It’s time to share and reflect on another guest post I wrote about 18 months ago. To this day my own journey blows my mind. I know it’s not typical but it is an example of what a lot of hard work, determination, and a little luck can do for someone given enough time to let the power of compounding work its magic. The key ingredient is consistency. It’s finding discipline when motivation is lacking. It’s doubling and tripling down on your strengths, which requires a keen sense of self-awareness. It’s about being prepared for the knock of opportunity that allows you to take advantage of “lucky” breaks.

In typical fashion, I will annotate the below post with updates from present-day, as a lot has happened in the 18 months since writing the below guest post.

If you search the ESI Money site, I am ESI Scale Interview # 33.

OVERVIEW

The Earn-Save-Invest blog model you have created is absolutely brilliant, because of its simplicity. Was it Einstein who said to make it as simple as it needs to be, but no simpler?

You’ve accomplished that, ESI, and I salute you!

Please tell us a bit about yourself.

Hey, I’m Dom. I’m a 31-year-old male, married six years (together 13 years), with our first kid on the way in November. We live in the always-sunny Southern California, in Temecula, a city I describe to others as the “Napa of Southern California.” I wear a lot of different hats: C-Suite Executive, Husband, Blogger, Investor, Intrapreneur, Finance Geek, Soon-To-Be Father, Fitness Fanatic, Brother, Friend, and Opportunist! To name a few.

After reading this interview, some might find it hard to believe that I grew up on welfare to drug-addicted parents. As you are about to discover, I live the truth of “it doesn’t matter where you start in life. What matters is how you play the hand you were dealt.” I truly believe that we live in unprecedented times with more opportunities for success (and riches) than at any other time in history. To get your piece, you only have to decide if you are willing to do the work. If I can start where I did, and end up in the C-suite by age 30, you can set your own eyes on your own prize and achieve it. Will you do the work?

[GYFG Here: We had baby GYFG and he is now almost 15 months old. I have also since left my C-Suite role to run my new company full-time. I guess I can now update the title of intrapreneur to entrepreneur and of soon-to-be father to father.]

Note: All financial numbers shared below reflect the team effort between my wife and me. Teamwork makes the dream work!

What is your current net worth?

Our current net worth is $806,918 as of June 30th, 2018. It has been a hell of a trajectory! My wife and I graduated from college in 2008 into the worst financial recession since the Great Depression. Because of some student debt and a misguided house purchase, we entered our careers with a net worth of negative $300,000. However, we have climbed our way out of that massive hole, reversing our situation by increasing our net worth by $1,106,918 in about nine years.

[GYFG Here: Who doesn’t love seeing the underdog come out victorious? That reversal of fortune has not only continued but in the last 18 months we were able to more than double our net worth from $806,918 in June of 2018 to $1,670,321 as of December 2019.]

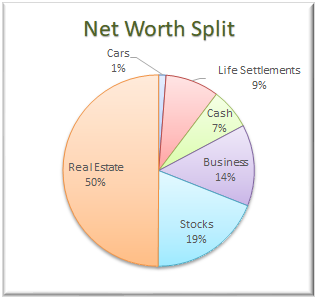

Our Net Worth Break Down:

The Real Estate category comprises $402,654 (or 50%) of our net worth. It includes the equity in our primary residence ($243,686), our investment in a commercial REIT ($55,369), and our hard money lending portfolio ($103,599).

The Real Estate category comprises $402,654 (or 50%) of our net worth. It includes the equity in our primary residence ($243,686), our investment in a commercial REIT ($55,369), and our hard money lending portfolio ($103,599).

Cash makes up 7%. We are currently holding $55,871 in cold hard cash. This does include about $1,700 sitting in a peer to peer lending account that I have been slowly withdrawing as the funds become available.

The Business category (at $111,045 or 14%) represents the ownership I have in the privately held company that I work for.

Life Settlements make up $73,178 or 9%. We currently have investments in seven separate policies.

The Stocks category (at $154,171 or 19%) represents the cumulative value of our brokerage accounts (retirement accounts and one after-tax account) that are invested in stocks. However, it is not all of our retirement money, as the majority of our hard money loans are made through a self-directed IRA (worth about $75,000 and are counted in the Real Estate category of the pie chart).

That leaves the Cars category at $10,000 or 1%. I include our cars because the goal is to keep the value of our cars as a percentage of the overall net worth pie as small as possible.

[GYFG here: you can see the latest Net Worth breakdown for our household here – I create it every month.]

How did you accumulate your net worth?

To date, the primary drivers in growing our net worth have been a very high income paired with a very high savings rate – especially the past five years. In 2008, the GYFG household graduated college and earned (combined) less than $100,000 in annual gross income. Our income from 2009 (our first full year of working) compounded at a respectable rate of 11.4% through 2014 and then it was off to the races from 2015 to the present.

Since 2015 the compound growth of our income has more than doubled to 25.7% over the past four years (see earning history in the chart below).

[GYFG Here: I thought our income growth would continue to grow but at a slower rate back when I wrote this. I remember thinking that 10% annual growth would be respectable. Then I got this crazy idea to start a business, and it has really taken off to exceed my initial expectations. Because of this our income finished 2019 at $747,427 and is on track for over $1,000,000 in 2020.]

Note: This is gross income before any side hustles and earnings from investments (both of which I don’t have a lot of detailed history on).

As you can imagine, this level of income has allowed us to save an incredible amount of money. Today we aim to save at least 50% of our after-tax income (we are on track for 61% in 2018), a goal we put into place in 2015. I did mention above that we started our financial journey with a net worth of negative $300,000; however, I didn’t start tracking our net worth regularly until 2012. Nonetheless, below you can visualize the growth of our net worth over the past seven years.

We are currently projecting our net worth to finish 2018 around $900,000 before any investment gains (assuming the market continues to cooperate). I would be remiss to not also mention the fact that this growth has happened during a bull market but until recently that has played a relatively small role in growing our net worth.

[GYFG Here: As I mentioned above our net worth has more than doubled to $1,670,321 as of December 2019. If all goes according to plan, we should exceed $2M net worth by the middle of next year.]

EARN

Tell us a bit about your career.

ME: I’m a 31-year-old C-suite executive with a title and role that I designed.

I got my start in corporate finance making $52,000 per year. That quickly jumped to $63,500 within three months when I changed companies. Initially, I wore the traditional FP&A hat (financial planning and analysis), but I was fortunate to participate in some mergers and acquisitions. After a few years, I transitioned into trading, where I helped run all the hedging activities for a private $3B oil company, and traded West Coast products (gasoline and diesel fuel) and options (on NYMEX) for profit.

I eventually left the oil industry and joined a public $2B company in action sports. After doing a small stint in FP&A again, I weaseled my way onto the eCommerce team, where I helped launch a global analytics team to support the fast-growing $100M online business. I am fascinated with the online world because of how measurable everything is.

Presently I’m nine years into my career working for a consulting company in the construction management space. So, what do I do for a living?

I get paid an obscene amount of money ($300,000) to play with data all day. I spend a lot of my time frolicking around a spreadsheet. I’m a lot more technical than your typical finance guy, but not so technical that I can’t interface with operations. My tentacles go far and deep throughout the entire organization and my job is to measure the things we want to manage in order to make fact-based decisions that will help increase both top and bottom line results.

I don’t get to play in a spreadsheet all day as I once did, as I’m also heavily involved in our strategic planning and I manage a team of about 15 (mix of IT and Finance folks).

[GYFG Here: I’m now running my own consulting business. I get paid even more money to play with data all day. I have so far built a team of five, which I plan to increase to ten over the next 12 to 18 months. The ideal background is someone that can be described as an Excel Wizard and is fascinated with data. Even better if you have years of finance and/or accounting experience. The cherry on top is experience using corporate performance management software. If this describes you and you’re interested in talking about new opportunities, please send me an email with your resume and a little about yourself to dom@genyfinanceguy.com. If you’re the right fit, the pay is $100,000 to $200,000 per year.]

My Wife: Also 31, she is currently being groomed to take over a family business (in real estate), and she will represent the third generation to run it.

She started out working for a firm that specialized in reducing property taxes for large real estate holders. She started at $35,000 per year and by the time she left to work for the family business, she was earning about $75,000 (2013). She strategically took a pay cut to work for her mom as her base salary was cut to $48,000 per year, but with added monthly bonus potential.

Today, she is earning a base of $72,000 and is on track to earn about $62,000 in bonuses ($134,000 total projected for 2018).

Do you have a side hustle?

As natural born hustlers, we have a few side hustles.

- I have this blog that is earning about $1,000 per month. I’m currently reinvesting all the income to grow its reach.

- I also sell tradelines, which is currently earning an additional $750/month. This is currently my favorite and easiest side hustle.

- My wife is also a notary and earns anywhere from $400 to $2,000 per month depending on how much she feels like hustling.

- We churn credit cards for the rewards and this typically amounts to $5,000 to $10,000 a year in additional income – enough to pay for a really nice vacation.

Then, of course, there is the income generated from our investments. Others may disagree, but I consider these to be side hustles as well. We are currently earning about $1,000 per month from interest and dividends off our investments.

If you were rating these results on a scale of 1 to 10 (with 10 being best), what rating would you give yourself and why?

I would give our household a nine! It’s not a ten because I know others in our peer group who have done significantly better than us. That said, we have compounded our earnings to a point that puts us in the top 1% of earners in the USA, an accomplishment we are very proud of.

My sole focus out of college was to climb the corporate ladder as quickly as humanly possible. Being in finance, I always got to see all the compensation of everyone in the organization, which was highly motivating to me. I graduated from college in 2008, with my first job paying $52,000 a year. Ten years later, in 2018 my income from just my day job will finish at $300,000.

My wife has also done well, growing her income from $35,000 to $134,000 in 2018. I haven’t always been ahead of her in compensation and I wouldn’t be surprised if she surpasses me again in the future. Let me be clear though: either way, our success is a team effort, and the whole is greater than the sum of the parts.

Some say we are a power couple. I’ll let you decide!

I believe that a high income is the first step towards financial nirvana.

Sidebar: My goal early on was to earn 3X my age in income (check), then it was 10X (check), and now I am working towards a 20X multiple over the next couple of years. As I was coming up in the corporate environment this was always a fun game to figure out how I could add enough value to hit my own income goals.

[GYFG Here: Can I revise my answer to 9.5? Our income has gone parabolic!]

What are your future plans regarding growing your income?

There could still be significant upside from our careers but I don’t expect the increases to sustain the 25.7% compounded growth of the past few years. We will be happy if we can deliver a 10% compounded growth in our income from our day jobs.

We will be shifting our focus in mid- to late-2019 to aggressively start building our passive income. This aligns with the timing of paying off our mortgage, which will free up a significant amount of cash that we are currently throwing against the mortgage ($227,000 over the next 14 months). Our goal will be to acquire five to ten rentals over a three to five year time frame.

I think we could be earning seven figures in the next five years (earned income + passive income).

To infinity and beyond!

[GYFG Here: I knew I got that 10% from somewhere. If I hadn’t started my own business, I think I would had been happy with 10% annual increases. But, year one in business helped us achieve a ~73% increase in income in 2019 vs. what I projected in 2018. We now have a new engine with much more earning horsepower and now I think we have the ability to continue growing our income by 25-50% annually for at least the next five years (I’m already projecting 41% growth in 2020 vs. 2019).]

SAVE

What percent of your gross income do you save?

Over the last three years (2015-2017) we have saved 37-38% of our gross income. However, we set our goal of 50% based on an after-tax savings rate. Here is what our after-tax savings rates were for 2015 through 2017:

- 2015 = 44%

- 2016 = 50%

- 2017 = 38% (we missed our 50% goal because we paid to put my brother through rehab)

In 2018, we are on track to save 43% of our gross income, and 61% of our after-tax income.

[GYFG Here: Our 2018 savings rate ended up at 62% for the year and 2019 just finished at 60%.]

How did you get to this level?

I can tell you that it wasn’t by practicing extreme frugality. Luckily, Mrs. GYFG and I intuitively understood that in order to build wealth we needed to spend less than we make. Instead of focusing on the expense side of the equation, we decided to focus on the income side. There is a floor to how much you can cut in expenses but no limit to how much income you can earn.

In the early part of our journey, we hadn’t set our goal of saving 50% of our after-tax income. I know a lot of blogs and financial pundits tell you to avoid lifestyle inflation but we have a different view. When we adopted the law of 50/50 (in 2015) whereby we save 50% of our after-tax income and spend the remaining 50% guilt free, we gave ourselves a free pass to inflate our lifestyle as our income grew.

We hit an inflection point in 2016 when our income growth outpaced our desire to increase our spending. We have settled into our sweet spot of spending around $120,000 per year.

Unfortunately, I don’t have the exact numbers, but if I had to guess, we started out saving about 20% of our after-tax income. Most of that savings was in the form of 401K and IRA contributions. It was our high income that has allowed us to increase our savings rate to where it is today.

If you were rating these results on a scale of 1 to 10 (with 10 being best), what rating would you give yourself and why?

Nine out of ten. Again, there is always room for improvement. As our income has grown, we have continued to increase our savings rate, with the ultimate goal of reaching a 50% gross savings rate over time (on track for 43% in 2018). However, if we want any chance of achieving that 50% gross savings rate, we are going to need to continue diversifying our income streams to streams with more favorable tax treatment (i.e., away from earned income). We are working to increase our passive income to around $120,000/year over the next five years.

We realized early on that frugality was relative to the amount of income brought home. And if you’re like me and enjoy the finer things in life, you have to increase your income to a point where you effortlessly reach your savings goal, while also living your desired lifestyle. We also realized that by focusing on the income side of the equation that any time we wanted to live a bigger lifestyle all we had to do was increase our income.

So, relative frugality permits you (and me) a free pass to lifestyle inflation, until you reach that point where increased spending no longer brings you joy.

I channeled my inner Einstein and came up with the Theory of Relative Frugality. Who knows, maybe one day I will win a Nobel prize for the 60 seconds it took me to fine tune the theory.

Here is a copy of my original work (completed in Microsoft Paint):

Which would you choose?

What are your future plans regarding saving your money?

Our goal is to keep saving aggressively as we continue growing our income aggressively. At this point we don’t see our spending increasing much beyond our current annual $120,000, so most of our additional after-tax income will go to savings.

[GYFG Here: 2019 was a year for breaking records and our expenses were not spared. I decided to start a business just as our first child was turning four months old. In doing so, Mrs. GYFG and I made a conscious decision to pay for convenience in 2019. We spent a record $192,168. This figure includes a new expense line for full-time child care at ~$30,000 for the year and about $30,000 for a big backyard project. I expect our spending to mean-revert to a number in the range of $120,000 to $140,000 in 2020.]

INVEST

What are your main investments?

Stocks (mostly index funds). As I mentioned above, this represents 19% of our overall net worth and is concentrated in pre-tax accounts. At the very least we will continue contributing as much as we can to max out all pre-tax accounts we have available to us. We currently can contribute $37,000 per year (combined) into our 401k’s available through our employers (plus any matches). Because we mostly invest in index funds, we can’t expect much better or worse than the index.

Real Estate. This currently makes up 50% of our overall net worth. We currently have a heavy concentration of equity tied up in our primary residence (currently 30% of the 50%). We expect this to grow to 40-50% as we work to pay down the mortgage by July of 2019.

The other 20% of this piece of the pie is made up of exposure to commercial real estate via a public non-traded REIT and the hard money lending we do through an online lending platform. We are currently earning a 7% annual dividend with monthly payments from the commercial REIT. We are also earning about 7% in interest payments from our hard money lending portfolio.

We are currently contributing $1,000 per month in additional capital to the commercial REIT. We stopped contributing to the hard money lending account once it reached $100,000 in value. That is our goal for the commercial REIT as well.

The last piece is the amount of capital we need to contribute to achieve our goal to be mortgage free by July of 2019. This will require us to make an additional principal payment of $16,214 per month on average.

[GYFG Here: We did finish paying off our mortgage in May of 2019 and we did see the equity in our home climb to just shy of 40% of our net worth at one point. Today it sits at around 28% and it will continue to be diluted over time to something less than 10%.]

Life Settlements. This is one of my new favorite asset classes. We would like to invest another $30,000 over the next 12 months in order to increase our investment to $100,000 even (a theme of ours is to round off investments to $100,000).

Private Business. We made a one-time $105,000 investment in the company I work for. All additional increases there will come from appreciation and the value of the options I receive every year.

[GYFG Here: This has proven to be a fantastic wealth accelerator. I’m getting cashed out of this investment in Q1 of 2020. As of December 2019, I’m currently valuing this at ~$514,000 vs. my original investment three years ago of $105,000.]

Cash. We aim to keep $30,000 to $50,000 in cash. It doesn’t earn much return but it provides optionality and flexibility, which leads to a lot of peace of mind for us.

If you were rating these results on a scale of 1 to 10 (with 10 being best), what rating would you give yourself and why?

I would give us a six on the investing scale. We haven’t been uber aggressive here, and have probably left a decent amount of money on the table by sitting on the sidelines for too long. However, we are getting better at this. We all only have so much bandwidth, and I chose to focus most of my energy earning, which takes the pressure off needing to earn super high returns from investments.

This is particularly important to me in light of our $10M net worth goal by the time we are 48.

Based on our earnings alone, with a 0% return, I am confident we will become multimillionaires. That said, I also realize we could blow even our biggest goals out of the water if we get more aggressive at putting money to work (something we have made significant progress in 2018 – having put almost $260,000 to work so far this year).

Now that I’ve made my goal of making the C-Suite by 30, I feel like I can spend more time in this area of wealth building (investing), which should help make our ascent to financial freedom exponentially faster. We have no plans of retiring anytime soon (as of now).

[GYFG Here: We ended up deploying approximately $415,000 in 2018 and $385,000 in 2019. Paying off our mortgage paired with the increased cash flow from the business has helped us get much more aggressive in terms of putting more money to work for us.]

What are your future plans regarding investing?

To do a lot more of it, especially after we have the house paid off. Our two focuses will be:

(1) To max out all of our pre-tax accounts investing in index funds.

(2) To begin aggressively building our passive income through real estate. As stated above, our goal is to acquire five to ten properties in the next three to five years.

[GYFG Here: At the time of writing this, I had only just begun my due-diligence process of starting my own business. One of the benefits of my business is the residual income it generates from selling software (the same software that we implement). Going into 2020, we have already accumulated about $67,000/year in passive income. In my industry, the average life of a customer is 10+ years, so this is certainly an x-factor I hadn’t considered. This seriously has me reconsidering the real estate game in favor of much more passive investments. That said, I have continued to increase my investment activity within the hard money lending space. I loan out money at 7-10% with a max LTV of 65% and I love the equity cushion that protects my capital from loss.]

WRAP-UP

What money mistakes have you made that others can learn from?

While I was still in college I got allured by the easy money. I was offered the “opportunity” to be the credit partner to someone who was supposedly a sophisticated investor. I didn’t do my homework. I was to be paid $1,000 per month for letting him use my credit to get financing on a home and then after three months we would do a “formal loan assumption” (which did check out to be a real thing). At the time of the formal loan assumption, my name would be removed from the mortgage and property and I would get a $5,000 bonus.

Things didn’t work out as planned and the credit markets started to tighten up. Come to find out this “sophisticated investor” had over-committed himself and didn’t make the payments during the first three months (a requirement to do a formal loan assumption). To make a long story short I ended up paying him $4,000 to remove his name from the property. I also had to come up with about $12,000 to bring the loan current with payments. I then got renters in place to stop the bleeding as best I could all while finishing my last two years of college (2007/2008).

Because of my naivety, I ended up holding the bag on a house with 100% financing and a negative cash flow of about $1,100/month for two years before I let the house go to foreclosure. I tried to work with the bank to do a short sale but they wouldn’t approve it. They ended up selling it for $280,000 with an original loan on the property of $442,000. The short sale was for $325,000, so their loss, I guess. I also got lucky because Obama made a temporary reprieve so I didn’t have to pay taxes on the debt forgiven due to the foreclosure.

This ended up costing me $36,000 and tanked my credit score down to the 500’s. The good news is that it motivated me to become the person and investor that I am today. At around the same time, I had just started taking classes related to my finance major (as I had just completed my general education). I became obsessed with all things related to finance (including personal finance). I was determined to become a savvy investor. I’m just glad I learned this lesson very early on when I had very little at risk.

The moral of the story is that if the deal sounds too good to be true it probably is and you should run away from it as quickly as possible. And always do your due diligence!

Are there any questions you have for ESI Money readers regarding any parts of your finances?

The thing I love most about the personal finance community is how these blogs act as a magnet to bring the best and brightest together. Maybe we can crowdsource the best locations to invest in real estate?

If you were in my shoes, would you pay the mortgage off early or invest with that money?

Any interesting ideas for reducing our growing tax bill with such a high income?

[GYFG Here: One thing I have learned about and deployed in 2019 was land conservation. I bought into a partnership that purchased a piece of land for $6M. My personal contribution was $68,400, which when we all decided to donate the land and conserve it resulted in a tax deduction of $343,000. You should note that the you can’t deduct any more than 50% of your adjusted gross income in any one year but you have 15 years to use up all of the deduction.]

Thank you for the opportunity to hang out on your blog, ESI. I’m looking forward to meeting more of your readers in the comments!

4 Responses

You guys are just like younger versions of us. We have a lot more assets but we are also older. I was a corporate warrior like you. And I was an ESI interview like you. I’ve lived your life, your future is crazy bright. I loved that you gave luck some credit. Indeed, we could have crashed and burned but for that little but of luck?

Hey Steveark,

Where were you guys at 33 vs. today?

Dom

Hi Dom,

Just recently discovered the idea of FIRE and feeling like I’m a little late to start but nevertheless, I’m motivated to do it anyhow. I’m 42 and setting a ten year goal that would hopefully make it achievable considering where I am currently.

I’m super impressed and inspired by your journey. Lots to learn from your blog and really grateful to have found you. Can you share more (or direct me to a blog post if you have already written about it) about the commercial REIT and contributing to the hard money lending. I’d like to know how that works and where you can find sources to invest in that space. Thank you so much!

-Late Bloomer

Hi there,

This ESI Scale Interview was written back in 2018 and so much has changed since then (we’ve more than 10X’ed our net worth and interest rates have risen a lot). I am no longer doing hard money lending and the Commercial REIT that I was invested in ended up listing for a public offering under ticker symbol MDV.

I think the two best places you can start is the “Start Here” page and the “The Archive” page.