GYFG here checking in for the December monthly financial report. If you have been reading these reports for a while you will notice that I introduce each month with the same intro month after month. I do this for two reasons; a) for the newbies to the site (which make up about 50% of the sites traffic); and b) to remind everyone what these reports are all about. By all means if you have read the intro at least once, then please feel free to skip down to the “Summary of December 2016” section where the new content begins (click the orange link to be taken there automatically).

For those of you that are new around this corner of the internet, I wanted to fill you in as to what these reports are all about. These monthly reports are about full transparency. They are just as much for me as they are for you. It’s a hard decision to make all of your financial details public, but it’s also a very motivating one. It’s not just the post, but the process of putting this post together that really benefits me.

My sincere hope is that my transparency will inspire you to take the helm of your own financial ship and be intentional with its direction. I truly believe that anyone can reach financial freedom, if they are willing to do things differently. If you earn an average salary and have an average savings rate, then you can expect an average result! That means you will likely have to work at a job you may or may not enjoy until you’re 65 and then maybe you can retire IF you’re lucky.

Hey, there is nothing wrong with average. If you’re happy with average, then by all means keep doing what everyone else is doing. Not sure how you feel about that, but I have no interest in living an average life. I want EXTRAORDINARY.

Most people don’t want to live below their means in order to reach FINANCIAL FREEDOM, because that’s painful. They think it involves cutting out all the joy in life. You know what I’m talking about, those financial gurus that tell you that in order to get rich you need to cut out the $5 lattes and stop going out to eat. Then after 40 years of diligent and above average savings and super low spending, you will be a millionaire. Basically, you have to live like a college student and suppress all the things you want to do in life and then when you’re old you will be rich.

Okay, that doesn’t sound like the plan for me either.

The good news is there is another way. This site and these reports are here to show you the OTHER path to financial freedom. There is a way where you can have your cake and eat it too. I believe and hope that over time I will be able to convince you of the following:

In order to reach financial freedom you can choose to live below your means by cutting expenses to the bone and living in a state of scarcity or you can expand your means and live in a state of abundance by increasing your income and enjoying the $5 latte or other indulgence of your choice.

Not only that, but if you’re diligent you can reach financial freedom a lot sooner than anyone has ever led you to believe.

Our Mission Statement:

To Humanize Finance, Build Wealth, and Reach Financial Freedom.

I know I don’t have to publish my juicy details every month, but it’s important to me that you know that I put my money where my mouth is (because not that many finance blogs or people giving financial advice do this). I publish all of my financial details not to brag, but instead to show you what is working as well as what’s not working. Sometimes finance can get pretty dense, but I think real life examples and numbers can help slice through the complexities (and BS). Personally, I have always enjoyed the financial reports put out by other bloggers around the blogosphere.

As always, you can find all my previous reports on the Financial Stats page (as well as annual trends and a few other financial metrics not found on this report). In these monthly reports the plan is to give you a month over month update on Gross Income, Assets, Liabilities, Net Worth, Expenses, Contributions, Savings Rate, and progress on the mortgage pay down goal.

Summary of December 2016

Wonder how I pull all this information together every month?

Note: You may be wondering why I don’t use a bunch of screenshots from personal capital in these reports, and that is a fantastic question. As many of the other bloggers out there who use personal capital, post nothing but the graphics from within the application. I personally only use it as an aggregation that feeds into my own database that creates all the graphics you see in this post. The tool is fantastic, but I personally think the graphics are a bit limited, and prefer my visualizations.

We use Personal Capital to aggregate and consolidate our transactions from across all of our financial accounts (checking, savings, retirement, credit cards, mortgages, HSA, and other investment accounts). At the end of the month I then drop that information into my financial stats spreadsheet in order to produce this (beautiful) monthly report.

Tracking your finances is, in my opinion, the best way to stay on top of your finances. You can’t optimize what you don’t measure. You can’t make informed decisions if you don’t know what you having coming in vs. going out. Without a holistic view of how much you spend every month, there’s no way to set savings, debt repayment, or investment goals. It’s a financial freedom must!

If you don’t already have a FREE account with Personal Capital, stop reading and go sign up for your account right now! (Seriously, this financial update will be here when your done. There’s no time like the present to take action. You will thank me later!)

Month Over Month Financial Summary

Just three things to point out in case you missed it:

- Income was up 12%; Mostly due to a 3rd pay period for me, due to a bi-weekly pay schedule..

- Cash is up $15,390 or 12.9%. A part of this increase has to do with the timing of our credit cards not being paid until January (they are set to auto-pay in full).

- We moved the value of our rental condo up to the latest comp from November of 2016, which brought resulted in a $30,000 increase in net worth this month. We were previously holding the value of our condo at $205,000 for the prior 6-months even when units were selling for more than this. The most recent unit with the same exact floor plan as ours sold in November of 2016 for $245,000 and it was just a basic unit and doesn’t even have all the upgrades ours has. However, we only adjusted our condo up by $30,000 instead of a full $45,000 to be conservative.

Note: We are currently carrying the most amount of cash we ever have, and will continue to build the cash stash through January of 2017. However, we will be cutting a $105,000 check for a new investment (click here for the details). I project our cash balance to be around $165,000 by the time we have to cut this check.

What went down in December?

The GYFG household finished 2016 strong on the income side of the equation. Besides Mrs. GYFG killing it again month after month this year, December also got a bit of a boost due to an additional pay period for me (I am paid on a bi-weekly schedule, which comes with 2 months a year that have 3 pay periods instead of 3

Here is a look at the trend for the last 13 months:

Back in October of 2015 I shared our 2016 forecast(first pass), which had only projected income of $261,600 (as you will see below, this did increase slightly to $281,600 by the end of 2015), and we finished the year with actual income of $339,661 for 2016 (blowing our original expectations out of the water, beating it by +30%). If you do the math, we brought in $78,061 or $6,500/month in additional income. I wish I could take credit for this, but my income was largely known for 2016, it was Mrs. GYFG who really got to see the fruits of her labor this year in a big way.

She has been building up her book of business for the past couple years, and the big bonus checks she received month after month this year, are the dividends of her efforts (lots of networking, working long hours, working weekends, and fulfilling special requests that most in her business don’t do).

If you’ve read my blueprint for how I plan to reach $10M, you will notice that we have jumped about 7 years ahead of schedule on the income front.

I didn’t have us at this earning level until 2023 in the original blueprint.

For those of you not familiar with the TTM acronym, it is short for ‘Trailing Twelve Months’. The month marks a NEW all-time high of $339,661. In January I an projecting around $390,000 depending on what my bonus comes in at, and how well Mrs. GYFG does with her bonus for the month. Overall, income was up 34% in 2016 vs. 2015.

The Juicy Details

- Previous Month: $24,081

- Difference: +$2,890

Now where did all that money go?

I have come to the realization that there are always going to be unplanned expenses. Our goal is to save 50% of our income and live off and enjoy the difference guilt free. With that type of rule governing our financial life, it is a free pass to inflate our lifestyle, but only proportional to our income. You can see prior financial reports here. We do however try to line up expenses with expected income as much as possible.

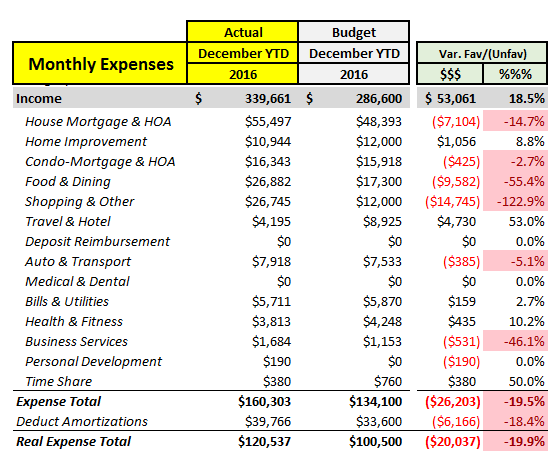

Since it is the end of the year, instead of looking at the month over month expenses, I thought this would be a good time to compare the full year 2016 actual vs. what we had planned. You will notice that the full year budget numbers are slightly different from the link I shared above as we made a few last minute changes to the budget to bring income up and expenses down.

Income – Overall income was up 18.5% vs. the final budget we put together in 2016. Again, as I mentioned above, this was all due to Mrs. GYFG hitting it out of the park in 2016

House Mortgage & HOA – This ended higher due to the mid-year refinance we completed to lock in 2.25% with a 3/1 ARM. This allowed us to free up ~$5,500/year in cash flow for a cash on cash return of ~20%. Based on our 7-year plan to pay off the mortgage, we don’t need to make any additional payments until April of 2017.

Home Improvement – Although this looks like it’s under budget, there are some expenses that got coded to Shopping and Other, which I didn’t bother changing, had I made those changes we would have been slightly over budget on this line item.

Condo Mortgage & HOA – Our rate adjusted slightly increasing the payment. Our HOA was increased from $250/month to $265/month. We will plan to follow through with the refinance we tried for early in 2016, which will allow us to free up about $300-$400 a month in cash flow (we won’t have to bring any money in, except for about $1,500 in closing costs). This will get done in Q1 of 2017.

Food & Dining – Yikes! This one got a little out of hand…again. It is a little misleading because there is at least $3,000 related to my day job that I was reimbursed for, but I code all those reimbursements to the Travel & Hotel line (which is where the majority of my work related expenses hit). I didn’t bother breaking this out and won’t going forward either. Additionally, we also through a 30th birthday bash that cost about $1,500 for food and booze. We spent a lot of time working, which didn’t leave much time for cooking, we knowingly accepted the increase here. However, we plan to slow down in 2017 and cook a lot more. We have budgeted $19,000 here in 2017.

Shopping & Other – Like I mentioned above, there were home improvement expenses that hit here that shouldn’t have. There is also about $600 that hit here for FIOS internet that should had hit the Bills & Utilities line. That said, we need to pay closer attention to what is hitting this line. I will plan to dig in as part of my deeper annual review.

Travel & Hotel – The common theme continues, there is irregularities and coding issues. I code 100% of my expense reimbursements from work here, event though some of those expenses hit the Food & Dining line item. Additionally, this is where all of the cash back rewards from our credit cards gets coded (worth about $2,000 in credits). I plan to try and earn about $2,000 to $4,000 a year in cash back, which will always be netted against expenses. I look at it as a discount to spending we were already going to do.

Auto & Transport – Not much to say here, pretty much on target. I have a post coming out in the near future that looks at the cost of use of a car. I hadn’t realized how expensive it really is, and the wealth destroying effect it can have on your net worth (to be published in Q1 of 2017).

Bills & Utilities – This is missing about $600 for FIOS internet, that mistakenly got coded to the Shopping & Other line. But other than that it is close enough.

Health & Fitness – Under budget, mostly due to me ending my cross-fit career early because of an injury (which took 6 months to recover from fully, and 24 visits to the chiropractor). It was my fault not cross-fit. I let my ego get in the way of using proper form and went way to heavy and got sloppy.

Business Services – Large percentage bust, but small dollars. No reason to waist any more words here.

Personal Development – Same as above.

Time Share – Looks like another issue with expense coding, as I know we paid 4 payments, totaling $760. It looks like January of 2016 and October of 2016 were coded to the wrong place (probably Shopping & Other).

Overall we spent about $20,000 more than expected, but to put it into context, we also earned $53,000 more than expected. More importantly, as you will read below, we hit our 50% savings target (up from 42% in 2015).

Here is the trend for the last 13 months:

Note: I have now changed the chart to reflect the add-back of loan amortizations to reflect what I call “real spending” above. This is done because amortizations are really just a balance sheet transfer from cash to pay down liabilities, it has no impact to net worth.

CALL OUT: It is crazy how slippery money can be. Because of this I totally recommend you automate as much of your finances as possible, especially the saving and investing piece. We set our financial goals at the beginning of the year and then automate the process of reaching them.

Examples:

Our mortgage payment is automatically set up to pay $1,600 in additional principal.This will be put on hold until 2017- My 401K contribution is automatically deducted at a rate that will ensure I max out by year end ($18,000)

- My HSA contribution is automatically deducted at a rate that will ensure I max out by year end ($6,750)

- In 2017 we will be adding additional automated savings (more to come soon)

All of these things take priority over any spending that we do in a given month. We monitor expenses but don’t really manage them. Instead we manage savings and investments and let the expenses work themselves out.

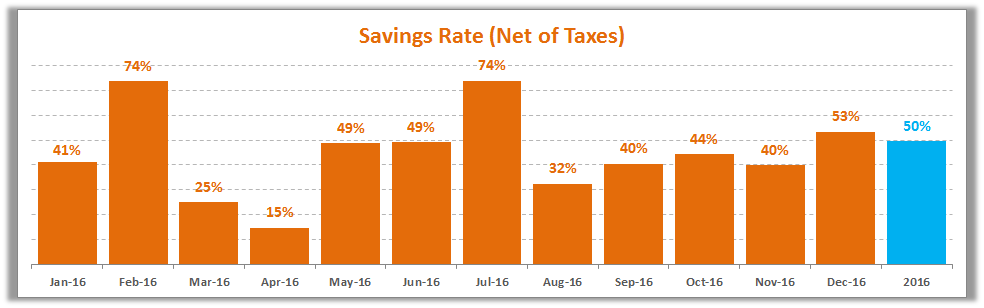

Savings Rate

Below is how we did vs. our goal of saving 50% of our after tax income.

You can see that although our goal for the year is 50%, we bounce all over the place on a monthly basis.

We hit our goal of saving 50% of our after tax income. This is up substantially from 2015, where we had a savings rate of 42%. Although we spent more than we budgeted, our income and savings outpaced our spending. On a gross basis, we ended up saving 37% of our gross income, in 2017 we are aiming for 42% gross savings and 63% after tax.

Speaking of savings rate, have you checked out my post where I mathematically prove the importance of your savings rate as a higher priority than the compound return? If you’re trying to build wealth quickly, then you have to read this post.

Net Worth and Mortgage Pay Down Update

My ultimate goal is to build up a Net Worth of $10M returning 6% a year or $50,000/month in gross income (at the end of December we are officially 5.3% there). Don’t freak out, this is only about $5.5M in today’s dollars when you take into account a 3% inflation rate.

Can’t believe we are half-way to a 7-figure net worth. It’s growing at a very respectable rate (just take a look in the side bar for growth at a glance). If you want to see how I plan to get there you can read all about it here.

December Net Worth $527,668 (this puts us up $209,941 or 66.1% vs. 2015)

- Previous month: $486,544

- Difference: +$41,125

Since publishing the first financial report we have been able to post 24 consecutive months of positive gains to Net Worth. Let’s see how long we can continue this trend. The larger the number becomes (and the more invested we become), the more difficult it will be to continue this trend.

Net Worth is up 1,144% since 2012 (More than 10X in 4 years)!

Net Worth Component Break Down:

In January you will see a new category added to the net worth allocation to reflect our new $105K investment.

Net Worth increased by $210K in 2016 vs. our original goal of $112K. I would call this a grand slam of a year. We are projecting an increase of around the same dollar amount in 2017, before accounting for any increases due to dividends, interest, and market appreciation (or depreciation if the market turns sour). Either way, at this point in our journey our contributions should still be far greater than any decline in the markets to continue to show a year over year increase in 2017 (remember the secret to wealth building is to get a little wealthier every day on average).

Something I have been thinking about and worth pointing out is that our net worth was actually negative to the tune of almost -$300K back in early 2009, so we have come a long way in a short period of time. Until now I had only reported our ending net worth from 2012. I am thinking up a post that would give the full story of how we started so negative right out of college and how we have improved it so dramatically in such a short period of time (it’s on the list). I mention the first drag in this post about our investment condo.

Note: I think people tend to glaze over the fact that the savings rate plays a much bigger role in increasing your net worth than the rate of return on your investments (in the early days of your journey). In the short term, savings rate has a bigger impact on net worth. The goal is to eventually build a big enough asset base that the gains from compounding will eventually outpace the gains from savings. Actually, check out the post I recently wrote: Savings Rate – The Most Important Variable to Wealth Building [and the math to prove it]

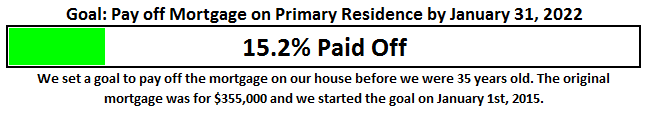

Progress On Our Mortgage Payoff Goal

You can read about our strategy to pay off our mortgage in 7 years (and 3 months). When you break it down and follow the 3 simple rules, it’s not as hard as it sounds. We bought our house in February of 2014 and then refinanced it into a 5/5 ARM in September of 2014 to remove PMI and free up cash-flow to put towards the principal and keep us on track to pay the mortgage off at an accelerated pace. We have since refinanced again into a 3/1 ARM at 2.25%, which has freed up an additional $400/month.

The progress chart above shows how much of our goal we have completed. The goal completion percentage is up 0.1% vs. November. We will begin making more rapid progress on this goal starting sometime in early 2017.

The End

I hope these reports inspire and move you to action. Don’t take a passive role in your finances and hope for the best. There is a famous Jim Rohn quote that I think everyone should keep in mind:

If you don’t plan your future, somebody else will. And you know what they have planned for you? NOT MUCH!

You have to be intentional with your finances if you ever want a fighting chance to make it to financial freedom. It doesn’t have to take 40-50 years of slaving away for the man before you have the option to retire. I personally think that 15-20 years is really all you need, and for the folks that are more aggressive (i.e. extremely frugal, not us) or very high earners you can probably reach financial independence in 10 years or less (maybe us, it’s yet to be seen but income is our focus vs. expenses).

I am looking forward to chatting with you all in the comments below. How was your month? Also, if you have a blog, I encourage you to write a monthly financial report and come back here and share the link. I would love to be part of your support and accountability.

One last thing before we go. If you are new or even if you’re not new and you have been wanting a more guided tour of the blog, I finally launched a “Start Here” page. I highly recommend you check it out.

Cheers!

– Gen Y Finance Guy

Oh, you’re still reading.

Do you want to help keep our lights on? You’re under no obligation, but if you were already thinking about it or were a little bit curious, why not help us out?

Here are a few ways you can help us out:

- Personal Capital – You know how big I am on tracking my finances, that’s why I totally recommend Personal Capital’s FREE software that helps you see all your financial accounts in one secure and convenient place (checking, savings, investments, and retirement accounts). Without a tool like Personal Capital, these reports would take 2-3 times as long to complete. You want to track your income? Your expenses? How about your Net Worth (who doesn’t like watching that bad boy climb). Just sign up and link your accounts today. Absolutely FREE to you!

- TD Ameritrade – They are hands down the best broker for the retail investor. TD Ameritrade provides a number of investing platforms that are more robust than any other platform I have ever used. My particular favorite is the “Think or Swim” platform. Oh, and did I mention that they have over 100 ETFs that you can trade commission FREE?

- Blue Host – Have we inspired you to create your own blog? Well let me save you some money. This is the hosting company that I use for this blog. It is stupid cheap and the customer service is amazing. The normal price is $5.99/month, but if you use this link you will get a 34% discount (only $3.99/month). It took me less than 5 minutes to buy my domain, install wordpress, and get the first version of this site up and running.

OR you can check out our Recommended Products and Resources page.

33 Responses

Great job beating that 2016 income goal! It never hurts to have extra moolah lying around. Food expenses are our #1 budget issue, so it’s good to see that other people struggle here as well. We’ve already slashed our monthly grocery bill in half (down to $500 from $1,000 for two people), but I know we could do better.

Mrs. Picky Pincher – I hate to admit that our food expense issue is just for two people as well. Can’t believe that we have spent almost $2,250/month. Although we have only budgeted an $8,000 reduction, I would really like to see it cut in half.

Any tips on what you did to cut your budget in half? I think our biggest issue is eating out at expensive restaurants. If we went out half as much, I think that would cut this bad boy by at least 40%.

That’s a pretty nice increase throughout 2016 overall. Now, if only you could keep that same percentage growth as you progress, you guys would be reaching your goals in no time at all 😉 Seriously though, while the percentage is bound to drop off as the absolute numbers get bigger, it looks like you’re well on your way to reaching your goals.

This was also my first time reading your financial reports, and I’m a big fan of some of your visual representations. I do all my own tracking in Excel, and some of these visuals were definitely nice enough that I want to dive right into my spreadsheet and start using them myself.

Thanks for stopping by Lars-Christian! I am glad you found the visuals interesting enough to incorporate in your own tracking.

The YoY % changes have continued to decline year after year going from 143% in 2013, 76% in 2014, 75% in 2015, and 66% in 2016. However, the absolute dollar increases are staggering, we are too a point that our contributions alone will increase our net worth by $200,000 a year (before any gains from Mr. Market). I think we have at least another 3-5 years of robust double digit increases in us 🙂

Nice like uptick here for December Dom! Good on you for closing out the year nicely.. Looking forward to seeing what you have in store for 2017, sure it’ll be big

Hey Jef – Thanks man! This was certainly another EPIC year. Although I have been saying that every year since 2011 🙂

2017 should start off strong with us potentially breaking $600K in net worth within Q1. Working to try and hit another grand slam this year and blow our goals out of the water. There are the goals I share, and then there are the moon shots in my head that I am really chasing 🙂

When do you leave on your 6 month tour around the world?

Haha that’s a great sign then if you’ve been saying it every year since then 😉

Like the sound of the way you’re thinking there and looking forward to hearing more about it..

I take off mid March, heading to Africa only (good memory though there).. Not sure if you’re on or comfortable with friending on Facebook however find me on there if you’d like and I’ll be putting updates (I’m the one with sunglasses and a blue shirt)

Keep up that hustle mate!

66% for the year!!! WOW.

You doubled your goal. That’s incredible, Dom.

See ya soon. 🙂

Michael – Just trying to catch up to you my friend. It’s like chasing a carrot on the end of a stick 🙂

Looking forward to dinner tomorrow night to catch up.

Cheers!

$210k in a year at your current net worth level is absurd and something to applaud. It is tough not to think about what your net worth increases will be in the future when you have a sizeable nest egg working for you as well!

Best of luck in 2017, do you think $800k is achievable?

I love reading your detailed updates because they keep me motivated to continue with my wealth and development goals. I can’t wait to see what 2017 brings for you; I know you are going to crush it!

Thanks Slyvia!

Glad these motivate you to continue progressing your own goals.

Cheers

How would you structure your future hypothetical $10 M portfolio?

For 2017, I am taking control back from various financial advisors and am pondering this very issue. Its going to be a lot of work…

Joe,

I don’t really have a target allocation. I would guess that 45% of my net worth would be stocks, 25% Real Estate, 5 % P2P Lending, 15% Private Business, 5% precious metals, and 5% cash.

That’s just a rough guess, that will for sure evolve over time.

You can see what I originally laid out here in my $10M blue print.

Thanks. I just read your $10M post. Honestly, I think you are sandbagging. With two high incomes and a lot of energy you should be able to do better…

Main decision for me is whether I should get more conservative now that I’m into 8 figures. I still have a huge amount (60+%?) allocated to stocks. I keep expecting another market crash but year after year the market just keeps powering up.

Joe, I’m curious on in what way you feel GYFG can do better? It’s great to push for people to set more stretch goals and hold others accountable however I’m curious..

He’s already way ahead of his projections. His goal chart shows 2017 starting with $427k, he’s already blown past that. He has a chance at making millionaire status 2 yrs earlier than his goal. The first million really is the hardest.

Their combined income was $340k for 2016, already 7 yrs ahead of his income projections. He’s estimating $390k for 2017, which is 9 yrs ahead of schedule.

His schedule shows spending increasing at the same rate as income. In reality, I think income will increase at a much higher rate (leading to a higher savings rate) than spending if he doesn’t go crazy with it. I would guess most high earners save a progressively higher portion of their income as their level increases.

He hasn’t included any X-factor (a business success, a popular blog, a lucky investment, a major move up from promotion or job change, etc) at all in his schedule. In the long run, X-factor is the biggest difference maker. And he seems highly motivated.

The dual income should help a lot. I made it to 8 figures in the timeframe he presented as the sole breadwinner. The only reason I am only at 8 figures is because that’s what I shot for, otherwise 9 figures was definitely possible.

He should be able to make his numbers just sleepwalking to work if both he and his spouse do decide to continue working for the next 20 years.

Fair points here Joe.. Appreciate you taking the time to write back very comprehensively there!

You don’t have your own blog? Would be interesting to follow your journey as well

Cheers

I 2nd that…AGAIN!!!

Jef – I think Joe has all very valid points.

Joe – Thank you very much for the thoughtful response. Things have really moved much faster than the original blue print. Stay tuned, I eventually might change my goal to something much larger than $10M, because of everything you pointed out, that my original assumptions didn’t capture.

Again, I would really love to hear more about your own journey, I am sure there is a ton of wisdom to pick up.

Joe – I love your comment “I think you are sandbagging”

Your probably right, if we can keep up the pace and trajectory we have been on, we should not only be able to hit $10M a lot sooner than my original 20 year plan (set in 2015), but we should also be able to blow past that number. And as long as we are still having fun, we probably will. Maybe one day I will revise my plan to $100M???

Maybe you get conservative with the first $10M and more aggressive with anything in excess???

I know in one of your other responses you said you used to have a blog that you stopped, but is it still alive on the web somewhere? Or do you have a back up of the articles that chronicled your journey? If you did, I would love to have a recurring series to share your journey to 8 figures. That is incredible.

Ya, I think that’s the big question. How conservative or aggressive are you going to be once you get close to that $10 M mark!!

That’s exactly what stopped me from getting to $100M+. I am by nature very conservative. I made 2 big decisions when I saw $10M approaching.

1) I left my job in my late 30s because I was burned out. If I kept going until 48 like you have in your chart, it would have meant many millions more. Only in hindsight now do I clearly see how much I left on the table. Then again I could be dead already from burnout.

2) I diversified out of winning investment in my employer because of the desire to hold on to what I already had. This extremely limited my upside, which would have been huge. Think owning an AAPL or MSFT in the early days and diversifying out as the stock grows 1000%, 2000%, 5000%+, only to have them subsequently grow 35,000%+. Of course, during the lifespan of many (most?) companies, there are years which look like the company is going to go belly up.

Fair enough Joe and Dom! I feel I was a bit hasty in my comment now, a lesson I’m learning to correct 🙂

I’d love to read you’re musings about wealth, investing etc Joe .. I’d say the whole frugality and median income has it’s place although I’d much rather the high salary and potential risk involved to see a different perspective..

Either way sure you’ll be around GYFG by the looks of it!

Dang, that net worth growth is INCREDIBLE! Well done. I think I might have grown my net worth by 10% – 15%. My goal is 10% a year, but it’s getting harder as my net worth grows b/c I don’t want to lose anything!

Well done.

Sam

Thanks Sam!

I was double what we were expecting at the beginning of 2016. It’s amazing as we look into the future, we have made huge steps since starting these monthly reports. We are now on tract to add about $200,000 per year with contributions alone (and hopefully growing).

With your net worth being 20X mine, I would happily settle for 10% a year. Honestly, when I get to $10M my goal is only 6%.

Cheers!

Thanks for the comment. I actually had a blog in 2006 and FIREd in 2007, but didn’t keep the blog going because I got busier after retiring. I’m more settled now, but still spend half the year out of the country.

I considered restarting the blog but I don’t think I’d have much of a readership especially now that FIRE is 9 years behind me. People are more interested in how to get to FIRE via median salary and frugality. My route involved high income, risk taking, and luck.

Not to sound like a broken record…but is your old blog still alive in some corner of the web?

I might look for it and revive it. I’d have to come up with an angle to be helpful to readers though. Not that many people can follow the route that I took, although I did start from absolute zero.

I would also have to commit to the time required. It’s hard to find time these days, right now I am replying from Lake Tahoe after a day in the snow with family.

Nice job!

You’ve officially passed me. the value of my condo via Zillow dropped $100k in the last couple months which makes zero sense. It went from $910k to $807k currently and our market in the SF area is still red hot…Id say it’s worth somewhere in the middle around $860-880k. But since I’ve been using Zillow values, I will continue to do so.

Based on all those numbers, we are right around $500k at the moment. Don’t think I am giving up that easily on the race to $1M, though 😉

We had a very expensive 2016 that included a wedding (20k), honeymoon (12k), new floors (5k), new couch (5k) and an unplanned trip to Chicago to visit family (3k). I don’t foresee any of these expenses in 2017 which should be a huge tailwind for us.

Best!

Sean

Oh also, since we are about the same age with about the same net worth, if we decided to take the foot off the gas, not save another penny, and earn aggressive S&P500 numbers on our current wealth, and decided to work til 65, we’d still be sitting on about $14M without saving another penny. Nice to know! And just chimes in with the previous comments that $10MM is pretty much a foregone conclusion at this point.

Sean

But I want it now!!!

By the time I am 65 I want to be worth $65,000,000 – LOL

Dang, that is a big drop. I use Redfin to update the value of our two properties, but I don’t really use their estimate. Instead I look for comps in my neighborhood to adjust the price up or down, and typically I always take less than I think we could sell it for to be conservative.

I don’t see you as the kind of person that would give up in any competition 😉

It might just be me, but I feel like I say we had an expensive year ever year, we always seem to find things to fill the void of the special spending. The good news is we have found a pretty comfortable annual spending amount between $110,000 to $120,000. This is going to allow us to increase our savings rate after tax to 63% in 2017.

Onward & Upward