I recently read Josh Brown’s book How I Invest My Money: Finance Experts Reveal How They Save, Spend, and Invest and thought it would be a good exercise for me to take Josh up on his offer at the end of the book to write my own essay on how I invest my money. Think of this as my money philosophy defined by a set of standard operating procedures.

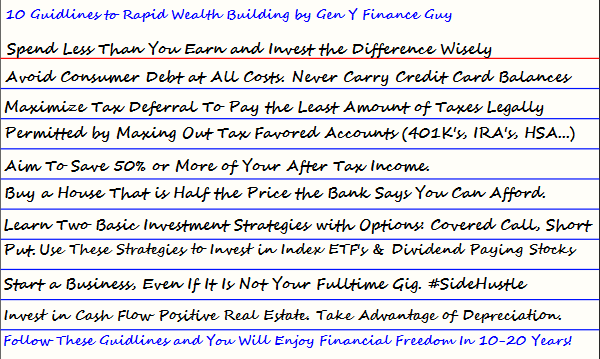

The first time I really thought about money in a structured way was back in 2015 when a blogger friend of mine asked me to participate in the “personal finance index card challenge,” where you get only a single index card to convey your best financial advice. The idea was that personal finance didn’t have to be complicated and that it shouldn’t take more than an index card to explain all the (best) financial advice someone might need. I’m still in contact with Adam Chuddy (my blogger friend) but his blog is no longer around so I dug up the index card I had originally created for his blog to memorialize it here (time-stamped as of 10/5/2015). I had only been blogging for a bit over twelve months and this was my first attempt at articulating what I thought to be all the advice you would need to not only be financially sound but to build wealth rapidly, which to me means reaching financial independence in 10-20 years.

A couple of months later I thought these guidelines ought to be expanded on for those interested in digging deeper, so, I wrote 10 Guidelines to Financial Independence (it was originally a guest post that was published on March 23, 2016). It wasn’t until February of 2020 that I thought about these again and shared them again on the blog with a few slight revisions – now referred to as The Tenacious Ten – a set of guidelines to achieve Financial Independence in 10-20 years.

I want to use this post to not only refine these ten core principles that have guided many of my money-related decisions over the years (the HOW) but also to explain the WHY (this is what really keeps you motivated).

The HOW

The spirit of what I share below is still very congruent with what I’ve shared previously but more succinct and better articulated through the lens of a practitioner. I admit that I was just a student of personal finance back when I originally wrote that index card and I hadn’t personally battle-tested these principles. By studying those that had accomplished what I wanted to accomplish I had adopted a set of principles; for the last six years, I have been battle testing them. With time and experience only now can I refine them into this post you are now reading.

(1) Income obsessed. Focus 80% of efforts on increasing income.

(2) Tax minimization. Defer taxes for as long as possible to allow investments to compound uninterrupted. Take maximum advantage of tax-favored accounts. Leverage the IRS code to pay the least amount of taxes legally permitted. (I once read a tax strategy book that helped me see the 50,000+ pages of tax law as 50,000 pages on how to pay the least amount of taxes possible. I paired that new lens with a really good attorney and CPA to help me take full advantage of the tax law to legally minimize taxes every year since.)

(3) Spend Less Than You Earn and Invest the Difference Wisely.

(a) Save 50% of after-tax income.

(b) Spend 50% guilt-free.

(c) Invest in assets that appreciate and/or produce positive cash flow (see #3 on risk mitigation).

(3) Risk Mitigation Lens First. Optimize for return of capital before return on capital by building in what Warren Buffett refers to as a “margin of safety.” Don’t overextend yourself by taking on too much debt or living too rich of a lifestyle.

(a) Cost basis reduction. Options are one way to do this by selling puts or writing covered calls (available on equities, commodities (futures), and Crypto)

(b) Conservative debt use on both investments and living expenses.

(i) Avoid Consumer debt at all costs and never carry a credit card balance.

(ii) Buy a house that is half the price the bank says you can afford (or less).

(c) Run from investments that sound too good to be true.

(4) Acquire Equity. This acts as a real wealth accelerator whether it is equity in your own business or that of someone else. Even better if you can do both!

(a) Start with a side hustle that could potentially turn into your main hustle.

(b) Negotiate stock/option-based compensation from your employer. Definitely participate in the discounted employer stock purchase program.

(5) Never Stop Learning. If you want to earn more then you have to learn more. This always requires a mental agility that enables you to adopt new mental models that either build on previous ones or are a complete paradigm shift due to a massive evolution in the world (the biggest one for me recently has been learning about and embracing Bitcoin as a new component of our monetary system and potentially a replacement long term).

As you can see, the “how” for me hasn’t changed all that much over the years; it is just better bucketed and articulated.

The WHY

When it comes to the why behind all my money beliefs and actions it boils down to four major things that I’m optimizing for.

(1) Peace of mind. I would much rather be able to sleep well at night than pursue the most financially optimized investment path. This is why I’m not aggressive in my use of debt, no matter how cheap it is. Although debt can magnify your returns on the upside, it can also be disastrous on the downside. My aversion to debt is driven primarily by my preference for ultimate optionality (see below).

(2) Optionality. Money is a tool that if used correctly should “buy” you options in life. It boils down to lifestyle design. How you leverage money in your own lifestyle design will dictate where you land on a spectrum: those that are good stewards of their wealth get to both live well and give well. Those who are not responsible with their spending end up living paycheck to paycheck, with little choice in how they get to live their lives. There is no living well at that end of the spectrum, and most certainly no giving well.

(3) Live Well, Give Well. It’s my job to figure out how to accumulate enough wealth to allow my family to both live well and give well. I decided early on that this would only be fully achieved if we could get to a point where money was no object (Part I and Part II), which leads us to the final optimization below.

(4) Accelerated & Sustained Financial Freedom. The slow path to wealth didn’t fit our life plan nor did extreme frugality, so I treated the personal finance space as the all-you-can-eat buffet that it is, to devise a plan to get our family to Financial Freedom in 10-20 years. Financial Freedom is the linchpin to making it all work. We’ve been tracking our progress against my self-defined five major stages of financial independence, which I differentiate from Financial Freedom, and will reach the final stage by the end of 2021. The last bonus stage on this journey is Financial Freedom and hitting our $10M net worth target.

This is how I invest my money!

I encourage everyone to go through an exercise like this to define your money operating and navigational system. Please feel free to borrow anything from what I have shared to date if you think it fits your unique journey.

– Gen Y Finance Guy

5 Responses

I think you are right to list “Peace of mind” as the number one thing you are optimizing for. If you are constantly stressed about money or your investment strategy, it is probably the wrong strategy. But you also have to keep learning so that you can keep iterating on your strategy and developing even further peace with your financial decisions!

Always be learning. Bitcoin has the potential to be the massive paradigm shift in the payments space. Great point about investing in equity. I believe equities are the best investment opportunities out there today.

Hi Gen Y Finance Guy,

I first discovered your site on Financial Samurai, which I’ve been following for a few years now. I think this is an awesome post and rings true to anyone who truly desires a better financial outlook in life. I learned to follow many of these principles from the greats who not only talk the talk but walk the walk…. it’s a huge part of what inspired me to go into personal finance as an entrepreneur versus my previous career.

By the way, I love your backstory and the choices you made to turn things around. Many of us come from the humblest of beginnings and find ourselves on the path to living the dream.

I’ll definitely be adding the book that inspired this post to my shelf this year.

I’m glad you enjoyed it.