Wow! I can’t believe that 25% of the year is now behind us. Has anyone figured out how to squeeze more than 24 hours out of a day? Or extract more than 31 days out of a month? Every crossed-out calendar page is a tangible reminder of how fleeting time is. Truly, it is THE most scarce and valuable resource we have, way more precious than money.

You see, money can be SPENT or SAVED.

But time, on the other hand, can only be SPENT. You may develop increased efficiencies in utilizing it, but you can never stockpile it. Once you spend it, it’s gone forever.

This blog spends a lot of time talking about money, but at the end of the day, money is merely a means to an end. Its true value lies in the freedom it provides you in how to choose to spend your precious time. Time is the truly scarce resource.

Are you spending your time to build your dreams? Are you spending your time with the people you love? Are you spending your time doing the things that bring you joy? Are you spending your time with intention?

YOU SHOULD BE!

As I look back on the last three months, I’m reminded how important it is to never get so consumed building wealth that I forget to build a life. I also realized it had been four weeks since I had last opened my Memento Mori (Latin for “Remember Your Mortality”) chart to reflect on time passed (an exercise I aim to do weekly). It’s a reflective tool I adopted back in 2011 to ensure I was spending my precious time intentionally (click the link above to read more).

March was a very productive month! I like to be regularly reminded of the bigger picture (macro) and to also periodically take a step back to enjoy the present, noting progress (micro) towards goals and activities reflective of values precious to me that I want to deepen. A few highlights include:

– Got a 401K plan set up for Mrs. GYFG at her place of work (family business). She was able to contribute almost $2,400 in the month of March.

– Launched a 30 day email series of valuable information to re-engage the GYFG community. (Don’t want to miss out? Click Here)

– Initiated the process to acquire term life insurance for both Mrs. GYFG and myself, protecting against an unexpected early demise.

– Converted this site from “http” to “https.”

– Moved my brother into his new place.

– Spent a long weekend with my favorite aunt and uncle (of whom we don’t see enough).

– Completed the loan process for a home equity line of credit (HELOC), which is now officially in place (we now have access to a $127,000 revolving line of credit).

If you’re a regular reader and only want to read the new content, feel free to just skip the intro below (no harm, no foul). If you are new or haven’t read many of these reports, I encourage you to take two minutes to read the intro below, which will change periodically.

Intro

Mission Statement: To Humanize Finance, Build Wealth, and Reach Financial Freedom.

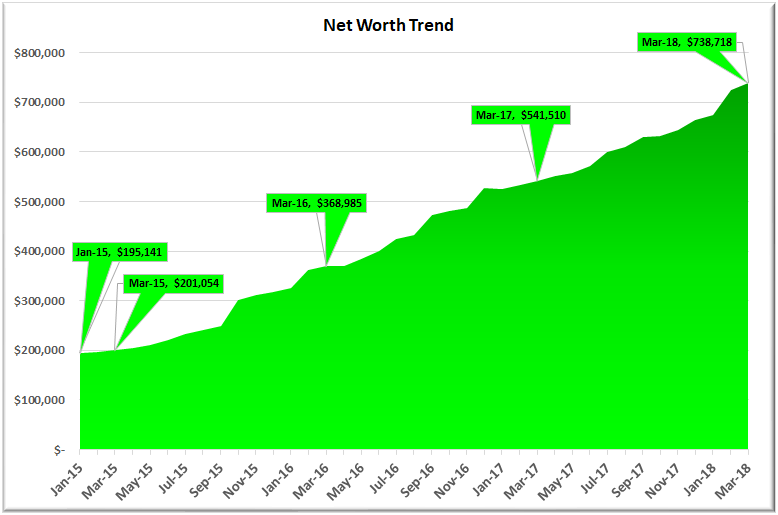

For those of you new around this corner of the internet, these monthly reports are about full transparency. They are just as much for me as they are for you. It was a hard decision to make all of my financial details public, but it has proved to be a very motivating one. The process I go through every month to produce these reports has been enlightening and life-changing. I published my first “income and net worth report” for January of 2015 when our net worth was only $195,141, and our gross income was on pace to hit $178,000 that year.

Fast forward three years: our net worth finished 2017 at $664,391 with a gross income of $372,477 (and as you will see below both are still growing exponentially).

- That’s a 3.4X increase in net worth due to a compound annual growth rate of 50% for the past three years.

- At the same time, income has increased 2.1X, which translates to a compound annual growth rate of 28%.

I honestly don’t think the GYFG household would have experienced these kinds of results without the existence of this blog and the accountability it brings. Knowing that I will need to share our results with my readers every month keeps me very focused and intentional with all things related to our financial well being. For that, I THANK YOU for taking the time to read and interact with me on this blog.

Above and beyond this benefit to my own household, my sincere hope is that my policy of full transparency will inspire you to take the helm of your own financial ship and be intentional with its direction. I truly believe that anyone can reach financial freedom if he or she is willing to do things differently than the pack. If you’re after average results, then you’ve landed on the wrong site. There’s nothing wrong with average, but the kind of results I preach are EXTRAORDINARY. Sure, the “get rich slow” method is proven, but there is an alternative, which is to “Get Rich Fast.” Look, I have no interest in living like a starving college student until I am old and brittle to only then have the means to check off bucket-list items when my body might no longer be physically capable of doing them. And I don’t want that for you either!

Here at GYFG, we approach the pursuit of FINANCIAL FREEDOM with an abundance mindset, so you won’t hear me telling you to cut out those $5 lattes. I spend a lot, but I also strategically earn a lot, save a lot and invest a lot.

I hope these reports inspire and move you to action. Don’t take a passive role in your finances and hope for the best. There is a famous Jim Rohn quote that I think everyone should keep in mind:

“If you don’t plan your future, somebody else will. And you know what they have planned for you? NOT MUCH!”

You have to be intentional with your finances if you ever want a fighting chance to make it to financial freedom. Nor does it have to take 40-50 years of slaving away for The Man before you have the option to retire. I think that 10-20 years is all you need, with the most aggressive folks probably able to reach financial freedom in 10 years or less. A high income paired with a high savings rate are two vital components of a good recipe for the 10 year track.

I know I don’t have to publish my juicy details every month, but it’s important to me that you know that I put my money where my mouth is (not that many people giving financial advice actually do this). I publish all of my financial details not to brag, but instead to show you what is working as well as what’s not working. Sometimes finance can get pretty dense, but I think real life examples and numbers can help slice through the complexities (and BS). Personally, I have always enjoyed the financial reports put out by other bloggers around the blogosphere.

As always, you can find all my previous reports on the Financial Stats page.

Net Worth

Our net worth was up $13,744 in March vs. February. Compared to last March, our net worth is up $197,208 year over year (or 36.4%).

March Net Worth $738,718 (up +11.2% for 2018)

- Previous month: $724,974

- Difference: +$13,744

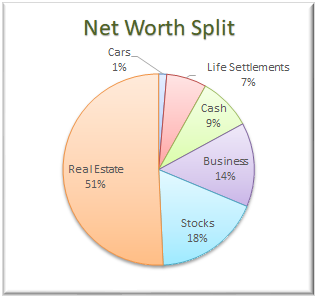

Net Worth Break Down:

– The Real Estate category remained steady at 51%. Keep in mind that this category includes the equity in our primary residence ($221,468), our investment in the Rich Uncles commercial REIT ($51,452), and our hard money loans through the PeerStreet ($101,917) platform.

– The Real Estate category remained steady at 51%. Keep in mind that this category includes the equity in our primary residence ($221,468), our investment in the Rich Uncles commercial REIT ($51,452), and our hard money loans through the PeerStreet ($101,917) platform.

– Cash increased from 8% to 9%. We are currently holding $71,896 in cold hard cash (what I like to call dry powder).

– As a clarification for newer readers, the Business category (at 14%) represents the ownership I have in the private company that I work for.

– Life Settlements made up 7%. We currently have investments in five policies at $10,000 each. I would like to build this up to $100,000 before 2018 is up. The plan is to invest in two to three additional policies in April.

– The Stocks category (at 18%) represents the cumulative value of our brokerage accounts (retirement accounts and after-tax account) that are invested in stocks. However, it is not all of our retirement money as the majority of our PeerStreet investments are made through a self-directed IRA (worth about $73,000 and counted in the Real Estate category of the pie chart).

– That leaves the Cars category at 1%. I include our cars because the goal is to keep the value of our cars as a percentage of the overall net worth pie as small as possible. By including them, it keeps me conscious of the opportunity cost of sinking too much capital into the machines that are only meant to get us from point A to point B. The combined value for our cars is currently being held at $10,000 based on current Kelly Blue Book. However, now that our cars make up a minuscule portion of our net worth, I am seriously considering removing that category from net worth altogether (which I have been saying for several months now).

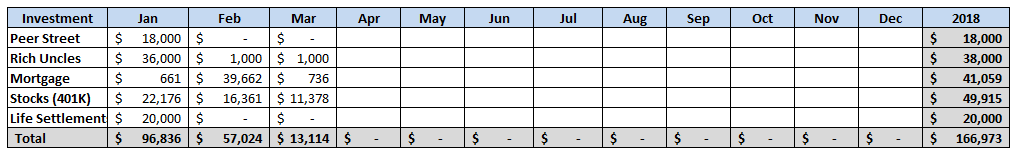

Total Capital Deployed in 2018 (YTD):

I am actually borrowing this idea from Sam over at Financial Samurai, who starting sharing his own capital deployments in a similar form last year. One item not captured in the table below is the capital deployed due to automatic reinvestment of dividends and interest, but I do plan to include that total at the end of the year. I estimate that we will deploy somewhere between $250,000 to $300,000 for the year. This will make for a very easy way to see where and when it was deployed.

About $80,000 of the 2018 total anticipated deployments is from idle cash that was sitting in my 401K (for way too long).

I can’t believe that we have already deployed $167,000 in the first three months of the year. I anticipate deploying about $25,000 to $35,000 in the month of April.

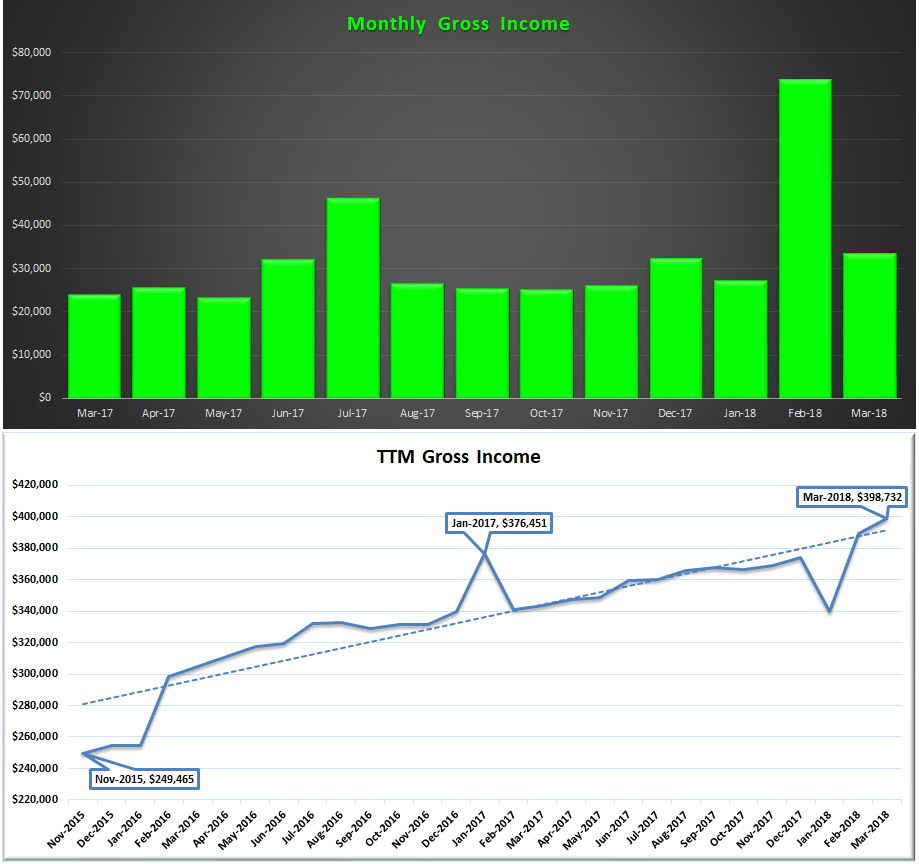

Gross Income

As anticipated, March income was significantly lower than February’s record-setting month ($74,190), but still was a respectable $33,691. I expect we will continue to bring in about $30,000 to $33,000 per month for April and May, then a step up in June (around $40,000) due to a three pay period month, and a larger step up in July due to mid-year bonuses (potentially a $50,000 month).

In the second chart above, I also track our income on a trailing twelve months, and we set another record in March.

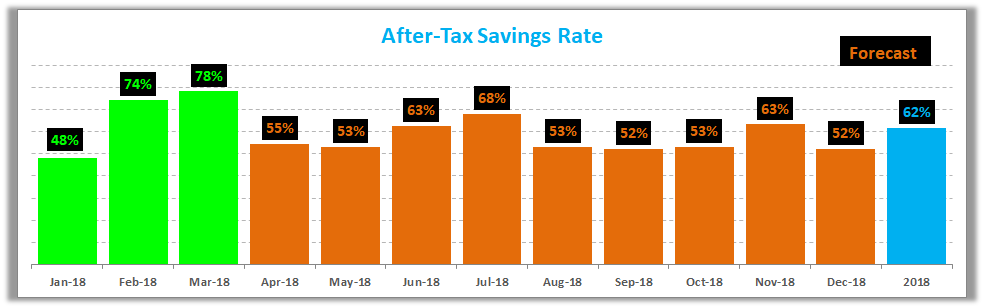

Savings Rate

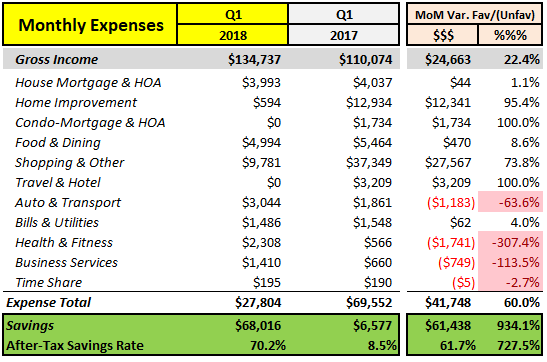

Below is how we actually did vs. our goal of saving 50% of our after-tax income.

We managed to save 78% in March! Somehow we managed to beat last month’s saving rate and this is likely the highest savings rate we will realize all year (But I said that last month in February, and then we blew through it in March! I’m saying it again now, thinking it to be true, but if we surpass it again, that’s great, too!). Unlike last year, it feels like the wind is yet again at our backs. Actually, I put together a special table for this quarterly version of the report:

– In Q1 we are getting leverage from both our income being up and our expenses being down.

– In Q1 we are getting leverage from both our income being up and our expenses being down.

– We realized robust growth of 22.4% in our gross income in Q1’18 vs. Q1’17. This is even after losing the rental income from the condo we sold in October and the room we used to rent in our house. Both Mrs. GYFG and I have worked hard to increase our salaries from our day jobs. Since Q1 of last year, we have increased our combined monthly salaries by about $7,250 per month (This explains $21,750 of the favorable variance for the quarter). The remaining $2,913 is due to increased bonus/commissions.

– Our expenses were down substantially. A big part of the $41,748 favorable variance is related to the money we spent (reflected in “shopping and other”) helping my brother through a tough time. You will also notice that we have zero expenses in the Travel and Hotel category because everything we have done so far was either prepaid last year or paid for with credit card reward points. We also have spent very little in the Home Improvement category, unlike this time last year when we installed wood looking tile flooring throughout the entire first floor.

– One final note to point out is that the expenses shown in the table to the left do not include amortizations for principal pay down on our mortgage since this is net worth neutral and only a balance sheet transfer.

Speaking of savings rate, have you checked out my post where I mathematically prove the importance of your savings rate as a higher priority in achieving financial independence than your compound return? If you’re trying to build wealth quickly, then you have to read this post.

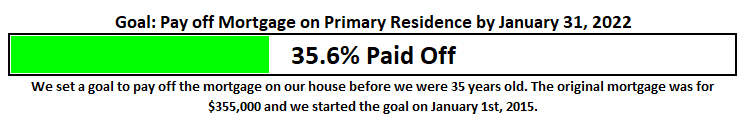

Mortgage Early Payoff Goal

Read about our strategy to pay off our mortgage in seven years (and three months). After several refinances we currently have a 3/1 ARM at 2.25% and we currently owe $268,930.

We are still committed to this goal. However, equity in our primary residence currently accounts for 30% of our net worth, and will continue to increase in absolute dollars but should be diluted throughout the rest of 2018 as we continue to grow our net worth pie with additional savings and investments. Based on my most recent projections, we should be able to dilute this concentration from 30% down to 25% by the end of 2018.

Over the past several months (maybe all of 2017), I have been stating how we would like to see this closer to 20% in the short term and far less in the long term (like less than 10% over the next ten years). The reasons are as follows:

(1) Concentration Risk – Although I am confident we will accomplish this goal on time, you never know what may happen unexpectedly. What if we both lost our jobs and couldn’t make our mortgage payment? The bank is going to foreclose on a house with 50% equity a lot faster than one with 5% equity. Until we have the house completely paid off, this will always be a concern and risk to manage.

(2) Diversification – We don’t want our entire net worth tied up in our house. That would be poor risk management.

With these factors in mind, in February we decided to add an element to our mortgage pay-off strategy, making a pivot to set up a home equity line of credit (HELOC) as a risk mitigant to my concerns above (this closed in March and we now have a $127,000 revolving line of credit in place). We now feel satisfied that we can both pay off the mortgage early, and still access our home’s equity as we need to.

The original philosophy of this plan to pay off the mortgage was to accomplish this goal while avoiding any austerity to our lifestyle. I coined it the “pay more tomorrow” plan. In keeping with the GYFG emphasis on the income side of our financial equation, I decided that we could easily increase our income (after tax) by at least $9,600/year and dedicate that additional income to fund the goal effortlessly. It has played out as planned, and we have used the cumulative increases in income thus far to execute this goal flawlessly. Since setting this goal in January of 2015, we have paid down an additional $96,600 (Year 1: $9,600, Year 2: $19,200, Year 3: $28,800, Year 4: $39,000).

This goal is now 35.6% complete! And with the addition of our HELOC, I feel we now have an even more nuanced and powerful strategy here.

RELATED: Our Mortgage Will Be Gone In Four More Years

Closing Thoughts

We may be 25% through the year but there is still 75% of runway to take advantage of. For both GYFG and for YOU that is another nine months to work towards achieving goals and building dreams. Remember that time is the only variable that levels the playing field for all. No human on Earth will have or has ever had more than 24 hours in any day. With that first click past midnight, we each receive a precious daily deposit of 86,400 seconds; it’s up to us to decide how we spend it.

Remember: Time can only be spent. It cannot be saved, and once spent, it’s gone forever.

Will you use your time today – this month – this year – purposefully and intentionally?

I look forward to chatting with you all in the comments below. How was your month? What big goals are you working towards? Are you using your time wisely? I would love to be part of your support and accountability.

Cheers!

– Gen Y Finance Guy

p.s. I recently had another opportunity to do a podcast interview. This time it was with Gwen and J from the FIRE Drill podcast. In this conversation, we talk about career hacking your way up the ladder, ambitious net worth goals (like my crazy $10M goal), putting up big income numbers, and the importance of high savings rates. My parting line “if you’re not happy and healthy, then what is the point of being wealthy?”

Career Hacking Lessons from a 31 Year Old Executive | Dom from GenY Finance Guy

p.s.s. If you haven’t already be sure to check out my interview with Erik from The Mastermind Within. The conversation we had was fun, informative, and unpacked many great nuggets of wisdom that have shaped my life. It was deeply gratifying that Erik reached out to have me on the podcast, as the greatest compliment I could ever receive is knowing that I’ve had a positive impact on someone else. Plus, revisiting The Slight Edge is always great – it’s the book that’s had the most impact on my life!

Practicing Simple Daily Disciplines to the C-Suite with Gen Y Finance Guy

9 Responses

A very awesome and detailed report. Thank you for sharing it. Amazing amounts of capital deployment/income. Keep up the great work!

Thanks, Mr. Robot!

Hi there. I love your spreadsheets and graphs you’ve created to track and share your expenses and Net Worth changes. Are those something you’d be willing to share? Thanks!

Amy – I am currently working on a version to share with my email subscribers and those should be made available in the next 3-4 weeks. There will soon be a welcome tool pack given instantly for new subscribers, but I’m also going to send it out to all current email subscribers.

Cheers,

Dom

Out of curiosity, where does the bulk of your income come from? It’s not your dividends is it?

Troy – most of our income comes from our day jobs.

great blog! thanks for having it out here. I hadn’t thought of a HELOC. Once I had paid an additional 20% down on my home, we diverted extra principal payments to a separate taxable account to invest in index funds. Just seemed like a huge waste to pay down a 3% loan when we’re making better returns in the stock market. Our thought was that when the account was on par with our remaining mortgage balance, we would have the house “paid off”.

Why did you choose HELOC over a separate account?