Sorry for the delay in getting a post out this week. Being on vacation and coming back to an insane week at work didn’t allow me much time to get the May report updated until this morning.

Enjoy!

GYFG here checking in for the May monthly financial report. If you have been reading these reports for a while you will notice that I introduce each month with the same intro month after month. I do this for two reasons, a) for the newbies to the site (which make up about 50% of the sites traffic) and b) to remind everyone what these reports are all about. By all means if you have read the intro at least once, then please feel free to skip down to the “Summary of May 2016” section where the new content begins (click the orange link to be taken there automatically).

For those of you that are new around this corner of the internet, I wanted to fill you in as to what these reports are all about. These monthly reports are about full transparency. They are just as much for me as they are for you. It’s a hard decision to make all of your financial details public, but it’s also a very motivating one. It’s not just the post, but the process of putting this post together that really benefits me.

My sincere hope is that my transparency will inspire you to take the helm of your own financial ship and be intentional with its direction. I truly believe that anyone can reach financial freedom, if they are willing to do things differently. If you earn an average salary and have an average savings rate, then you can expect an average result! That means you will likely have to work at a job you may or may not enjoy until you’re 65 and then maybe you can retire IF you’re lucky.

Hey, there is nothing wrong with average. If you’re happy with average, then by all means keep doing what everyone else is doing. Not sure how you feel about that, but I have no interest in living an average life. I want EXTRAORDINARY.

Most people don’t want to live below their means in order to reach FINANCIAL FREEDOM, because that’s painful. They think it involves cutting out all the joy in life. You know what I’m talking about, those financial gurus that tell you that in order to get rich you need to cut out the $5 lattes and stop going out to eat. Then after 40 years of diligent and above average savings and super low spending, you will be a millionaire. Basically, you have to live like a college student and suppress all the things you want to do in life and then when you’re old you will be rich.

Okay, that doesn’t sound like the plan for me either.

The good news is there is another way. This site and these reports are here to show you the OTHER path to financial freedom. There is a way where you can have your cake and eat it too. I believe and hope that over time I will be able to convince you of the following:

In order to reach financial freedom you can choose to live below your means by cutting expenses to the bone and living in a state of scarcity or you can expand your means and live in a state of abundance by increasing your income and enjoying the $5 latte or other indulgence of your choice.

Not only that, but if you’re diligent you can reach financial freedom a lot sooner than anyone has ever led you to believe.

Our Mission Statement:

To Humanize Finance, Build Wealth, and Reach Financial Freedom.

I know I don’t have to publish my juicy details every month, but it’s important to me that you know that I put my money where my mouth is (because not that many finance blogs or people giving financial advice do this). I publish all of my financial details not to brag, but instead to show you what is working as well as what’s not working. Sometimes finance can get pretty dense, but I think real life examples and numbers can help slice through the complexities (and BS). Personally, I have always enjoyed the financial reports put out by other bloggers around the blogosphere.

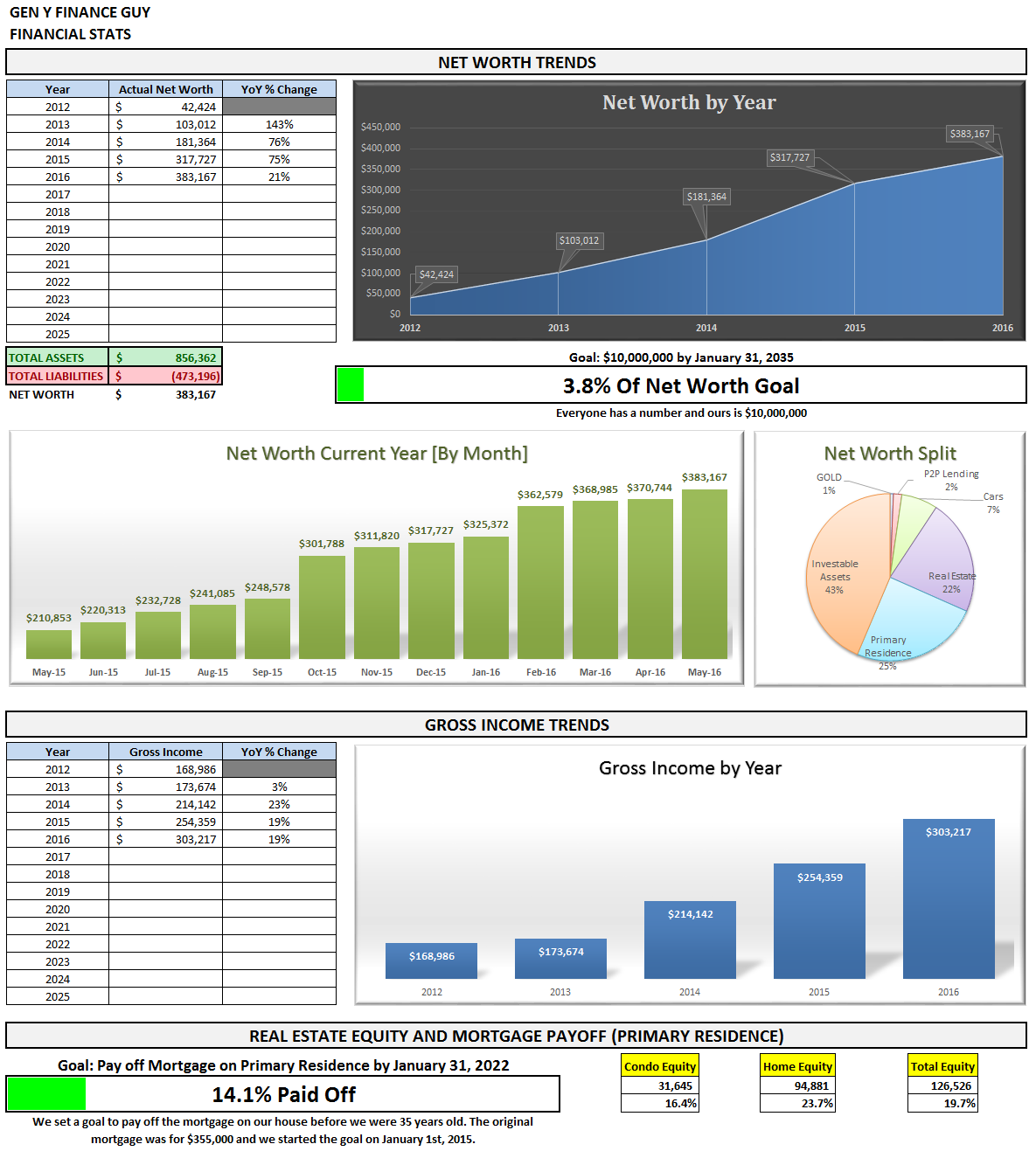

As always, you can find all my previous reports on the Financial Stats page (as well as annual trends and a few other financial metrics not found on this report). In these monthly reports the plan is to give you a month over month update on Gross Income, Assets, Liabilities, Net Worth, Expenses, Contributions, Savings Rate, and progress on the mortgage pay down goal.

Summary of May 2016

Wonder how I pull all this information together every month?

We use Personal Capital to aggregate and consolidate our transactions from across all of our financial accounts (checking, savings, retirement, credit cards, mortgages, HSA, and other investment accounts). At the end of the month I then drop that information into my financial stats spreadsheet for this monthly report.

Tracking your finances is, in my opinion, the best way to stay on top of your finances. You can’t optimize what you don’t measure. You can’t make informed decisions if you don’t know what you having coming in vs. going out. Without a holistic view of how much you spend every month, there’s no way to set savings, debt repayment, or investment goals. It’s a financial freedom must, folks.

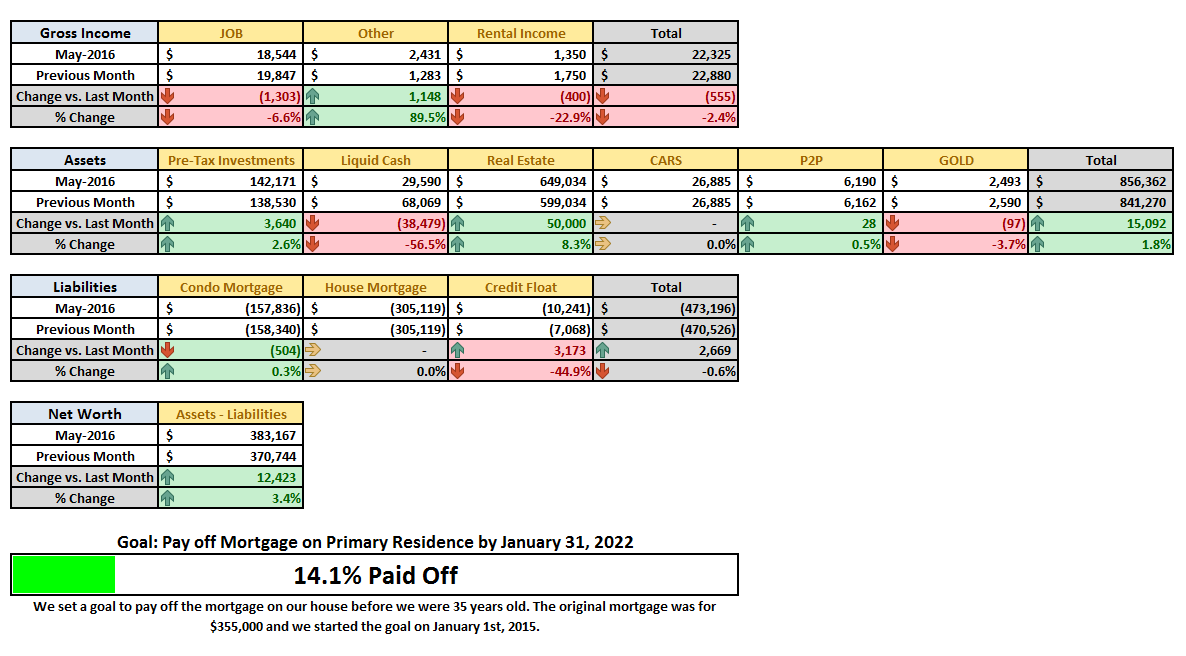

Month Over Month Financial Summary

Just three things to point out in case you missed it:

- Cash took a -56.5% hit due deploying $50K in the form of a hard money loan at 8% (with my in-laws), with the offset in Real Estate popping 8.3%. We expect to get this back in full by the end of July.

- You will notice that our mortgage on our house remained flat month over month. This is due to the refinance and no payment in May.

- Our credit card float increased substantially from $7,068 to $10,2418 for a 44.9% increase.

What went down in May?

Last month I was forecasting a drop in income down to $18,200/month, yet we beat it again (I know it’s probably getting old hearing this). Mrs. GYFG continues to blow her numbers out of the water bringing in an additional $5,000 in income again this month (that’s 5 for 5 for anyone keeping track). And next month is looking great for her as the business has been booming, and she may have a record income month in June.

Since Mrs. GYFG has been so consistent, I am now forecasting income for June at $22,000. This is up from the $18,200 I have been forecasting the past 3 months.

Here is a look at the trend for the last 13 months:

I updated the 2016 forecast, and it’s now forecasting gross income of $303,217 for 2016 ( I still think we will actually come in closer to $315K or more). If you’ve read my blueprint for how I plan to reach $10M, you will notice that we have jumped about 6 years ahead of schedule on the income front.

I didn’t have us at this earning level until 2021 in the original blueprint…which will obviously need to be updated (post to come probably ???? when I get some free time back, work has been insane lately).

On an exciting note my promotion to VP has now been escalated to a C-Suite position later this year. That means although 2016 will be a great year financially, 2017 is setting up to be AMAZING!!!

Post to come soon…

The Juicy Details

- Previous Month: $22,880

- Difference: -$555

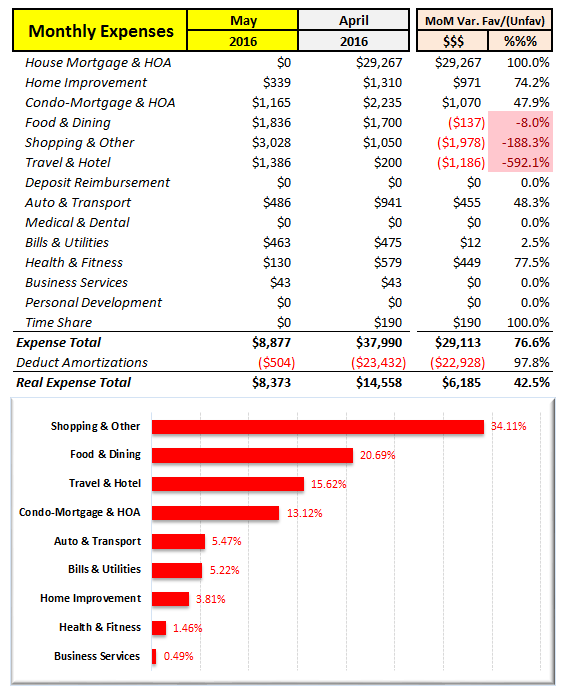

Now where did all that money go?

I have come to the realization that there are always going to be unplanned expenses. Our goal is to save 50% of our income and live off and enjoy the difference guilt free. With that type of rule governing our financial life, it is a free pass to inflate our lifestyle, but only proportional to our income. You can see prior financial reports here. We do however try to line up expenses with expected income as much as possible.

Notes on May Results:

1 – House Mortgage & HOA down favorably to the tune of $29,267. This is due to the cash-in refinance we just completed in April. We refinanced our 5/5 ARM at 3.625% into a 3/1 ARM at 2.25%. We didn’t have a mortgage payment due in May.

2 – Home Improvement should continue to slow down as we had front loaded the year.

3 – Shopping & Other About $600 of this is due to a cash withdrawl from the bank for spending money on our Costa Rica Trip. It probably should have been classed in Travel & Hotel…but I am too lazy to move it. My wife got her hair done and bought all her face creams and lotions that she does every 6 months. There was some shopping done for the trip and I bought several hundred dollars worth of books to replenish my stack of unread books.

4 – Travel & Hotel Since we knew we would not have a mortgage trip this month AND the deal was right, we went ahead and booked our tickets for our St. Thomas trip at the end of the year.

As expected our expenses overall were down substantially due to some one-time expenses that hit last month as well as the skipped mortgage payment. Currently I have expenses jumping back up to around $10K next month as we have to resume making mortgage payments.

Through the end of the year we should be able to keep spending flat vs. last year when you adjust spending for amortizations. More importantly, as you will see below, we are still on track to hit our 50% savings rate goal. I will do a YTD analysis in the month of June to see how we are doing and if we need to make any course corrections.

Here is the trend for the last 13 months:

I have now changed the chart to reflect the add-back of loan amortizations to reflect what I call “real spending” above. This is done because amortizations are really just a balance sheet transfer from cash to pay down liabilities, it has no impact to net worth.

CALL OUT: It is crazy how slippery money can be. Because of this I totally recommend you automate as much of your finances as possible, especially the saving and investing piece. We set our financial goals at the beginning of the year and then automate the process of reaching them.

Examples:

Our mortgage payment is automatically set up to pay $1,600 in additional principal.This will be put on hold until further notice (see below)- My 401K contribution is automatically deducted at a rate that will ensure I max out by year end ($18,000)

- My HSA contribution is automatically deducted at a rate that will ensure I max out by year end ($6,750)

All of these things take priority over any spending that we do in a given month. We monitor expenses but don’t really manage them. Instead we manage savings and investments and let the expenses work themselves out.

What were Investments and Contributions?

- Contributed $0 There is no longer any tax benefit for us to contribute to my wife’s IRA due to our income level in 2016.

- Previous month: $0

- Difference: -$0

- Contributed $962 Into my 401K. Contributed $8,988 so far in 2016.

- Previous month: $962

- Difference: -$0

- P2P Lending $0 We now have $6,000 invested here (post to come soon). We opened an account with Lending club in March. Trying to spread the love 🙂

- Previous month: $0

- Difference: -$0

- Rich Uncles REIT $0 This was from reinvested dividends. We currently have $5,555. We will be liquidating this position sometime this summer as we finally gear up for our 2nd investment property. If you have been reading for a while, you know that a little over a year ago we put money here because we decided we were not ready for another property.

- Previous month: $0

- Difference: $0

- Increase in Savings $11,521 This includes checking, savings, and CD’s.

- Previous month: $0

- Difference: +$11,521

- HSA Contribution $488 This is set up to max out by the end of the year. We currently have $8,000 here.

- Previous month: $488

- Difference: -$0

Total Investments & Contributions $12,971

- Previous month: $1,450

- Difference: +$11,521

Savings Rate

Below is how we’re tracking to our goal of saving 50% of our after tax income.

You can see that although our goal for the year is 50%, we bounce all over the place on a monthly basis.

So far in 2016 we are still on target to hit our goal of 50%.

Speaking of savings rate, have you checked out my recent post where I mathematically prove the importance of your savings rate as a higher priority than the compound return? If you’re trying to build wealth quickly, then you have to read this post.

Net Worth and Mortgage Pay Down Update

My ultimate goal is to build up a Net Worth of $10M returning 6% a year or $50,000/month in gross income (at the end of May we are officially 3.8% there). Don’t freak out, this is only about $5.5M in today’s dollars when you take into account a 3% inflation rate.

I am not anywhere close to a 7-figure net worth yet (or what some refer to as the double comma club). However, it is growing at a very respectable rate (just take a look in the side bar for growth at a glance). If you want to see how I plan to get there you can read all about it here (soon to be reviewed and updated at some point).

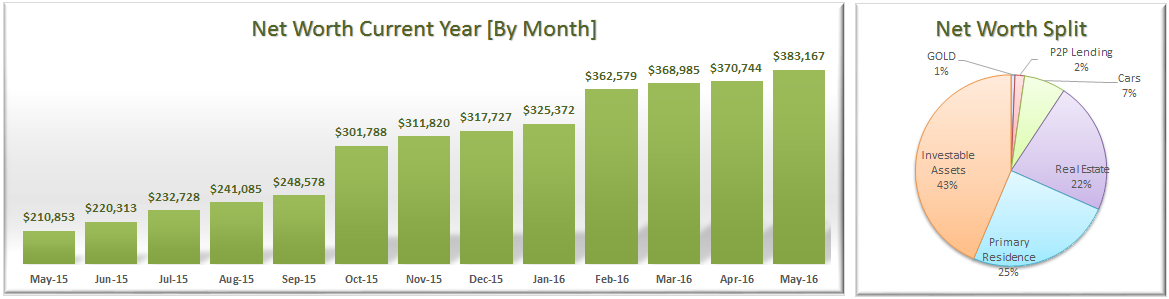

May Net Worth $383,167 (this puts us up $65,440 or 20.6% vs. 2015 with 7 months to go)

- Previous month: $370,744

- Difference: +$12,423

Since publishing the first financial report we have been able to post 17 consecutive months of positive gains to Net Worth. Let’s see how long we can continue this trend. The larger the number becomes (and the more invested we become), the more difficult it will be to continue this trend.

Net Worth Component Break Down:

With the refinance closing in April, our primary residence has crossed a threshold over our target of 25% or less of net worth. This means we will be discontinuing our additional principal payments until we can dilute this number to reduce our concentration risk. This doesn’t really effect the pay down goal, as the refinance forced us to bring in enough cash to satisfy our scheduled extra payments through April of 2017.

Speaking of net worth, the next 3 months should bring some very healthy increases. We are currently forecasting an increase of about $38,000 over the next 3 months. We are currently on track to increase net worth by $122K in 2016 vs. our original goal of $112K.

Something I have been thinking about and worth pointing out is that our net worth was actually negative to the tune of almost -$300K back in early 2009, so we have come a long way in a relative short period of time. Until now I had only reported our ending net worth from 2012. I am thinking up a post that would give the full story of how we started so negative right out of college and how we have improved it so dramatically in such a short period of time. I mention the first drag in this post about our investment condo.

Note: I think people tend to glaze over the fact that the savings rate plays a much bigger role in increasing your net worth than the rate of return on your investments (in the early days of your journey). In the short term, savings rate has a bigger impact on net worth. The goal is to eventually build a big enough asset base that the gains from compounding will eventually outpace the gains from savings. Actually, check out the post I recently wrote: Savings Rate – The Most Important Variable to Wealth Building [and the math to prove it]

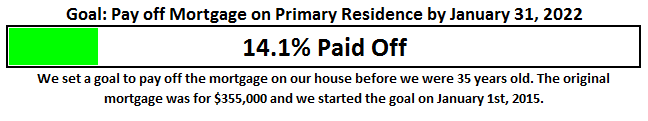

Progress On Our Mortgage Payoff Goal

You can read about our strategy to pay off our mortgage in 7 years (and 3 months). When you break it down and follow the 3 simple rules, it’s not as hard as it sounds. We bought our house in February of 2014 and then refinanced it into a 5/5 ARM in September of 2014 to remove PMI and free up cash-flow to put towards the principal and keep us on track to pay the mortgage off at an accelerated pace. We have since refinanced again into a 3/1 ARM at 2.25%, which has freed up almost $400/month.

The progress chart above shows how much of our goal we have completed. The goal completion percentage is flat vs. April due to no payment due or extra payments made. Going forward until early 2017, we will only be making our regular payment, and thus amortizing the loan at about $600/month.

This goal will move a bit slower over the next few months as we work to reduce the concentration of our net worth in this area. We should be able to get it well below 20% by January of 2017.

The End

I hope these reports inspire and move you to action. Don’t take a passive role in your finances and hope for the best. There is a famous Jim Rohn quote that I think everyone should keep in mind:

If you don’t plan your future, somebody else will. And you know what they have planned for you? NOT MUCH!

You have to be intentional with your finances if you ever want a fighting chance to make it to financial freedom. It doesn’t have to take 40-50 years of slaving away for the man before you have the option to retire. I personally think that 15-20 years is really all you need, and for the folks that are more aggressive (i.e. extremely frugal, not us) or very high earners you can probably reach financial independence in 10 years or less (maybe us, it’s yet to be seen but income is our focus vs. expenses).

I am looking forward to chatting with you all in the comments below. How was your month? Also, if you have a blog, I encourage you to write a monthly financial report and come back here and share the link. I would love to be part of your support and accountability.

One last thing before we go. If you are new or even if you’re not new and you have been wanting a more guided tour of the blog, I finally launched a “Start Here” page. I highly recommend you check it out.

Cheers!

– Gen Y Finance Guy

Oh, you’re still reading.

Do you want to help keep our lights on? You’re under no obligation, but if you were already thinking about it or were a little bit curious, why not help us out?

Here are a few ways you can help us out:

- Personal Capital – You know how big I am on tracking my finances, that’s why I totally recommend Personal Capital’s FREE software that helps you see all your financial accounts in one secure and convenient place (checking, savings, investments, and retirement accounts). Without a tool like Personal Capital, these reports would take 2-3 times as long to complete. You want to track your income? Your expenses? How about your Net Worth (who doesn’t like watching that bad boy climb). Just sign up and link your accounts today. Absolutely FREE to you!

- Prosper or Lending Club – Lending to consumers is a great industry that’s produced profits year after year for a handful of banks. Now with Prosper, you as the investor get unprecedented access to this market. My personal P2P portfolio is earning over 5%. Open a FREE investment account today!

- TD Ameritrade – They are hands down the best broker for the retail investor. TD Ameritrade provides a number of investing platforms that are more robust than any other platform I have ever used. My particular favorite is the “Think or Swim” platform. Oh, and did I mention that they have over 100 ETFs that you can trade commission FREE?

- Blue Host – Have we inspired you to create your own blog? Well let me save you some money. This is the hosting company that I use for this blog. It is stupid cheap and the customer service is amazing. The normal price is $5.99/month, but if you use this link you will get a 34% discount (only $3.99/month). It took me less than 5 minutes to buy my domain, install wordpress, and get the first version of this site up and running.

OR you can check out our Recommended Products and Resources page.

21 Responses

Whoah. C-Suite!!? Is that what that tweet was all about? Can’t wait for the details!

BigLaw – Yes, that is what the tweet was all about 🙂

Fantastically making progress to your goals.. You’re inspiring me! Starting my first job out of college in a month so I will have fun tracking my income and expenses as you do 🙂

Glad to here it Finance Solver!

Do you already have a job lined up for when you finish college?

I sure do! Will be working in a rotational program! Thought it would be a great way to learn different sides of finance because of the rotational feature.

Very nice!

Hey excellent job excited to hear the details on this promotion. I recently landed the biggest client of my career, so I guess that could be considered a promotion as well 😀

I know ever since I have been posting here I talked about how I thought zillow had the value of my condo about 100k less than actual market value, and it seems zillow is finally seeing the light. The value of my condo jumped $45k in the month of May via zillow, I still think it has another $40-50k to go. It was also a fantastic income month and our expenses have dropped dramatically with the honeymoon paid for. Our net worth has officially broke through $500k, all the way to $505k. We will see what June has in store, but it looks like zillow is finally catching up to my perceived market value which should give another $40k or so tail wind for us.

All good developments for both of us! Keep up the good work and looking foreward to hearing how much this promotional is going to hurt my chances in our race 😉

Sean – Congrats on landing that Whale (I think that is what they call them in your biz right?)

And nice to see you crossing the $500K threshold.

I have lots of work to continue doing in order to close that gap in Net Worth. By end of July we should cross over the $400K mark and be at around $414K with a decent bonus month for me.

Onwards & Upwards!

I just checked Zillow and Redfin for the estimate on the value of our home. Zillow has it at $389K and Redfin has it at $457K. However, we just got a refinance done that required an appraisal that came in at $400K. I think we could get more than $400K for our house if we sold it now, but I will continue to carry it at $400K. If I didn’t have the appraisal, what I have done in the past is hold it at comparable sales in the same neighborhood that are the same floor plan. So, from a net worth stand point I am leaving about $23K on the table for now.

Going to adjust the value of our cars again next month (June), as the plan is to do that every 6 months. That will cause net worth to take a hit for that piece, but will also bring the value of our cars to even small amount of the total (which I like). In total I will be adjusting them down about $5K.

It has also been about 16 months since I adjusted the value on our rental condo. A condo in our complex with the same floor plan just sold for $215K, so I will be booking that gain in Net Worth in June (will be about a $20K pick up to Net Worth). Need to be better about updating this every 6 months, I just totally forgot about it.

Yeah I’ve noticed Zillow to be historically low for my condo as well. Our $505k net worth is just using Zillow value. For us it’s very easy because there are 500 units in our complex with 300 of them having the exact same floor plan as ours. They have all been selling for around $950k recently, and Zillow has us listed at $890k at the moment. Also, our unit has one of the best views in the complex which should put us $15-20k above the average.

I’ll continue to Zillow values because it’s the easiest thing to do, and if anything once Zillow catches up, it should provide a nice tail wind to our net worth.

That said, it’s not a stretch for me to say our actual net worth at the moment is closer to $560kish.

I would love a post that takes your net worth way back. The only reason I haven’t shared mine is because it’s so far below zero. It’s a little overwhelming, yet I’m always motivated by your posts.

Great progress on your goals so far! Ya’ll are KILLIN’ it!

Pia – We all have to start somewhere. The good news is that it sounds like you are at least tracking your net worth. I am fond of telling people that you can manage what you don’t measure.

I have the post idea on my list, just a matter of finding the time. It would be more general, as my records are not nearly as detailed as they are in recent times.

I’ve always used ‘what you measure will get better’ – definitely true since we’ve started tracking our net worth.

Congrats on the potential C-Suite opportunity! Looking forward to reading more about it! Seems like you’re climbing the corporate ladder so fast! Great work.

Thanks Julie! The last two years of my career have been a crazy fun run, with plenty of ups and downs. I have had a goal that was on again off again to make it to the C-Suite by the time I was 30. Looks like it was on just enough to make it a reality.

Am I correct that 20% is the max net worth you want in your personal residence? That sounds like as good a number as any, but I’m curious how you came up with it?

Brian – Actually the upper limit is 25%, at least at this point in our journey. Overtime I want to continue to dilute this concentration. I honestly just pulled the number from the gut, I do think I read somewhere that something like 75-95% of most peoples net worth is the equity in their home. I knew that ours needed to be much less than that. Additionally, based on the blueprint I put together for the $10M net worth goal, I have the house at about 10% of net worth by then (assumed a historical 5% appreciate rate over the 20 year period).

I know you don’t like comments that are not positive.. however I will still be inclined to visit more often once your net worth climbs a bit more.. net worth of around $400k still seems low to me given your age / income.. I know that is much more than average folks or those saddled with student loans however this blog is presenting yourself as a financial expert.. will check back in a few months.. looking forward to seeing a 7 figure net worth eventually (as I am sure you are as well).

Joe, I’m not sure what your motivation was for leaving this comment, since it’s not like GYFG could magically skyrocket his net worth into the seven figures simply for your viewing pleasure, but allow me to offer a different perspective.

While it’s great reading blogs of folks who already have seven-figure net worths, there’s something to be said for learning along the journey as well. GYFG has made huge strides, and learning from those strategies is meaningful for those of us who haven’t hit the double-comma club yet.

Hey Dom,

You guys are doing well there with the pay-down and reducing expenses etc!

It’s inspiring to read the numbers you guys are putting in and looking forward to keep on watching you grow

Once again thanks for sharing a peek into your financial lives! 🙂

Just laying one brick at a time. Reflection always proves to be enlightening with respect to how much progress we have made.