I wrote myself a letter back in October of 2012 wherein I set out a vision for my life 10 years into the future. I can’t believe it has already been seven years since writing that letter (2.5 years since I shared it here on the blog). Many of the things I envisioned accomplishing have already come to fruition. I feel fortunate to have had such a clear vision of what I wanted to accomplish and to know where I wanted to be in my future life. I don’t think I would have been able to accomplish so much in a relatively short period of time if it were not for the act of sitting down, thinking through, and writing my vision for the next ten years.

I now have visibility into the eighth year of that vision and I have a high degree of confidence that I will accomplish the last goal I wrote in that letter to myself. That is achieving a seven-figure income. The GYFG household has been fanatical about growing the income side of the equation and it has paid off. We are projected to finish 2019 with an income of $721,492, with 2020 currently projected at $1,050,000. I had actually forgotten about this goal until I dug up the letter a few years ago. My original blueprint to a $10M net worth at 48 (a 20-year goal) has proved to be very conservative with respect to the income assumption. The most I ever had us earning by the end of the 20-year goal (in 2035 at age 48) was $578,800.

Although Mrs. GYFG and I didn’t officially combine our finances until we were married in 2012, we had formed a household in 2009 when we moved in together after graduating college in 2008 (she in May and myself in December). Our first year of full-time work post-college was 2009 and together we were earned $101,336. We thought we were ballers back then because we were making the most money we had ever made. We worked very hard those first five years out of college and were rewarded with above-average raises, which allowed us to compound our combined income of $101,336 in 2009 to $214,142 by the end of 2014, a 16% Compound Annual Growth Rate (CAGR). Again, we thought we were crushing it! We didn’t know very many people our age making that kind of money.

Over the years we each also invested a lot of time into both personal and professional development. We were able to monetize our hard work and ongoing investments in ourselves but I realized we were leaving too much to chance without clear goals of where we wanted to be. That first revelation came after writing the aforementioned letter to myself in 2012. Then in late 2014, I decided to start this little blog project which supercharged my interest in personal finance. I started to set what seemed like outlandish goals to the few kind souls that started reading my blog in the early days. Even Mrs. GYFG thought I had lost my marbles. The first crazy goal was to pay off our $350,000 mortgage in seven years, which we accomplished in under five years. Then it was developing and adopting the law of 50/50 whereby we aimed to save 50% of our after-tax income and spend the remaining 50% guilt-free.

I didn’t stop there. I announced to the world that I had a Big Hairy Audacious Goal of building a $10M net worth in 20 years with an income of nearly $600,000. It doesn’t seem that crazy today from my current vantage point but it was very much a stretch back in 2015 when I first published that 20-year plan. Back then (early 2015) we had just finished 2014 with a net worth of $181,364 and an income of $214,142. We surpassed every single income goal for the entire 20-year period this year and we are on track to earn almost double the income I had projected for 2035 (in 2020).

From 2012 to 2019 we have managed to grow our income from $101,336 to $721,492 (a CAGR of 20% over that 11-year span of time). As I mentioned above, our current projection for income in 2020 is $1,050,000 (a CAGR of 22% over the 12-year period). It doesn’t seem so crazy when you look at it in percentage terms. But when you look at the increase in absolute dollars, an increase of $950,000 in 12 years is insane. With a 22% CAGR, that means we were effectively doubling our income every 3.3 years.

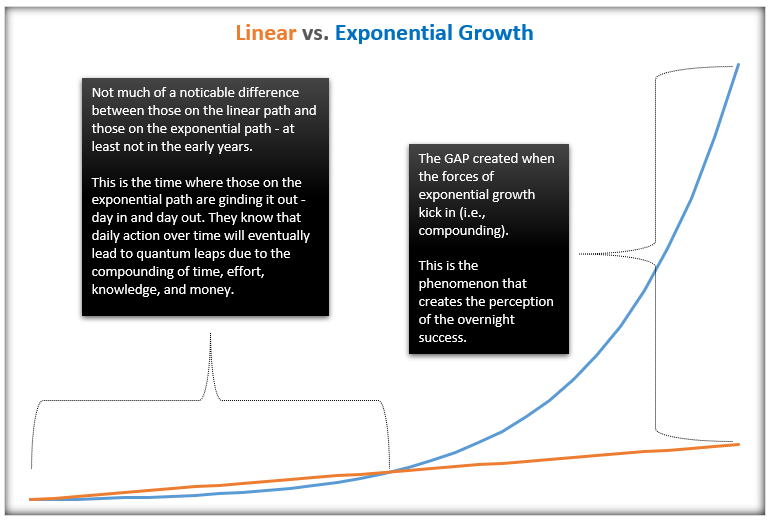

The income didn’t grow overnight. It took extreme focus and discipline. It took sacrifice. We made a commitment to ourselves and our future that we would live a few years like most won’t in order to live the rest of our lives like most can’t. Most people don’t want to – and will not – work 70-80 hours a week for years-on-end, and then spend their free time working on additional personal and professional development. And even if they think they want to, many fizzle out. The results can seem painfully slow. Most people want instant gratification but that’s not how this formula works. The power of compounding takes years to work its magic and then all of a sudden the results explode when you hit the elbow of the exponential curve (see below). Most people get discouraged because they are programmed to think in a linear fashion (it’s human nature) and they give up way too early. That’s because early on, there isn’t much visible difference between the hustlers (those riding the exponential path) and the average Joe’s (those riding the linear path).

For those ambitious enough to embark on an exponential journey, it is important to remember that when motivation wanes, discipline reigns!

Additional Reading

You CAN Get Rich Working for Someone Else Because Your Career Is Worth Millions of Dollars!

Connecting The Dots Looking Backwards – Deconstructing My Career

The Reality of The Overnight Success…It’s 10 Years in the Making!

How I Plan to Increase My Annual Income to $600,000

Thanks for riding the exponential curve along with me. Your reading this blog has played a HUGE part in my growth.

-Gen Y Finance Guy

11 Responses

Thanks for this thought provoking post.

Although you say it was fortunate you had a clear vision I think it was the very inventional “tact of sitting down, thinking through, and writing my vision for the next ten years.” that gave you this. Perhaps many people are either don’t know themselves well enough or are scared to clearly articulate what they want for some reason. Or the idea of forward planning doesn’t occur to them.

“Over the years we each also invested a lot of time into both personal and professional development. “.

>Think this is so critical. Knowledge is the power you need to achieve your dreams.

“I started to set what seemed like outlandish goal”.

>Once again I think that fear stops many people from forming and stating their own BHAGs. I think that many people are quick to disparage as a denigrate others. It can be hard to keep moving towards stretch goals in the face of negativity from others. I think the goals you had and your approach of pursuing optimism which you’ve written about elsewhere go hand in hand.

“Most people don’t want to – and will not – work 70-80 hours a week for years-on-end, and then spend their free time working on additional personal and professional development. And even if they think they want to, many fizzle out.”

>I’d be interested to know more about strategies to avoid ‘fizzling out’. My thinking at the moment consists of a clear vision / roadmap, having a reliable system in place (what you’ve written about in the context of discipline), but then also adding rest, relaxation and rejuvenation.

“Most people get discouraged because they are programmed to think in a linear fashion”.

>I think you’re right that unless told otherwise, one would not expect results to compound out even think that such compounding is possible.

“Your reading this blog has played a HUGE part in my growth.”

>Anonymous digital accountability partners seems like a pretty extreme way to ensure you keep hustling, but whatever works lol.

Happy hustling!

HH

HH,

Such a thoughtful comment.

Re: Strategies to avoid fizzling out.

I think you hit the nail on the head – it starts with getting very clear on the vision you have for your life. You also need to find the right system that works for you. I’d be lying if I never got the feeling of burnout. When I do I spend time reviewing the plan, reflecting on the progress made, and reminding myself that when When Motivation Wanes Discipline Reigns!!

Re: Anonymous digital accountability partners

It’s the system that works for me!

Cheers,

Dom

Congrats on the rewards of your hard work! I’ve been reading your blog for quite some time and it’s fun to see your progress. Keep it up!

Thanks, Zac!

I hope I’ve inspired and motivated you to charge hard after your own rewards.

Cheers,

Dom

Congrats Dom! It has been great seeing all that you achieved and the progress towards your goal

Thanks, FFC!

It’s going to be almost impossible to NOT hit your $10M goal if you’re earning $1M/year. Even if you assume a total of 50% taxes, that leaves you $500k/year of net income. If you save 50% of that, you’ll be investing $250k/year.

And of course, that is completely ignoring the value of the business that you’ve built. If it’s generating $1M/year in income, and you value it at a very reasonable PE of 10, that’s $10M right there.

Money Commando,

I’m not sure my seven-figure income will be repeated after 2020, at least not for some time to come as a big chunk of my income for 2020 is related to cashing out of my stock position in Jan/Feb of next year. However, if the growth of the business continues as it has, then it might just be possible to repeat in 2021 (only time will tell).

The good news is that the S-Corp will help make that income much more tax-efficient than if it all came from W-2 income. I don’t have to pay payroll taxes on distributions and my CPA will soon provide me with the minimum payroll I need to have for myself to appease the IRS (the rest will be taken in the form of distributions). There is also the expenses from my personal life that can now become business expenses. For example, my trip to Hawaii was paid for as our annual shareholder’s meeting. My business is paying for our Suburban. With my wife as an officer, many of our meals out are now business expenses as long as we talk about business.

I’ve always got the land conversation tax strategy at my disposal. I’m also exploring other options like a deferred compensation plan. I’m exploring how investing in real estate with the qualified real estate professional could benefit us with respect to doing a cost segregation study to accelerate depreciation (something I’ve read about some high-income doctors doing and completely sheltering their W-2 income).

I don’t think I would value the business at more than 4-7X earnings at this point based on the transactions I’ve been involved with at my W-2 employer. The kicker towards the high end if we hit enough critical mass will be the residuals from the software revenue stream.

All that said, I don’t currently include a valuation for the business in my net worth figures, only the accrued profits and pay the business owes me (it’s effectively the Cash + open AR). The business is too new and so until it’s at least a year or two old I won’t carry any value for the business. That said, at a 4X multiple, the business for its nine months of operation would be worth about $1M by the end of the year.

Dom