for additional interest payments until you can invest the minimum $1,000.

(4) The allocation process at PeerStreet is also a variable that can create a drag on your return. Let’s say you have set up automated investing with a $2,000 desired investment amount per loan. A new loan may become available, but you may only get a portion or none of that loan based on your place in line to get a piece of the allocation. More detail from PeerStreet:

Our allocation system is designed to help investors get into the type of investments they want through two methods: Automated Investing and manual investing. A portion of each loan is made available for manual investing, making space available for investors who prefer hand-selecting loans.

Everyone enrolled in Automated Investing will be put in a line. If a loan comes up that matches your criteria, and it’s your turn in the queue, you will get placed into that loan. For clarification, you will either be allocated into your specified investment maximum or, if there’s not that much of a loan available, any balance greater than $1,000.

If there are more automated orders than availability in a loan then it is considered “oversubscribed.” Any individuals who receive an allocation to an oversubscribed loan will be placed at the back of the line. If you do not receive an allocation or if the loan is not oversubscribed, you will not lose your spot in line.

(5) Loans that are late with making interest payments create a drag on your return. I currently have four loans that are late 30 days, two loans that are late 60 days, and one loan that is late 90+ days in this particular account. BTW, this isn’t uncommon to have late payments from hard money loans.

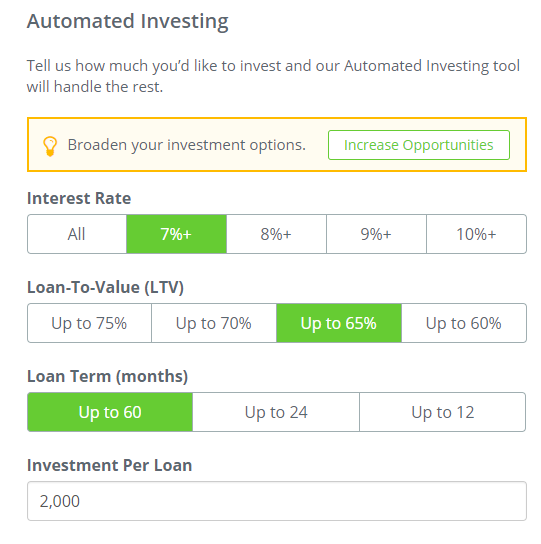

(6) Your investment criteria can create a drag on your return. This is true whether you manually hand-select loans or have automatic investing turned on. If you set the bar “too high” it will take longer to invest free cash, which means you’re earning 0% while you wait for investments that meet your criteria. Here is a look at my current criteria:

The only difference between this Account #2 and the after-tax account is that in Account #1 I only invest in loans with durations of up to 24 months. As supply has increased I have tightened my criteria to loans with a max LTV of 65%. This seems to be the right mix of risk mitigation and optimal yield, with minimal drag. I would like to move my LTV up to 60%, but I’m fearful that this would create too much drag on the account, with much less opportunity to remain fully invested.

The only difference between this Account #2 and the after-tax account is that in Account #1 I only invest in loans with durations of up to 24 months. As supply has increased I have tightened my criteria to loans with a max LTV of 65%. This seems to be the right mix of risk mitigation and optimal yield, with minimal drag. I would like to move my LTV up to 60%, but I’m fearful that this would create too much drag on the account, with much less opportunity to remain fully invested.

(7) Defaults are the last major piece – that I can think of now – that create a drag on your return. I currently have one loan in this account that is in default. Let me stress that just because a loan is in “technical default” doesn’t necessarily mean there are losses on the horizon.

Concluding Thoughts

Overall I’m good with the performance of this asset class to date, but I also think it is far too early to draw any long-term conclusions. I’m also not all that surprised that my account has yielded about 7% for the first account, especially since my automatic investment criteria has set 7% as the minimum rate I’m willing to accept (12 of my active loans are yielding 7%, with the others yielding something north of this).

I have noticed that a good percentage of the loans get paid off early, meaning that if the original duration was supposed to be ten months, it might actually get paid back in seven months.

I do want to reach out to the PeerStreet team to request the following enhancements:

(1) The ability to allow the auto investment feature to invest amounts smaller than $1,000 in order to reduce the drag on performance from cash sitting on the sidelines.

(2) Additional metrics added to the dashboard that show the following: time-weighted return, weighted average LTV, and weighted average return of current mix. Or even the ability to easily export all of your positions so that you can do the math yourself in a simple Excel template.

(3) It would also be nice to be able to have visibility into accrued but unpaid interest. As I mentioned above, I have six loans that are late with interest payments, and one that is in default. I anticipate I will get paid on those eventually, but don’t want to have to go and manually do the math.

It will be interesting to see what happens to yields as interest rates continue to increase, which to date doesn’t seem to have had an effect, probably due to the demand outstripping supply. It will also be interesting to see how this asset class performs during the next recession. Knock on wood, but there still have yet to be any losses to investors due to defaults (and thats over $1 Billion in loans funded). I attribute this to the equity cushion built into this asset class, which is a minimum 25% of downside protection. This means if a loan has a LTV of 75%, the value of the property would have to fall 25% before investor money is ever at risk of loss. In my case my average LTV is running south of 65%, so my equity cushion is 35%+.

There you go – PeerStreet is performing right on schedule as expected. As I said to begin with, it’s boring, which translates to, it’s great! Naturally, I will keep my eye on this allocation of my portfolio, but for all my analysis currently, it is full steam ahead PeerStreet.

Your turn! Are you investing through the PeerStreet platform (this site gets a little commission if you use my link)? What enhancements would you like to see? Let me know and I will share the feedback with the PeerStreet team. Can you think of any other forms of drag I may have missed? What other thoughts do you have?

– Gen Y Finance Guy

21 Responses

My main issue here is the taxes, at least with a taxable investment at a brokerage, you don’t pay taxes on gains till you sell… I know this gives you diversification, guess i’m just speaking from personal frustration.

I got into lending club a couple years ago, hoping i could get maybe 10-12% over the long run by choosing the right notes… needless to say i was never able to do it, i’m still hovering around 7-8% return before taxes. (my stock portfolio has way outperformed lending club)

I’ve been thinking of playing with investments like these, or fundrise but i haven’t pulled the trigger yet because i figure it will be similar to my lending club experience, even though they are different asset classes.

Half Life Theory – I hear you on the taxes. That is why 75% of my investment is held in a self-directed IRA. I favor PeerStreet over Lending Club or Prosper and have been slowly pulling my money from both of those accounts as the loans are paid back. I have less than $1,600 left in my P2P lending accounts.

I think Fundrise would be a bit different than PeerStreet since you will be on the equity vs. debt side of the investment. It’s more risk but that is offset by a higher expected return.

Cheers,

Dom

I have been with PeerStreet since August 2016 and have had similar experiences and satisaction.

I’d like to see a more divserse offering in terms of state locations as well as offer a state selection filter when it comes to the automated investing feature. It seems to concentrated in California at the moment.

Church – I agree that there tends to be a majority of the properties in CA. Looking at one of my accounts I see that 21 out of 38 positions are on CA properties.

If they added a state filter, where would you focus your investments from a geographic standpoint?

I’m interested to see how a few of the loans in my portfolio (there are now two in default) get worked out. One has a 60% LTV and the other has a 70% LTV.

Given the limitations on investor due diligence, I’d like to see more in the Boston to Washington corridor because there is a heavy population on the east coast that, in my opinion, will continue to maintain real estate values. In addition, I’d like to see PeerStreet chase places that are going through a major economic redevelopment due to big businesses coming in such as Austin, TX (Merk & Co.), Nashville, TN (AllianceBernstein) and Raleigh, NC (MetLife).

The default process is interesting, especially since the comments PeerStreet provides is at a 10,000 foot level. I’d like more detail into the bankruptcy and turn-around process; especially, I’d like to know how much the equity cushion has absorbed from external costs to take ownership and sell the property.

Still to this day, I standby my statement that their reputation is held up by “zero principle losses”. Myself and a buddy of mine both had default properties. Both principles were returned.

I invested with Peerstreet in mid-2016. I’ve stopped investing in new deals and plan to move my funds back to Vanguard when my remaining loans mature.

I only have about 20k invested so the $150 annual IRA fee is too much of an earnings drag. I’m not comfortable with the heavy California weighting. I’ve become less comfortable with the lack of diversification-one bad loan could wipe out all earnings for over a year. Money sits idle too long because good deals (based on rate/location/LTV) aren’t often available.

It has added a bit of complexity to my portfolio that I’ve decided isn’t necessary.

Hi Liz – You have to do what feels right for you and your overall financial plan. Simple is never a bad thing.

The $150 fee is felt a lot more on returns with lower account values.

All the best!

Dom

After over a year, my annualized return is clocking in at 6.83%, which makes my after-tax return about 3.25%. I really like the platform and think this would be an ideal income source if I were early retired. I’d probably put in about $150,000 and collect about $10,000 in income a year. I haven’t felt motivated to create a pre-tax account with PeerStreet because it would mess up my ability to do the Backdoor Roth IRA. I could invest Roth IRA money in PeerStreet but I’ve ultimately decided for now that I want all of my retirement accounts to contain a mix of stocks and bonds according to my asset allocation.

Josh – Thanks for sharing your experience. The after-tax return is not nearly as appealing to setting this up in a pre-tax account. I totally understand your hesitation to set up an SDIRA, due to your Roth IRA conversion. I have the inverse problem, in that I can’t do backdoor Roth contributions because I had multiple IRA’s out there.

Hey Dom, my sample size is much less than yours. Only four. Two went into default. One of those two finally paid off 10 mths after maturity. The other is still in default 8 mths after maturity and non-paying longer than that.

Good point about the time-weighted returns- I’m sure the IRR is much less than advertised due to the many points of drag you pointed out.

Hi,

I’ve been invested at Peerstreet since April 2018. I’m not doing very well. Of the 17 positions in my portfolio 1 is late 90+ days, 3 are late 60 days and 1 is late 30 days. The late, non-paying positions, represent 74% of my investment! I think Ally Savings is paying more than I’m earning at Peerstreet!

Hi RCW,

Thanks for commenting. It sounds like you got a bad batch of loans. However, I will say that hard money loans are notorious for being late payers. You mentioned that 74% of your investment is represented by the 4 out of 17 positions you have. That brings a few questions to mind:

(1) What were the criteria you used to invest in those loans (Max LTV, Duration, Interest rate, etc)?

(2) Did you hand select the investments or use the auto invest feature?

(3) Why did you put so much capital in 4 out of the 17 investments instead of spreading/diversifying your capital over the 17 loans evenly?

I have seen many of my loans go delinquent only to be brought current (with all accrued interest paid) and eventually paid off. I don’t think it’s anything to worry about yet but I would recommend you spreading your capital a bit more evenly. My rule is no one position can make up more than 2% of the account value. My account value is around $105,000 and my investments are set to $2,000 per loan (less than 2%).

Cheers,

Dom

I don’t think PeerStreet has a good risk department to calculate the loan interest correctly. I think default rate is too high & investors are not paid enough for the risk they are taking. I have a 7.5% loan which has matured but is late on returning principal. Unimaginable in my book. I expect loans that pay low 7.5% interest to be loans of high quality.

George – Do you only have the one loan? Or is this one loan of many in your portfolio? I don’t think you can draw that conclusion with such a small sample size. In my own $100K+ investment I have over 50+ loans I have observed the following:

(1) A high percentage of loans tend to be late at some point. 90% of the time the loans are eventually brought current.

(2) A high percentage of loans get paid back early

(3) I personally think that PeerStreet has a great risk mitigation filter. Only about 40% of the loans submitted make it onto the platform.

(4) There has still yet to be any losses to investors yet, another hat tip to PeerStreet risk filter.

(5) I personally think the rates are justified given the equity cushion you have before your capital is ever at risk.

(6) A default doesn’t equate to losses to the investor. My portfolio has an average LTV of about 63% and I sleep very well at night knowing that the properties value would have to sync 37% before my capital was at risk.

Anyways, if you’re willing to share more details about your investment and other positions, I’m happy to continue the dialogue.

Dom

I started investing with them in Jun 2017, invested $4000 in total. The system made 8 investments.

Many loans were paid early. Currently I have 2 positions. If this loan goes into default, I will be at loss.

If it does not, my overall return for this period would be ~7.5%.

As I said, I expect the 7.5% loan should be pretty safe investment with very small default rate. At least it’s at LendingClub. And I don’t like the fact that they for some reason don’t bother to calculate investors’ IRR.

Thank you for sharing details about your personal experience with the platform. Have you tried to get estimate of your IRR?

George,

A default doesn’t equate to a loss. I have had several loans go into default and although it was a pain to wait it out was made whole on my entire investment and the interest owed to me. I would argue that your sample size isn’t large enough to be representative and at $1,000 minimum investments, each loan is too concentrated within your loans portfolio.

As you read in this update, I’ve currently earned just shy of 7% after my first full year. I will do another update sometime in 2019.

I have recently asked the PeerStreet team to add an enhancement that would show you the accrued but unpaid interest across all of the loans that are late or in default. Based on the risk parameters of my own loan portfolio with an average LTV of 63% I believe all my loans will eventually return my capital and interest earned. I’m not saying there will never be any loss of principal but I think it will be rare with that kind of equity cushion.

These days I have set my automatic investment to only invest in loans with a 60% LTV and 8%+ interest rate.

Dom

I really wish I could figure out how on earth you got those results. I invested in PS over a year ago, choosing only loans generating 8% or more and reinvested the proceeds consistently. I figure I’ve gotten a little over 7% on an annualized basis. The major downside is that an increasing number of the borrowers have been late with payments and non-responsive. One is in foreclosure and two others are headed there. On the latter, the borrower or the originator got a sweetheart appraisal that is way over valued. If the economy sputters, I’d conjecture this would get much worse. From my optic, seems way too much risk for the level of return. Welcome your thoughts.

Hi Jo,

Can I ask how much capital you have invested and how many loans you spread that across? My suspicion is that you may not have a large enough sample size and are concentrated in too few loans.

Also, hard money is notorious for being late from my experience these past few years, but have so far all been brought current at some point. I have also had loans go into default but have not experienced any losses to date.

As the economy has continued its bull run, I’ve tighten up my investment criteria to a max LTV of 60% and a minimum 8% interest rate.

This reminds me that I should do a post update now that I’ve been investing for almost 3 years on the PeerStreet platform.

Cheers,

Dom