GYFG here checking in for the November monthly financial report. If you have been reading these reports for a while you will notice that I introduce each month with the same intro month after month. I do this for two reasons, a) for the newbies to the site (which make up about 50% of the sites traffic) and b) to remind everyone what these reports are all about. By all means if you have read the intro at least once, then please feel free to skip down to the “Summary of November 2015” section where the new content begins (click the orange link to be taken there automatically).

For those of you that are new around this corner of the internet, I wanted to fill you in as to what these reports are all about. These monthly reports are about full transparency. They are just as much for me as they are for you. It’s a hard decision to make all of your financial details public, but it’s also a very motivating one. It’s not just the post, but the process of putting this post together that really benefits me.

My sincere hope is that my transparency will inspire you to take the helm of your own financial ship and be intentional with its direction. I truly believe that anyone can reach financial freedom, if they are willing to do things differently. If you earn an average salary and have an average savings rate, then you can expect an average result! That means you will likely have to work at a job you may or may not enjoy until you’re 65 and then maybe you can retire IF you’re lucky.

Hey, there is nothing wrong with average. If you’re happy with average, then by all means keep doing what everyone else is doing. Not sure how you feel about that, but I have no interest in living an average life. I want EXTRAORDINARY.

Most people don’t want to live below their means in order to reach FINANCIAL FREEDOM, because that’s painful. They think it involves cutting out all the joy in life. You know what I’m talking about, those financial gurus that tell you that in order to get rich you need to cut out the $5 lattes and stop going out to eat. Then after 40 years of diligent and above average savings and super low spending, you will be a millionaire. Basically, you have to live like a college student and suppress all the things you want to do in life and then when you’re old you will be rich.

Okay, that doesn’t sound like the plan for me either.

The good news is there is another way. This site and these reports are here to show you the OTHER path to financial freedom. There is a way where you can have your cake and eat it too. I believe and hope that over time I will be able to convince you of the following:

In order to reach financial freedom you can choose to live below your means by cutting expenses to the bone and living in a state of scarcity or you can expand your means and live in a state of abundance by increasing your income and enjoying the $5 latte or other indulgence of your choice.

Not only that, but if you’re diligent you can reach financial freedom a lot sooner than anyone has ever led you to believe.

Our Mission Statement:

To Humanize Finance, Build Wealth, and Reach Financial Freedom.

I know I don’t have to publish my juicy details every month, but it’s important to me that you know that I put my money where my mouth is (because not that many finance blogs or people giving financial advice do this). I publish all of my financial details not to brag, but instead to show you what is working as well as what’s not working. Sometimes finance can get pretty dense, but I think real life examples and numbers can help slice through the complexities (and BS). Personally, I have always enjoyed the financial reports put out by other bloggers around the blogosphere.

As always, you can find all my previous reports on the Financial Stats page (as well as annual trends and a few other financial metrics not found on this report). In these monthly reports the plan is to give you a month over month update on Gross Income, Assets, Liabilities, Net Worth, Expenses, Contributions, Savings Rate (NEW), and progress on the mortgage pay down goal.

Summary of November 2015

November was a crazy freakin month. I put in about 400 hours in the day job over the 4 weeks leading up to Thanksgiving. Although the days were long (4am to 9pm during the week), I had fun, and the pay off is right around the corner. There are some exciting things setting up for 2016 (don’t worry there is a post for that). The last 3 months of the year are always pretty busy for me in the day job, but this month definitely set some records.

That didn’t stop us from making forward progress on the financial front, but I took a step back from my fitness over the last month…there really just wasn’t enough time in the day. Or put another way, I decided to not make it a priority (we all have to make choices).

Our Solar got installed on the last day of the month, and we should get approval today to flip the switch to turn it on. We should not have any sort of electrical bill for all of 2016, as we got a system that will produce 11% more than our annual needs. We financed it, because the IRR and NPV was more favorable, and the finance company gives a 3 month grace period before your first payment is due (from the turn on date). So, our first payment will likely not be until March 1st. And then in April when we file our taxes, we will get to realize the $4,500 tax credit the Federal Government provides for going solar.

We also had a chance to spend the weekend in a little cottage by the beach, I did spend Saturday not working and spending time with my wife. It was a nice little break from the chaos.

Those are kind of the highlights…so let’s jump in…

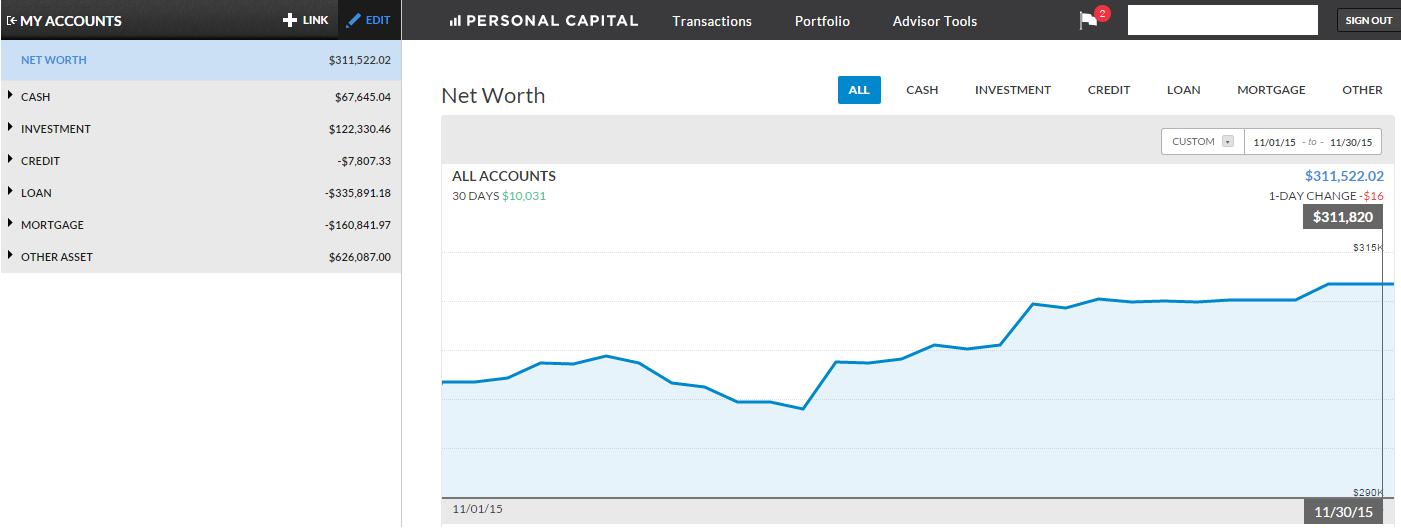

We use Personal Capital To Track Everything

I will continue to add screenshots of my Personal Capital account as another level of transparency in the numbers that I share. I forgot to take a screen shot on the last day of the month, but you will see that I highlighted it by hovering over the last day on the chart below (only about $300 difference from 12/1 when I took the screen shot).

We use Personal Capital to aggregate and consolidate our transactions from across all of our financial accounts (checking, savings, retirement, credit cards, mortgages, HSA, and other investment accounts). At the end of the month I then drop that information into my financial stats spreadsheet for this monthly report.

We use Personal Capital to aggregate and consolidate our transactions from across all of our financial accounts (checking, savings, retirement, credit cards, mortgages, HSA, and other investment accounts). At the end of the month I then drop that information into my financial stats spreadsheet for this monthly report.

Tracking your finances is, in my opinion, the best way to stay on top of your finances. You can’t optimize what you don’t measure. You can’t make informed decisions if you don’t know what you having coming in vs. going out. Without a holistic view of how much you spend every month, there’s no way to set savings, debt repayment, or investment goals. It’s a financial freedom must, folks.

Personal Capital (which is free to use) is a great way for us to systematize our financial overviews since it links all of our accounts together and provides a comprehensive picture of our net worth. If you’re not tracking your expenses in an organized fashion, give Personal Capital a try.

Month Over Month Financial Summary

What went down in November?

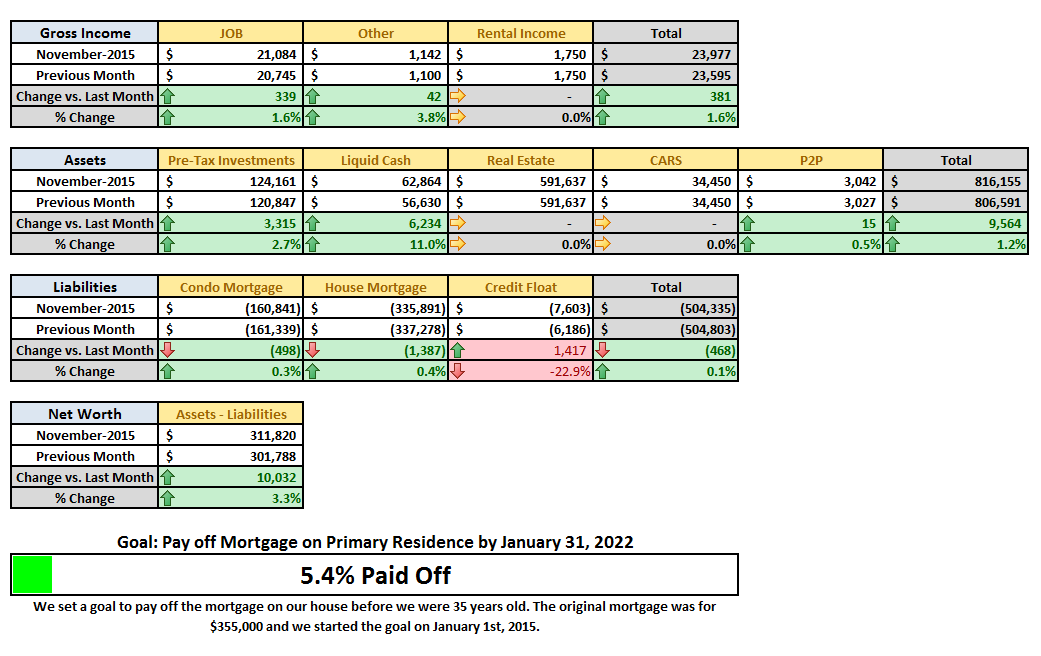

This month came in much higher than I had anticipated on the income side of the equation (again, it’s been a much welcomed theme in 2015). We even managed to eke out a gain of +1.6% vs. last month. Mrs. GYFG killed it again this month bringing in an additional $7,500 above and beyond her regular pay. Part of this was from a monthly commission and the other part was from her notary business.

I only have about $16,500 in the forecast for December income, but Mrs. GYFG could help us surpass that number depending on how here numbers were for November. Let’s just say at this point I would not be surprised if income reaches the $20,000 mark in December.

Here is a look at the trend for the last 12 months:

So far this year we have produced $235,638 in gross revenue (January through November). This means we should hit at least $250,000 for 2015. If you read my blueprint for how I plan to reach $10M, you will notice that I was actually forecasting a drop in revenue to $178,000 this year vs. $214,142 in 2014. That is a huge swing!

The Juicy Details

- Previous Month: $23,595

- Difference: +$381

Now where did all that money go?

I have come to the realization that there are always going to be unplanned expenses. Our goal is to save 50% of our income and live off and enjoy the difference guilt free. With that type of rule governing our financial life, it is a free pass to inflate our lifestyle, but only proportional to our income. You can see prior financial reports here: January, February, March, April, May, June, July, August, September, and October.

Home Mortgage & HOA $3,149 The NEW normal payment is $2,349/month for the mortgage and $84 for the HOA . However, as a part of our 7-year mortgage pay off plan, we started adding an extra $800/month towards principle in January of 2015.

- Previous Month: $3,317

- Difference: +$168

Condo Mortgage & HOA $1,150 This is the payment on our rental condo and includes the mortgage of $888 and HOA of $250. We currently rent this place out for $1,350/month, as seen in the summary table above. Our interest rate adjusted up from 2.875% to 3%. Will probably look to refinance this in 2016 to increase the cash flow by extending the loan back out to 30 years. We are currently 10 years in on a 30 year loan.

- Previous Month: $1,150

- Difference: –$0

Timeshare $0

- Previous Month: $0

- Difference: +$0

Home Improvement $624 The wife always has some sort of project going on. I honestly don’t even remember what this was for, but it was mostly purchases at Home Depot.

- Previous Month: $470

- Difference: -$154

Food & Dining $1,277 This was a nice decline vs. last month. As I have mentioned before, our long term target is $1,200/month (to date we have averaged $1,560).

- Previous month: $1,907

- Difference: +$630

Shopping & Entertainment $1,407 This category covers any discretionary shopping and entertainment expenses.

- Previous month: $1,558

- Difference: +$151

Travel & Hotel $568 This was from our trip to Kansas for Thanksgiving and the Beach house I mentioned earlier for our weekend getaway.

- Previous month: $1,575

- Difference: +$1,007

Auto and Transport $498 This includes fuel, car insurance on two cars, and toll roads. I realized a charge from AAA, which I didn’t think we were member of anymore. So, I will need to call and cancel that to get my $78 back.

- Previous month: $438

- Difference: -$60

Personal Development $0 We do buy books on a regular basis but that would fall in the shopping category above. This is just for some of the larger investments we make in ourselves.

- Previous month: $0

- Difference: +$0

Bills & Utilities $527 This includes our monthly utilities like gas, electric, water, internet, and cell phones. Sometimes this also includes a cleaning lady and our monthly lawn service.

- Previous month: $535

- Difference: +$8

Health & Fitness $457 This includes a monthly massage subscription, monthly dues to remain an active member of Team Beachbody to ensure my discounts on supplements like Shakeology and Results and Recovery Formula. It now also includes a membership fee for Hot Yoga for my wife, and starting in December will include a membership fee for Cross Fit for me.

- Previous month: $312

- Difference: -$145

Business Services $1,078 This covers hosting with WP Engine for $49/month and MailChimp email service $10/month (for those emails I have been sending everyone on my list). I have now upgraded to SumoMe Pro for an additional $40/month. Will look to convert these to annual subscriptions in 2016 to save 20-30%. This also includes about $1,000 for travel I did for work during the first week of November (the reimbursement is reflected in our gross income).

- Previous month: $99

- Difference: -$979

Total Expenses $10,735

- Previous month: $11,361

- Difference: +$626

Expenses were down 5.5%% this month vs. last month.

Here is the trend so far this year:

What is great about all this detailed tracking that I started this year, is that that it is allowing me to plan for 2016 at a very detailed level.

CALL OUT: It is crazy how slippery money can be. Because of this I totally recommend you automate as much of your finances as possible, especially the saving and investing piece. We set our financial goals at the beginning of the year and then automate the process of reaching them.

Examples:

- Our mortgage payment is automatically set up to pay $800 in additional principal.

- My 401K contribution is automatically deducted at a rate that will ensure I max out by year end ($18,000)

- We have an auto investment of $500/month into my wife’s IRA to make sure we max it out by year end ($5,500)

All of these things take priority over any spending that we do in a given month. We monitor expenses but don’t really manage them. Instead we manage savings and investments and let the expenses work themselves out.

What were Investments and Contributions?

- Contributed $500 to the wife’s IRA for the 2015 tax year.

- Previous month: $500

- Difference: $0

- Contributed $1,058 Into my 401K.

- Previous month: $1,058

- Difference: $0

- Prosper Lending $0 We have deposited $3,000 so far this year.

- Previous month: $1,000

- Difference: -$1,000

- Rich Uncles REIT $0 We currently have $5,158

- Previous month: $0

- Difference: $0

- Increase in Savings $6,234 This includes checking, savings, and CD’s.

- Previous month: $2,458

- Difference: +$3,776

- HSA Contribution $1,000 This is set up to max out by the end of the year. We currently have $5,110 here.

- Previous month: $1,000

- Difference: $0

Total Investments & Contributions $8,792

- Previous month: $6,016

- Difference: +$2,776

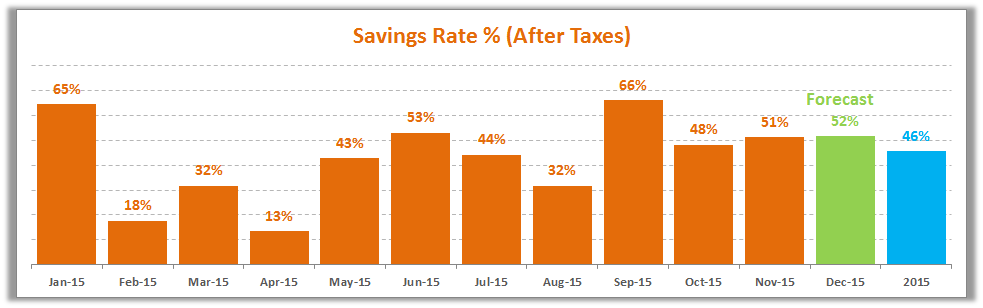

Savings Rate

Since publishing our goal of saving 50% of our after tax income, I thought it would be a good idea to keep track of it in these reports going forward.

In the above chart you will see the trend of our savings rate by month. You can see that although our goal for the year is 50%, we bounce all over the place on a monthly basis. I still have us forecasted to miss our 50% goal, but we are still on track for 46%.

This year has largely been a foundational year, where I finally formalized the financial philosophies that drive our finances. It will be very interesting to see what we can do in 2016, going in with such a solid foundation.

Speaking of savings rate, have you checked out my recent post where I mathematically prove the importance of your savings rate as a higher priority than the compound return? If you are trying to build wealth quickly, then you have to read this post.

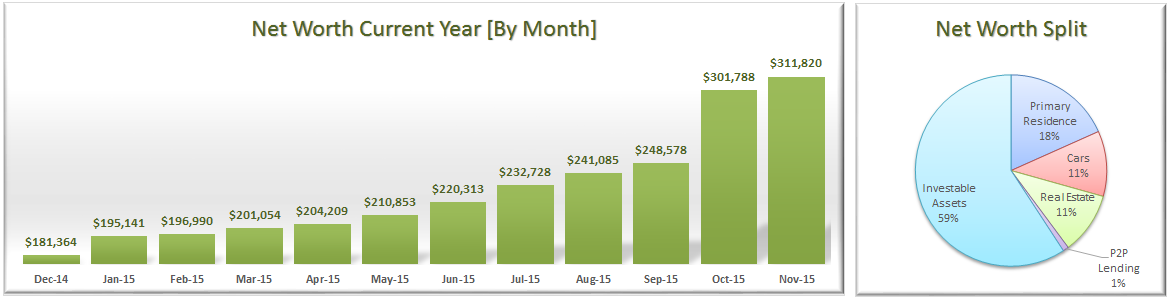

Net Worth and Mortgage Pay Down Update

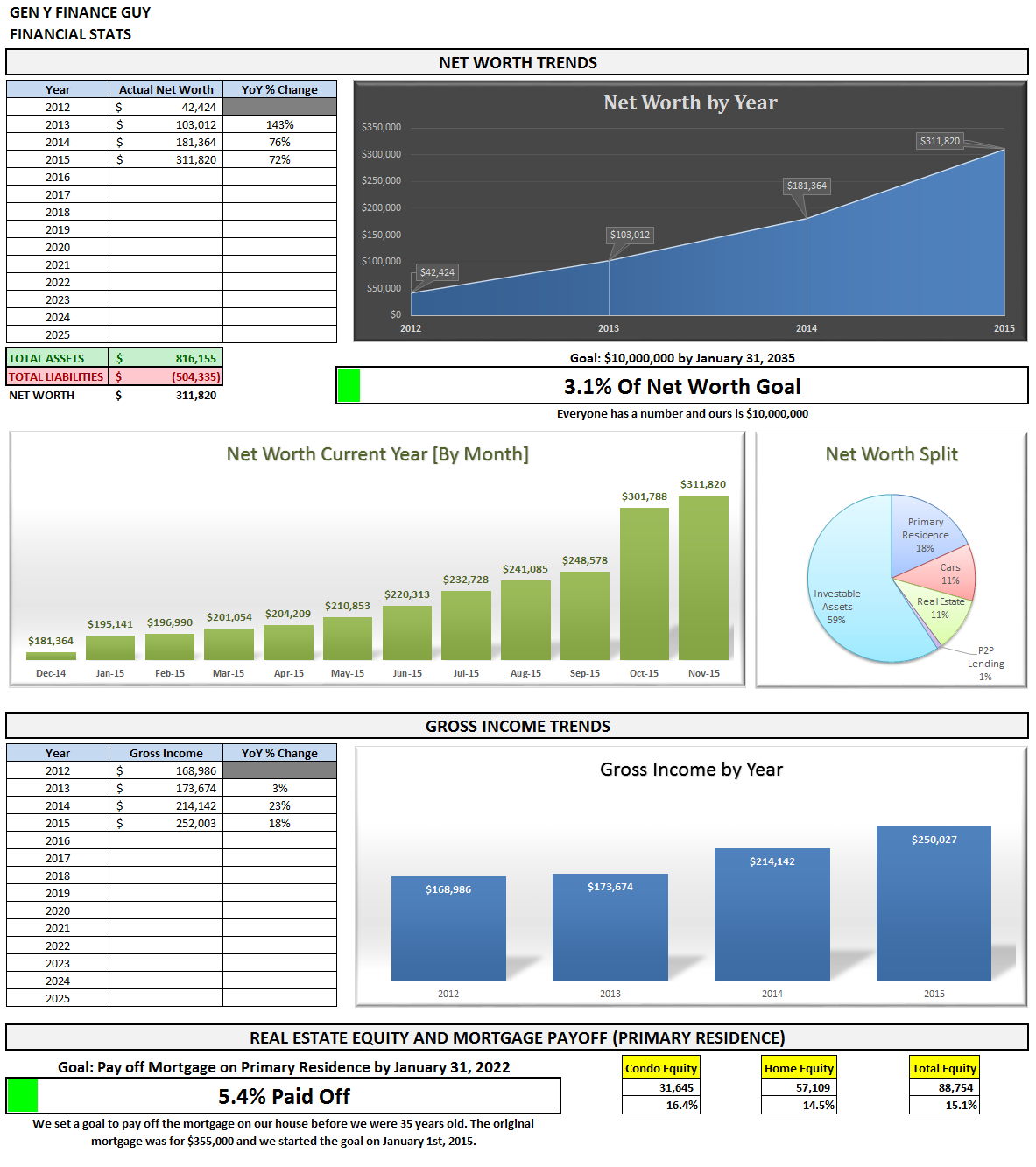

My ultimate goal is to build up a Net Worth of $10M returning 6% a year or $50,000/month in gross income (last month we officially reached 3% of our goal). Don’t freak out, this is only about $5.5M in today’s dollars when you take into account a 3% inflation rate.

I am not anywhere close to a 7-figure net worth yet (or what some refer to as the double comma club). However, it is growing at a very respectable rate (just take a look in the side bar for growth at a glance). If you want to see how I plan to get there you can read all about it here (soon to be reviewed and updated in 2016).

November Net Worth $311,820 (with eleven months down in 2015, this puts us up $130,456 or 71.9% vs. 2014 so far and we still have 1 month to go)

- Previous month: $301,788

- Difference: +$10,032

Net Worth Component Break Down:

You will notice that in the second chart above that I have broken our net worth out into 5 categories: Primary Residence, Cars, Real Estate, P2P Lending, and Investable Assets. I want to continue to see our primary residence and cars make up a smaller and smaller piece of the overall pie. Over time I can see myself adding two more categories to represent insurance (post coming early 2016), and stock options (in the company I currently work for).

Note: I think people tend to glaze over the fact that the savings rate plays a much bigger role in increasing your net worth than the rate of return on your investments (in the early days of your journey). In the short term, savings rate has a bigger impact on net worth. The goal is to eventually build a big enough asset base that the gains from compounding will eventually outpace the gains from savings. Actually, check out the post I recently wrote: Savings Rate – The Most Important Variable to Wealth Building [and the math to prove it]

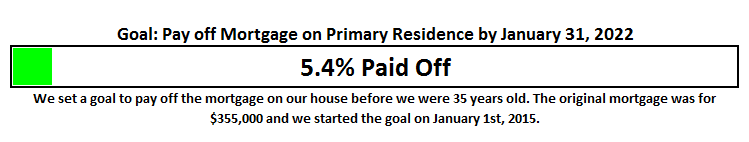

Progress On Our Mortgage Payoff Goal

You can read about our strategy to pay off our mortgage in 7 years (although the execution of this is going to change up a bit in 2016, details to come). When you break it down and follow the 3 simple rules, it’s not as hard as it sounds. We bought our house in February of 2014 and then refinanced it into a 5/5 ARM in September of 2014 to remove PMI and free up cash-flow to put towards the principal and keep us on track to pay the mortgage off at an accelerated pace.

The progress chart above shows how much of our goal we have completed. Last month we were at 5%, which means we picked up another 40 basis points in November. Those monthly 40 basis point improvements have really started to add up (we ended 2014 with 1.2% paid off).

I am still working out our plan for the slight change in the execution of the mortgage payoff goal. If you don’t know what I am talking about, you can go to the August report to read about my concerns around tying up to much capital in the property before it’s paid off and it becoming too large a percent of our net worth here (You will find it in the same section).

I have decided what I am going to do with the extra money earmarked for paying off the mortgage every month. I found what I believe to be the perfect financial vehicle for these extra payments. All I can tell you is that it involves the very controversial Whole Life Insurance. But before you judge, wait to read the posts I have coming out in 2016. I am not saying this is right for everyone, but it seems to be the right fit for us right now. I have been researching this product for the past year and have been working with an agent that specializes in a special use of these that reduces the front loaded fees significantly and maximizes the cash value of the policy. That is all I can tell you for now.

The End

I hope these reports inspire and move you to action. Don’t take a passive role in your finances and hope for the best. There is a famous Jim Rohn quote that I think everyone should keep in mind:

If you don’t plan your future, somebody else will. And you know what they have planned for you? NOT MUCH!

You have to be intentional with your finances if you ever want a fighting chance to make it to financial freedom. It doesn’t have to take 40-50 years of slaving away for the man before you have the option to retire. I personally think that 15-20 years is really all you need, and for the folks that are more aggressive (i.e. extremely frugal, not us) or very high earners you can probably reach financial independence in 10 years or less (maybe us, it’s yet to be seen but income is our focus vs. expenses).

I am looking forward to chatting with you all in the comments below. How was your month? Also, if you have a blog, I encourage you to write a monthly financial report and come back here and share the link. I would love to be part of your support and accountability.

One last thing before we go. If you are new or even if you’re not new and you have been wanting a more guided tour of the blog, I finally launched a “Start Here” page. I highly recommend you check it out.

Cheers!

– Gen Y Finance Guy

PS: Here are my favorite ways to track this stuff:

- The “Financial Stats” spreadsheet – a simple Excel template I created to provide the tables and charts you see in this post as well as on the Financial Stats Page. If you would like a copy of this spreadsheet, sign up for my email list (sign up form in the right side bar) and I will send you a copy.

- PersonalCapital.com (free) – I track everything in Personal Capital and then enter into my custom Excel template. Check out my Personal Capital Review to see if its right for you.

15 Responses

Another great month for you Dom. (And your wife!)

I love the way you layout your monthly reports. I don’t think mine will look that refined initially. 🙂

Keep up the great savings rate! You’re crushing it.

Hey Michael – Yep, the wife is kicking butt. When we started the year, I had forecasted a drop in income from $214K in 2014 to $178K in 2015. This was mostly due to the fact that we had a windfall of $20K and I shut down my analytics business that generated $18K in 2015. But now 11 months into the year and a lot has changed.

We are now forecasting income to be $250K for 2015 (WOW! a $72K swing). It’s really been a team effort with my wife killing it in her business and my $60,000/year raise that took place mid year (+ a $10K back dated bonus for 2014).

It took 11 months to get my report to where it is today. Feel free to rip as much or as little as you would like for your own. It is still a work in progress…as I try to add different things every few months.

Cheers,

Dom

nice job you keep staying on the right track. It has been trying times in our financial life recently. We have a wedding in January with the expenses quickly spinning out of control. I also began heavily investing in KMI with the recent sell off and have a cost basis of about $27, which at the time I thought was the deal of a century..Here we sit a week later and KMI is at a staggering$16.80. Something I never thought would have happened if you asked me 6 months ago. This dramatic price has hurt my net worth in the short term in the tune of roughly $7k.

I ended the month at $338k. There’s only 1 last $1,000 expense for the wedding we need to pay for and I have some fairly significant income months coming up in December and February. Hopefully I start getting the needle moving in the right direction!

Hey Sean – I was in your shoes 4 years ago. We dropped about $25K for the wedding, $10K for the ring (luckily I knew a Jewler and paid wholesale), and $5K for the honeymoon. It made for a great party, and people still talk about our wedding to this day. So, in the end I think it was worth it, to celebrate with all our friends and family.

When is the big day?

It’s funny you mention Kinder Morgan…as I had been eyeing it and almost put a position on around $27 as well, but then passed on it. That is a big kick in the nuts for sure…but it happens to the best of us. Probably still a decent position longer term.

I see what you are doing…you are being a pal and letting me catch up with you before we race to $1M 🙂

We will have to compare notes after February. Like you, I have a big month coming up in January, it’s year end bonus time and a 3 cycle pay period. In my forecast I have it estimated at a record $60K income month (the wild card that could drive that number high is my wife’s commissions, she has been earning $5K to $7K a month in commissions, but I only have $2K in the forecast).

Cheers!

What an awesome month for you GYFG (and year!) There’s a great intensity about you as you power towards your $10 million goal, but those hours at the day job are nuts!! At least you know what you’re striving for, and have a good reason to keep working so hard – but hope you manage to get back on track on the fitness front.

Good luck finishing the year strongly, and getting as close to that 50% savings rate as possible!

Cheers,

Jason

Thanks Jason!

It’s funny that my intensity is conveyed on the blog. I agree that the hours I have put in over the last few weeks were nuts…luckily my work schedule is not like that all year round. As it would not be sustainable in the context of all the other things I enjoy allocating time too. Mid-October through all of November is an extreme pendulum swing…December will be a bit lighter at 60-70 hours a week, and by January I should be back in the 40-50 hour per week sweet spot.

I honestly don’t think we will do much better than the 46% that I am projecting…but it is so close to the goal we only set in July. If I was not tracking it, I think we would have been further away.

2016 should be no problem to hit 50% or better.

Thanks for stopping by my friend.

Wow, great job Dom! You’ve really been crushing it this year. That’s fantastic. And gosh you sure do write extremely detailed reports. Impressive, keep up the great work!

Thanks Sydney!

It really helps going through the detail every month. Keeps me focused and motivated.

Cheers!

Wow… It was a great month for you. Your growth is amazing and I will follow you in the future 😉

Thanks Marko!

Welcome to the community.

Super impressive GYFG! Looking at how far you’ve come from 2012 I can only imagine what the next few years have in store for you and Mrs GYFG. Appreciate all the transparency you provide. Keep up the good work.

Thanks Thomas!

The next 3 years are going to be very impact on earnings and net worth front. I think we can keep if not increase the pace of the last 3 years.

Happy New Year!

Nice little uplift there although feels like you really smashed yourself this month!

Looking forward to hearing or reading more about those updates 🙂

Jef – Yes it was certainly a crazy month at work…a month I don’t really care to repeat this November.